Homeowners Income Tax Rebate Web You must reduce the basis of your home by the 426 122 247 365 215 1 275 the seller paid for you You can deduct your 426 share of real estate taxes on your return for the year

Web For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss Web So what exactly is in there for you We talked to a tax expert to get the rundown on the credits that promise to make your next home energy upgrade a lot cheaper What is the

Homeowners Income Tax Rebate

Homeowners Income Tax Rebate

https://www.gannett-cdn.com/-mm-/9902e24b3ce22452871a78d74d7f00970fb66eca/c=0-0-533-401/local/-/media/Westchester/None/2014/10/23/635496480107570533-1412267325000-REFUNDCHCKphoto.JPG?width=534&height=401&fit=crop

The Homeowners Guide To Tax Credits And Rebates

https://blog.constellation.com/wp-content/uploads/2017/01/tax-credits-rebates-homeowners-guide.png

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

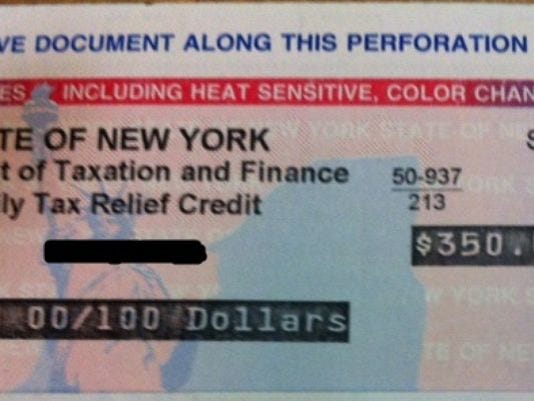

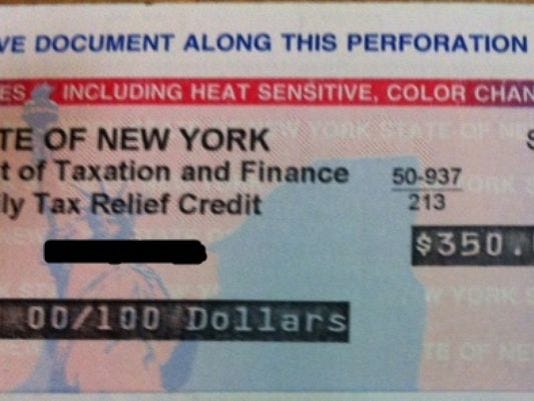

Web 14 juin 2021 nbsp 0183 32 3 Must earn a modest income based on location and household size Eligible home buyers must earn an income within 160 percent of the area s median income For example in Columbus Ohio Web 27 f 233 vr 2023 nbsp 0183 32 Expert Alumni If you receive a check for the homeowner tax rebate credit you do not need to do anything on your New York State income tax return unless you

Web 23 juin 2022 nbsp 0183 32 The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or Web 9 avr 2022 nbsp 0183 32 The State Budget also creates a new property tax relief credit the Homeowner Tax Rebate Credit for eligible low and middle income households as well as eligible

Download Homeowners Income Tax Rebate

More picture related to Homeowners Income Tax Rebate

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

https://boisedev.com/wp-content/uploads/2022/03/prop-tax-1024x540-1-768x405.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

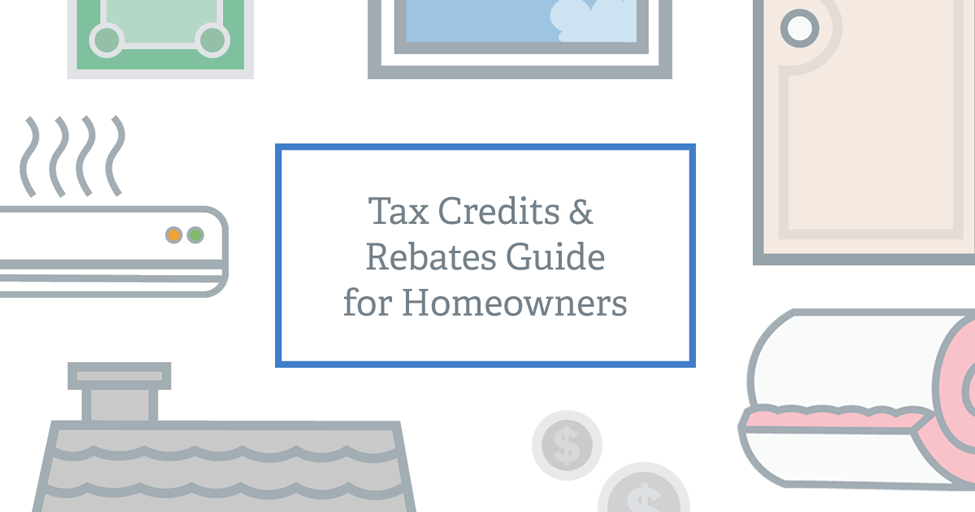

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

Web We ve begun issuing homeowner tax rebate checks We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Web 14 mars 2023 nbsp 0183 32 Note The homeowner tax rebate credit was a one year program providing direct property tax relief to eligible homeowners in 2022 Homeowners used this lookup

Web 5 avr 2007 nbsp 0183 32 Most New York homeowners with incomes over 75 000 claim itemized deductions on their federal returns and thus will find that their newly increased property Web The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2022

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

Montana Homeowners Could Receive Property Tax Rebates Of Up To 1 000

https://texasbreaking.com/wp-content/uploads/2023/02/uploads_1588684651325-iuh0f2bnegf-a0cbf661014ca2cf0cbadcd60572017e_How-Homeowners-and-Home-Buyers-Take-Advantage-of-Low-Interest-Rates-1536x1025.jpg

https://www.irs.gov/publications/p530

Web You must reduce the basis of your home by the 426 122 247 365 215 1 275 the seller paid for you You can deduct your 426 share of real estate taxes on your return for the year

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

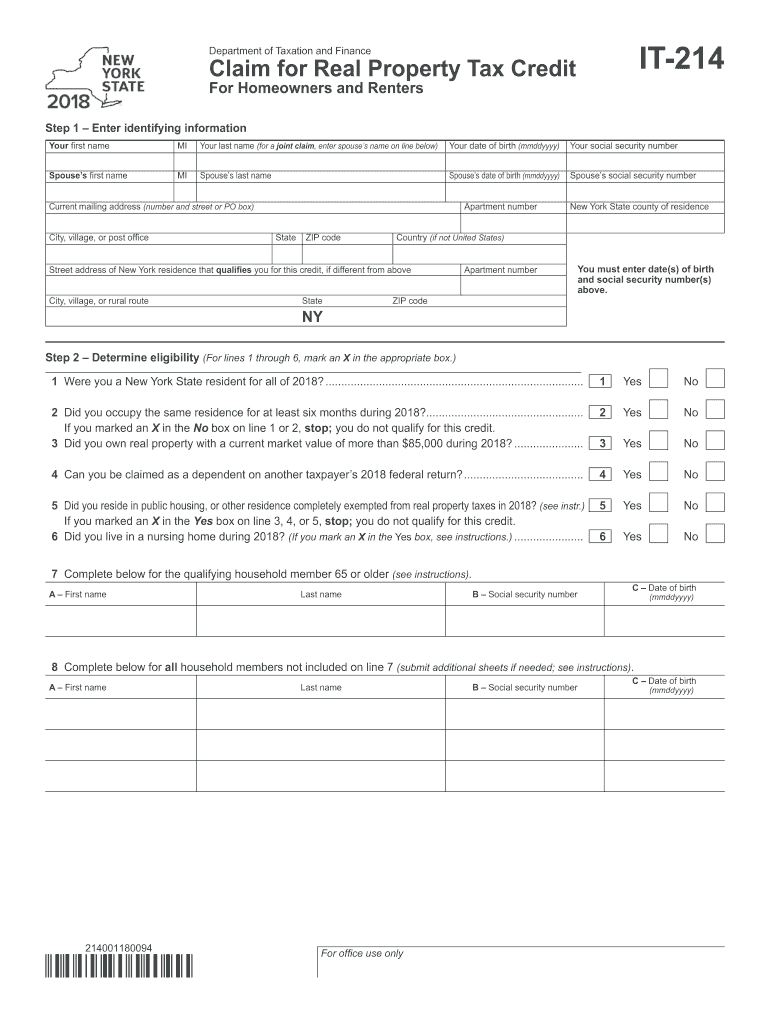

It 214 Rental Rebate Forms Fill Out And Sign Printable PDF Template

P55 Tax Rebate Form By State Printable Rebate Form

P55 Tax Rebate Form By State Printable Rebate Form

More Pa Seniors Would Qualify For The Property Tax Rent Rebate

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Proposed Tax Increase For PA Residents AR15 COM

Homeowners Income Tax Rebate - Web 14 juin 2021 nbsp 0183 32 3 Must earn a modest income based on location and household size Eligible home buyers must earn an income within 160 percent of the area s median income For example in Columbus Ohio