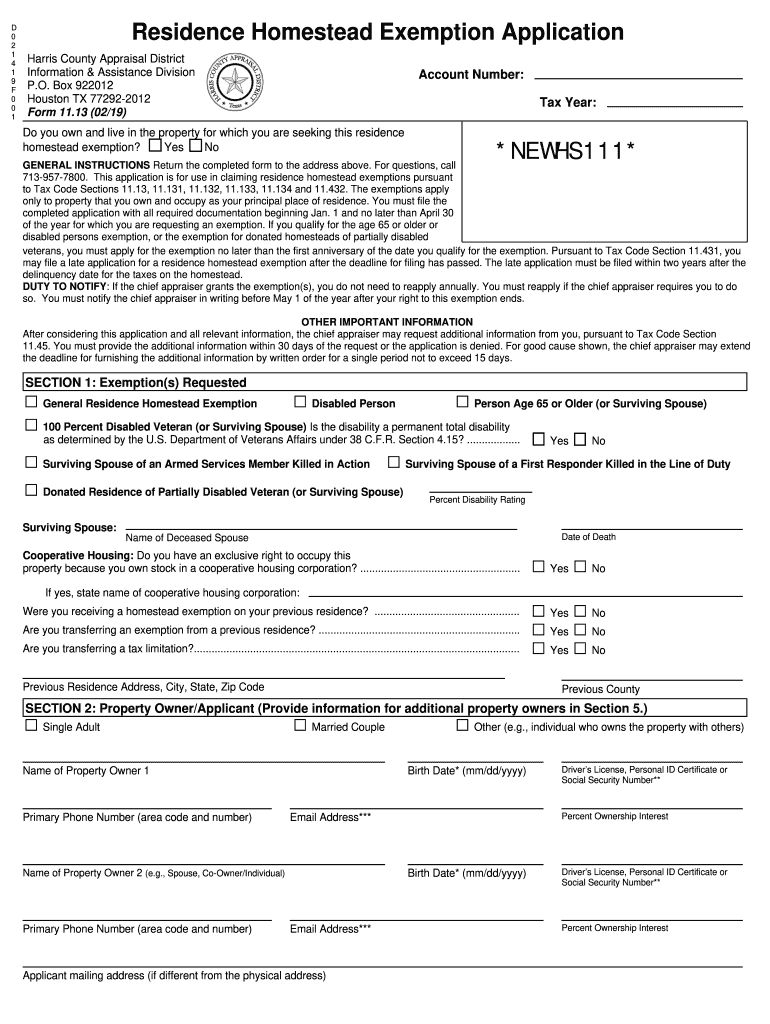

Homestead Tax Credit And Exemption Polk County Iowa Homestead Tax Credit and Exemption Iowa Code chapter 425 and Iowa Administrative Code rule 701 110 1 This application must be filed or postmarked to your city or

DES MOINES IA Iowan s age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning January 1 2023 In Homestead Tax Credit and Exemption form In addition to the homestead tax credit eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax

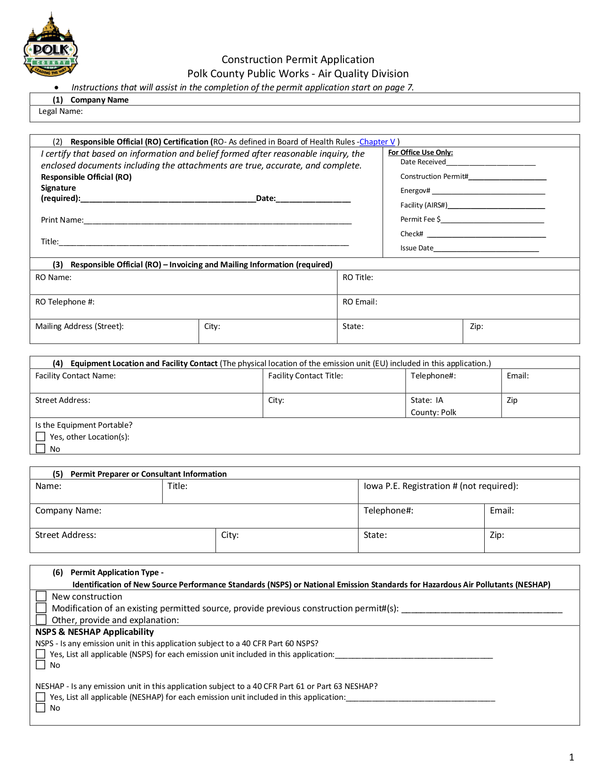

Homestead Tax Credit And Exemption Polk County Iowa

Homestead Tax Credit And Exemption Polk County Iowa

https://res.cloudinary.com/agiliti/image/upload/v1665312015/harris-cad-homestead-exemption-status.webp

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

https://www.signnow.com/preview/479/105/479105302/large.png

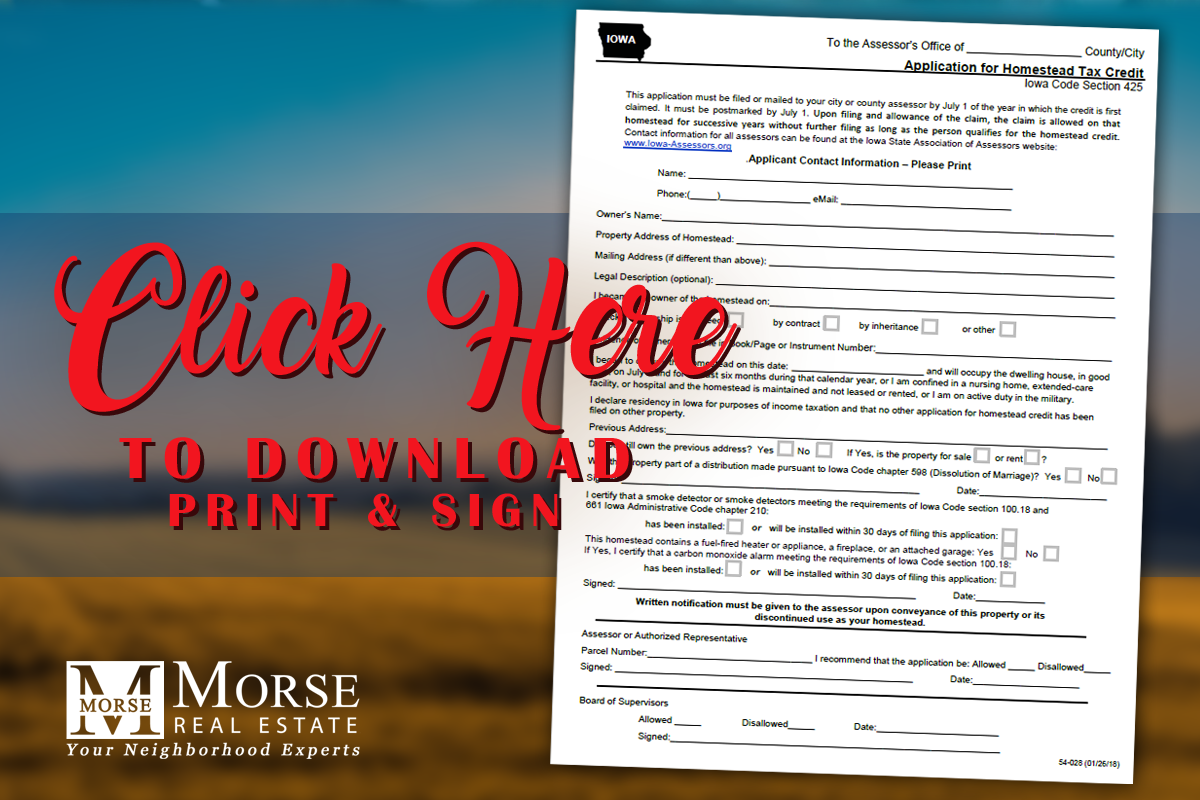

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

http://www.morse-re.com/agent_files/homestead-exemption-download.png

The Iowa Department of Revenue announced Monday it had updated the homestead tax credit and exemption form on its website to reflect the changes Iowans Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is

2023 Iowa Property Tax Credit Claim Iowa Code chapter 425 and Iowa Administrative Code chapter 701 104 Complete the following personal information Your name An exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax you pay The Iowa Department of Revenue

Download Homestead Tax Credit And Exemption Polk County Iowa

More picture related to Homestead Tax Credit And Exemption Polk County Iowa

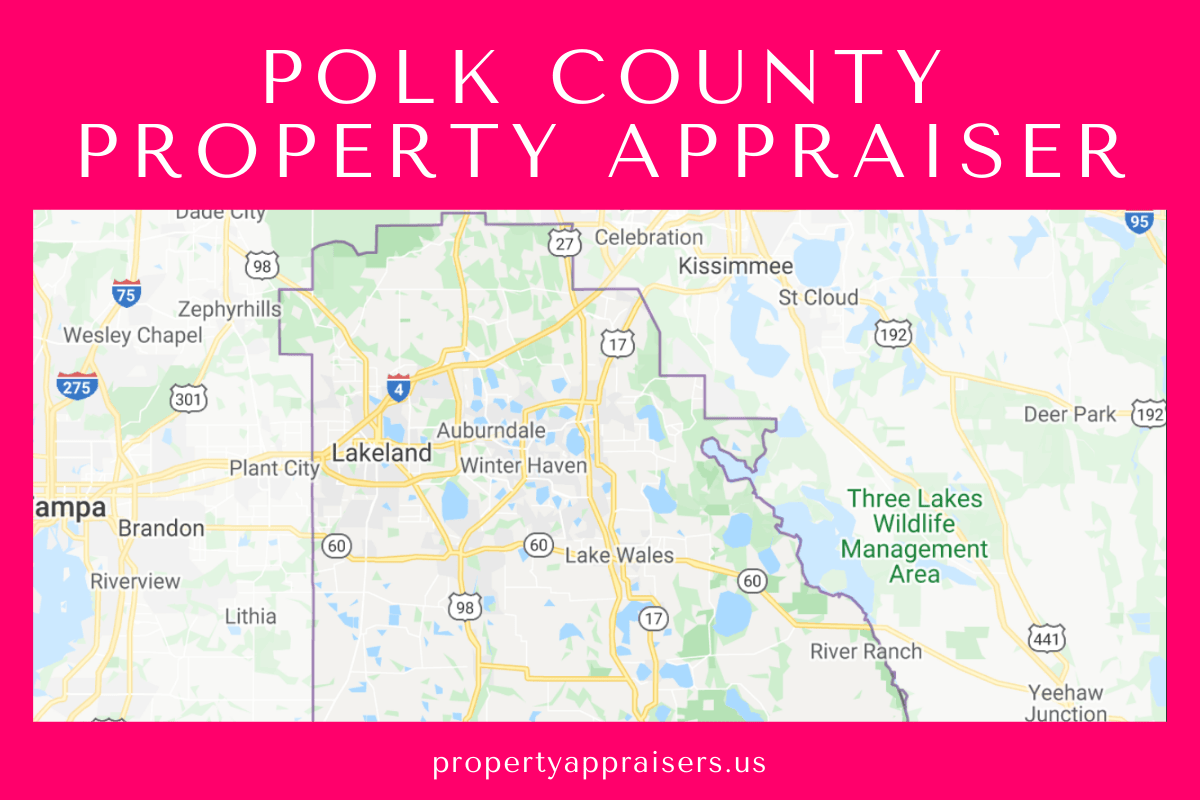

Polk County Property Appraiser s Office Website Map Search

http://propertyappraisers.us/wp-content/uploads/Polk-County-Property-Appraisers.png

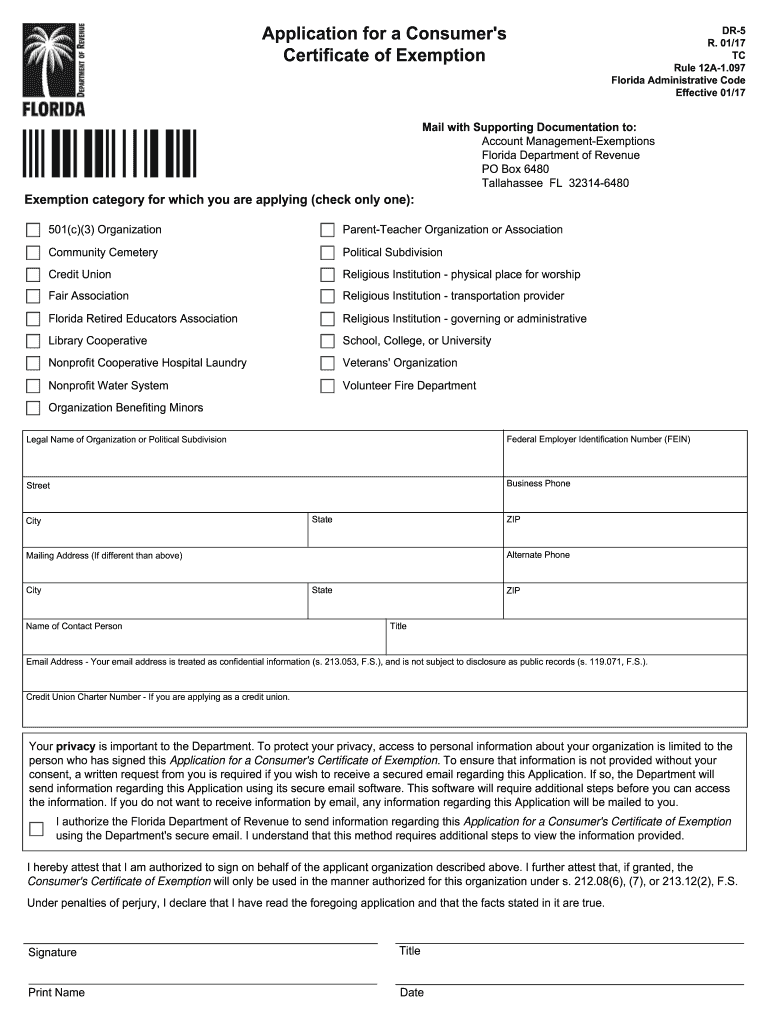

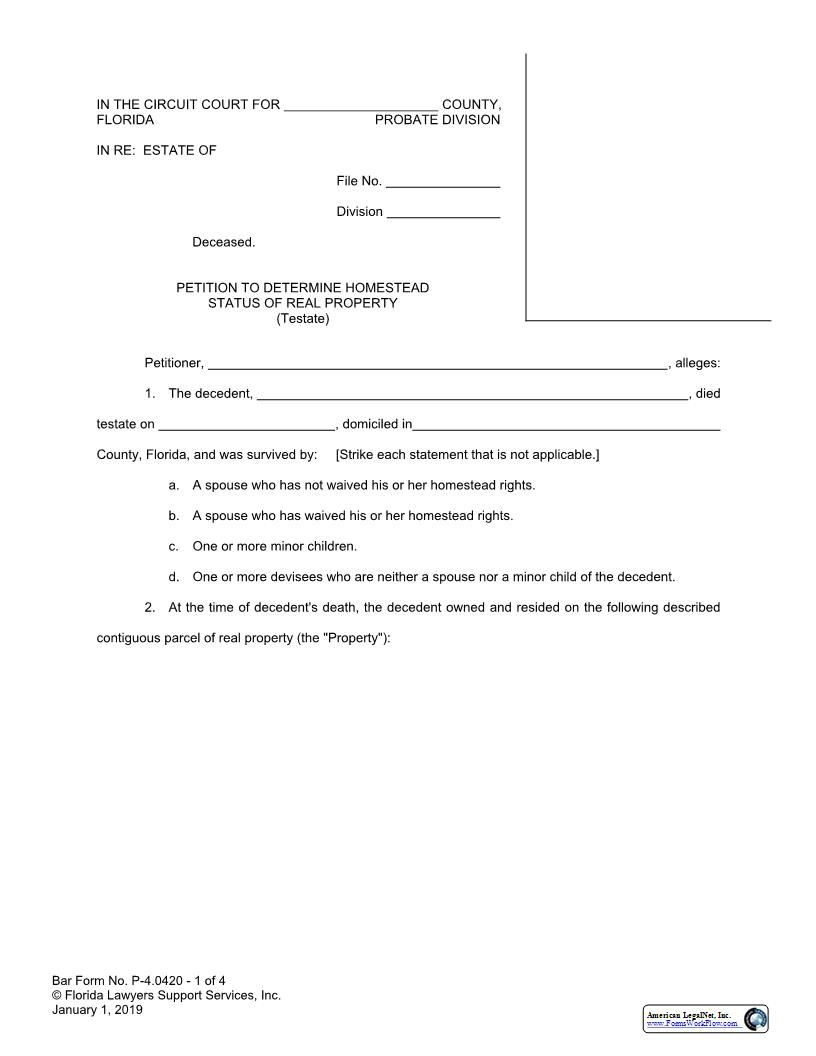

Florida Homestead Exemption 2017 2024 Form Fill Out And Sign

https://www.signnow.com/preview/423/935/423935544/large.png

Benefits Of Home Ownership And Tax Exemptions MSI Credit Solutions

http://msicredit.com/wp-content/uploads/2018/01/Homestead-Exemption-Blog.png

The payment stub for the 2nd installment of tax to be remitted with a mailed orin office payment Please read all special messages and call the Polk County Treasurer s Office Iowa Code 561 1 defines a Homestead as The homestead must embrace the house used as a home by the owner and if the owner has two or more houses thus used the

The Iowa Department of Revenue has amended the Homestead Tax Credit and Exemption 54 028 to allow claimants to apply for the new exemption Source URL https tax iowa gov forms homestead tax credit and exemption 54 028 https tax iowa gov forms homestead tax credit and exemption 54 028

Homestead Exemption Form

https://cdn.slidesharecdn.com/ss_thumbnails/harriscohomesteadexemption-110902150756-phpapp01-thumbnail.jpg?cb=1314976138

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

http://www.morse-re.com/agent_files/homestead-exemption-mre.png

https://tax.iowa.gov/sites/default/files/2024-01...

Homestead Tax Credit and Exemption Iowa Code chapter 425 and Iowa Administrative Code rule 701 110 1 This application must be filed or postmarked to your city or

https://www.polkcountyiowa.gov/board-of...

DES MOINES IA Iowan s age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning January 1 2023 In

Filing For Homestead Exemption In Polk County Florida PROFRTY

Homestead Exemption Form

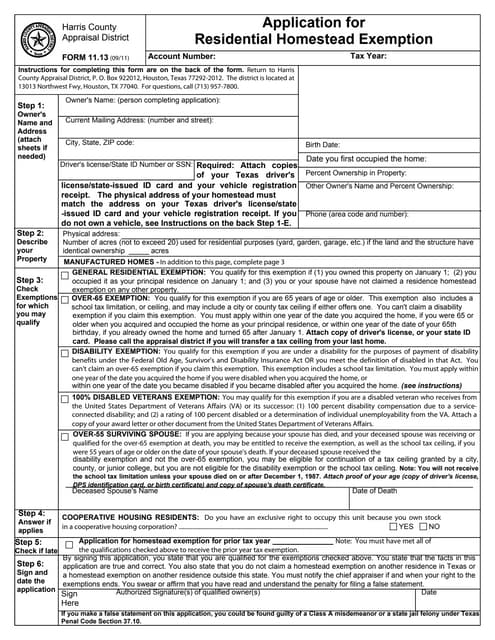

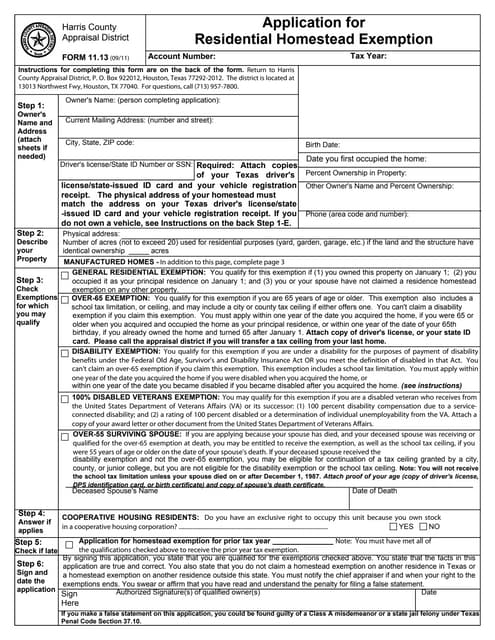

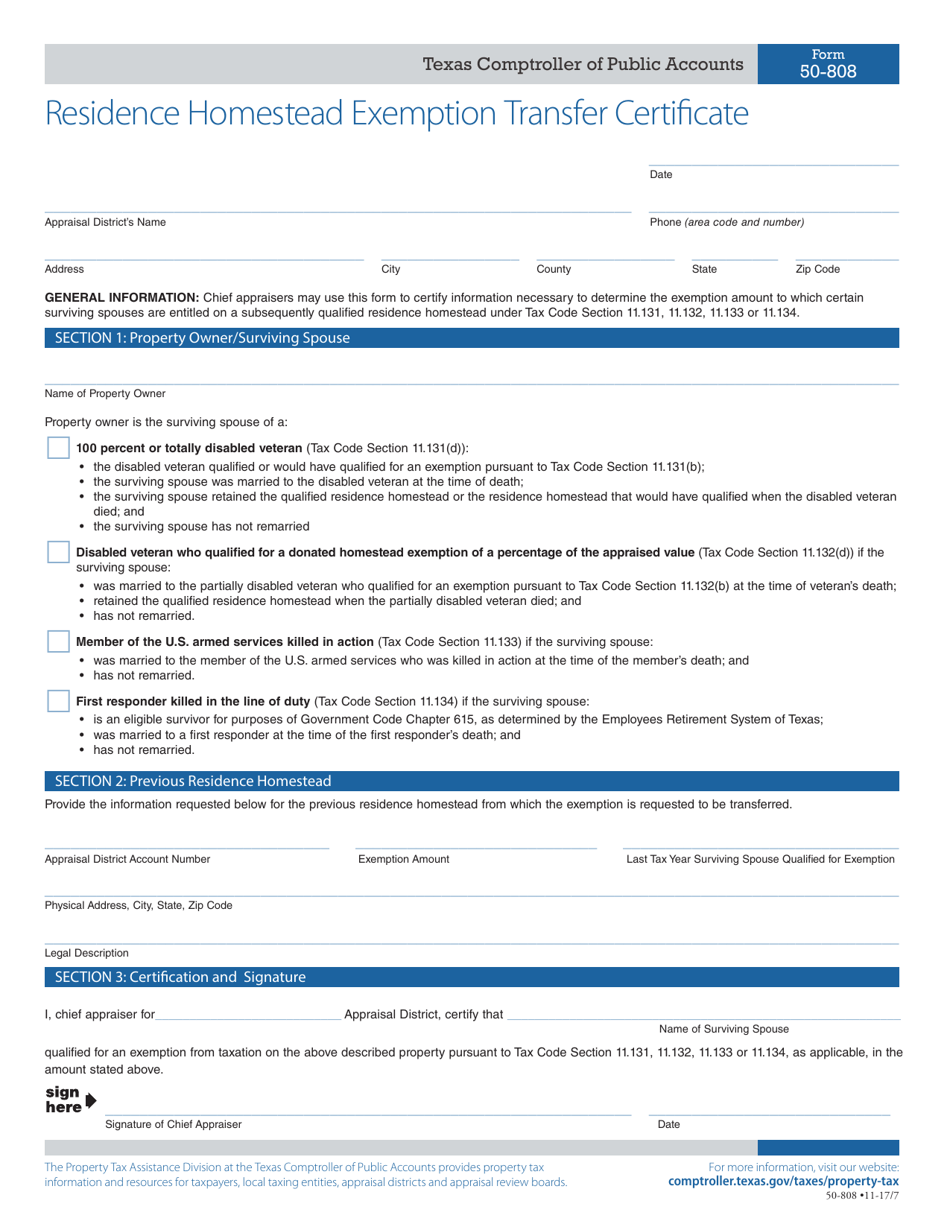

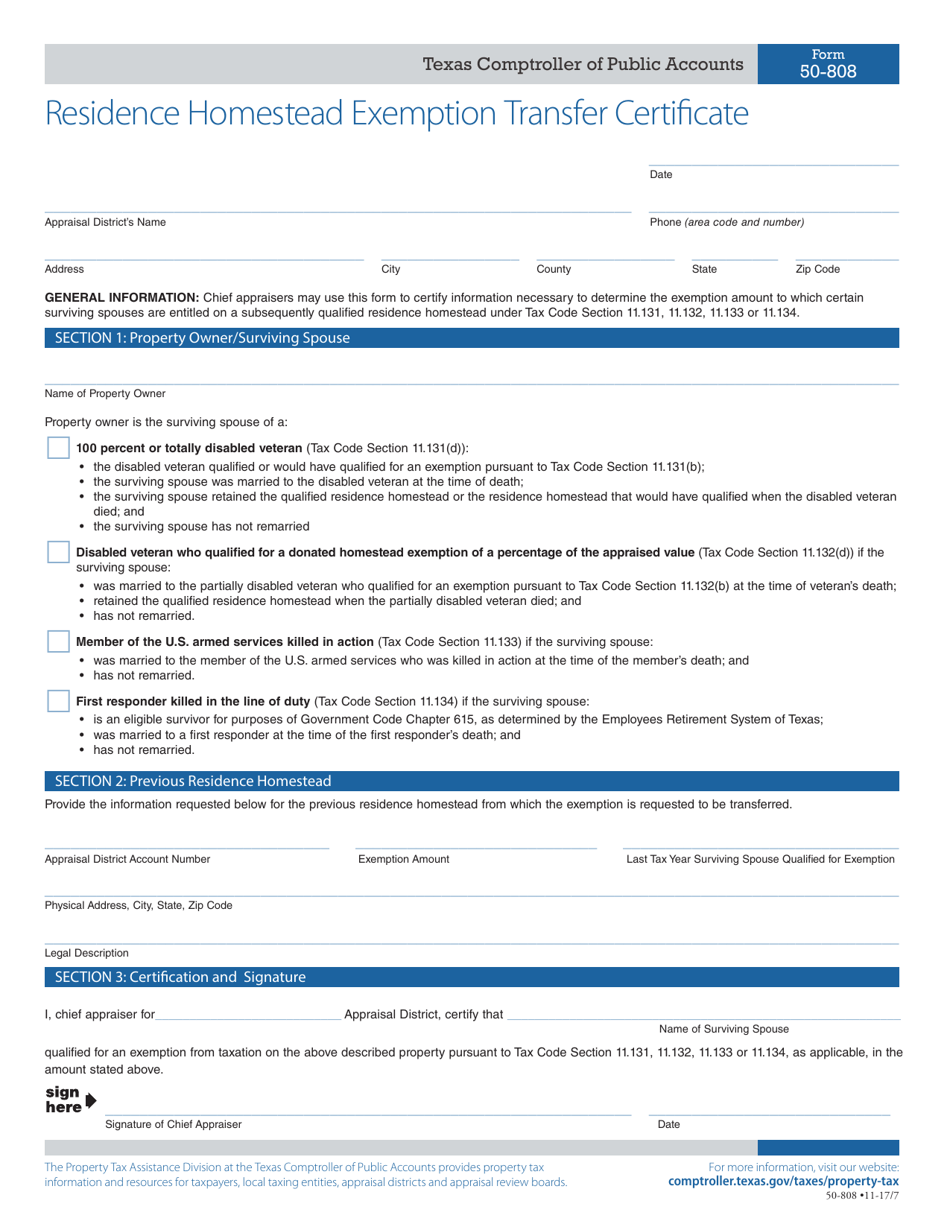

Texas Homestead Exemption Form Fill Out Printable PDF Forms Online

Filing For Homestead Exemption In Polk County Florida PROFRTY

Texas Homestead Tax Exemption Form ExemptForm

Homestead Exemption

Homestead Exemption

Hecht Group In Iowa Seniors May Be Eligible For A Property Tax

Homestead Exemption

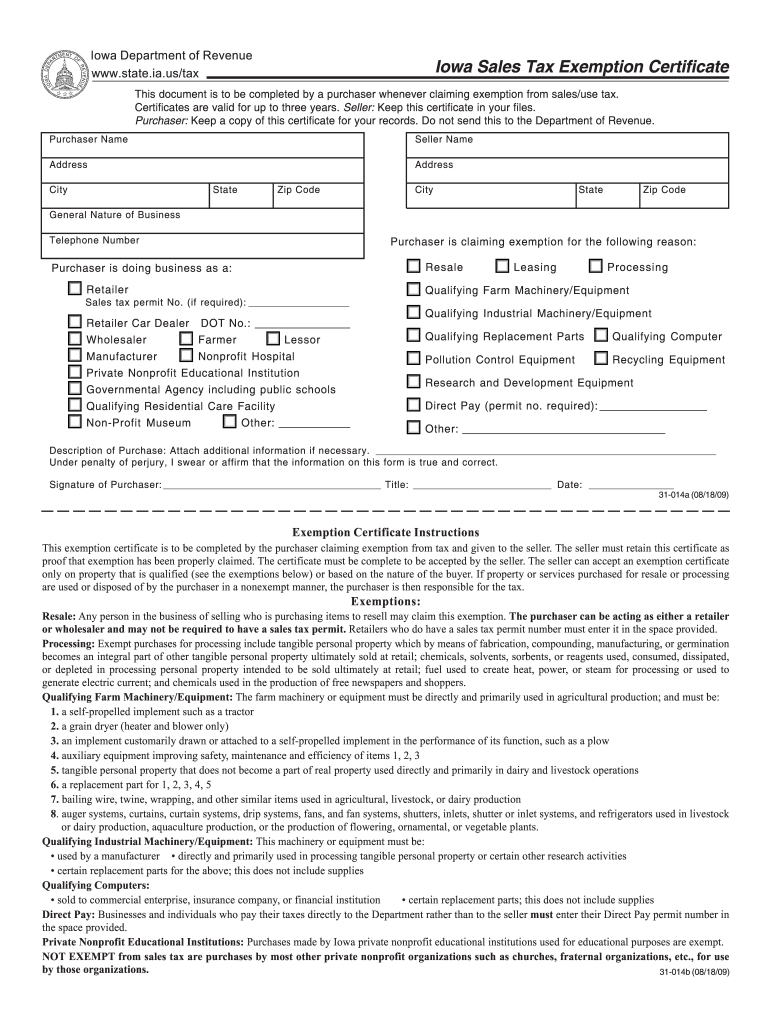

Iowa Sales Tax Exemption Certificate Fillable Fill Out And Sign My

Homestead Tax Credit And Exemption Polk County Iowa - 2023 Iowa Property Tax Credit Claim Iowa Code chapter 425 and Iowa Administrative Code chapter 701 104 Complete the following personal information Your name