Hong Kong Tax Return Form Download Download Forms and Electronic Forms Available General Information Automatic Exchange of Financial Account Information Country by Country Reporting Double Taxation Relief Profits Tax Salaries Tax Personal Assessment Property Tax Employers Non resident Individual rendering services in Hong Kong Tax Exempt Charities

Employer s Return of Remuneration Pensions For the year ended 31 March of all years Since built in PDF viewer of some browsers may not be able to perform the functions embedded in the fillable PDF form properly please download the fillable PDF form to local drive open and complete the form by using the latest version of Adobe Acrobat Reader Benefits of Internet Filing Automatic extension of 1 month for filing Pre filling of data including income amount details and the tax deduction records saved under the e service of Records for pre filling deduction claims under Tax Return Individuals if applicable to save your time in completing the tax return

Hong Kong Tax Return Form Download

Hong Kong Tax Return Form Download

https://corporatehub.hk/wp-content/uploads/2016/02/profits-tax-return-1080x675.jpg

Tax Return Form And Notebooks On The Table Free Stock Photo

https://images.pexels.com/photos/6863517/pexels-photo-6863517.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

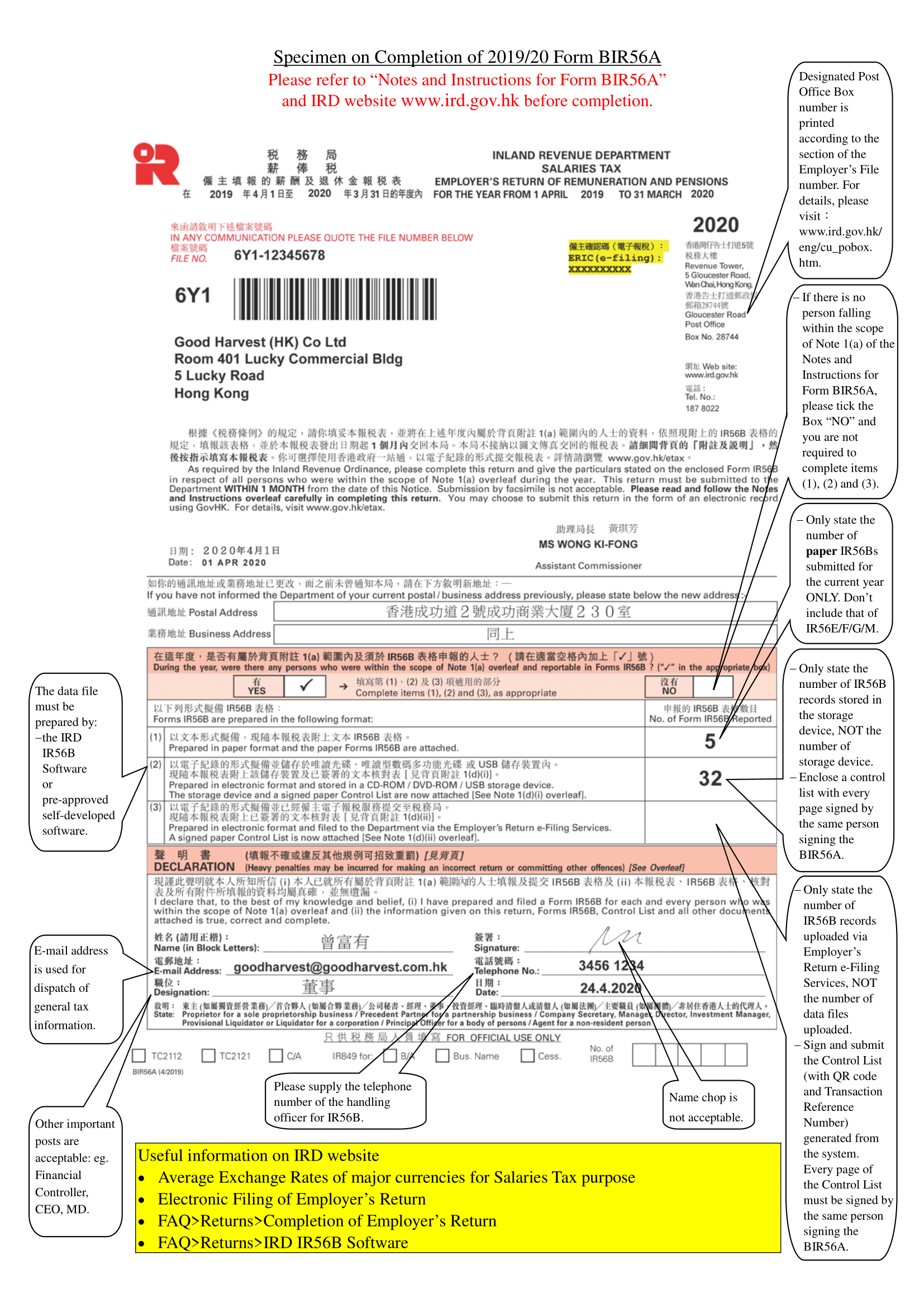

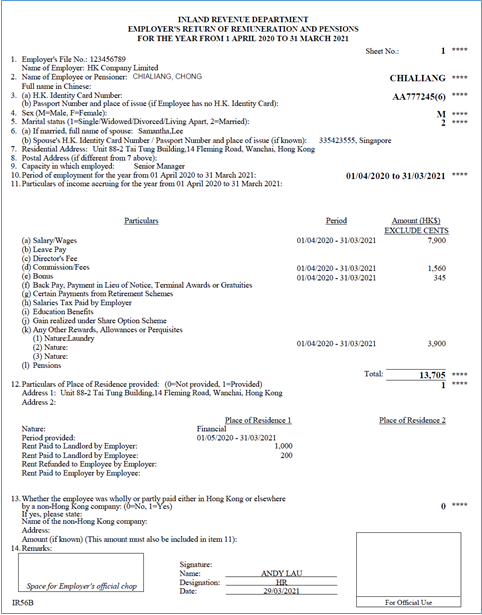

What Is The Hong Kong Employer s Return BIR56A And IR56B

https://osome.com/content/images/size/w1300/2021/03/bir56a_completion_e-.png

You may select to receive notices and documents relating to tax return filing assessment and tax payment in the form of electronic records instead of paper You will also receive e Alert messages before the due dates for filing tax returns or making tax payment Find out more about settling your tax and stamp duty payment and purchasing Tax Reserve Certificates by post You can also download forms here

All required supplementary forms S1 to S18 and S20 and other forms IR1478 IR1481 and IR1482 must be submitted electronically through the eTAX irrespective of the filing mode of Profits Tax return for any year of assessment from 2018 19 to 2024 25 both inclusive Tax Return Individuals consists of the BIR60 the Appendix to BIR60 and any required supplementary forms You should complete and sign the BIR60 the Appendix to

Download Hong Kong Tax Return Form Download

More picture related to Hong Kong Tax Return Form Download

Nd2a Form Document Samples

https://www.companyincorporation-hongkong.com/wp-content/uploads/2020/02/nar1-sample-hk.png

Hong Kong Tax Return Startupr hk Startupr hk

https://startupr.hk/app/uploads/2020/09/Hong-Kong-Tax-Return-1.png

Record HK 341 4 Billion In Tax Revenue For Hong Kong Tops Last Year s

https://cdn.i-scmp.com/sites/default/files/d8/images/methode/2019/05/03/92dc3b06-6cb6-11e9-994e-1d1e521ccbf6_1320x770_093325.JPG

Download fillable PDF forms Corporations and partnerships can file their Profits Tax returns BIR51 or BIR52 for the years of assessment 2022 23 and 2023 24 and attach the required financial statements tax computation supplementary forms IR56B AY 3 31 1 PDF PDF PDF Adobe Acrobat Reader

[desc-10] [desc-11]

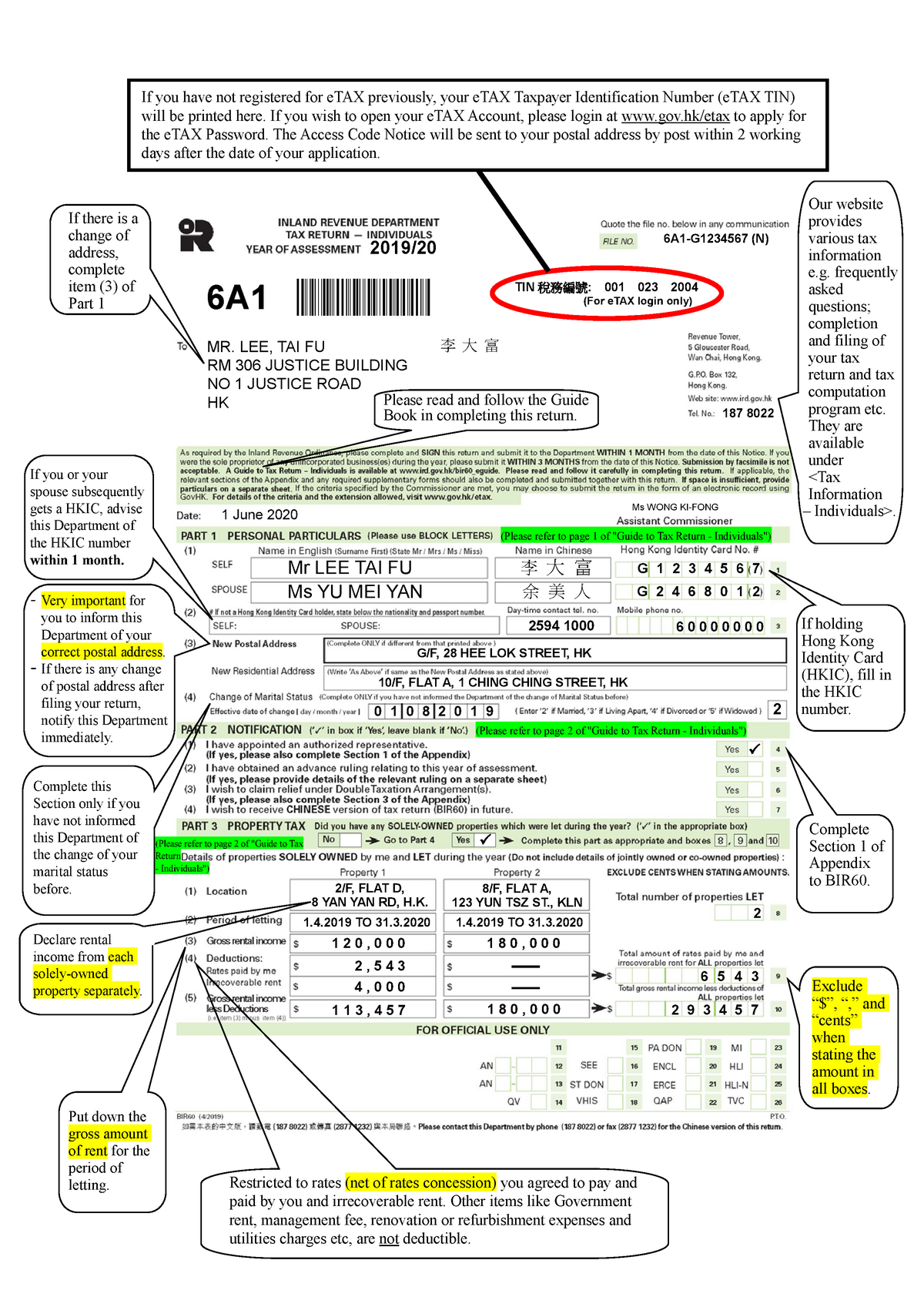

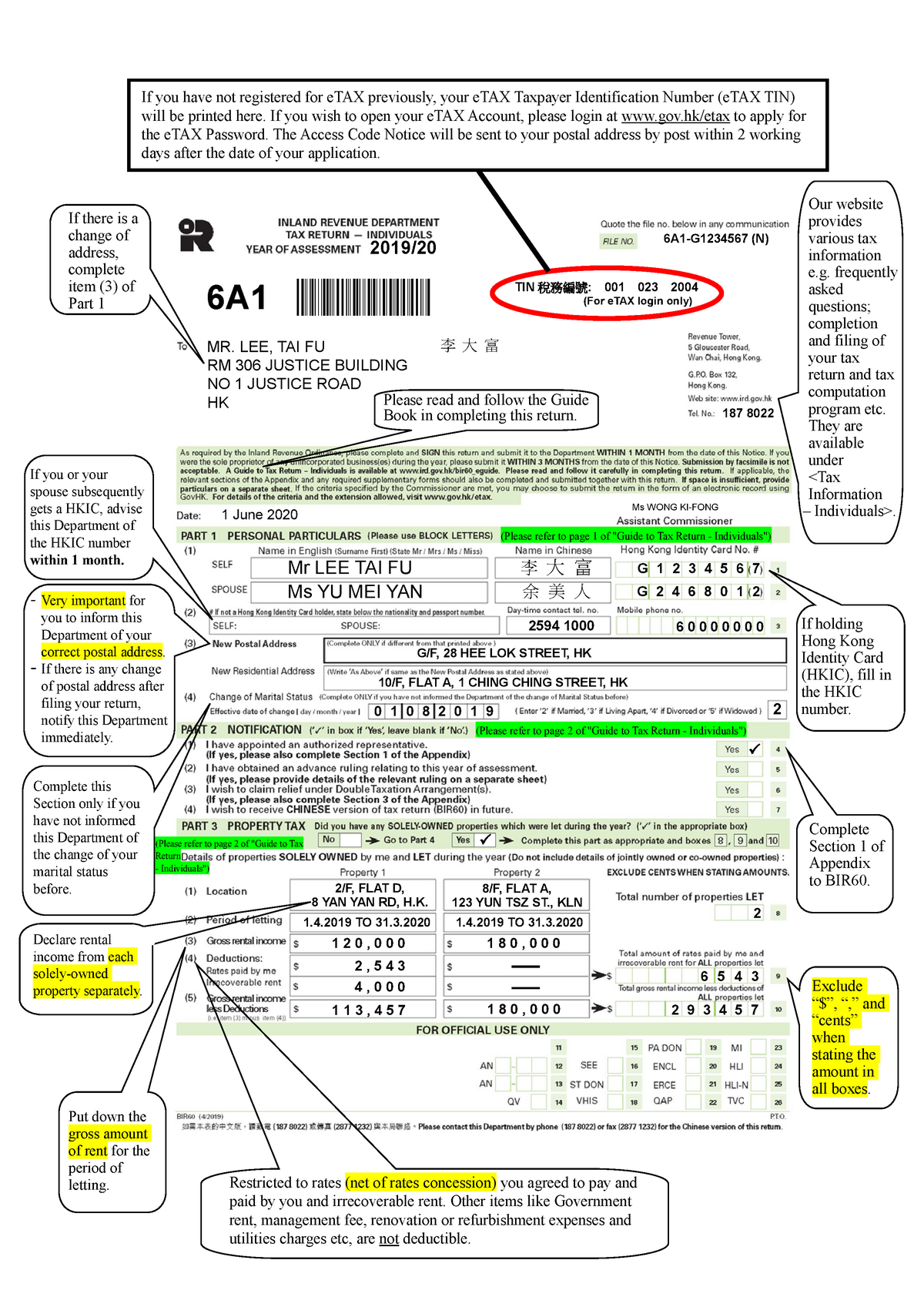

BIR60 Sample 2019 20 Put Down The Gross Amount Of Rent For The Period

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2ed6f57e46dcb2c76628e77f4fc57ef6/thumb_1200_1697.png

Hong Kong Income Tax For Non local Employees Jenny

https://user-images.githubusercontent.com/30020736/132364098-cd6eab2b-baca-410e-918b-84482b44d41f.jpeg

https://www.ird.gov.hk/eng/paf/for.htm

Download Forms and Electronic Forms Available General Information Automatic Exchange of Financial Account Information Country by Country Reporting Double Taxation Relief Profits Tax Salaries Tax Personal Assessment Property Tax Employers Non resident Individual rendering services in Hong Kong Tax Exempt Charities

https://www.ird.gov.hk/eng/paf/download_pdf1.htm?...

Employer s Return of Remuneration Pensions For the year ended 31 March of all years Since built in PDF viewer of some browsers may not be able to perform the functions embedded in the fillable PDF form properly please download the fillable PDF form to local drive open and complete the form by using the latest version of Adobe Acrobat Reader

/GettyImages-153205900-5b08cb708e1b6e003ed4e7d6.jpg)

Understanding Hong Kong Tax And How It Works

BIR60 Sample 2019 20 Put Down The Gross Amount Of Rent For The Period

A Business Owner Guide How To File Your Profit Tax Returns BIR51

FastLane Group Employment Tax Obligations Employer s Return

How To Fill In Hong Kong Tax Return Ultimate Helpful Guide

Tax Avoidance In Hong Kong

Tax Avoidance In Hong Kong

HK IR56 Tax Return Compliance Updates ABSS Support

Hong Kong Tax Return Guide Profits Tax Returns BIR51 BIR52 BIR54

Online Tax Return Form BKG Book Keeping Accounting Services

Hong Kong Tax Return Form Download - Tax Return Individuals consists of the BIR60 the Appendix to BIR60 and any required supplementary forms You should complete and sign the BIR60 the Appendix to