Hong Kong Tax Return Form Download Forms and Electronic Forms Available General Information Automatic Exchange of Financial Account Information Country by Country Reporting Double Taxation Relief Profits

Learn how to file your tax return online through eTAX if you meet the eligibility criteria Enjoy benefits such as automatic extension pre filling saving and computation of tax payable Download Forms Since built in PDF viewer of some browsers may not be able to perform the functions embedded in the fillable PDF form properly please download the fillable PDF form

Hong Kong Tax Return Form

Hong Kong Tax Return Form

https://lh6.googleusercontent.com/YMZ5UlCkhDxH0lbyoTj2CtPFvN65O4meS3odQ9KtRQqU5c1MGwF7vUNI5gfNvHDTiBVUZDk5Clixf0K2gQF-cClTc7iUFTXTKSE1DPsZa4GwNit-QjJYtmBkRcsuelfikz8RoZ2W

FAQ On Completion Of Tax Return Individuals

https://www.ird.gov.hk/images/faq/e_q8.jpg

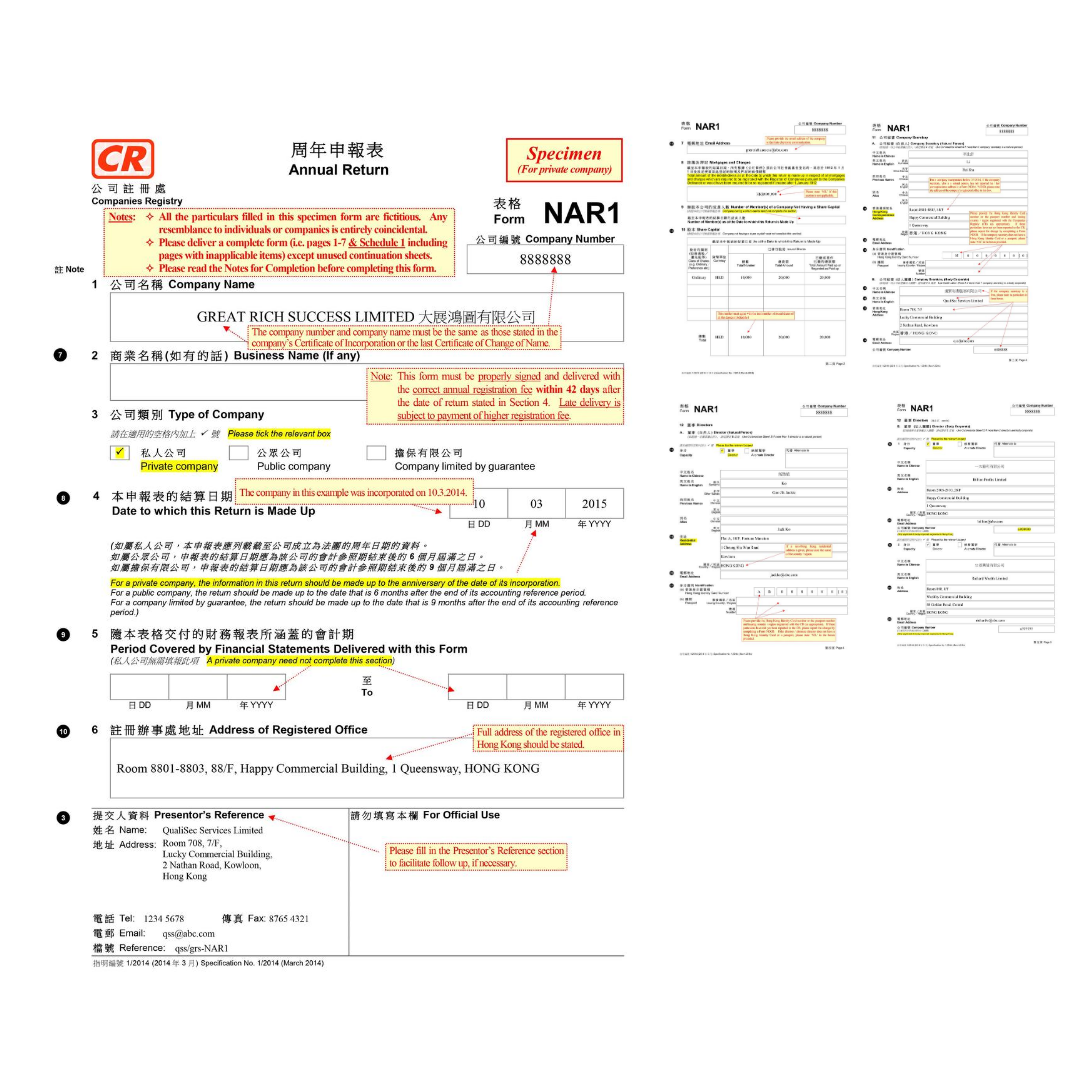

A Quick Guide To Annual Return Filing In Hong Kong

https://osome.com/content/images/2020/08/Osome-HK-Annual-Return-Filing.png

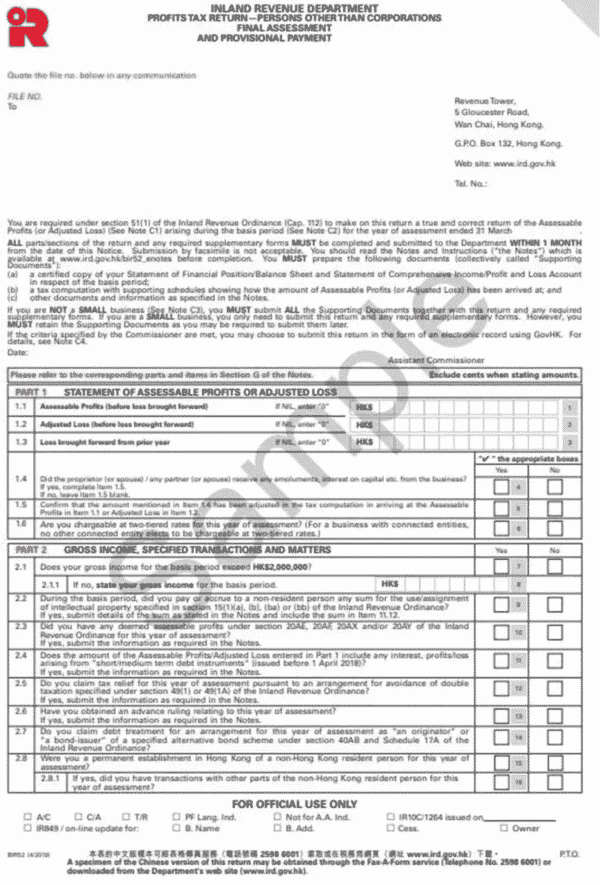

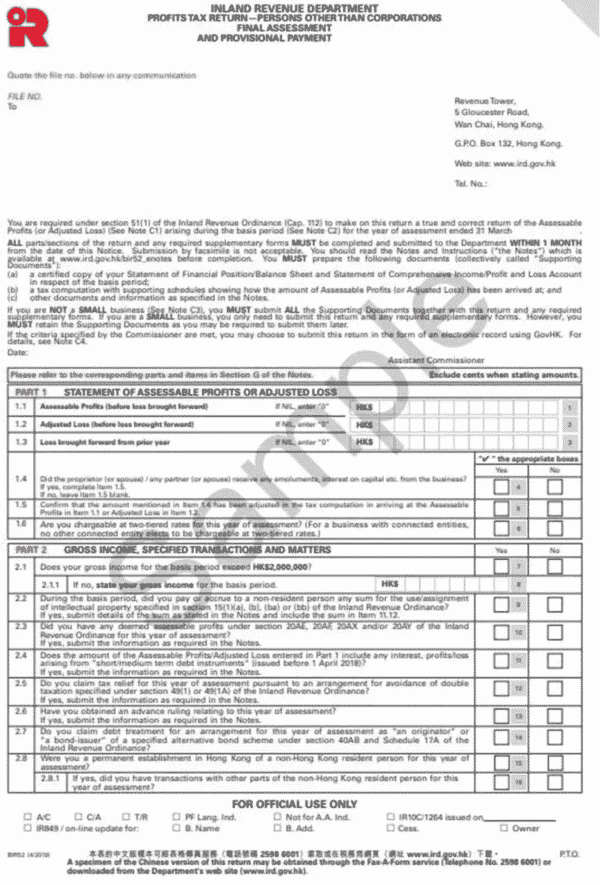

Find out how to complete and file individuals tax returns property tax returns or profits tax returns and consequences if you fail to submit them Corporations and partnerships can file their Profits Tax returns BIR51 or BIR52 for the years of assessment 2022 23 and 2023 24 and attach the required financial statements tax computation supplementary forms and other forms

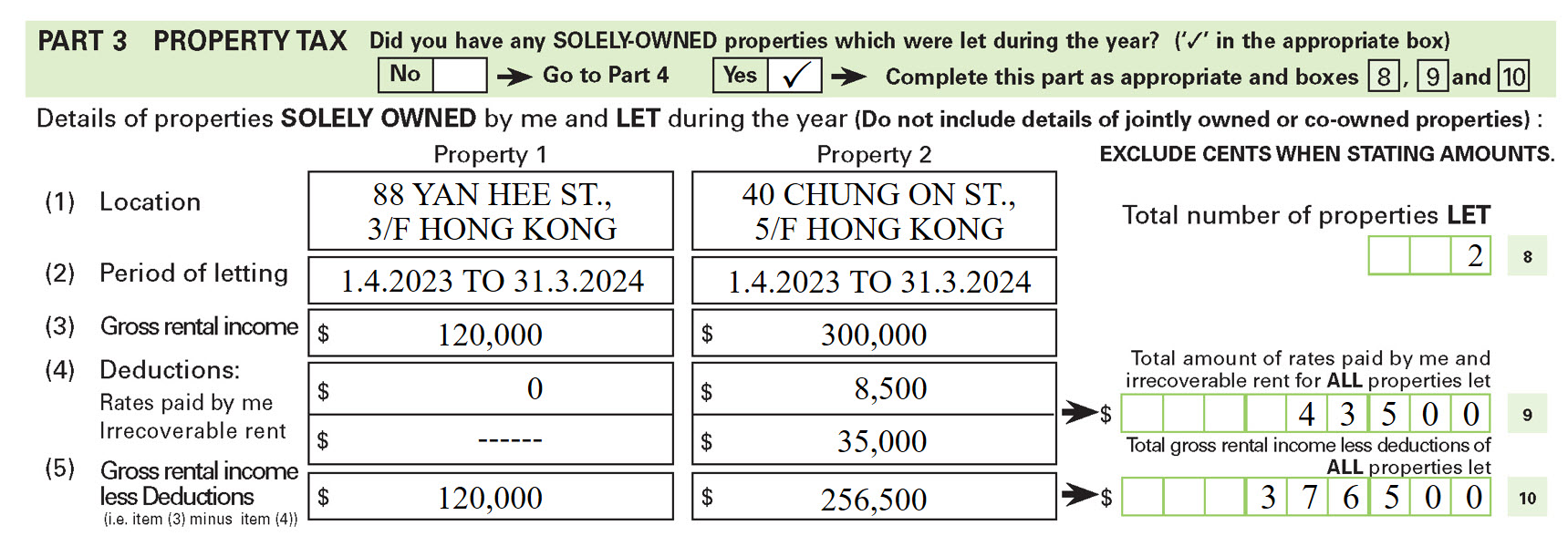

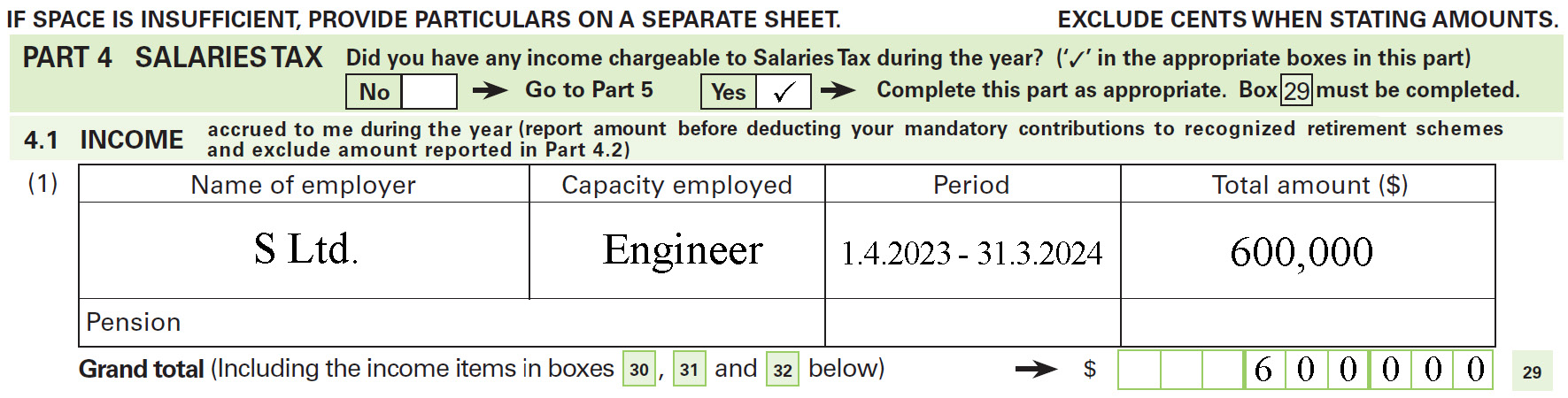

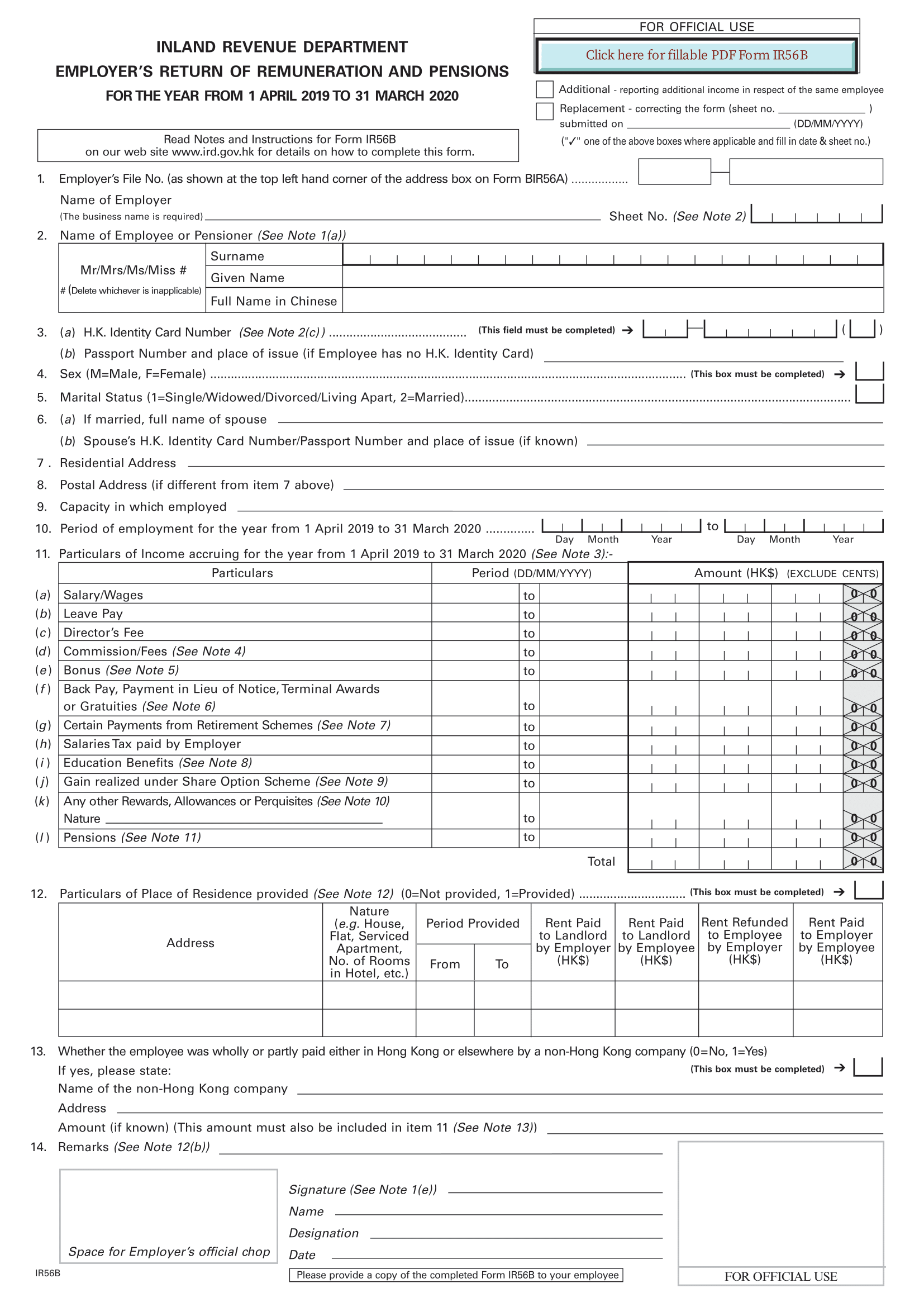

Income includes income from an office employment on a full time part time or casual basis or pension from a former employer If you claim full or partial tax exemption in respect of your Table of contents Hong Kong BIR60 tax filing Filing of Tax Return Individuals BIR60 Filling in the BIR60 Form Section 4 Salaries tax Filling in the BIR60 Form Tax deductible sections Tax payment tips in Hong

Download Hong Kong Tax Return Form

More picture related to Hong Kong Tax Return Form

A Business Owner s Guide To Salary Tax Returns BIR60 Sleek Hong Kong

https://sleek.com/hk/wp-content/uploads/sites/2/2022/03/esem_ctr_ctre_demo_page-0001-768x1087.jpg

Income Tax Form Hong Kong Never Underestimate The Influence Of Income

https://i.pinimg.com/originals/ca/d2/d7/cad2d702517357d0aa0f5b10ffad989f.png

How To Pay Taxes In Hong Kong

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_moneyhero/How-to-Pay-Taxes-in-Hong-Kong_chart_blog-1.jpg

Issued by the Inland Revenue Department IRD this form is essentially your income tax return This guide aims to simplify the process by offering a step by step walkthrough of the BIR60 form The BIR60 form covers This Guide explains how to complete the Tax Return Individuals BIR60 Most of your questions will be answered here If you need other information or assistance you may visit

You may select to receive notices and documents relating to tax return filing assessment and tax payment in the form of electronic records instead of paper You will also receive e Alert messages before the due dates for filing tax Through the Internet Filing service taxpayers may lodge their Tax Returns Individuals B I R 60 and Property Tax Returns Property Jointly owned or Co owned by

Hong Kong Tax Return Startupr hk

https://lh5.googleusercontent.com/yNWgwvrpvLyz5kGGRiEXtIdBCdNc0GhpHQFJUjvS3yk_t5ohEuvb06om4Suqb0-7AGtExzHftUOVXuxekV6zOkZiGBMAM5u27l7hX3be77ivBZEtDZ-snpmGDG2wxv2bCdCelF9o

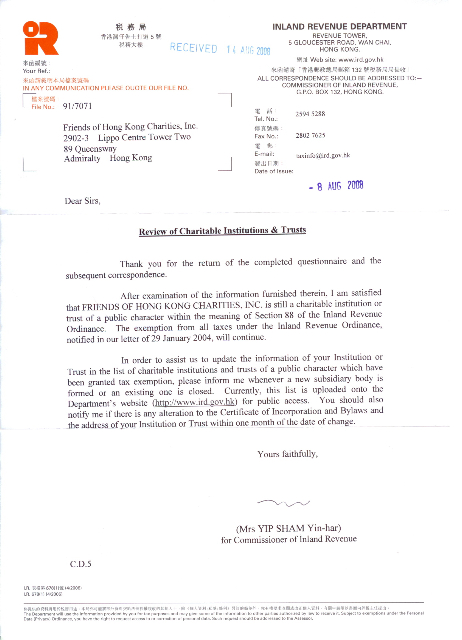

Friends Of Hong Kong Charities

http://fohkc.com/docs/tax exempt 08.jpg

https://www.ird.gov.hk/eng/paf/for.htm

Download Forms and Electronic Forms Available General Information Automatic Exchange of Financial Account Information Country by Country Reporting Double Taxation Relief Profits

https://www.gov.hk/.../filing_of_tax_retu…

Learn how to file your tax return online through eTAX if you meet the eligibility criteria Enjoy benefits such as automatic extension pre filling saving and computation of tax payable

Tax Return Inland Revenue Tax Return

Hong Kong Tax Return Startupr hk

Employment Tax Employer s Return Salaries Tax FastLane

Hong Kong Tax Return Guide Salaries Tax Returns BIR60 FastLane

GovHK How The Provision Of A Place Of Residence To An Employee Is Taxed

Hong Kong Profit Tax Return Guide BIR51 BIR52 BIR54

Hong Kong Profit Tax Return Guide BIR51 BIR52 BIR54

IRD Tax Return Form Fill Out And Sign Printable PDF Template

Hong Kong Tax Return Startupr hk

What Is The Hong Kong Employer s Return BIR56A And IR56B

Hong Kong Tax Return Form - Income includes income from an office employment on a full time part time or casual basis or pension from a former employer If you claim full or partial tax exemption in respect of your