Homestead Tax Rebate Maine Web The homestead exemption provides a reduction of up to 25 000 in the value of your home for property tax purposes To qualify you must be a permanent resident of Maine the

Web Provided Additional Direct Tax Relief Governor Mills bolstered the Homestead Exemption Program allowing Maine people to take 25 000 off the value of their home and only pay Web Homestead Exemption This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and

Homestead Tax Rebate Maine

Homestead Tax Rebate Maine

https://printablerebateform.net/wp-content/uploads/2023/04/Maine-Tax-Rebate-2023-768x690.png

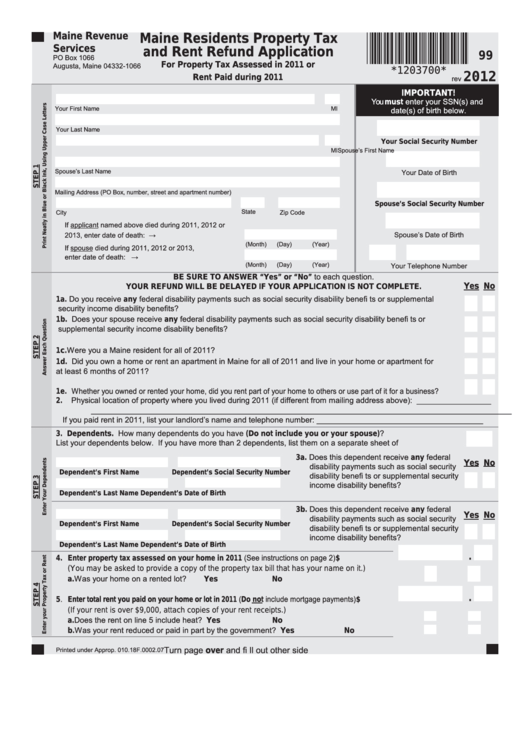

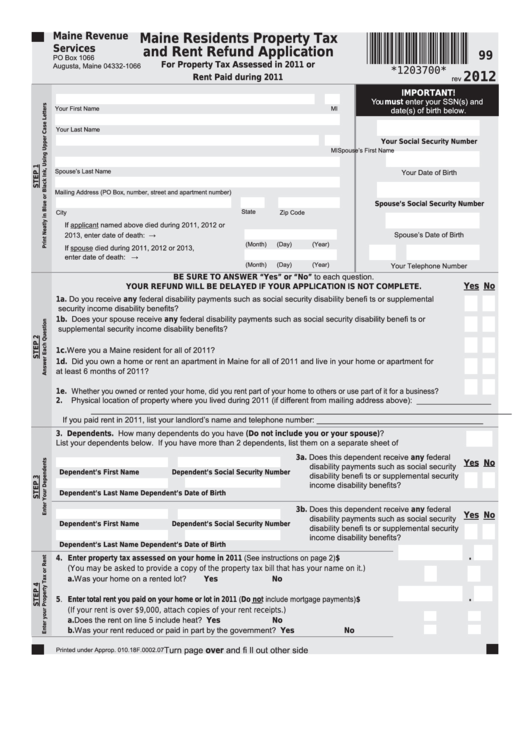

Form 99 Maine Residents Property Tax And Rent Refund Application

https://data.formsbank.com/pdf_docs_html/359/3591/359134/page_1_thumb_big.png

Maine Property Tax Rebate 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/maine-property-records-search-owners-title-tax-and-deeds-infotracer.jpg

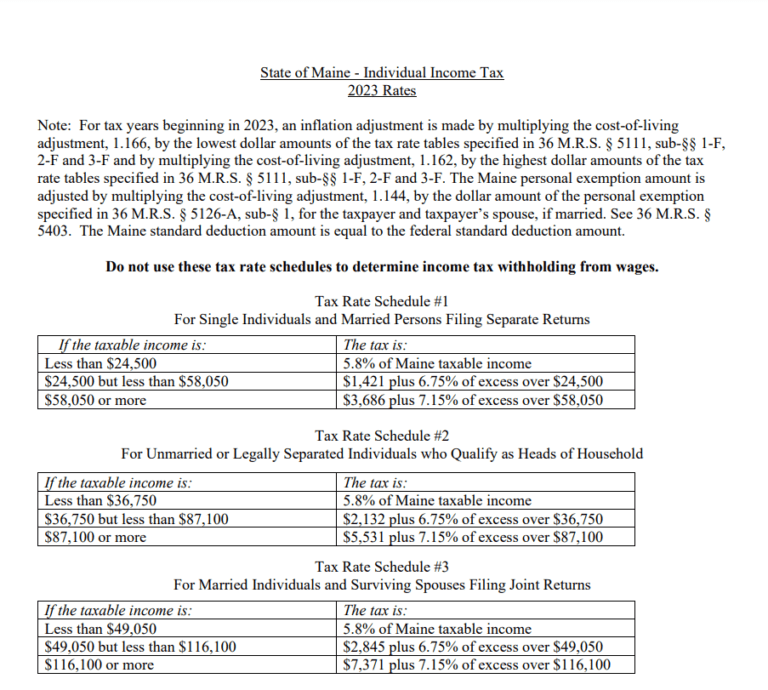

Web The State of Maine provides a measure of property tax relief through different programs to qualified individuals While some are applied at a local level others may be applied for Web Individual income tax credits provide a partial refund of property tax and or rent paid during the tax year to eligible Maine residents and part year residents

Web Homeowners or renters who meet all of the following requirements Were Maine residents during any part of the tax year Owned or rented a home in Maine during any part of the Web The Maine Homestead Exemption may lower your property tax bill It makes it so the town won t count 25 000 of value of your home for property tax purposes You can qualify if

Download Homestead Tax Rebate Maine

More picture related to Homestead Tax Rebate Maine

State Of Maine Renters Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Maine-Renters-Rebate-2023.png

M1PRX Amended Homestead Credit Refund for Homeowners Fill Out

https://www.pdffiller.com/preview/397/780/397780212/large.png

/cloudfront-us-east-1.images.arcpublishing.com/gray/UA5GCZVLXJGN3KOLYVAYCGJMW4.jpg)

Scam Pretends To Offer Homestead Tax Exemption

https://gray-kcbd-prod.cdn.arcpublishing.com/resizer/sqnQaP3dG9cF4cDqT_QuD95lEc0=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/UA5GCZVLXJGN3KOLYVAYCGJMW4.jpg

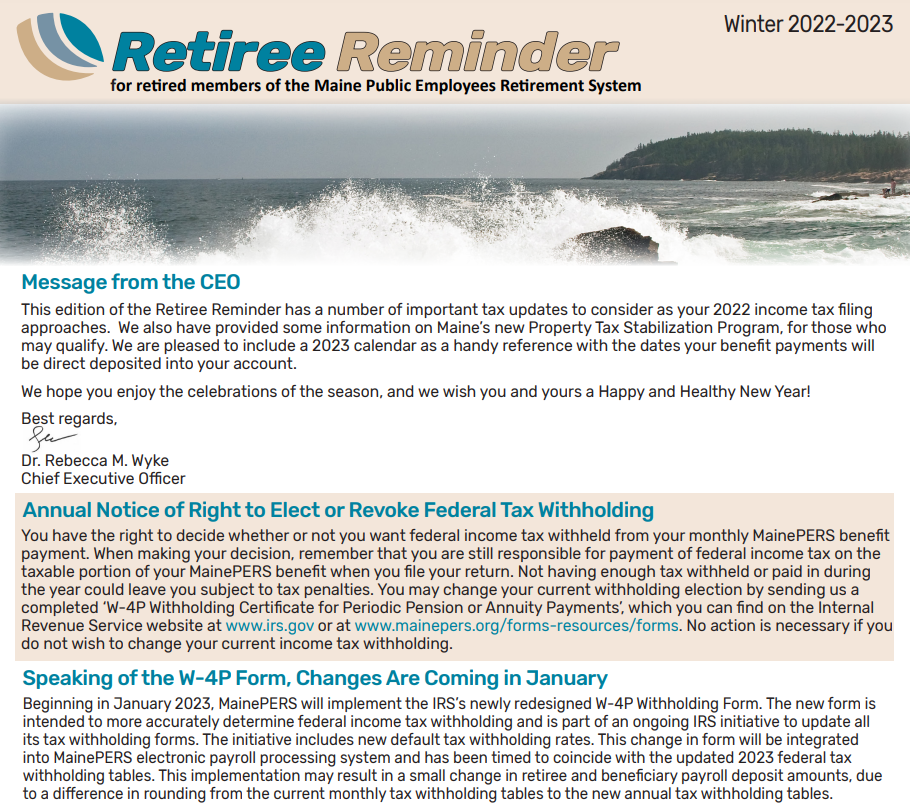

Web Eligible residents may transfer the fixed tax amount to a new homestead even between municipalities The State will fully reimburse municipalities for lost revenue The law goes Web 17 mars 2023 nbsp 0183 32 Published March 17 2023 at 4 00 PM EDT Robert F Bukaty AP The Maine State House is seen Monday Nov 12 2018 in Augusta Maine State lawmakers

Web 4 avr 2023 nbsp 0183 32 It proposes tripling the homestead exemption for homeowners 65 and older to 75 000 while sunsetting the new stabilization program at the end of the current property tax year But the Taxation Committee has Web 3 mai 2023 nbsp 0183 32 What is Maine s Law on Homestead Exemption In Maine the just value of 10 000 of the homestead of a permanent resident of this State who has owned a

Maryland Homestead Tax Credit

https://dat.maryland.gov/realproperty/PublishingImages/HomesteadApplicationStatus2023Approved.png

Is There A Nj Homestead Rebate For 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/what-happens-to-the-homestead-rebate-and-my-tax-return-njmoneyhelp.jpg?w=689&h=458&ssl=1

https://www.maine.gov/revenue/faq/homestead-exemption-program

Web The homestead exemption provides a reduction of up to 25 000 in the value of your home for property tax purposes To qualify you must be a permanent resident of Maine the

https://www.maine.gov/governor/mills/issues/housing-property-tax-relief

Web Provided Additional Direct Tax Relief Governor Mills bolstered the Homestead Exemption Program allowing Maine people to take 25 000 off the value of their home and only pay

Maine Tax Rates By Town Well Developed Blawker Image Database

Maryland Homestead Tax Credit

NJ Tax Rebate The ANCHOR Program Formerly Homestead Rebates

Renters Rebate Maine Online Application RentersRebate

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

News Homestead Tax Rebate Filing Deadline Extended To December 31st

News Homestead Tax Rebate Filing Deadline Extended To December 31st

Maine Will Double Its Rebate On Certain Heat Pumps For Homeowners

Can I File An Appeal For The Homestead Rebate NJMoneyHelp

Who Is Eligible For The Maryland Homestead Tax Credit

Homestead Tax Rebate Maine - Web Individual income tax credits provide a partial refund of property tax and or rent paid during the tax year to eligible Maine residents and part year residents