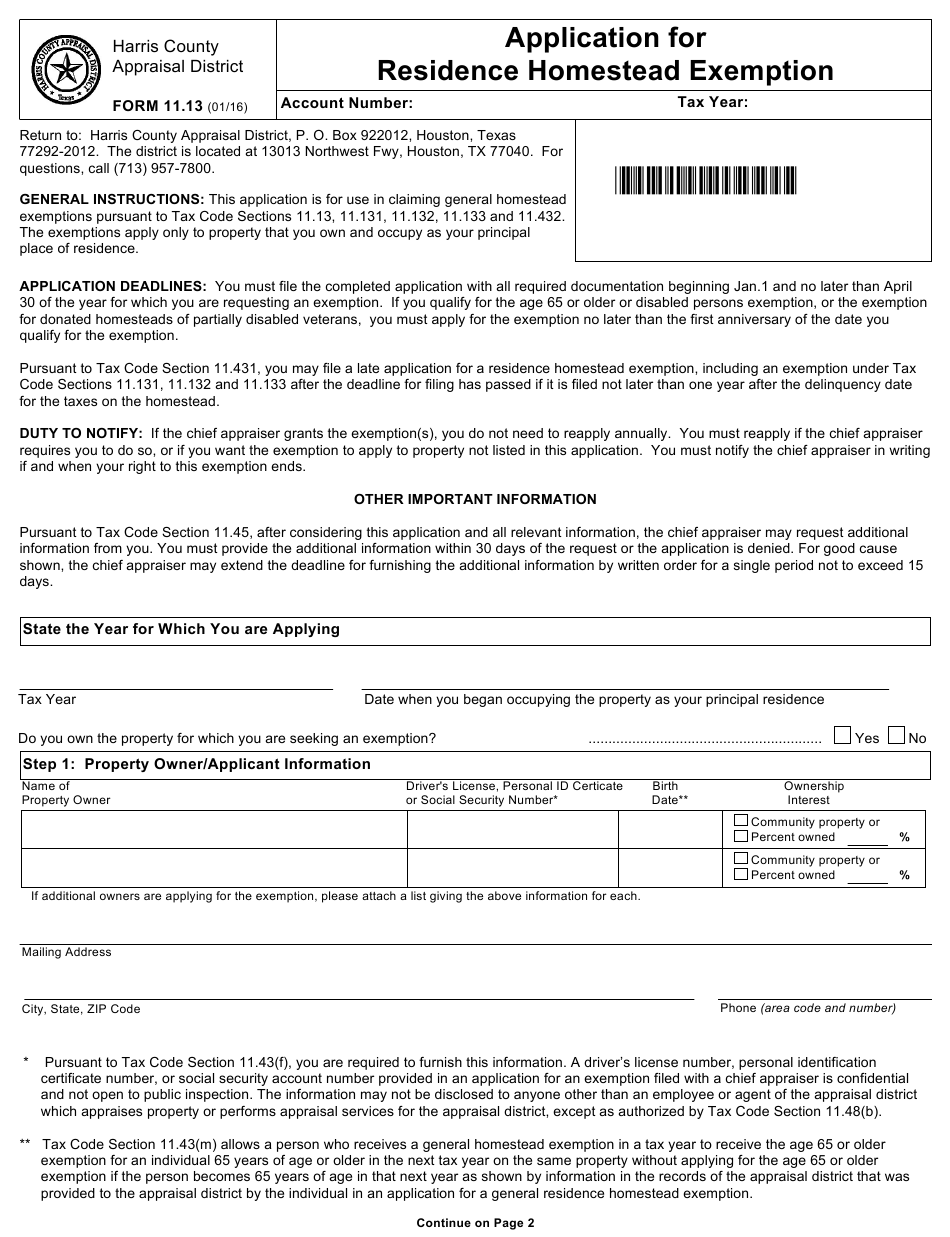

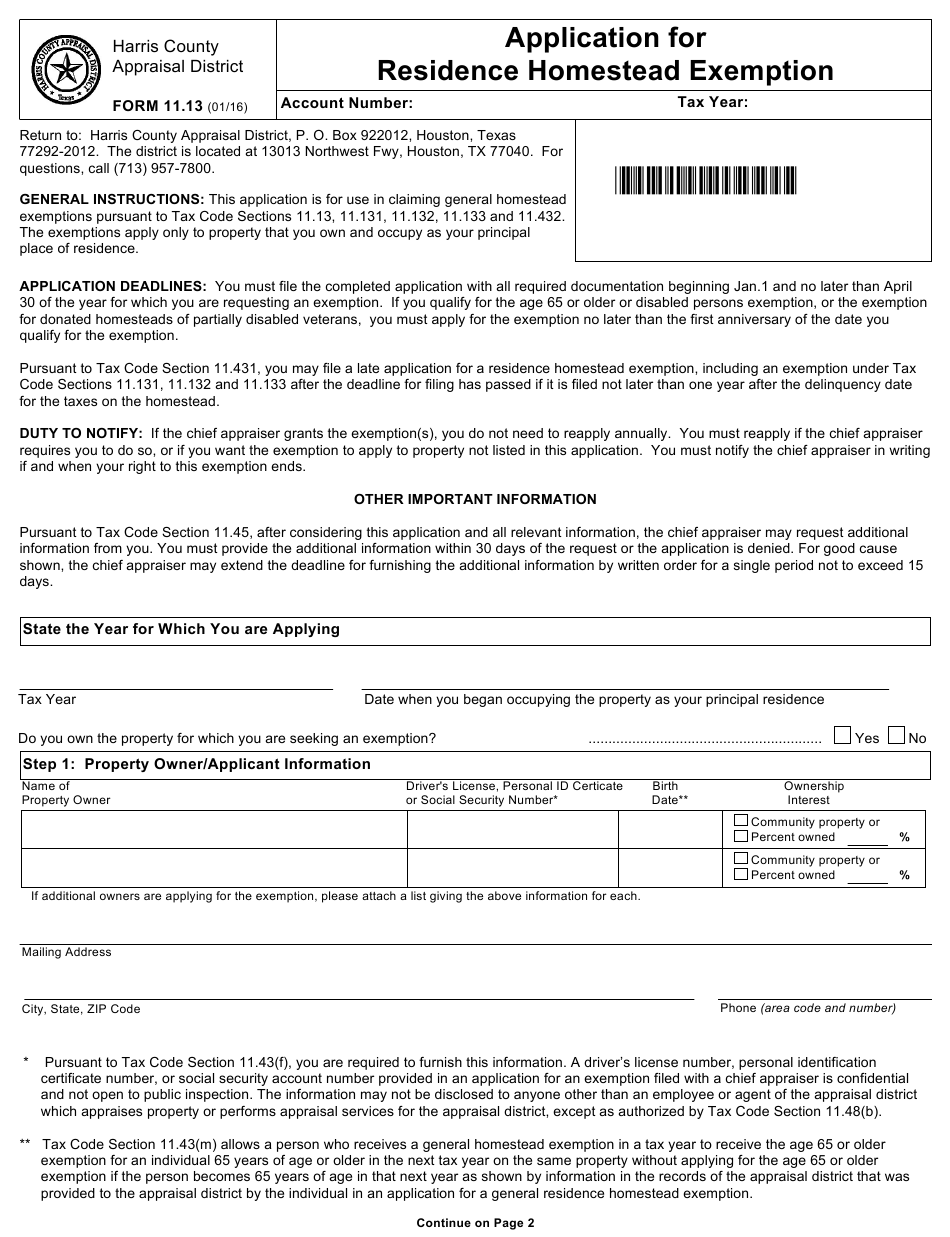

Homestead Exemption Status Harris County How to Apply for a Homestead Exemption To apply for a Homestead Exemption you must submit the following to the Harris Central Appraisal District HCAD A copy of your valid Texas Driver s License showing the homestead address This requirement may be waived if you are

Harris County Appraisal District Exemption Submission ONLINE EXEMPTION FILING Return to Main Page Qualification Requirements This application currently works only for the general homestead and over 65 exemptions You must have a Texas driver s license or state ID card that matches the property address of your residence Open All Do I as a homeowner get a tax break from property taxes Do all homes qualify for residence homestead exemptions What is a residence homestead What residence homestead exemptions are available How do I get a general 40 000 residence homestead exemption What is the deadline for filing a residence homestead exemption

Homestead Exemption Status Harris County

Homestead Exemption Status Harris County

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

How To File For Harris County Homestead Exemption Deadline April 30th

https://i.ytimg.com/vi/hWT7e9UzBFU/maxresdefault.jpg

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

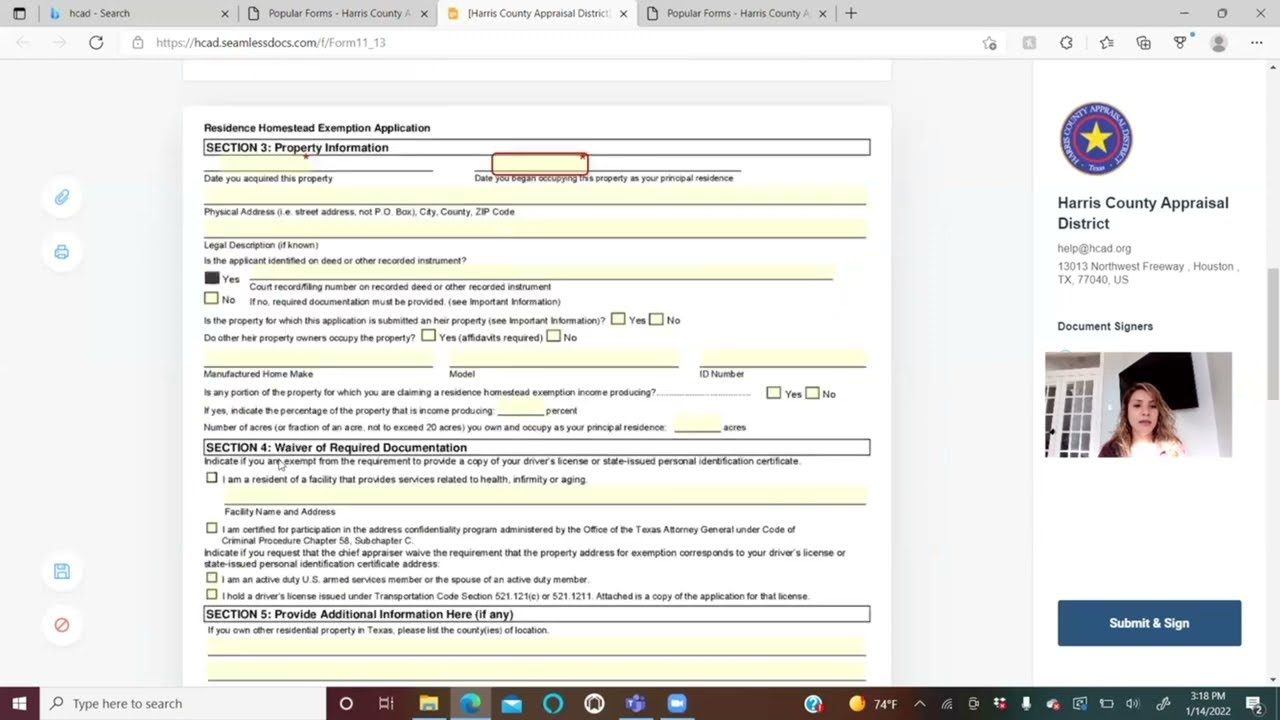

To obtain a Homestead Exemption please submit the completed APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION Form 11 13 and submit it directly to the Harris Central Appraisal District Harris Central Harris County currently provides a 20 optional homestead exemption to all homeowners This means for example that if your home is valued at 100 000 the exemption will reduce its taxable value for Harris County taxes by 20 000 to 80 000

Updated 1 31 PM Feb 22 2022 CST Homeowners who take advantage of homestead exemptions can alleviate their property tax burden Courtesy Adobe Stock Officials with the Harris County GENERAL RESIDENTIAL EXEMPTION You qualify for this exemption if 1 you owned this property on January 1 2 you occupied it as your principal residence on January 1 and 3 you or your spouse have not claimed a residence homestead exemption on

Download Homestead Exemption Status Harris County

More picture related to Homestead Exemption Status Harris County

Dallas Homestead Exemption Explained FAQs How To File

https://assets.site-static.com/userFiles/3705/image/dallas-homestead-exemptions.jpg

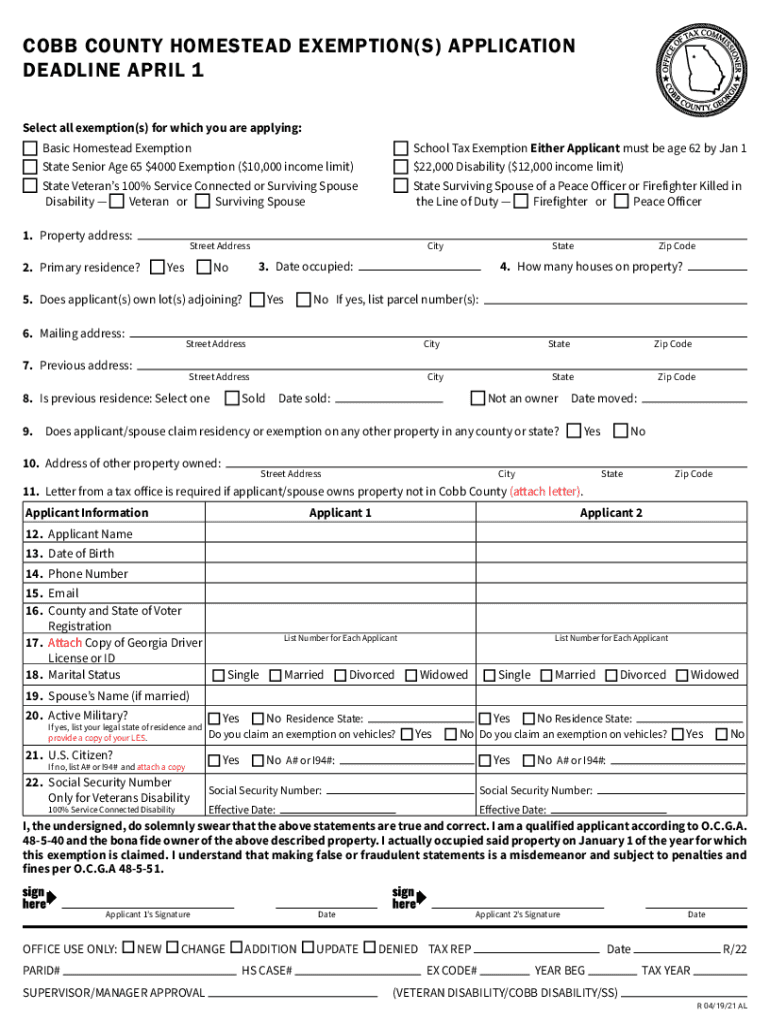

Cobb Homestead Exemptions 2021 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/569/944/569944231/large.png

How Much Is The Homestead Exemption In Houston Square Deal Blog

https://res.cloudinary.com/agiliti/image/upload/v1667895615/homestead-exemption-sample.webp

Download the HCAD Information and Exemption App to file your homestead exemption You can get the app on both Apple and Android devices using these links Apple App Store Or visit iTunes and search Property tax attorneys say if you haven t applied you can backdate the exemption two years after you move into your home For Harris County homeowners you can find information on that

HOMESTEAD EXEMPTION FILING DATES ARE JANUARY 1st THROUGH April 1st Effective June 1 2005 homestead exemptions may be filed for any time during the year However exemptions must be filed for by April 1 to apply to the current tax year You must still own and occupy the property as of January 1 to be eligible Standard Homestead How to apply for Homestead Exemption in Harris County Share Posted by Dan Boutwell Visit My Blog Claiming Texas Homestead is important and will save you money If you bought a Texas home in 2021 now is the time to file for you Texas Homestead Exemption A quick estimate would be approximately 15 16 of you total

How Much Is The Homestead Exemption In Houston Square Deal Blog

https://res.cloudinary.com/agiliti/image/upload/v1665312015/harris-cad-homestead-exemption-status.webp

Harris County Homeowners Watch Your Mail For Homestead Exemption

https://s.hdnux.com/photos/01/17/46/55/20867949/4/rawImage.jpg

https://www.hctax.net/Property/TaxBreaks

How to Apply for a Homestead Exemption To apply for a Homestead Exemption you must submit the following to the Harris Central Appraisal District HCAD A copy of your valid Texas Driver s License showing the homestead address This requirement may be waived if you are

https://portal.hcad.org/mobile/Exemptions

Harris County Appraisal District Exemption Submission ONLINE EXEMPTION FILING Return to Main Page Qualification Requirements This application currently works only for the general homestead and over 65 exemptions You must have a Texas driver s license or state ID card that matches the property address of your residence

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

How Much Is The Homestead Exemption In Houston Square Deal Blog

What Happens When You File For Homestead Exemption In Texas WICZ

Homestead Exemption Montgomery Harris County Texas YouTube

Florida Homestead Exemption Definition Tutorial Pics

Harris County Homestead Exemption Form ExemptForm

Harris County Homestead Exemption Form ExemptForm

Harris County Homestead Exemption How To File For Homestead Exemption

San Antonio And Bexar County Homestead Exemption Square Deal Blog

Houston Homestead Exemption Lower Your Property Taxes Now

Homestead Exemption Status Harris County - Updated 1 31 PM Feb 22 2022 CST Homeowners who take advantage of homestead exemptions can alleviate their property tax burden Courtesy Adobe Stock Officials with the Harris County