Homestead Rebate And Property Tax Deduction Web A It s not as straightforward as you might expect The Homestead Rebate is something the IRS would call an itemized deduction recovery said Laurie Wolfe a certified financial

A homestead exemption is most often on only a fixed monetary amount such as the first 50 000 of the assessed value The remainder is taxed at the normal rate A home valued at 150 000 would then be taxed on only 100 000 and a home valued at 75 000 would then be taxed on only 25 000 The exemption is generally intended to turn the property tax into a progressive tax In some plac Web 2 nov 2018 nbsp 0183 32 Homestead exemptions generally work this way If your home is assessed at a certain value the exemption reduces the value by a particular amount and that

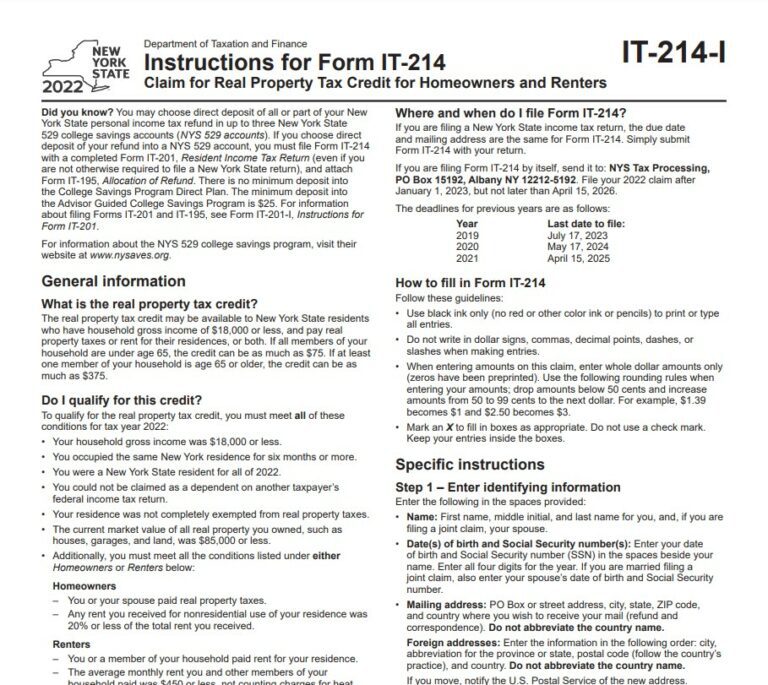

Homestead Rebate And Property Tax Deduction

Homestead Rebate And Property Tax Deduction

https://i.pinimg.com/originals/6a/08/61/6a0861d8982fefbb26417d347dca1c22.jpg

2021 2023 Form VT HS 122 HI 144 Fill Online Printable Fillable

https://www.pdffiller.com/preview/548/386/548386591/large.png

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet

https://i.pinimg.com/originals/16/16/86/161686673757e7aaf5dba85fa41be0ed.jpg

Web 31 mars 2023 nbsp 0183 32 For the 2022 tax year the standard deduction ranges from 12 950 to 25 900 for joint filers Deduct your property taxes in the year you pay them Sounds simple but it can be tricky Web Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction Only a

Web 15 mars 2022 nbsp 0183 32 In 2006 the IRS issued guidance specifically for New Jersey residents in IRS News Release No NJ 2206 03 stating that New Jersey taxpayers would report the Web Homestead Deduction and Senior Citizen or Disabled Property Owner Tax Relief This benefit reduces your real property s assessed value by 84 000 savings of 714 00

Download Homestead Rebate And Property Tax Deduction

More picture related to Homestead Rebate And Property Tax Deduction

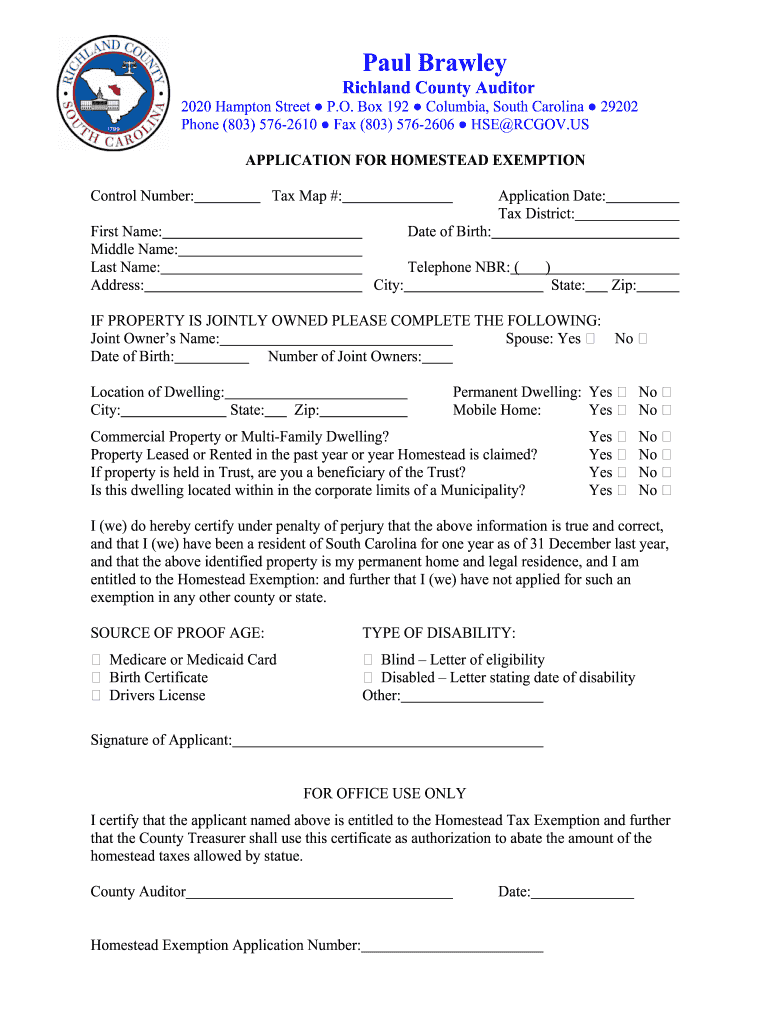

Berkeley County Property Tax Homestead Exemption ZDOLLZ ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/sc-application-for-homestead-exemption-fill-and-sign-printable-4.png

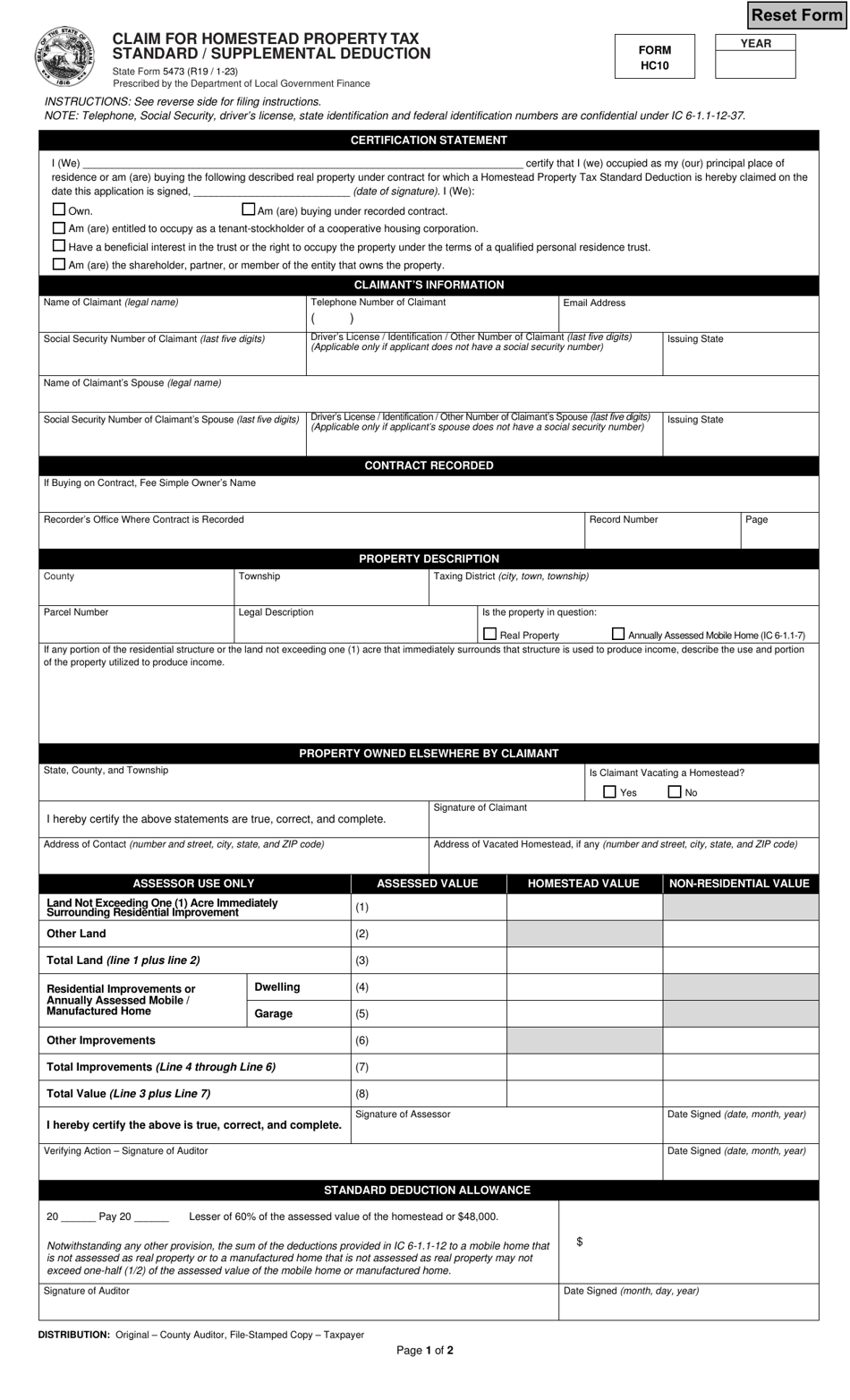

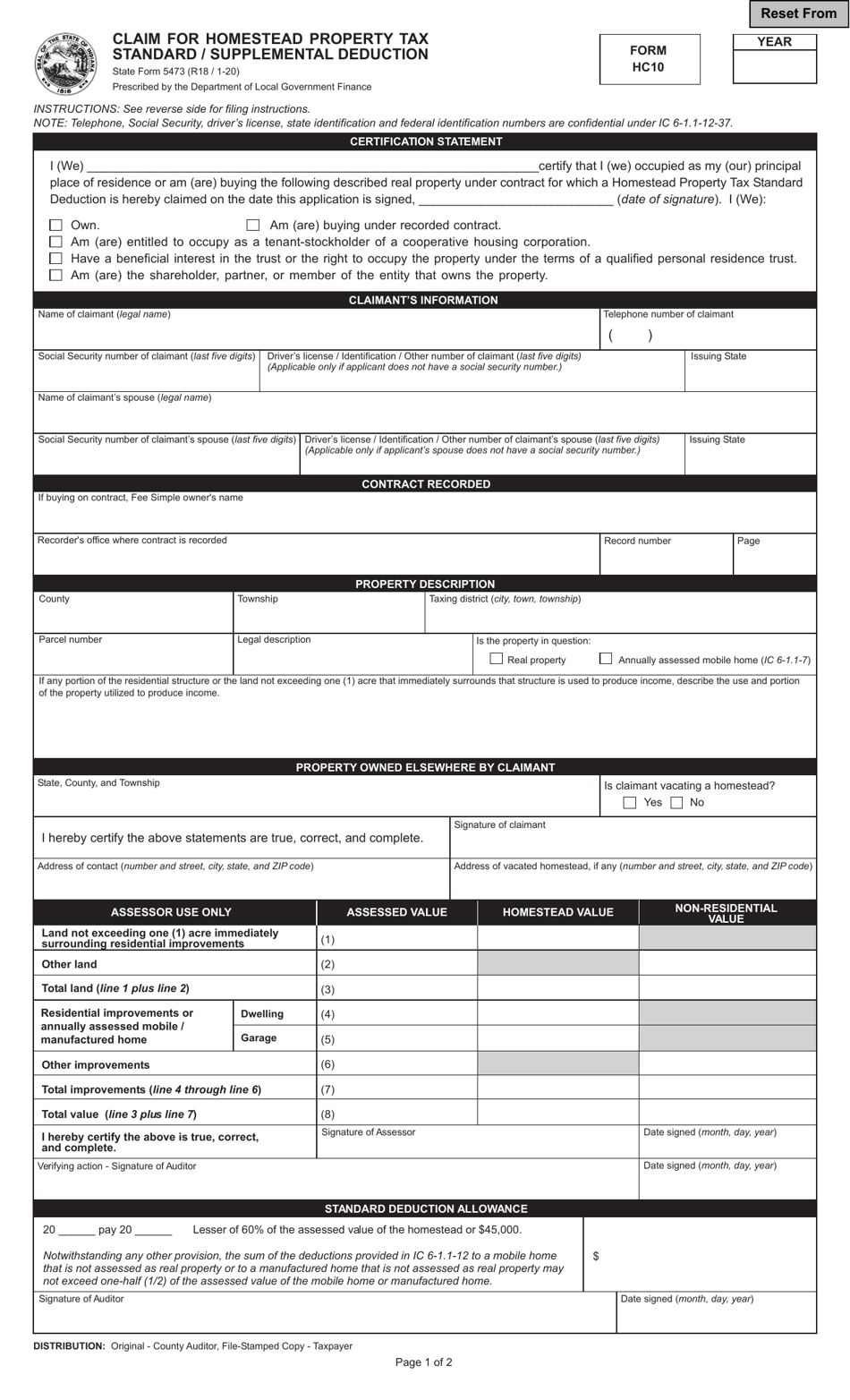

State Form 5473 HC10 Download Fillable PDF Or Fill Online Claim For

https://data.templateroller.com/pdf_docs_html/2646/26460/2646070/state-form-5473-hc10-claim-for-homestead-property-tax-standard-supplemental-deduction-indiana_print_big.png

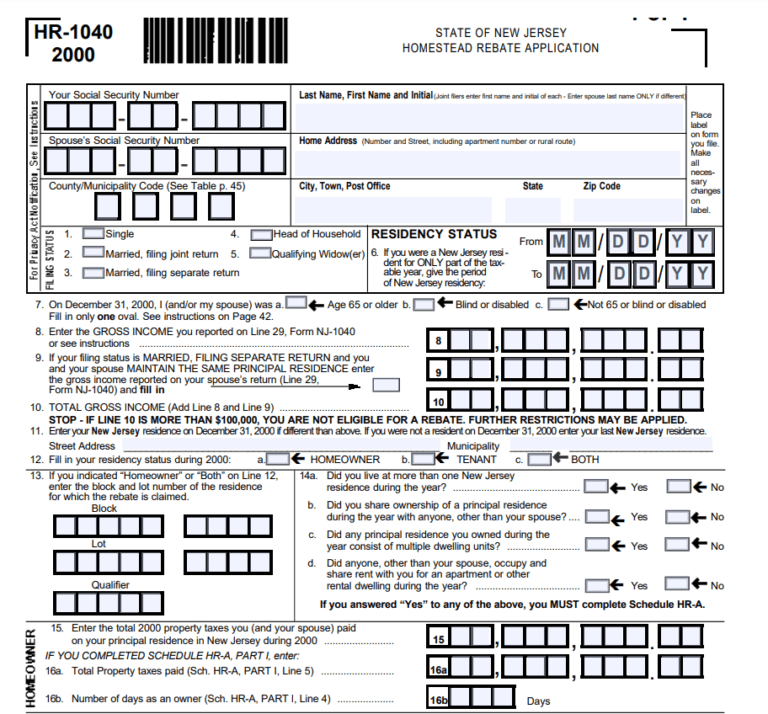

File Nj Homestead Rebate Form Online Application Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online-768x714.png

Web 6 mars 2019 nbsp 0183 32 What the Exemption Does The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home s value from Web 24 janv 2020 nbsp 0183 32 The idea is to issue property tax exemptions to qualified homeowners again those owners suffering a disability loss of a spouse or personal bankruptcy thus saving them money on potentially

Web 30 avr 2023 nbsp 0183 32 A homestead exemption reduces homeowners state property tax obligation The exemption can help protect a home from creditors in the event of a spouse dying or Web 1 sept 2011 nbsp 0183 32 Homestead exemptions are a progressive approach to property tax relief that is the largest tax cuts as a share of income go to lower and middle income taxpayers There are two broad types of

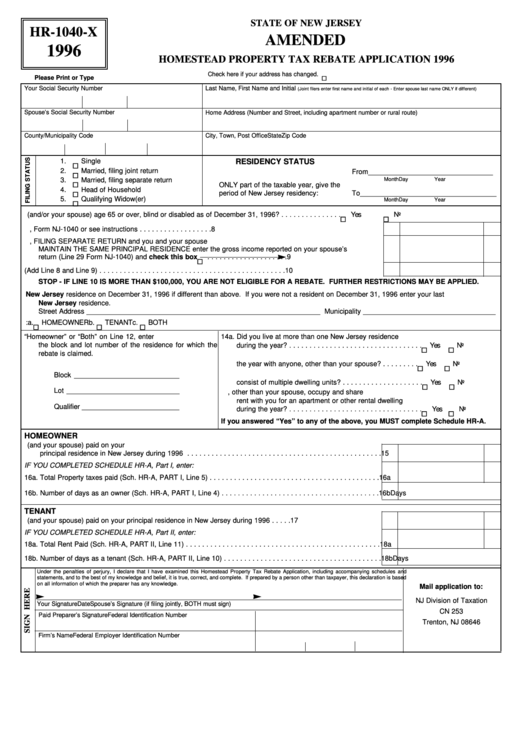

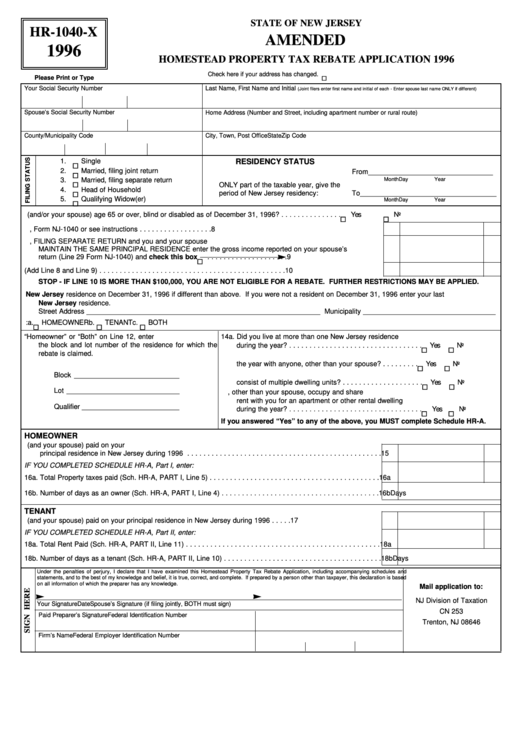

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

https://data.formsbank.com/pdf_docs_html/188/1889/188928/page_1_thumb_big.png

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

https://njmoneyhelp.com/2019/03/happens-homestead-rebate-tax-return

Web A It s not as straightforward as you might expect The Homestead Rebate is something the IRS would call an itemized deduction recovery said Laurie Wolfe a certified financial

https://en.wikipedia.org/wiki/Homestead_exemption

A homestead exemption is most often on only a fixed monetary amount such as the first 50 000 of the assessed value The remainder is taxed at the normal rate A home valued at 150 000 would then be taxed on only 100 000 and a home valued at 75 000 would then be taxed on only 25 000 The exemption is generally intended to turn the property tax into a progressive tax In some plac

Property Tax Rebate New York State Printable Rebate Form

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

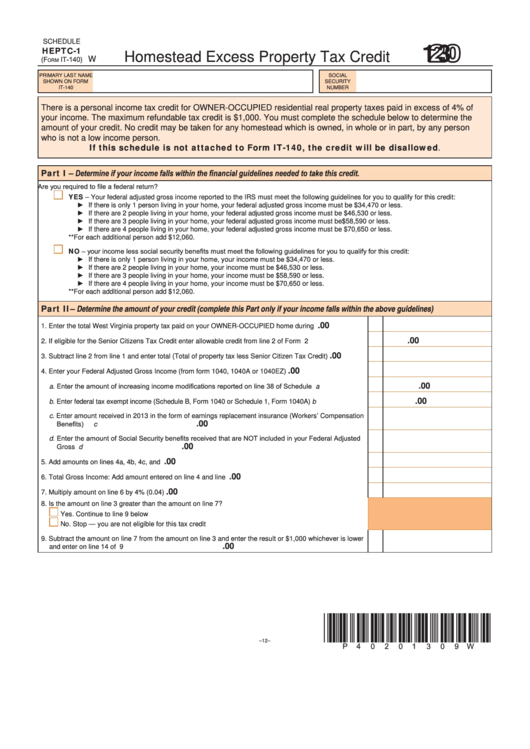

Fillable Schedule Heptc 1 Form It 140 Homestead Excess Property Tax

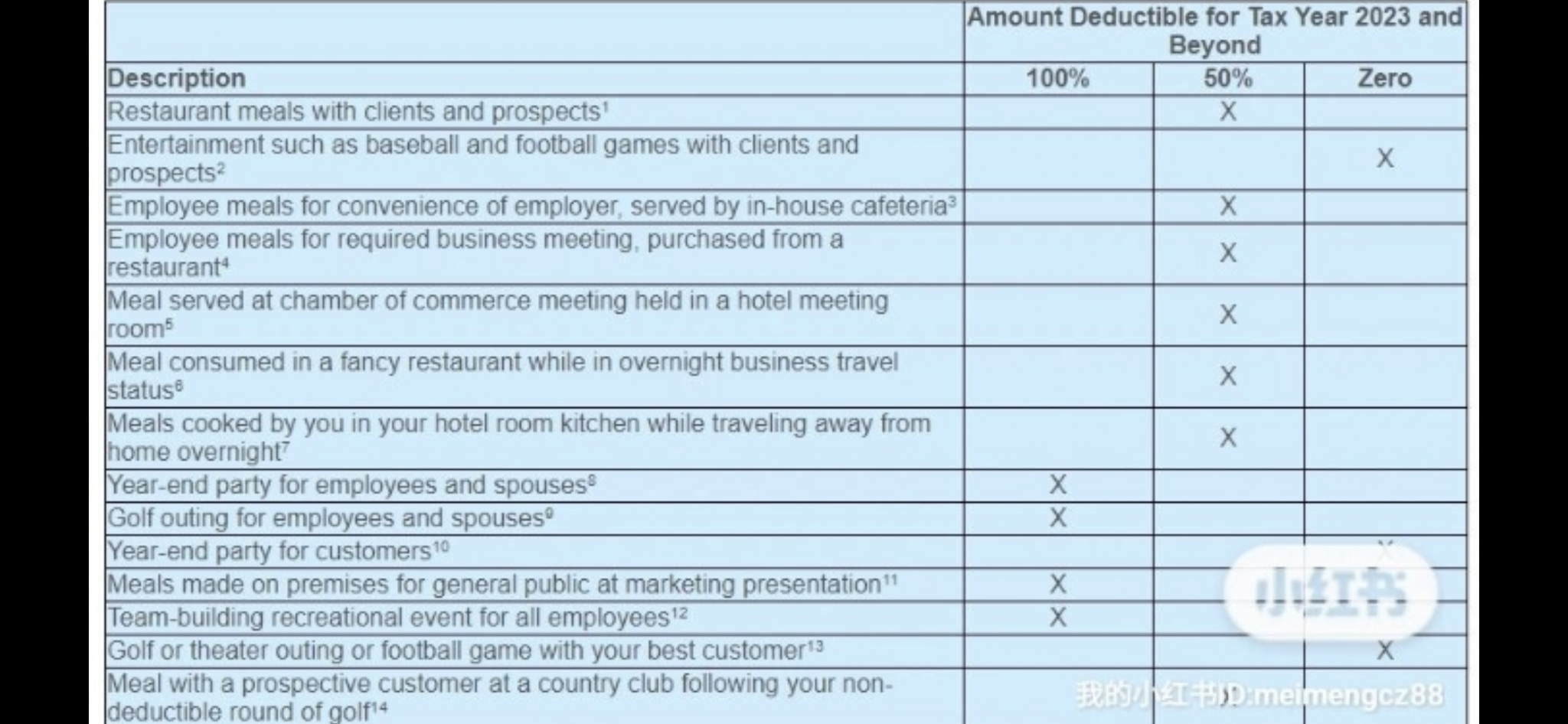

Real Estate Tax Deduction To Mine And Beyond

Pin On Realtor Tips

Pin On Realtor Tips

Aging In Place Property Taxes Homestead Exemptions Rebates And

5 Most Overlooked Rental Property Tax Deductions AccidentalRental

State Form 5473 HC10 Download Fillable PDF Or Fill Online Claim For

Homestead Rebate And Property Tax Deduction - Web Homestead Deduction and Senior Citizen or Disabled Property Owner Tax Relief This benefit reduces your real property s assessed value by 84 000 savings of 714 00