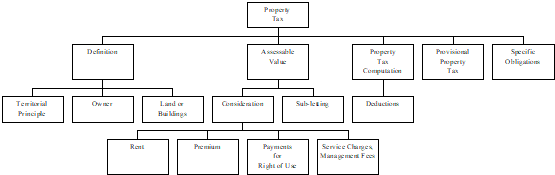

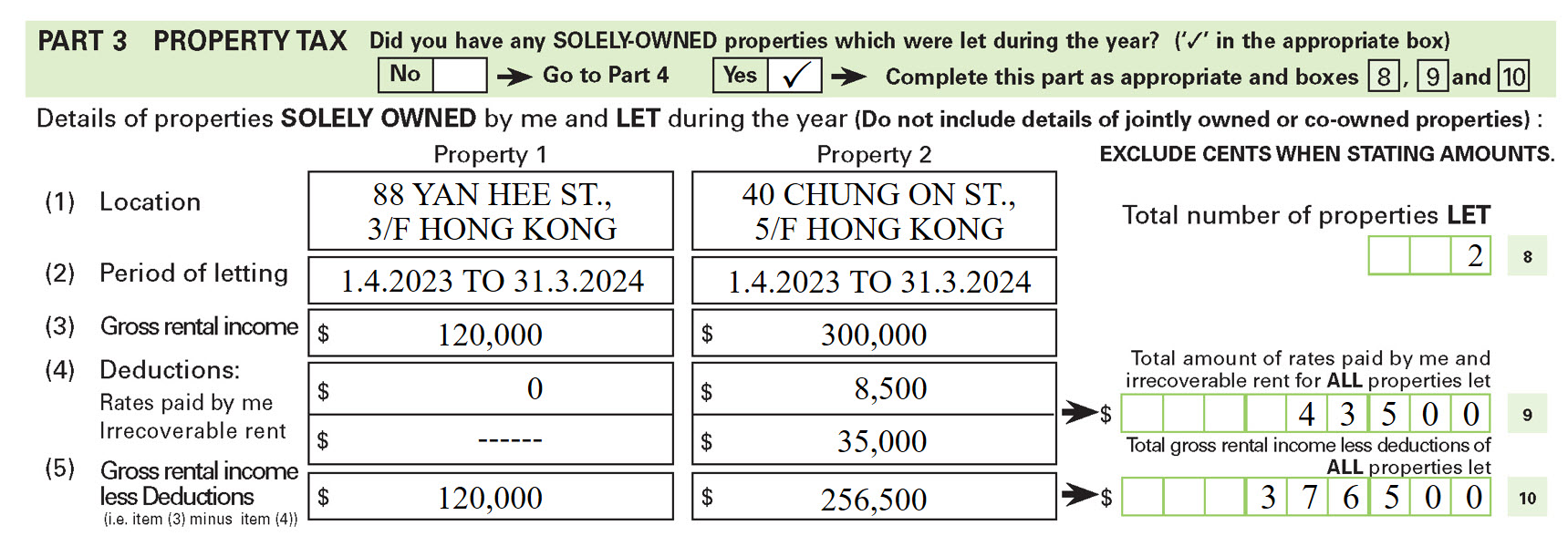

Hong Kong Property Tax Find out deductions you can claim under property tax including rates paid by owner s irrecoverable rent and statutory allowance for repairs and outgoings

Property Tax is payable by the owner s at the standard rate by the year of assessment on net assessable value NAV Where the owner receives only rent and no other How Property Tax is computed What is rental income What deductions can I claim Can I pay less tax by electing Personal Assessment Is there any relief if the property is for

Hong Kong Property Tax

Hong Kong Property Tax

https://www.tetraconsultants.com/wp-content/uploads/2021/07/hong-kong-offshore-company-tax-what-to-know-640x905.png

Are Property Taxes In Hong Kong Expensive Asia Pacific Tax Rates

https://www.paulhypepage.com.hk/wp-content/uploads/2020/04/Are-property-taxes-in-Hong-Kong-expensive.jpg

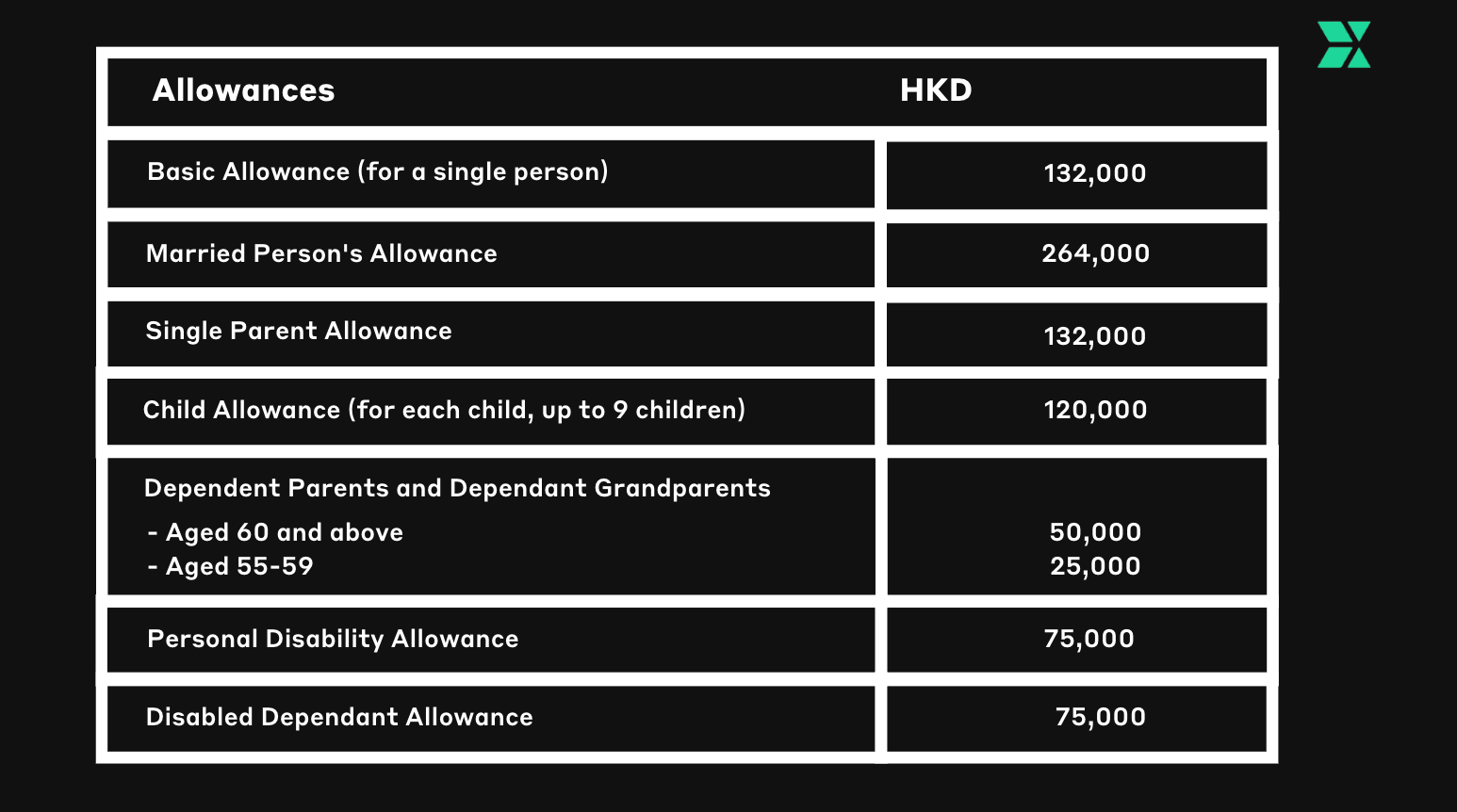

Currenxie An Easy Guide To Understanding Hong Kong s Tax System

https://www.currenxie.com/static/a5864fbc2b036e7cd17803221ec2ef03/b750f/screenshot-2021-09-02-at-11.50.31-am.png

Property tax returns BIR57 and BIR58 should be filed within 1 month of the date of issue If your case meets the criteria specified by the Commissioner and you file the return The standard levy for all properties is currently 5 and that rate will stay in place for homes with a rateable value of HK 550 000 US 70 335 and below according

The Property Information Online PIO provides round the clock service for the public to conveniently obtain property information held by the Rating and Valuation Department using a versatile bilingual search Taxes collected in Hong Kong can be generally classified as Direct tax including Salaries Tax Property Tax and Profits Tax the guiding statue is Inland Revenue

Download Hong Kong Property Tax

More picture related to Hong Kong Property Tax

Property Tax Of Hong Kong Explained

https://onlinecompanyregister.com/wp-content/uploads/2022/04/Hong-Kong-property-tax-for-foreigners.jpg

Hong Kong Property Tax To Rise For Owners Of Expensive Homes Bloomberg

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/i5ehvCyV_52w/v1/2000x1334.jpg

Hong Kong Property Tax

http://www.summaryplanet.com/industrial-economics/Hong-Kong-Property-Tax_clip_image002.png

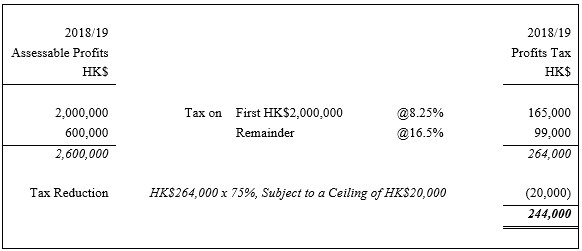

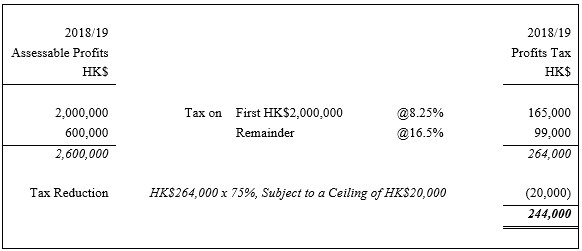

Persons including corporations and partnerships carrying on business in Hong Kong are chargeable to tax on all profits excluding profits from the sale of capital Property tax in Hong Kong is a tax levied on the income generated from renting out immovable property within the territory It s an annual tax imposed on

Discover Hong Kong s property tax system from assessing net values to tax relief options and learn about the critical procedures for tax payment and potential ETAX Login Information eTAX is the gateway to the Inland Revenue Department s IRD electronic services It offers you an EASY SECURE and ENVIRONMENT FRIENDLY

PTR EFiling Service Demo

https://www.ird.gov.hk/eng/demo/ptr/images/10.gif

How To Estimate Tax Title And License

https://www.ird.gov.hk/images/faq/e_q8.jpg

https://www.gov.hk/en/residents/taxes/property/index.htm

Find out deductions you can claim under property tax including rates paid by owner s irrecoverable rent and statutory allowance for repairs and outgoings

https://www.ird.gov.hk/eng/pdf/pam54e.pdf

Property Tax is payable by the owner s at the standard rate by the year of assessment on net assessable value NAV Where the owner receives only rent and no other

Hong Kong And Cryptocurrency Blockchain And Cryptocurrency Regulations

PTR EFiling Service Demo

Hong Kong s Planned Property Tax Cut May Stabilize Ailing Market

Investing In Hong Kong Property The Ultimate Guide InvestAsian

How Higher Estate Taxes Can Make Hong Kong Equitable South China

Hong Kong Profits Tax

Hong Kong Profits Tax

The Current Property Tax Systems In Hong Kong And Singapore Download

Parties Split Over Amendments For Hong Kong Property Tax Bill South

Corporate Tax In Hong Kong Hong Kong Corporate Tax

Hong Kong Property Tax - Property tax returns BIR57 and BIR58 should be filed within 1 month of the date of issue If your case meets the criteria specified by the Commissioner and you file the return