Homesteaders Tax Rebate Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to

Homestead exemption laws typically have four primary features 1 Preventing the forced sale of a home to meet the demands of creditors usually except mortgages mechanic s liens or sales to pay property taxes 2 Providing the surviving spouse with shelter 3 Providing an exemption from property taxes on a home Web 14 juil 2023 nbsp 0183 32 The Homestead Benefit program provides property tax relief to eligible homeowners For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes

Homesteaders Tax Rebate

Homesteaders Tax Rebate

https://data.formsbank.com/pdf_docs_html/361/3610/361049/page_1_thumb_big.png

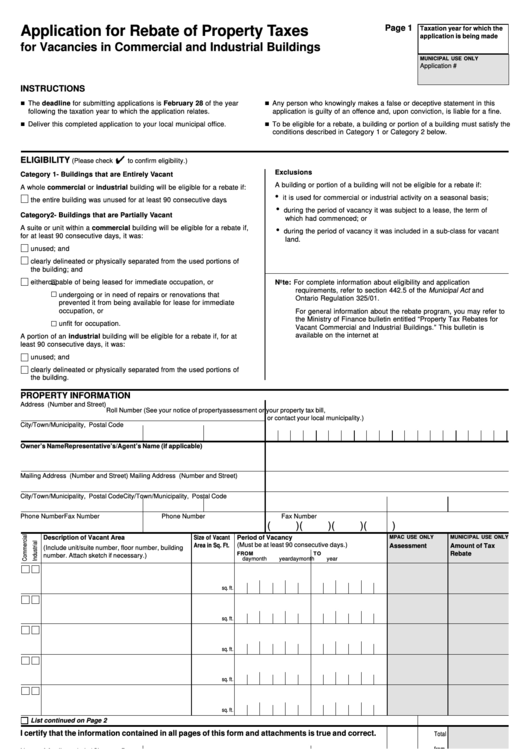

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Application For Rebate Of Property Taxes Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140796/page_1_thumb_big.png

Web 20 avr 2021 nbsp 0183 32 The homestead property tax credit program is generally a dollar for dollar reduction in your property tax assessment While this is the general rule in some Web 18 juil 2022 nbsp 0183 32 The property tax rebate is tied into your New Jersey gross personal income tax filings said Neil Becourtney a certified public accountant and tax partner

Web 19 juin 2023 nbsp 0183 32 A homestead tax exemption is a special provision in a state s tax laws that helps a homeowner to reduce the property taxes they must pay These rules vary from Web If you are a homeowner with a primary residence in New Jersey who qualifies by income who paid your property taxes and who applies by November 30 2021 you can take

Download Homesteaders Tax Rebate

More picture related to Homesteaders Tax Rebate

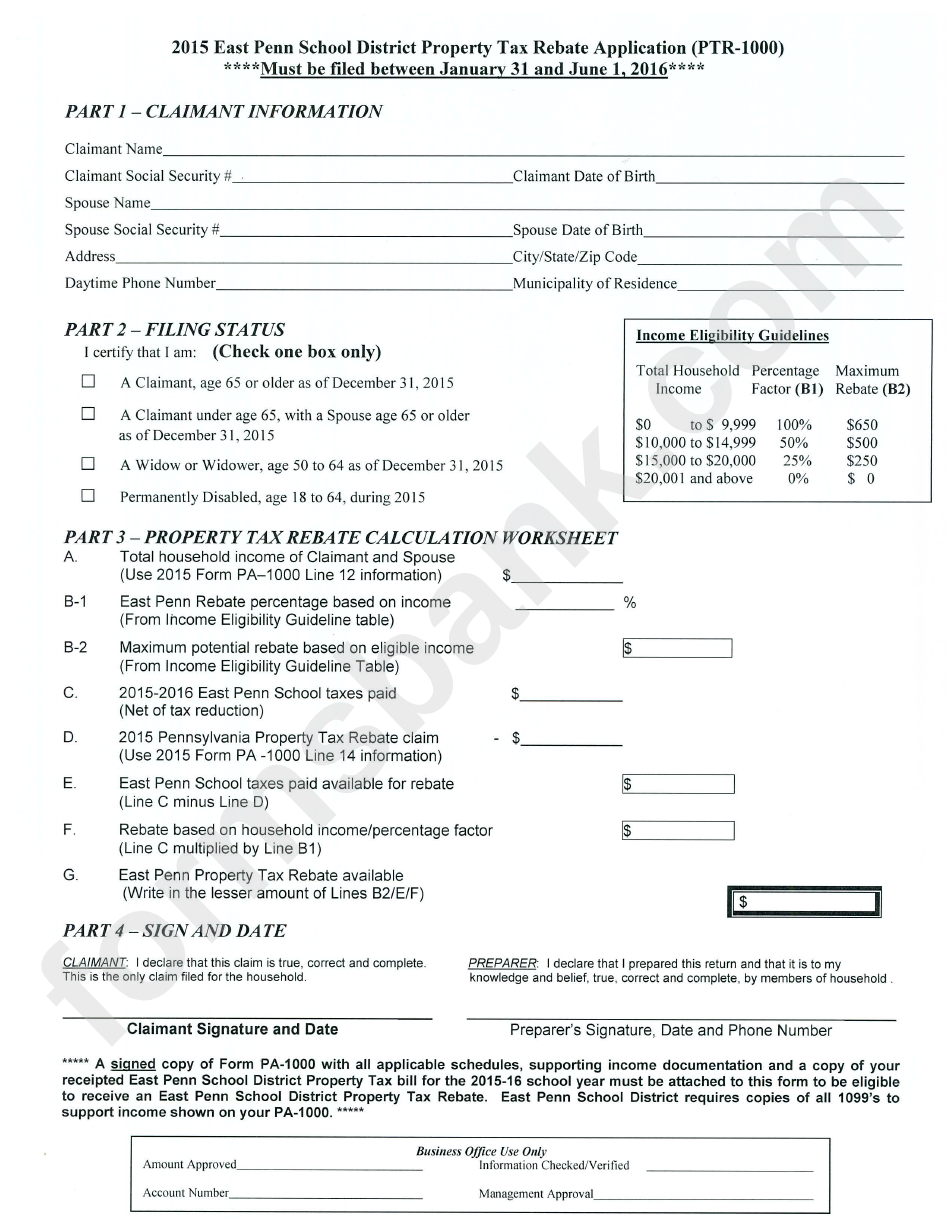

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

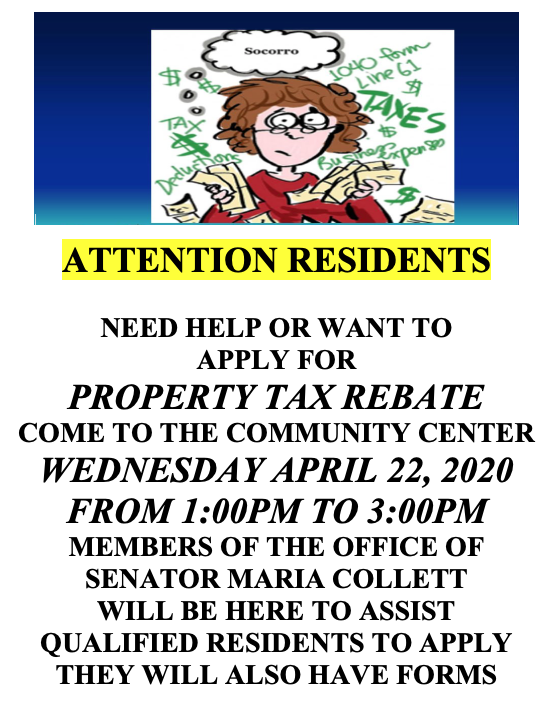

PROPERTY TAX REBATE Information Flyer Warminster Heights

https://warminster-heights.org/wp-content/uploads/2020/03/Screen-Shot-2020-03-04-at-9.31.20-AM.png

Schedule F Explained For Homesteaders Tax Organization Farm Life

https://i.pinimg.com/originals/43/37/86/433786603674d01dd753da278ae85c9b.jpg

Web 8 mai 2023 nbsp 0183 32 The city has signed legislation to provide one time property tax rebates to homeowners who qualify for them These rebates are worth up to 150 and will help Web 2023 HOMESTEAD amp FARMSTEAD TAX RELIEF Do you qualify Home ONLINE PAYMENTS RESIDENTIAL REBATES

Web 10 juin 2020 nbsp 0183 32 The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills Most people who qualify for the rebate will Web 15 mars 2022 nbsp 0183 32 The program provides property tax relief to eligible homeowners and for most homeowners the benefit is distributed to your municipality in the form of a credit

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

https://floridarevenue.com/property/documents/pt113.pdf

Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to

https://en.wikipedia.org/wiki/Homestead_exemption

Homestead exemption laws typically have four primary features 1 Preventing the forced sale of a home to meet the demands of creditors usually except mortgages mechanic s liens or sales to pay property taxes 2 Providing the surviving spouse with shelter 3 Providing an exemption from property taxes on a home

Seasonal Tax Tips For Homesteaders And Hobby Farmers Profit And Loss

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Paulding County Homestead Exemption

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

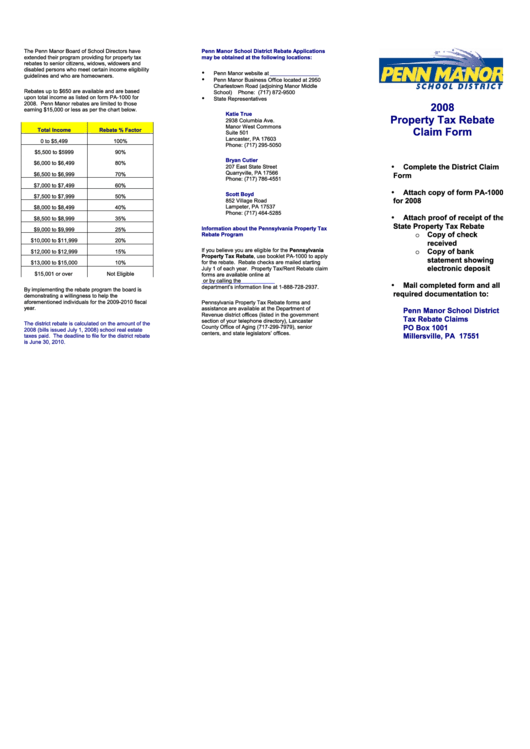

Property Tax Rebate Claim Form 2008 2009 Printable Pdf Download

Bettencourt On Property Taxes The Cavalry Is Coming Over The Hill For

Bettencourt On Property Taxes The Cavalry Is Coming Over The Hill For

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

P55 Tax Rebate Form By State Printable Rebate Form

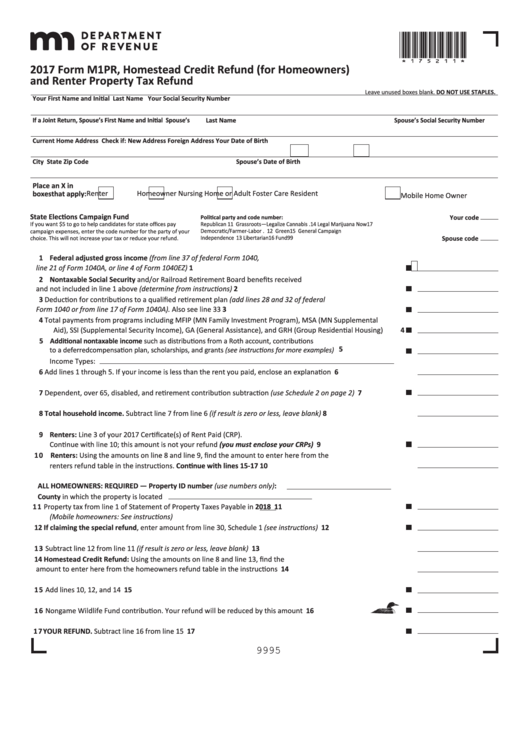

Certificate Of Rent Paid 2014 Eligibility Requirements And Refund

Homesteaders Tax Rebate - Web The Application for Senior Citizens or Permanently and Totally Disabled Renter s Property Tax Refund is available mid January through May 31 of each year Applications are