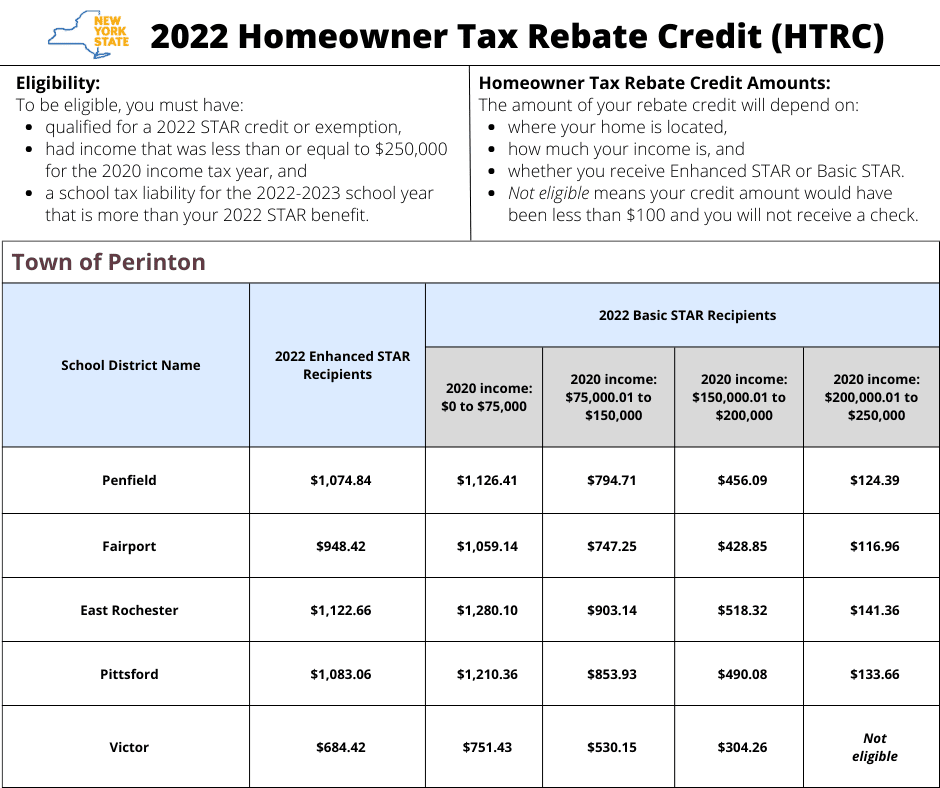

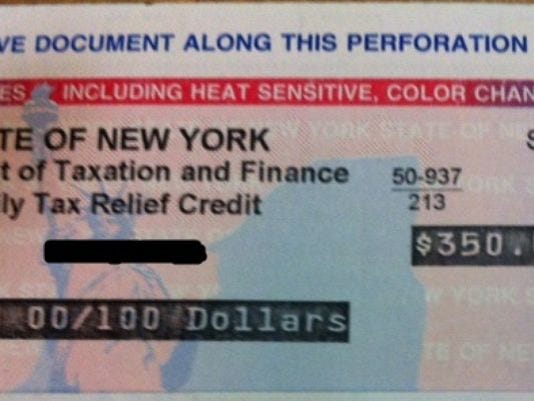

Homeowners Tax Rebate Credit Web For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount

Web 29 ao 251 t 2022 nbsp 0183 32 Tax Credits for Homeowners Energy Efficient Home Improvement Credit The Nonbusiness Energy Property Credit expired at Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three

Homeowners Tax Rebate Credit

Homeowners Tax Rebate Credit

https://swcllp.com/wp-content/uploads/2022/06/NYS-Homeowner-Tax-Rebate-Credit-Header-940x675.png

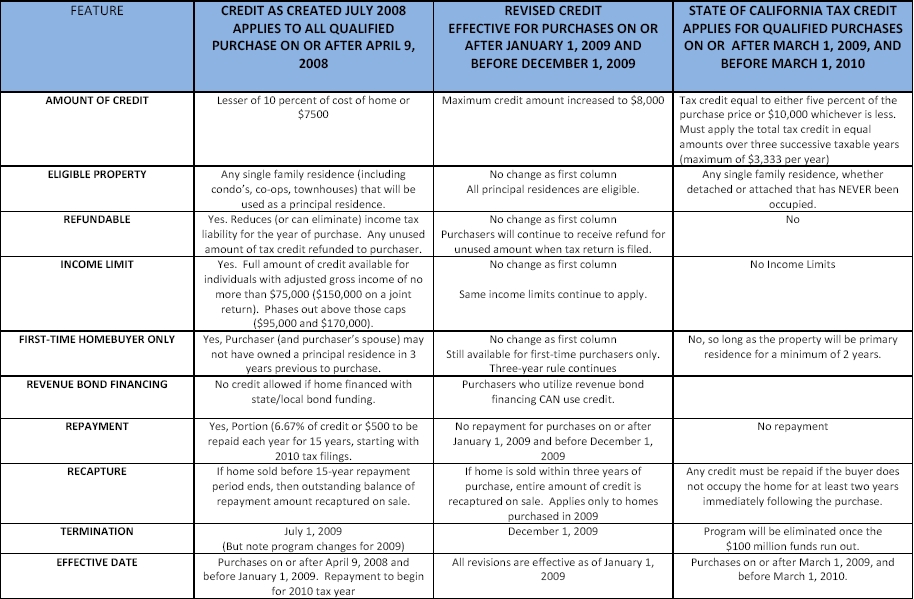

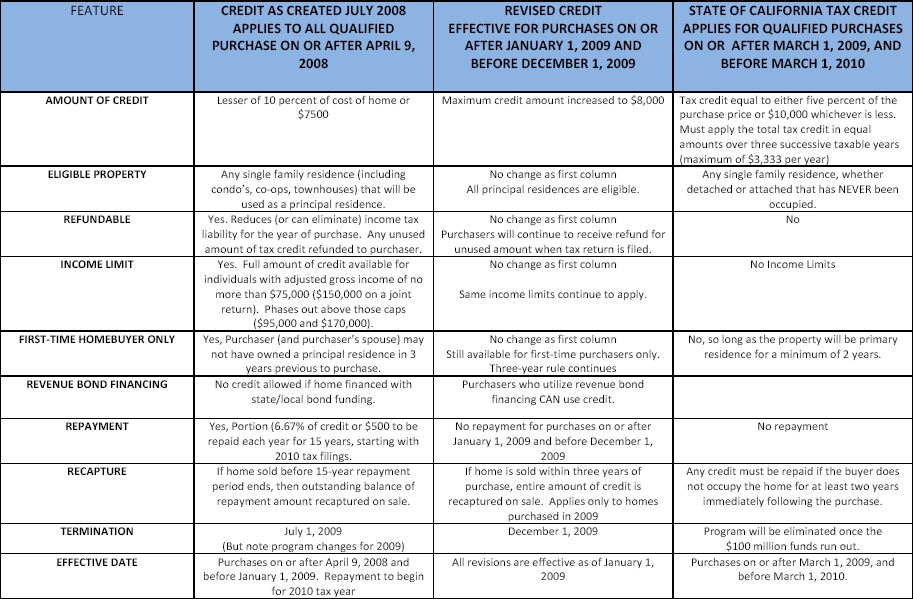

Homeowners Tax Credit Overview Part 2 CA 10k Credit The Basis Point

https://thebasispoint.com/wp-content/uploads/2009/03/fed-and-ca-homeowner-tax-credits.jpg

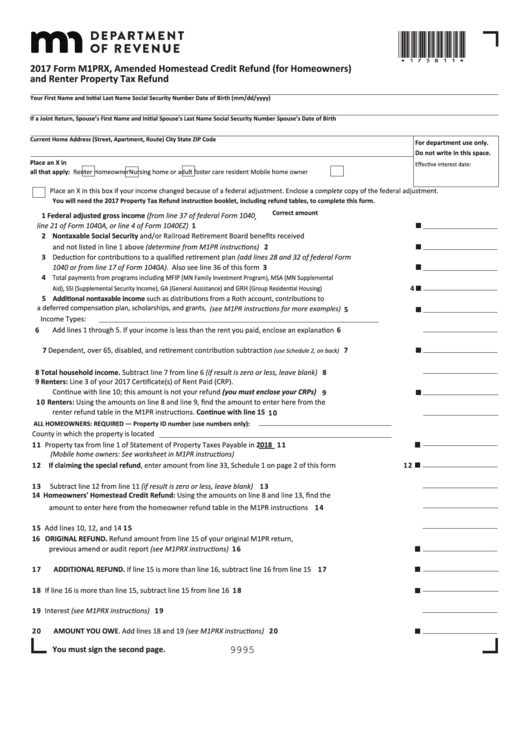

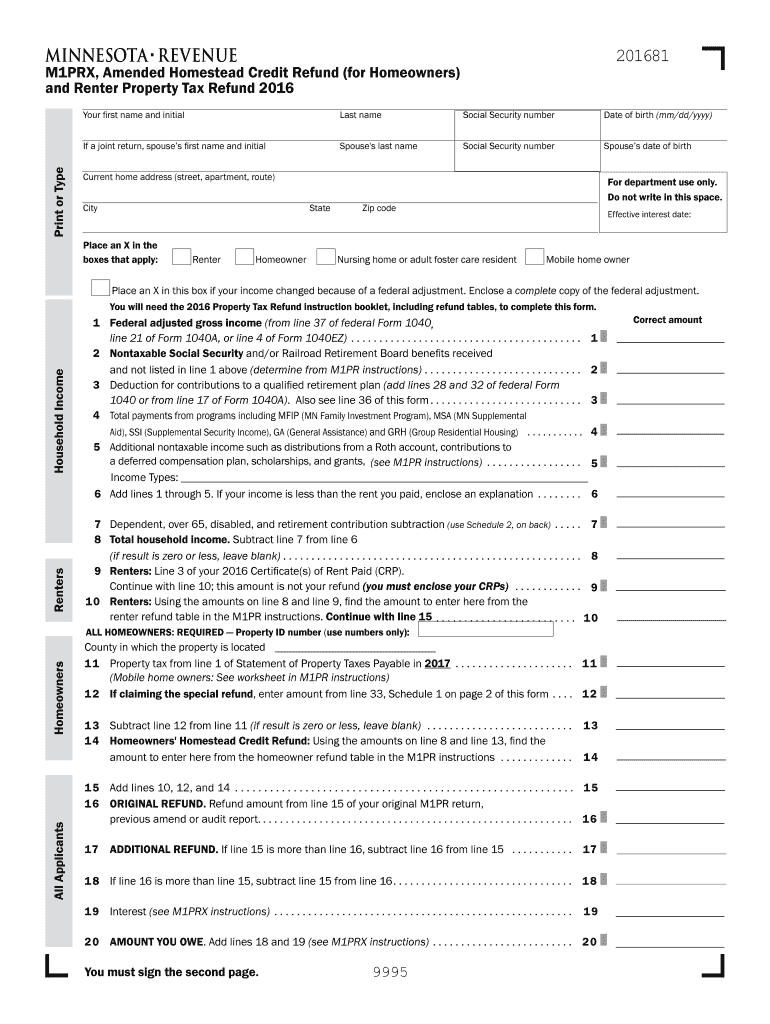

Fillable Form M1prx Amended Homestead Credit Refund For Homeowners

https://data.formsbank.com/pdf_docs_html/361/3610/361048/page_1_thumb_big.png

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web This year your regular tax liability is 1 100 you owe no alternative minimum tax and your mortgage interest credit is 1 700 You claim no other credits Your unused mortgage

Web 17 ao 251 t 2022 nbsp 0183 32 Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please follow Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available

Download Homeowners Tax Rebate Credit

More picture related to Homeowners Tax Rebate Credit

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1.png

Constellation s Best Of 2017

https://blog.constellation.com/wp-content/uploads/2017/11/tax-credits-rebates-homeowners-guide.png

M1PRX Amended Homestead Credit Refund For Homeowners Fill Out And

https://www.signnow.com/preview/397/780/397780212/large.png

Web 15 d 233 c 2022 nbsp 0183 32 OVERVIEW If your home renovation project includes the installation of energy efficient equipment a tax credit may be available to you TABLE OF Web To find the amount of your credit use our Homeowner Tax Rebate Credit HTRC Check Lookup Find your credit amount Note By law the Tax Department cannot issue a

Web 14 juin 2022 nbsp 0183 32 The New York State homeowner tax rebate credit HTRC is a one year program benefitting nearly three million eligible homeowners in 2022 Eligibility To be Web Eligibility In order to be eligible for the Homeowner Tax Rebate Credit you must meet the following requirements Be eligible for a 2022 STAR Credit or exemption Had an

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

https://media.wgrz.com/assets/WGRZ/images/6bb6d79c-d629-4757-b1e2-c5fefa386c2f/6bb6d79c-d629-4757-b1e2-c5fefa386c2f_750x422.jpg

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount

https://www.investopedia.com/tax-credits-for …

Web 29 ao 251 t 2022 nbsp 0183 32 Tax Credits for Homeowners Energy Efficient Home Improvement Credit The Nonbusiness Energy Property Credit expired at

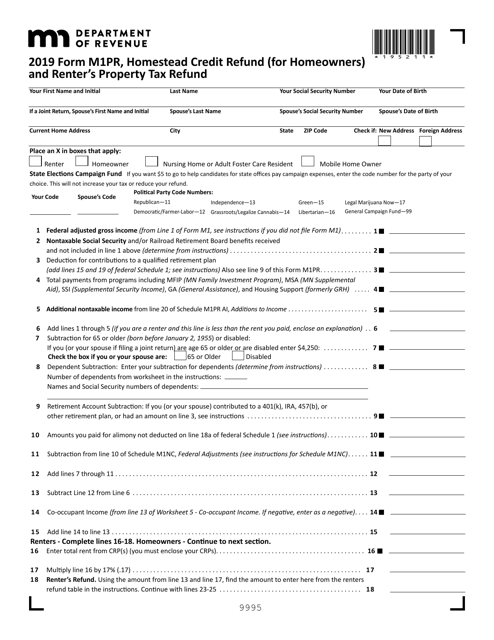

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

Tax Rebate Checks Come Early This Year Yonkers Times

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Mn Renters Rebate Refund Table RentersRebate

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

Mass Tax Rebate Check

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Homeowners Tax Rebate Credit - Web 4 ao 251 t 2023 nbsp 0183 32 A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first