Homeowners Tax Rebate Credit 2024 All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 CNET Taxes All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 Tax time is

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat How to maximize your 2024 tax refund according to a CPA 02 34 Homeowners who tapped expanded home energy tax credits might get a bigger refund he noted

Homeowners Tax Rebate Credit 2024

Homeowners Tax Rebate Credit 2024

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

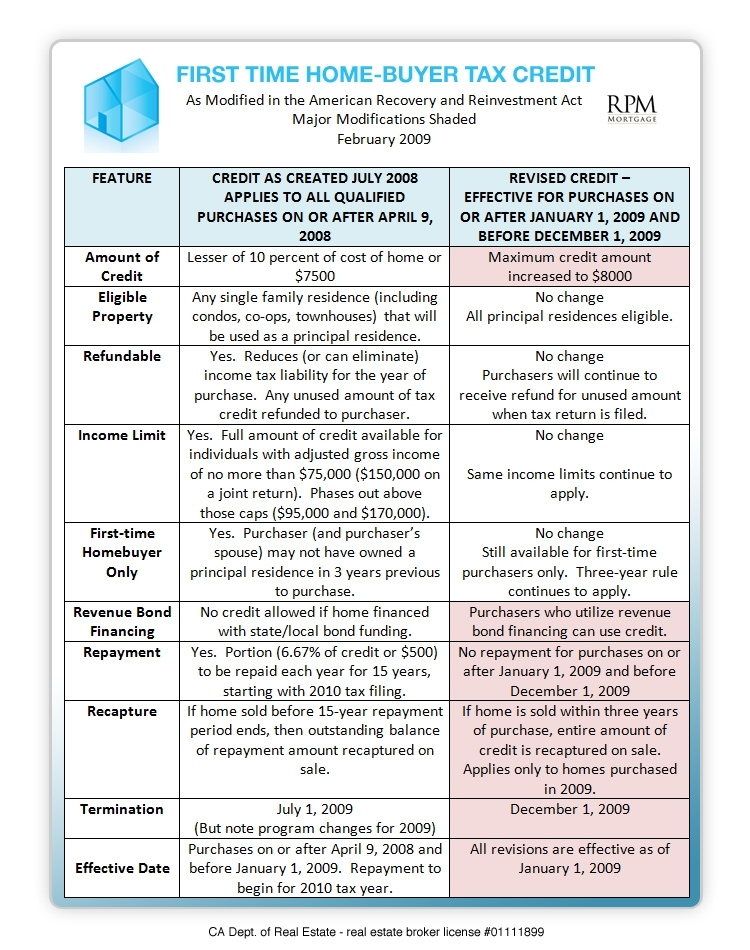

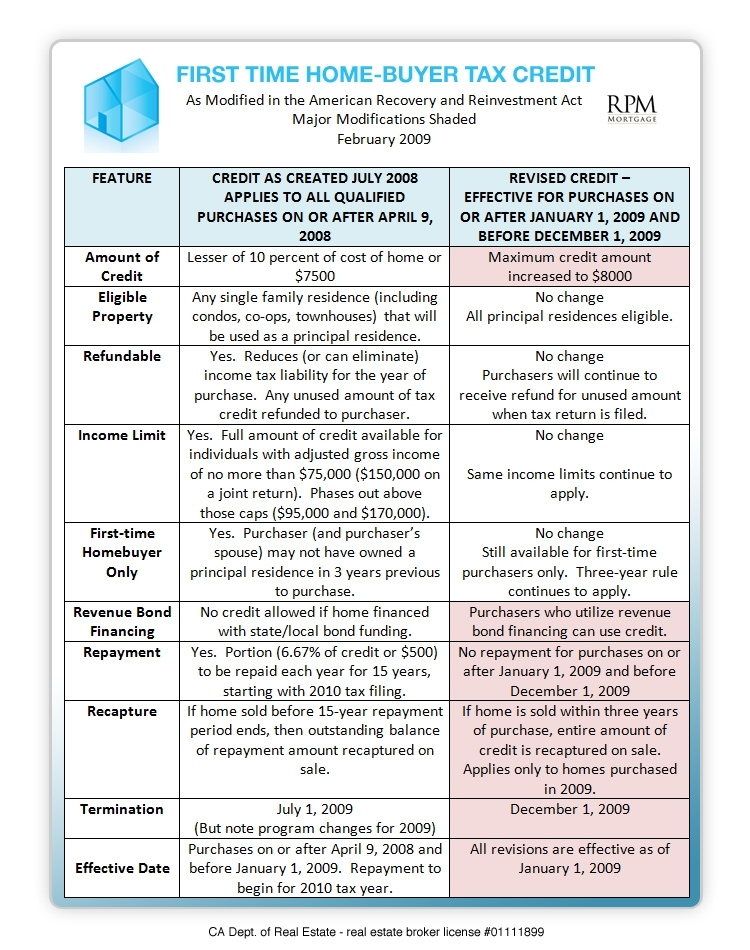

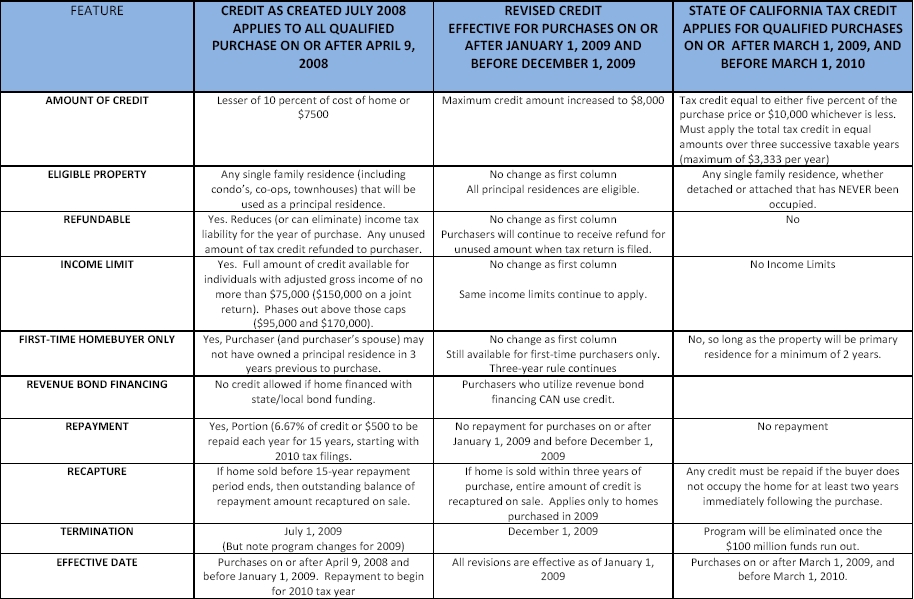

Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS defined a first time home buyer as Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Here s an overview of tax credits many first time homebuyers can claim 10 Tax Breaks You Have as a New Homebuyer Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Download Homeowners Tax Rebate Credit 2024

More picture related to Homeowners Tax Rebate Credit 2024

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

Two Million Americans Could Get Automatic Checks Worth 970 Under State Proposal Are You

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/NINTCHDBPICT000664164748.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief These credits which can provide cash back or lower any tax you might owe are available to Californians with incomes up to 30 950 for CalEITC and up to 30 931 for YCTC and FYTC CalEITC can be worth up to 3 529 while YCTC and FYTC can be up to 1 117 Individuals earning less than 63 398 may also qualify for the federal EITC

What HVAC Tax Incentives Are Available for Homeowners Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between January 1 2023 and December 31 2034 Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy production However the bill also offers several tax credits and

Homeowners Tax Credit Overview The Basis Point

https://thebasispoint.com/wp-content/uploads/2009/03/tax-credit-overview.jpg

https://blog.constellation.com/wp-content/uploads/2017/01/tax-credits-rebates-homeowners-guide.png

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 CNET Taxes All the Tax Breaks Homeowners Can Take for a Maximum Tax Refund in 2024 Tax time is

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat

Electric Car Credit Income Limit How The Electric Car Tax Credit Works For Businesses

Homeowners Tax Credit Overview The Basis Point

Homeowners Tax Credit Overview Part 2 CA 10k Credit The Basis Point

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

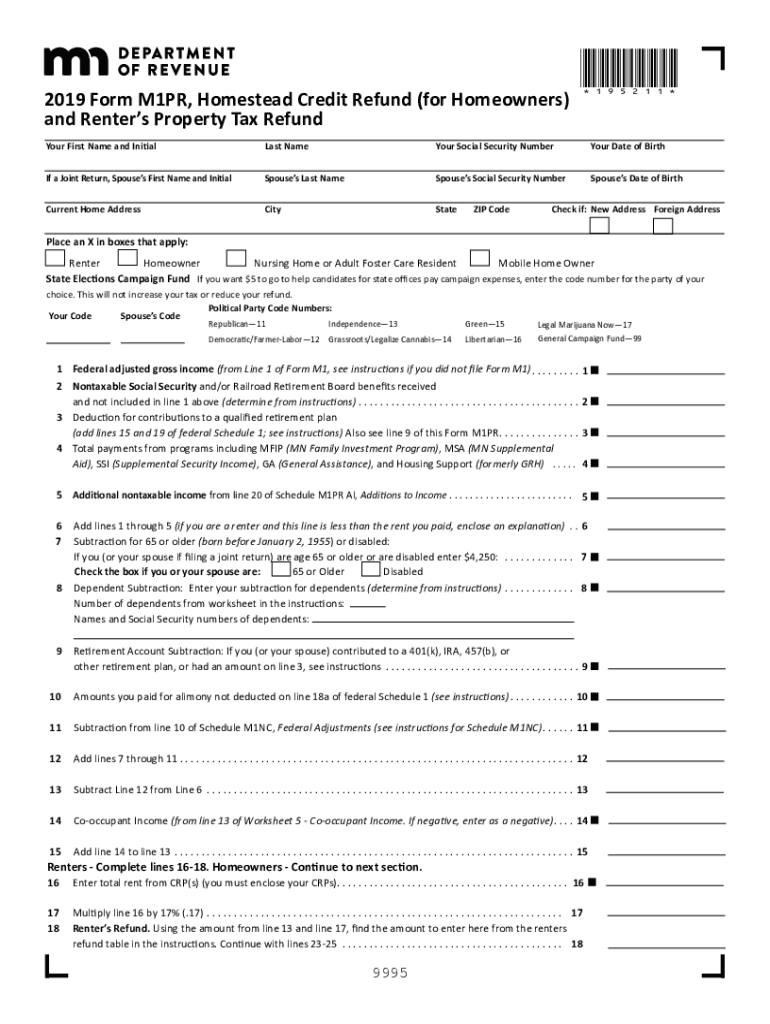

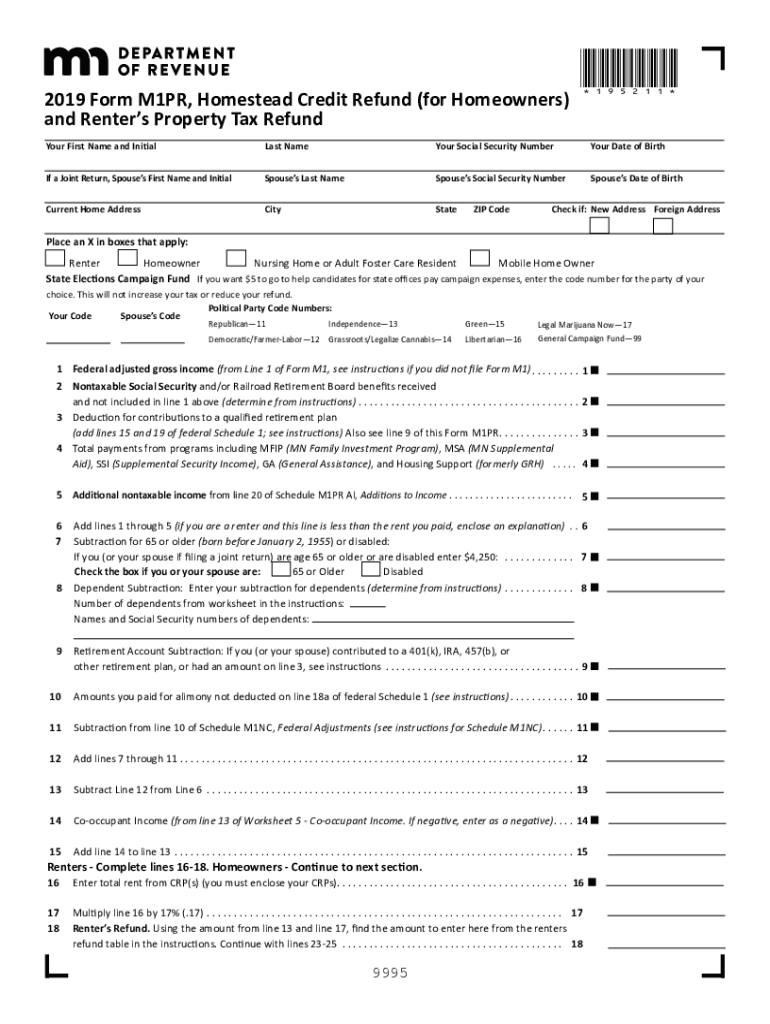

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign Printable PDF Template SignNow

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign Printable PDF Template SignNow

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Property Tax Rebate Pennsylvania LatestRebate

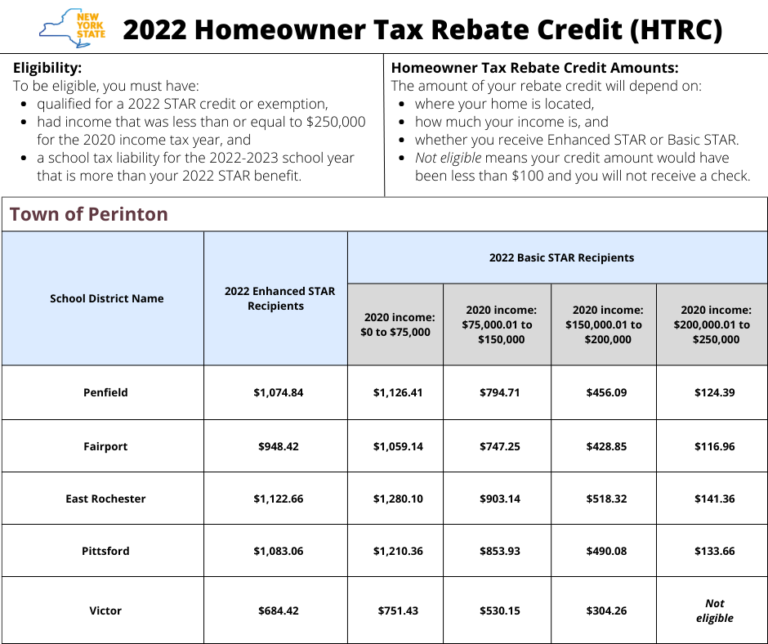

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Homeowners Tax Rebate Credit 2024 - Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS defined a first time home buyer as