Hong Kong Tax Return ETAX Login Information eTAX is the gateway to the Inland Revenue Department s electronic services It offers you an easy secure and environment friendly means to facilitate your compliance with the tax law eTAX Account

To submit tax return please send to us by post to GPO Box 132 Hong Kong or submit in person during office hours to our office Inland Revenue Centre 5 Concorde Road Kai Tak Kowloon Find out how to complete and file individuals tax returns property tax returns or profits tax returns and consequences if you fail to submit them

Hong Kong Tax Return

Hong Kong Tax Return

http://www.co-opcons.com/wp-content/uploads/2022/03/e_q26.jpg

Tax Planning Compliance Corporate Hub Hong Kong

https://corporatehub.hk/wp-content/uploads/2015/06/hong-kong-revenue-tower.jpg

Hong Kong Tax Return Startupr hk Startupr hk

https://startupr.hk/app/uploads/2020/09/Hong-Kong-Tax-Return-1.png

Inland Revenue Amendment Tax Deductions for Leased Premises Reinstatement and Press Release October 16 2024 CE s speech in delivering The Chief Executive s 2024 Policy Individuals Tax Returns for 2023 24 have been issued on 2 May 2024 Taxpayers are required to complete and send the tax return back to the Inland Revenue Department IRD within 1

Welcome to eTAX Please note that system update has been scheduled to take place daily from 3 00a m to 4 00a m You may not be able to view some of the documents here during this Income includes income from an office employment on a full time part time or casual basis or pension from a former employer If you claim full or partial tax exemption in respect of your

Download Hong Kong Tax Return

More picture related to Hong Kong Tax Return

4 Things To Do When Your Company Receives Its First Profits Tax Return

https://corporatehub.hk/wp-content/uploads/2016/02/profits-tax-return-1080x675.jpg

BIR60 Workstem

https://www.workstem.com/wp-content/uploads/2022/10/pasted_image_01-min-2-724x1024.png

Hong Kong Tax Return Startupr hk

https://lh6.googleusercontent.com/YMZ5UlCkhDxH0lbyoTj2CtPFvN65O4meS3odQ9KtRQqU5c1MGwF7vUNI5gfNvHDTiBVUZDk5Clixf0K2gQF-cClTc7iUFTXTKSE1DPsZa4GwNit-QjJYtmBkRcsuelfikz8RoZ2W

If you change your postal address or marital status after lodging your return you should inform this Department immediately in writing eTAX account holder may notify this Department about Tax authority Inland Revenue Department IRD Website www ird gov hk www ird gov hk This link will open in a new window Tax year 1 April to 31 March Tax return due date Within 1 month of the date of issue

Hong Kong SAR adopts a territorial basis of taxation All individuals whether a resident or non resident of Hong Kong SAR are subject to Hong Kong salaries tax on i Hong Individual tax returns are issued on the first working day of May each year The filing deadline is usually within a month from the date of issue However individuals who are

Hong Kong Tax Return Startupr hk

https://lh5.googleusercontent.com/yNWgwvrpvLyz5kGGRiEXtIdBCdNc0GhpHQFJUjvS3yk_t5ohEuvb06om4Suqb0-7AGtExzHftUOVXuxekV6zOkZiGBMAM5u27l7hX3be77ivBZEtDZ-snpmGDG2wxv2bCdCelF9o

Hong Kong Tax Return Guide Salaries Tax Returns BIR60 FastLane

https://fastlanepro.hk/wp-content/uploads/2020/03/audit-report-scaled-e1585558665809.jpg

https://www.gov.hk/en/residents/taxes/e…

ETAX Login Information eTAX is the gateway to the Inland Revenue Department s electronic services It offers you an easy secure and environment friendly means to facilitate your compliance with the tax law eTAX Account

https://www.ird.gov.hk/eng/tax/ind_ctr.htm

To submit tax return please send to us by post to GPO Box 132 Hong Kong or submit in person during office hours to our office Inland Revenue Centre 5 Concorde Road Kai Tak Kowloon

Hong Kong Tax Return Startupr hk

Hong Kong Tax Return Startupr hk

Hong Kong Tax Return Guide Salaries Tax Returns BIR60 FastLane

Hong Kong Tax Return Startupr hk

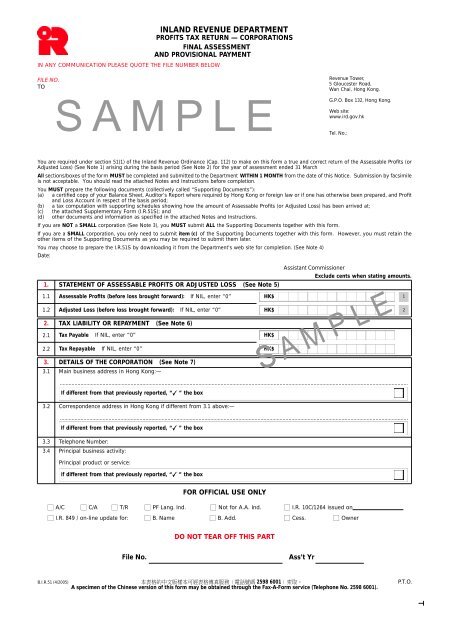

Profits Tax Return

Filing Tax Return On Time In Hong Kong Essential Guide

Filing Tax Return On Time In Hong Kong Essential Guide

Tax Return Deadline Hong Kong TAXIRIN

Sample Hong Kong Profits Tax Return

Hong Kong Tax Return Guide Salaries Tax Returns BIR60 FastLane

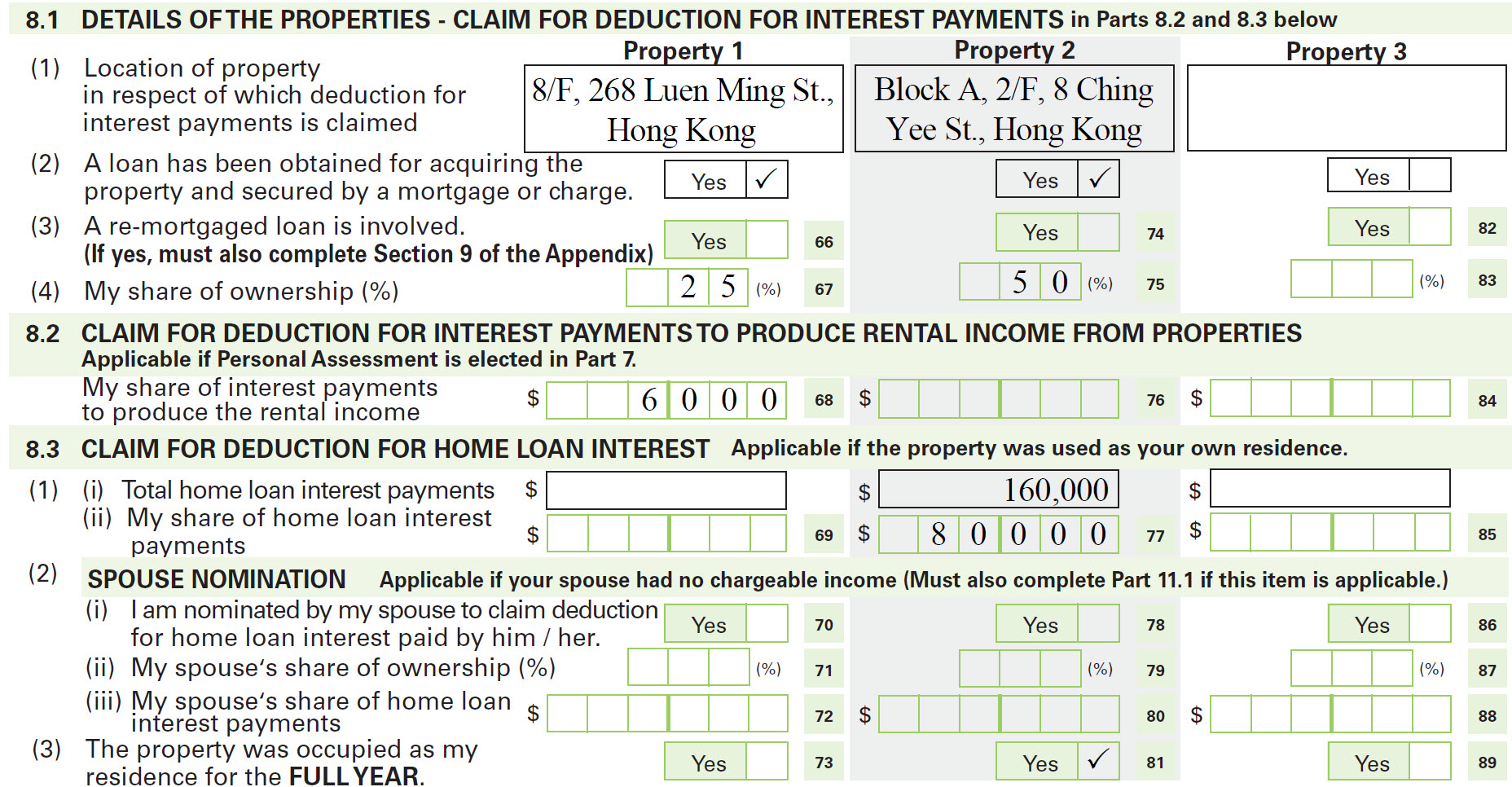

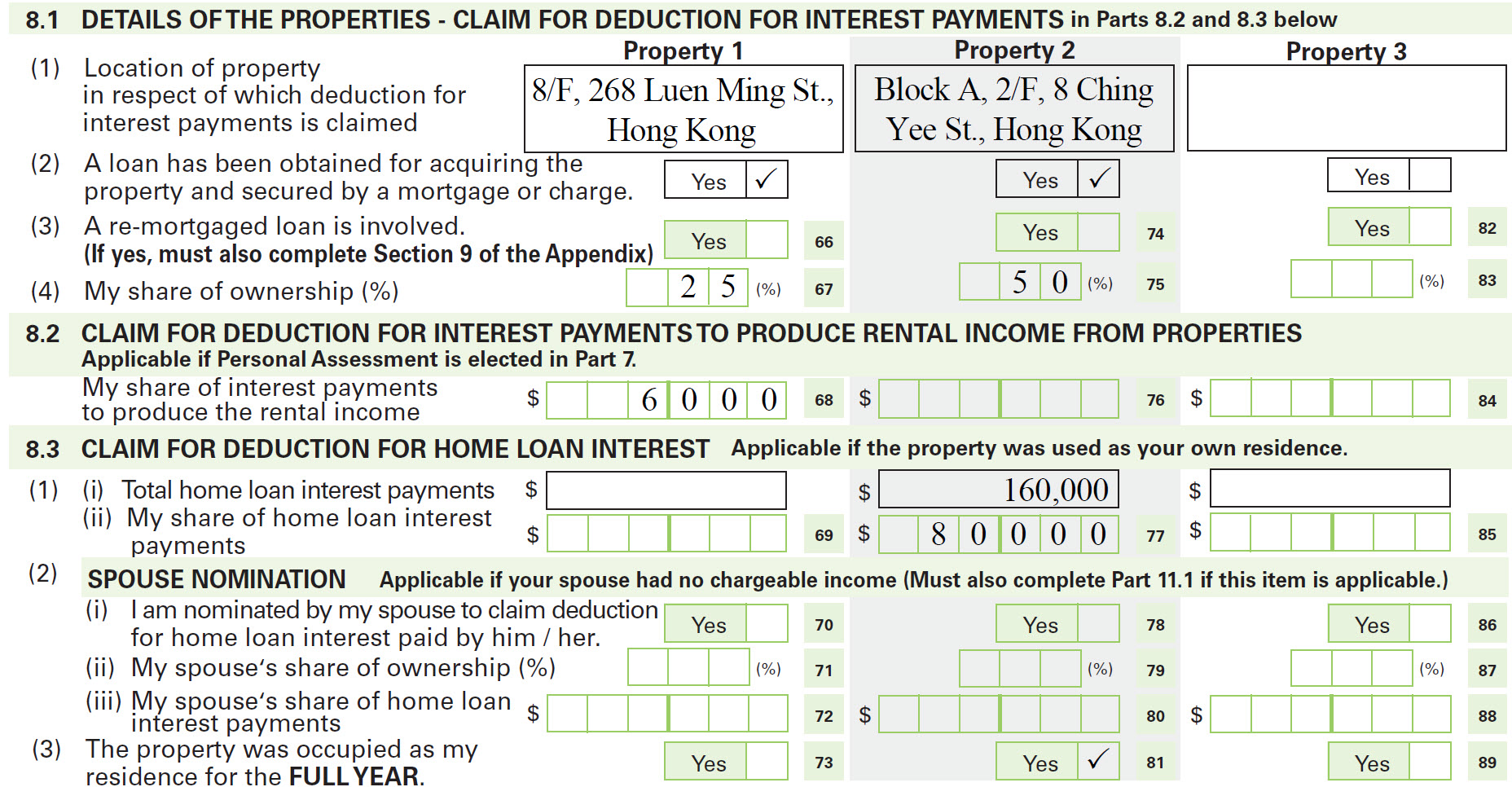

Hong Kong Tax Return - Guide to Electronic Filing of Profits Tax Return Corporations and businesses can file their Profits Tax returns for the years of assessment 2022 23 and 2023 24 and attach the required