Homestead Exemption Bexar County 2022 2022 Official Tax Rates Exemptions 2022 Official Tax Rates Exemptions

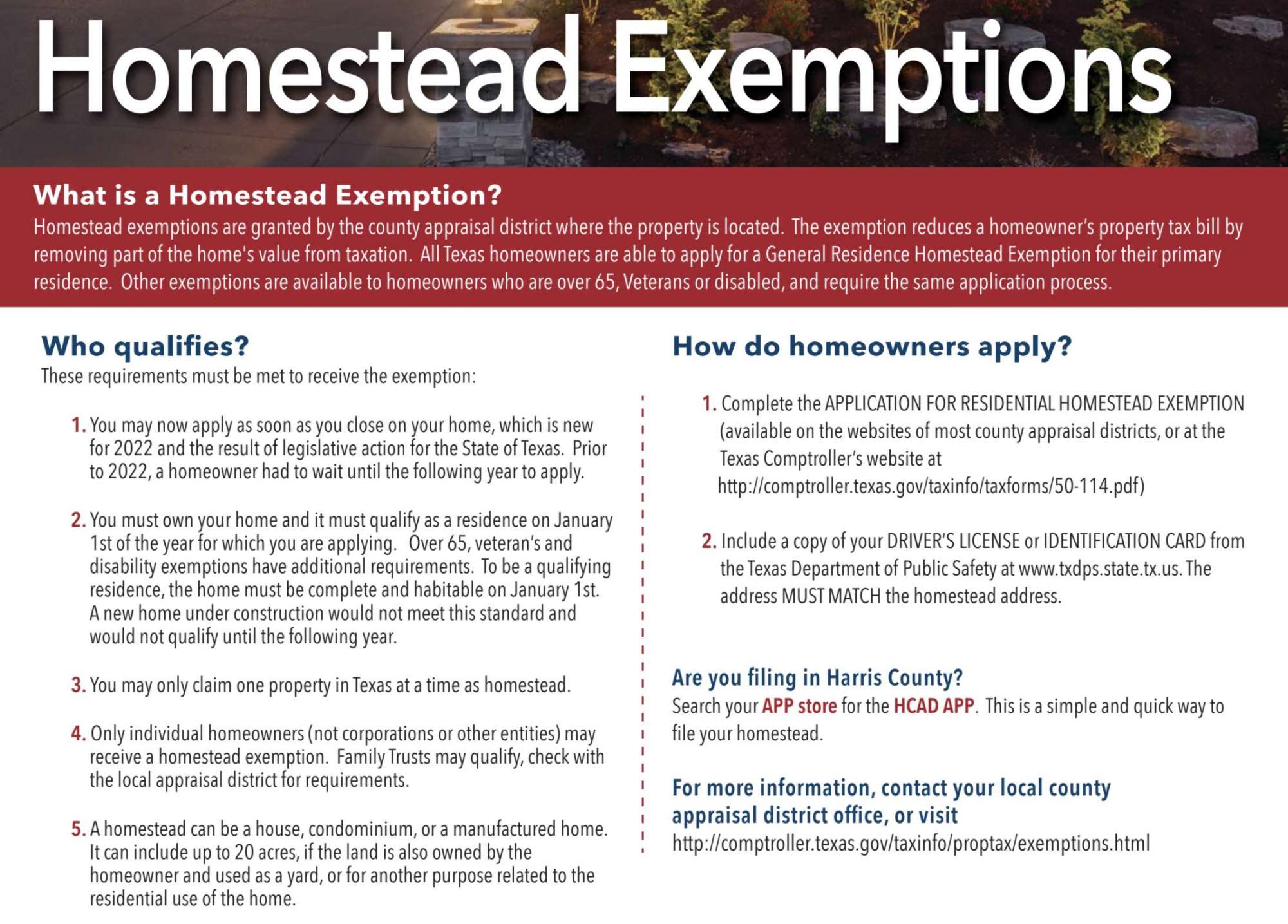

This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online The City of San Antonio increased the homestead exemption for its portion of a resident s tax bill from 05 or a minimum of 5 000 up to 10 for 2022 property tax

Homestead Exemption Bexar County 2022

Homestead Exemption Bexar County 2022

https://www.exemptform.com/wp-content/uploads/2022/08/2020-update-houston-homestead-home-exemptions-step-by-step-guide.png

Bexar County Homestead Tax Exemption

https://sabor.com/-/media/Project/SABOR/SABOR/SABOR/sabor-cta/White-house-on-hill.jpg?la=en&h=499&w=742&mw=742&hash=A35FD21C7FAF3124F07448D7698ACC23

What Is A Homestead Exemption And How Does It Work LendingTree 2022

https://www.lendingtree.com/content/uploads/2020/12/Homestead-Tax-Exemption-Examples.png

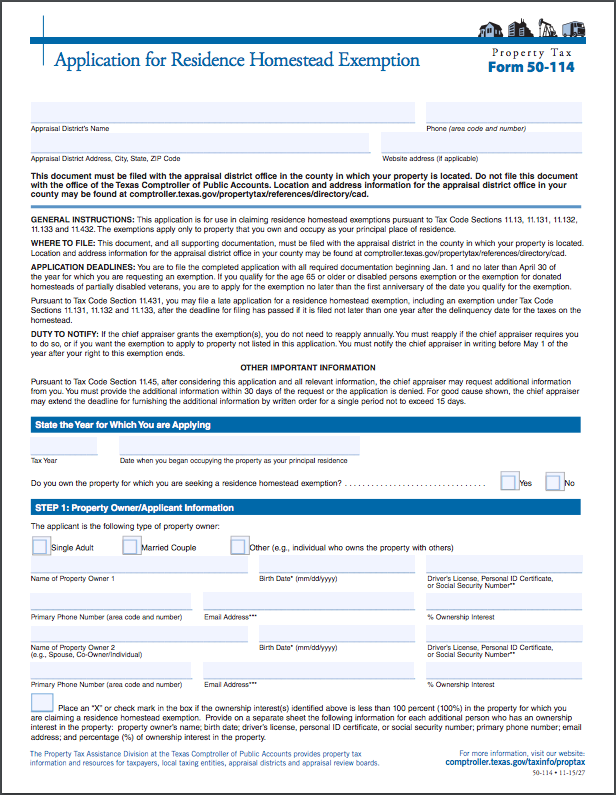

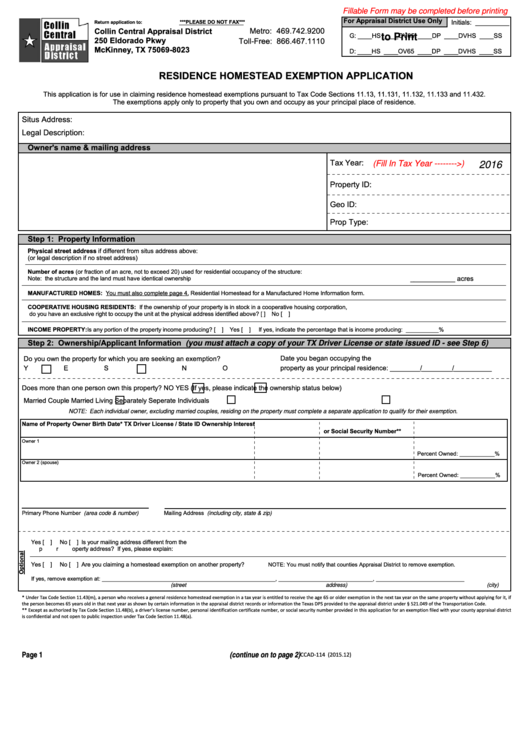

Residence Homestead of 100 or totally Disabled Veterans House Bill 3613 of 81st Texas Legislature authorized the creation of Section 11 131 of the Texas Property Tax Code This Homestead exemptions reduce your home s appraised value and as a result lower your property taxes To apply for an exemption on your residence homestead contact

What residence homestead exemptions are available How do I get a general 40 000 residence homestead exemption What is the deadline for filing a residence homestead The Bexar County Commissioners Court on Tuesday approved a plan to offer homeowners a property tax exemption worth 20 of the appraised value of their home

Download Homestead Exemption Bexar County 2022

More picture related to Homestead Exemption Bexar County 2022

Bexar Cad Homestead Exemption

https://image.slidesharecdn.com/bexarcadhomesteadexemption-160521054048/95/bexar-cad-homestead-exemption-3-638.jpg?cb=1463809971

HECHO How To Fill Out Texas Homestead Exemption 2022 YouTube

https://i.ytimg.com/vi/WnvkhRQRJfU/maxresdefault.jpg

Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/homestead-exemption.png?fit=1023%2C1023&ssl=1

Bexar county homestead exemption applications are due by April 30th each year Beginning Jan 1st 2022 you can apply for your homestead exemption as soon as you move Qualifying residents in Bexar County will see a 15 decrease in their annual property tax bill after county commissioners Tuesday approved an across the board 5 000 homestead exemption The decrease will be the

If you have any questions or require assistance in filling out the form please contact Bexar Appraisal District at 210 224 2432 or find more information on exemptions How do I get an additional 10 000 age 65 or older or disabled residence homestead exemption How do I qualify for a disabled person s exemption What is the deadline for

Homestead Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/224/224079/large.png

How To Fill Out Homestead Exemption Form Bexar County Texas

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/50-132-fill-out-and-sign-printable-pdf-template-signnow.png

https://www.bexar.org/3607

2022 Official Tax Rates Exemptions 2022 Official Tax Rates Exemptions

https://bcad.org/online-portal

This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online

Free Homestead Exemption Fill Out Sign Online DocHub

Homestead Exemption Form Fill Out Sign Online DocHub

Homestead Exemption 2022

Texas Homestead Tax Exemption Guide 2023

Homestead Exemption

What Is A Homestead Exemption For Property Ta Bios Pics

What Is A Homestead Exemption For Property Ta Bios Pics

Life Estate Texas Homestead Exemption Inspire Ideas 2022

Harris County Homestead Exemption Form Printable Pdf Download

Ingham County Property Homestead Exemption Form ExemptForm

Homestead Exemption Bexar County 2022 - Homestead exemptions reduce your home s appraised value and as a result lower your property taxes To apply for an exemption on your residence homestead contact