Homes Rebates 2024 We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Homes Rebates 2024

Homes Rebates 2024

https://snuggpro.com/images/uploads/benjamin_m_a_high_quality_illustration_of_residential_street_wi_d0e634aa-5d4b-4444-86fb-246cc9a3dbf8.jpg

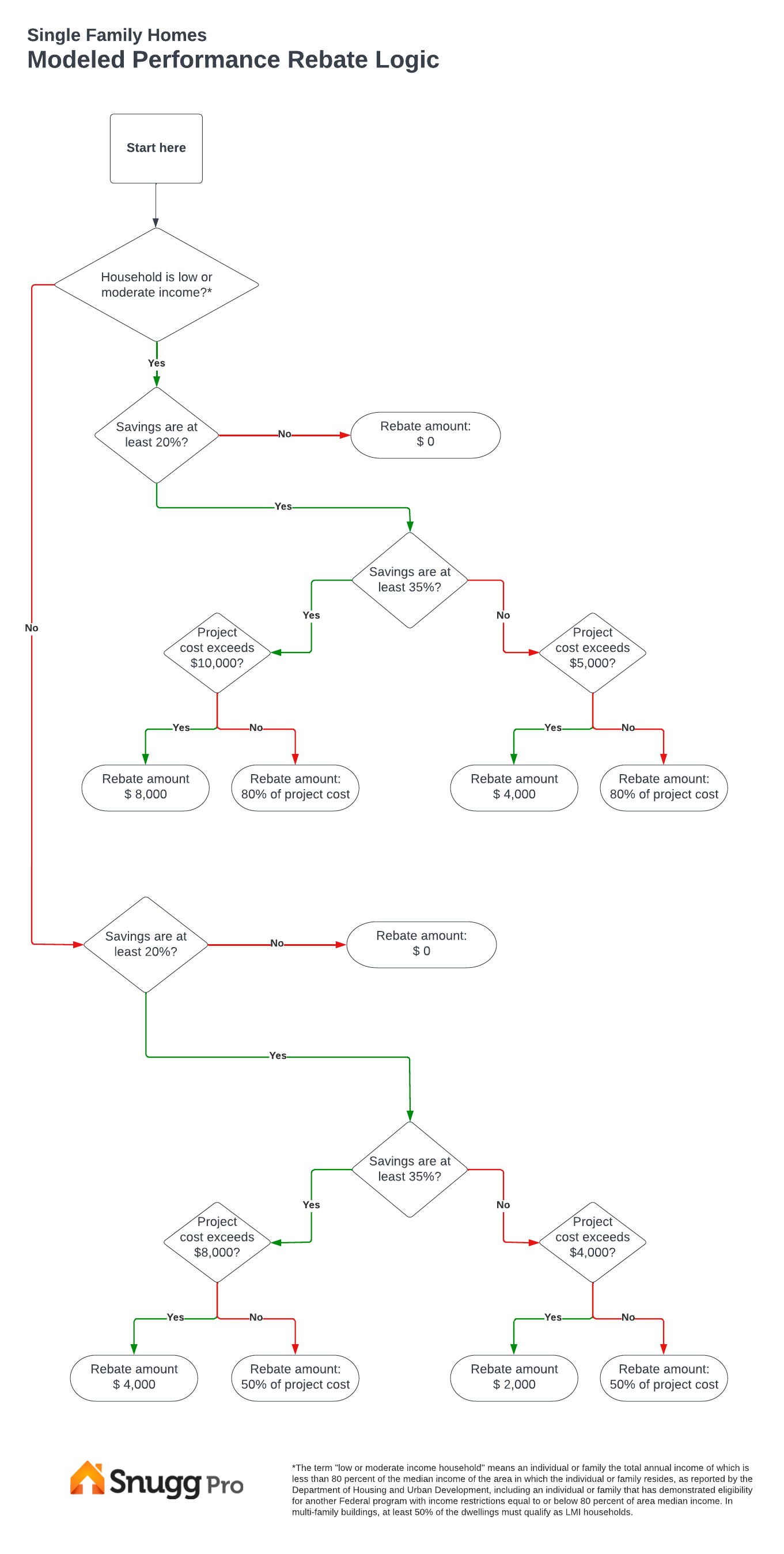

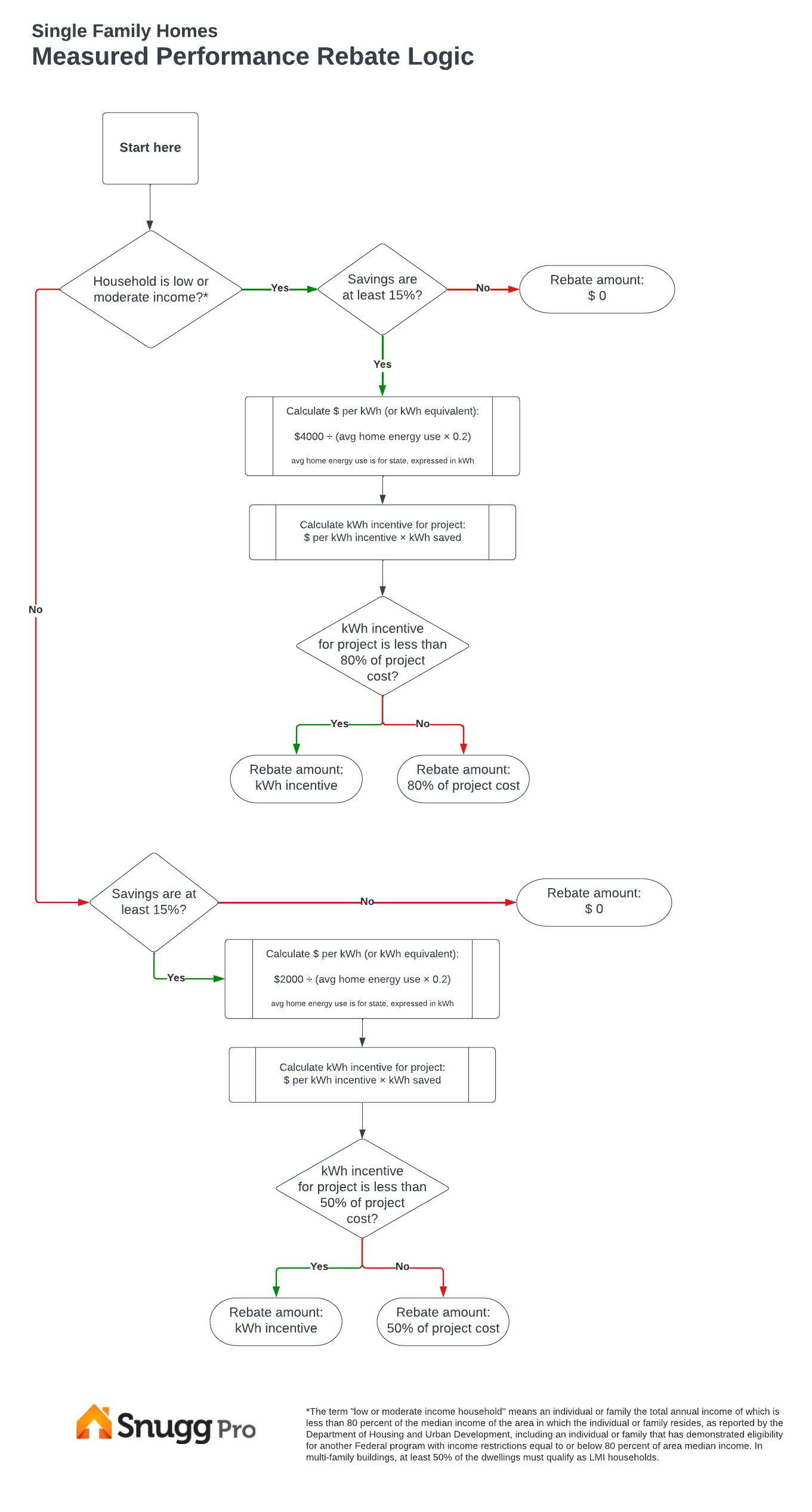

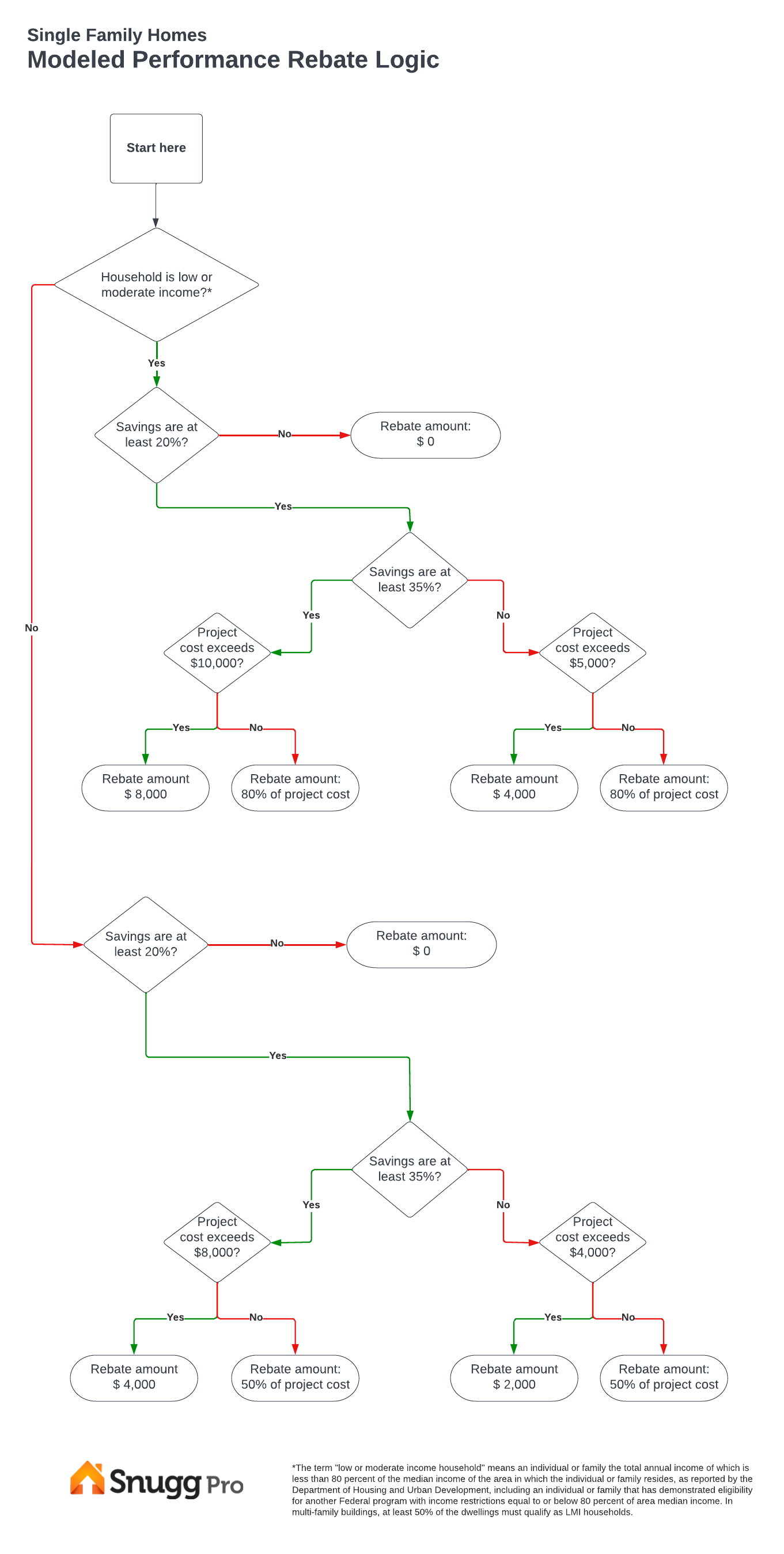

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Modeled_Savings.png

InlandNWrealestategal

https://3.bp.blogspot.com/-ARug_DjdyNI/W33jSyTnVBI/AAAAAAAABVM/tJwIOpYlI24orSYNoBm5ZHCiLrtNJH0pACEwYBhgL/s1600/rebates.jpg

About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving Key Points The Inflation Reduction Act which President Joe Biden signed in August 2022 created rebate programs for consumers tied to energy efficiency There are two initiatives the Home

Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Download Homes Rebates 2024

More picture related to Homes Rebates 2024

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

Solar Homes Rebates Up For Grabs Australian Energy Upgrades

https://australianenergyupgrades.com.au/wp-content/uploads/2021/09/Solar-Homes-Program.png

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August 16 2022 and completed before Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state energy

5 Turn the thermostat down a few degrees Heating your home makes up a big chunk of your monthly energy bill According to the Department of Energy you can save as much as 10 a year on heating and cooling by turning your thermostat down 7 F 10 F for 8 hours a day in the fall and winter In 2023 the U S Department of Energy released its program guidance for the Home Efficiency Rebates HER and Home Electrification and Appliance Rebates HEAR programs which together allocate over 208 million to North Carolina to provide energy efficiency rebates As of January 2024 DEQ is applying for the planning grant funding for the

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Measured_Savings2.png

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Meritage Homes Buyer Rebates Credits Incentives YouTube

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

Latest Incentives DR Horton Homes Rebates

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Rebates For Seniors Mark Coure MP

DEC Savage Rascal Rebate Gun Rebates

DEC Savage Rascal Rebate Gun Rebates

Manufacturer Rebates CleanFreak

Understanding The HOMES Rebate Program Building Performance Institute Inc

CAT Rebates W L Inc

Homes Rebates 2024 - Washington expects to receive IRA funding for home energy improvement rebates in early 2024 and will begin to make these available no earlier than mid 2024 The Washington State Legislature also appropriated additional funding to support investments in high efficiency electric appliances for households and small businesses