Homeowner Tax Rebate Credit 2024 All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 CNET Taxes All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 Tax time is

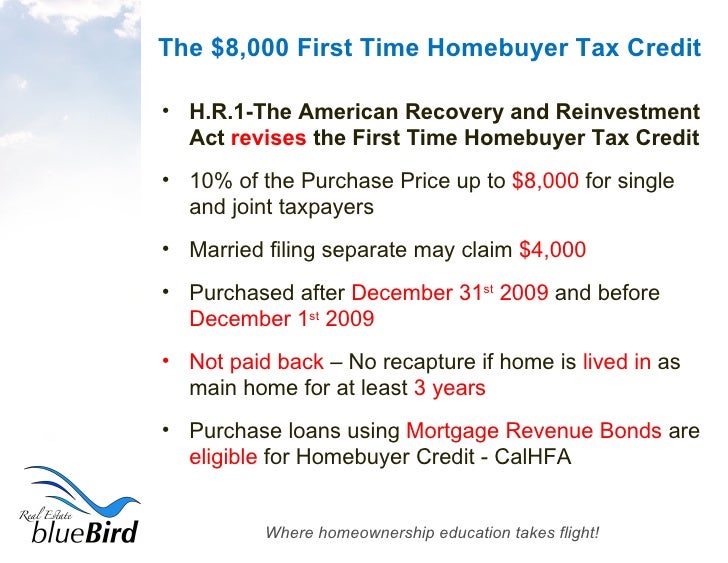

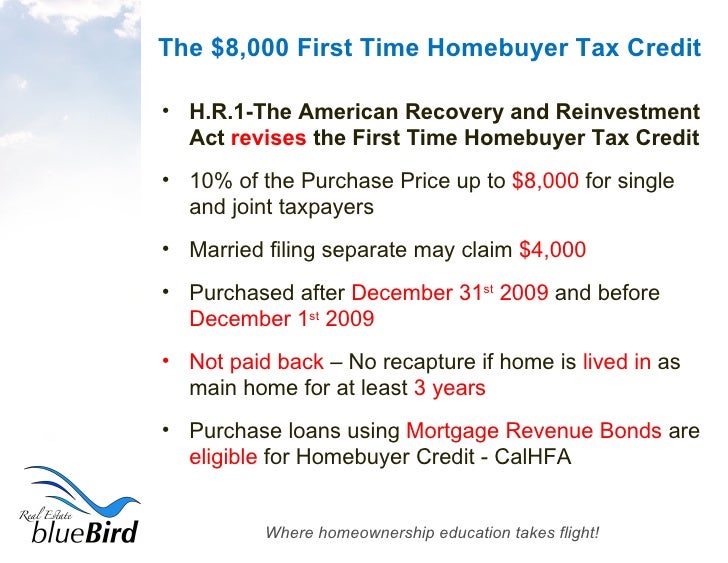

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 As of January 23 2024 the First Time Homebuyer Act has not been enacted President Biden first announced the 15 000 tax credit on his 2020 campaign trail and the program became known as the Biden First Time Home Buyer Tax Credit The bill did not survive the last Congress and the tax credit is also not dead

Homeowner Tax Rebate Credit 2024

Homeowner Tax Rebate Credit 2024

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

Is There a Tax Credit for Buying a New House There is no specific broad federal tax credit in the United States solely for buying a new house Tax credits and incentives related to homeownership can vary over time and may depend on specific circumstances such as being a first time homebuyer or making energy efficient improvements Today s Homeowner Tips To qualify for the maximum credit you must have your upgrades installed by 2032 Beginning in 2033 the maximum percentage of your installation cost you can deduct is 26 which drops to 22 in 2034 Beyond 2034 the credit expires you cannot claim any percentage credit for new installations

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit There s a 14 000 cap on the dollar amount of rebates offered under the program For instance low income homeowners can get up to 100 of electrification projects covered up to the cap of

Download Homeowner Tax Rebate Credit 2024

More picture related to Homeowner Tax Rebate Credit 2024

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

The Ultimate List Of Homeowner Tax Credits For 2020 Lifestyle

https://blog.nhregister.com/lifestyle/files/2020/07/homeowner-tax-credits-768x512.jpeg

Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy production However the bill also offers several tax credits and For example Richardson says the average homeowner in Denver who installs a heat pump qualifies for an additional 8 000 in incentives 4 500 in rebates from the city 2 200 in rebates from the

Biggest Tax Credits Boost Your Tax Refund Even if You Don t Itemize All the Possible Tax Credits and Deductions for Homeowners Here are a few of the more common tax questions for 2024 Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Understanding The First Time Homebuyer Tax Credit

https://image.slidesharecdn.com/a-complete-guide-to-homebuyer-tax-credit-1234918660234241-2/95/understanding-the-first-time-homebuyer-tax-credit-3-728.jpg?cb=1234951089

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 CNET Taxes All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 Tax time is

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Understanding The First Time Homebuyer Tax Credit

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

The NY Homeowner Tax Rebate Credit Benefits Plus

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

The NY Homeowner Tax Rebate Credit Benefits Plus

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Homeowner Tax Rebate Credit 2024 - Today s Homeowner Tips To qualify for the maximum credit you must have your upgrades installed by 2032 Beginning in 2033 the maximum percentage of your installation cost you can deduct is 26 which drops to 22 in 2034 Beyond 2034 the credit expires you cannot claim any percentage credit for new installations