Hotel Tax Relief Malaysia Sponsorship Tax Deduction Incentives Garis Panduan Manual Pengguna Permohonan Bantuan Serta Insentif Surat Sokongan Kebudayaan G2G Services Online Services Registration Application 1 MALAYSIA HOTEL Lot S0110 0115 Blok J One Avenue Phase 8 Taman Utama Sabah 15 12 09 4

It is charged at a fixed rate of RM10 00 per room per night However during the Covid 19 pandemic The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022 The Tourism Tax in Malaysia also known as TTx is a tax charged for all foreign passport holders staying at accommodation premises in Malaysia It is collected by the operators of these premises and is charged at a fixed rate of RM10 00 per room per night

Hotel Tax Relief Malaysia

Hotel Tax Relief Malaysia

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/SPC-4467_IncomeTax-2022.png

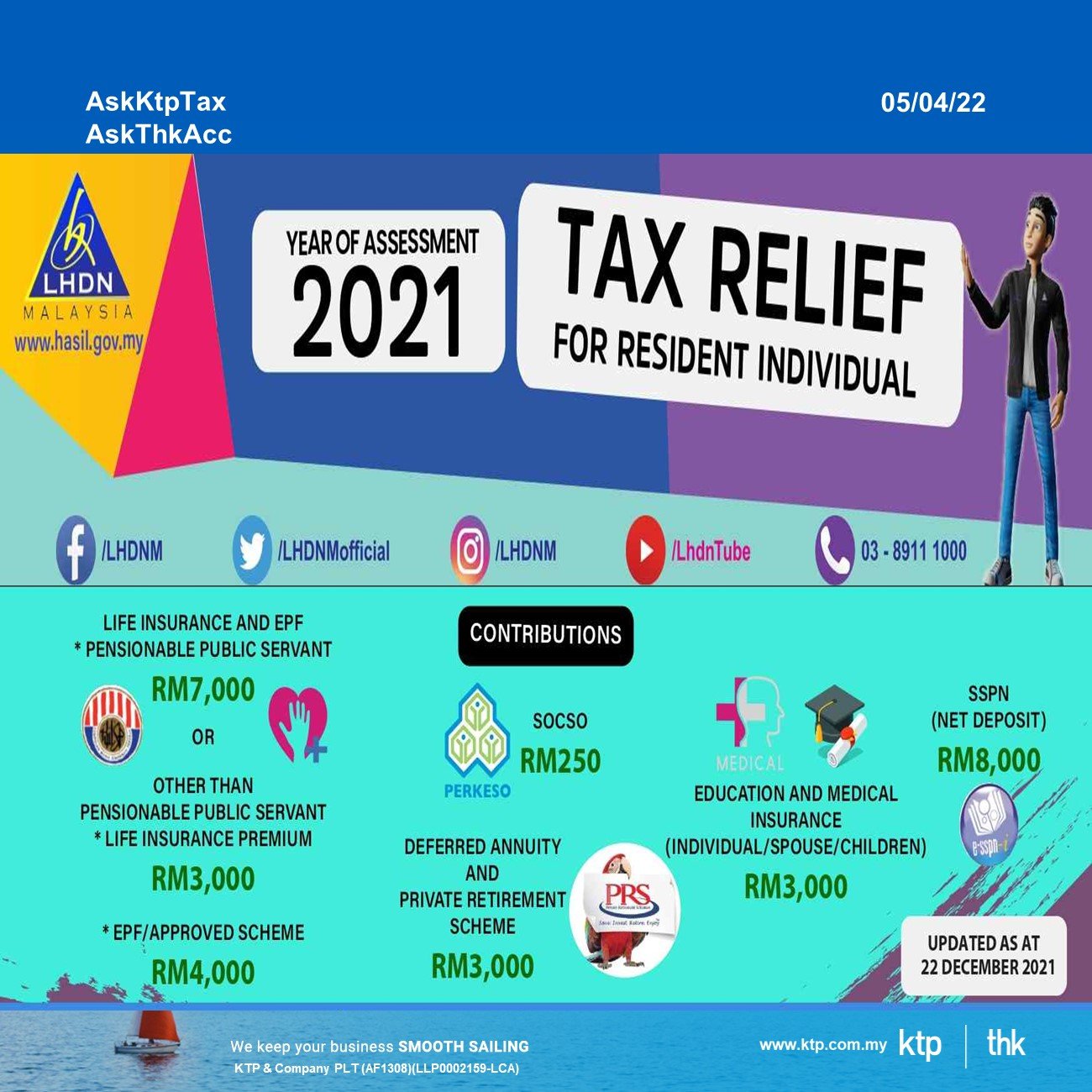

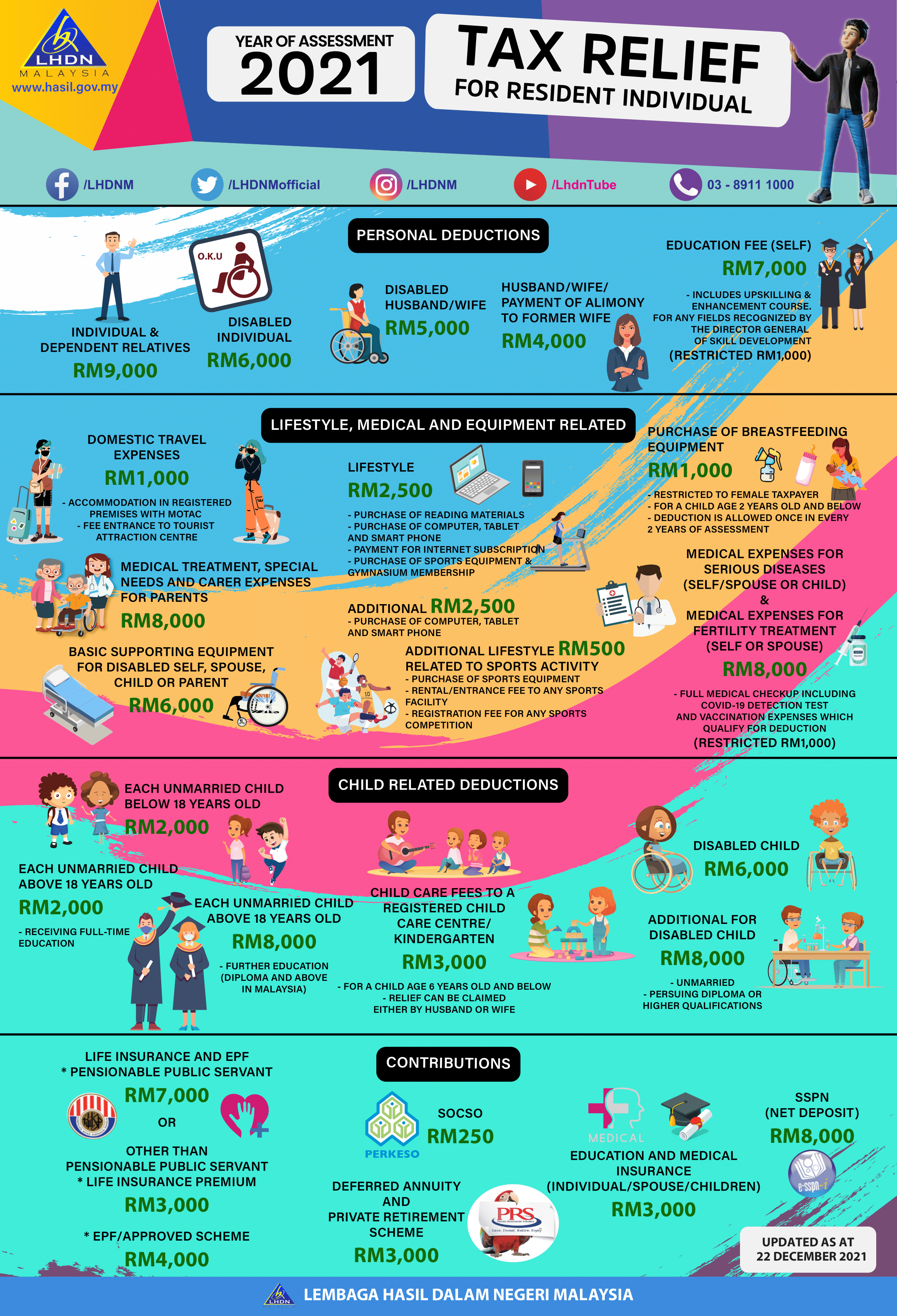

Resident Individual Tax Relief YA 2021 WSY Associates

https://wsyassociates.com/images/Pelepasan_Cukai_2021_2-1.png

Malaysian Tourism Tax System MyTTx Jabatan Kastam Diraja Malaysia Paparan Buletin Pengumuman Terkini Lihat lagi 12 07 2024 Notis Penyelenggaraan Sistem MyTTx 13 07 2024 12 00 AM 4 00 AM Jabatan Kastam Diraja Malaysia Jalan Tun Abdul Razak Presint 2 Suasana PJH 62100 Putrajaya Maklum balas Kindly be informed that the exemption of tourism tax on foreign tourist staying at a registered accommodation premise will end on 31st December 2022 Accordingly the imposition of tourism tax on foreign tourist staying at a registered premise will be re imposed effective from 1st January 2023

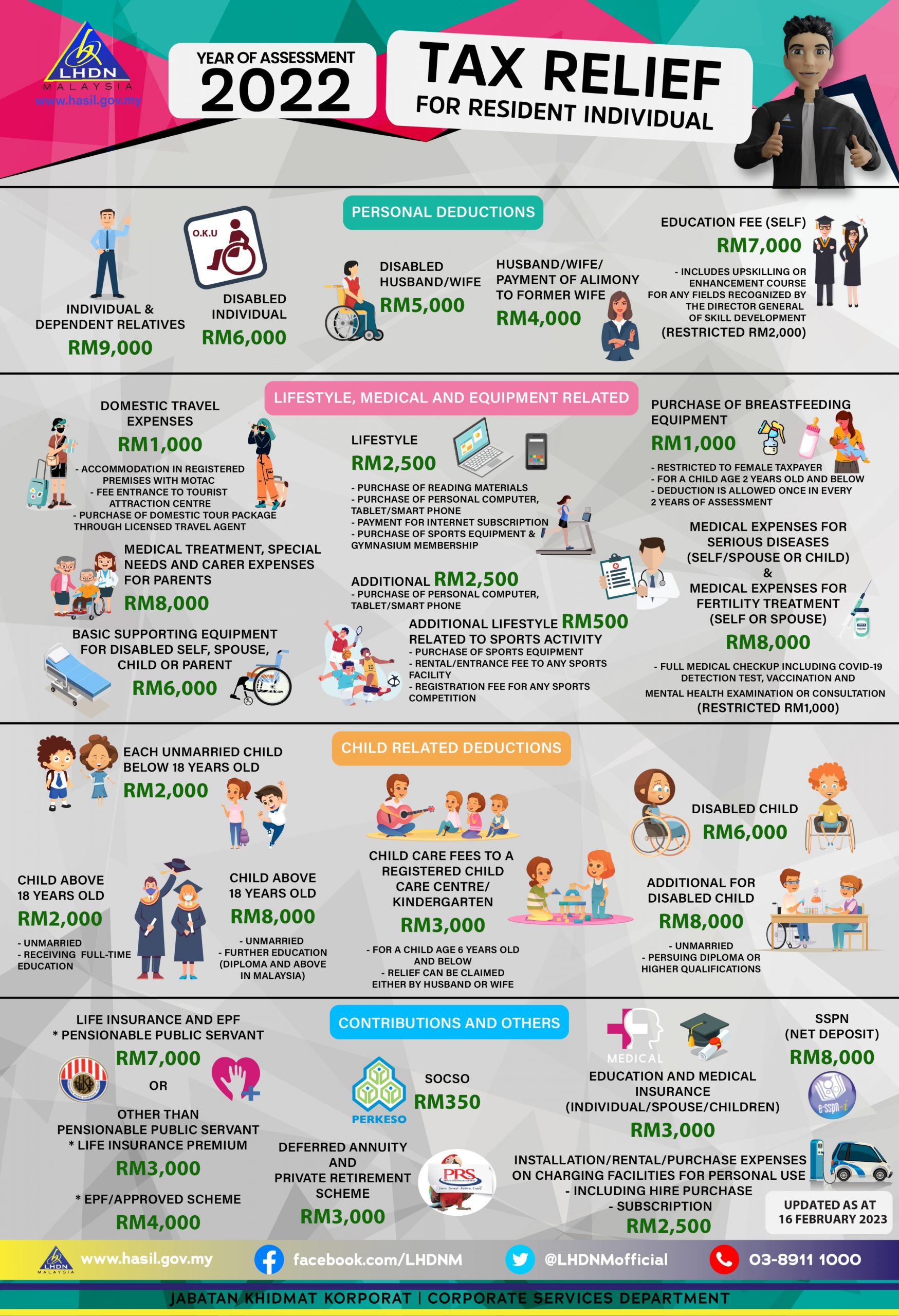

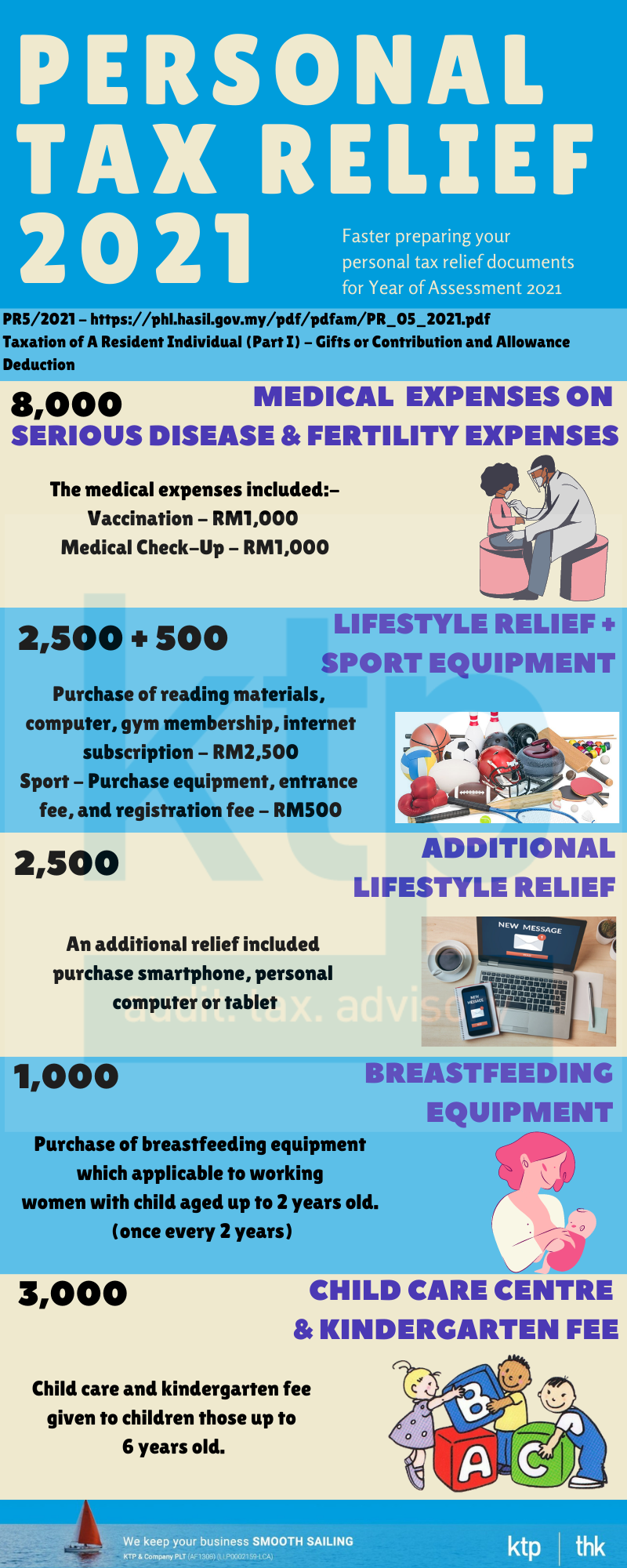

The deadline for tax payment under the Voluntary Disclosure Programme VDP for applications submitted to the RMCD on or before 31 May 2024 has been extended from 31 May 2024 to 30 June 2024 Personal tax relief of up to MYR1 000 is given to resident individuals for the following domestic travel expenses incurred from 1 March 2020 to 31 August 2020 has since been extended to 31 December 2021 You can easily check on the Ministry of Tourism Arts and Culture Malaysia website which has a searchable list of registered

Download Hotel Tax Relief Malaysia

More picture related to Hotel Tax Relief Malaysia

KTP Company PLT Audit Tax Accountancy In Johor Bahru

https://images.squarespace-cdn.com/content/v1/59bb3b0146c3c48c4746b775/1649127626659-YWTHKJY4M140RQKCBQXU/Slide4.JPG

Malaysia Budget 2023 MilesConnir

https://static.imoney.my/articles/wp-content/uploads/2023/02/24180611/Income-Tax.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Registered accommodation premise operators are exempted from charging Service Tax from 1 March 2020 to 31 December 2021 Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022 A The Malaysian Tourism Tax TTx is a tax of RM10 per room per night charged on any tourist staying at any accommodation premises within Malaysia collected by the operator under the Tourism Tax Act 2017 TTx Act

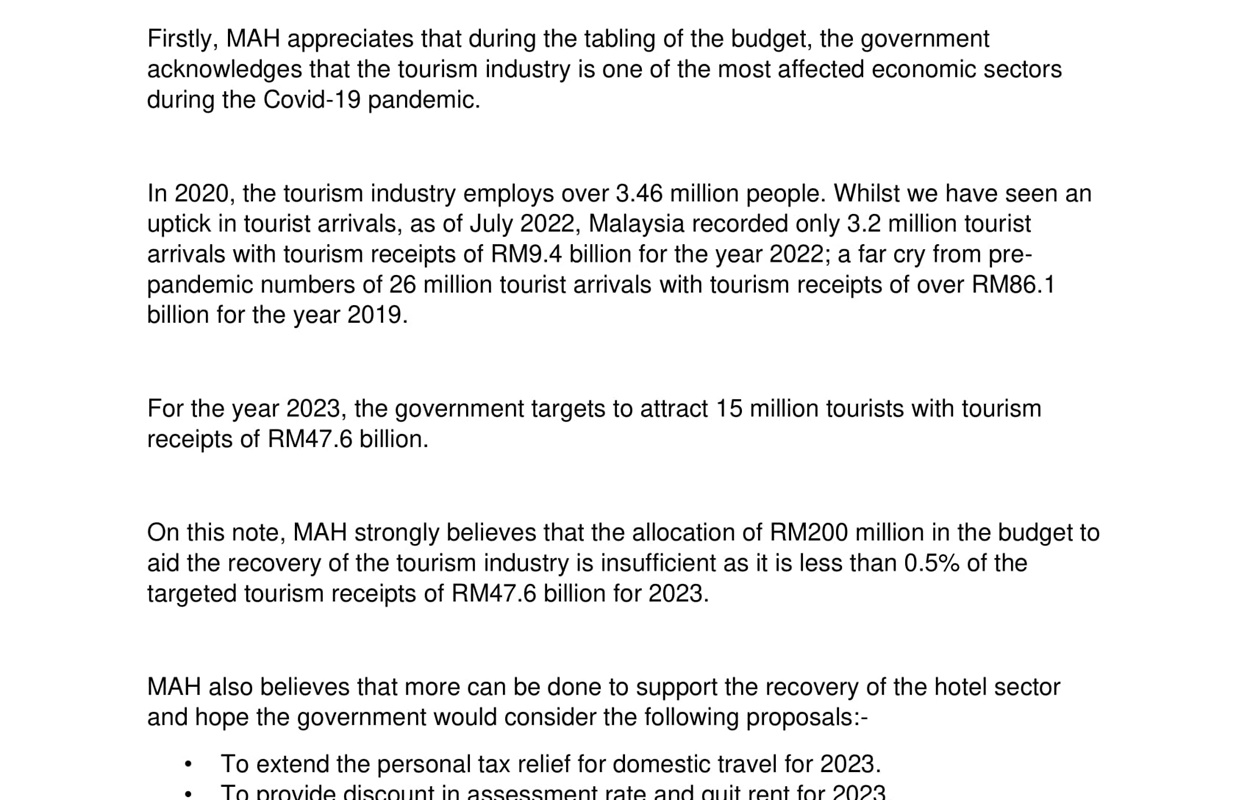

To extend the personal tax relief for domestic travel for 2023 To provide discount in assessment rate and quit rent for 2023 To re introduce wage subsidy program for 2023 Individual Relief Types Amount RM 1 Self and Dependent Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up to RM96 000 annually This relief is applicable for Year Assessment 2013 and 2015 only 9 000 2 Medical treatment Parents 5 000 Limited 3 Basic supporting

What Can I Claim On Tax 2023 Malaysia Sep 22 2022 Johor Bahru JB

https://cdn1.npcdn.net/image/16638164303644d5a619cb5f96244214590013c1bc.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

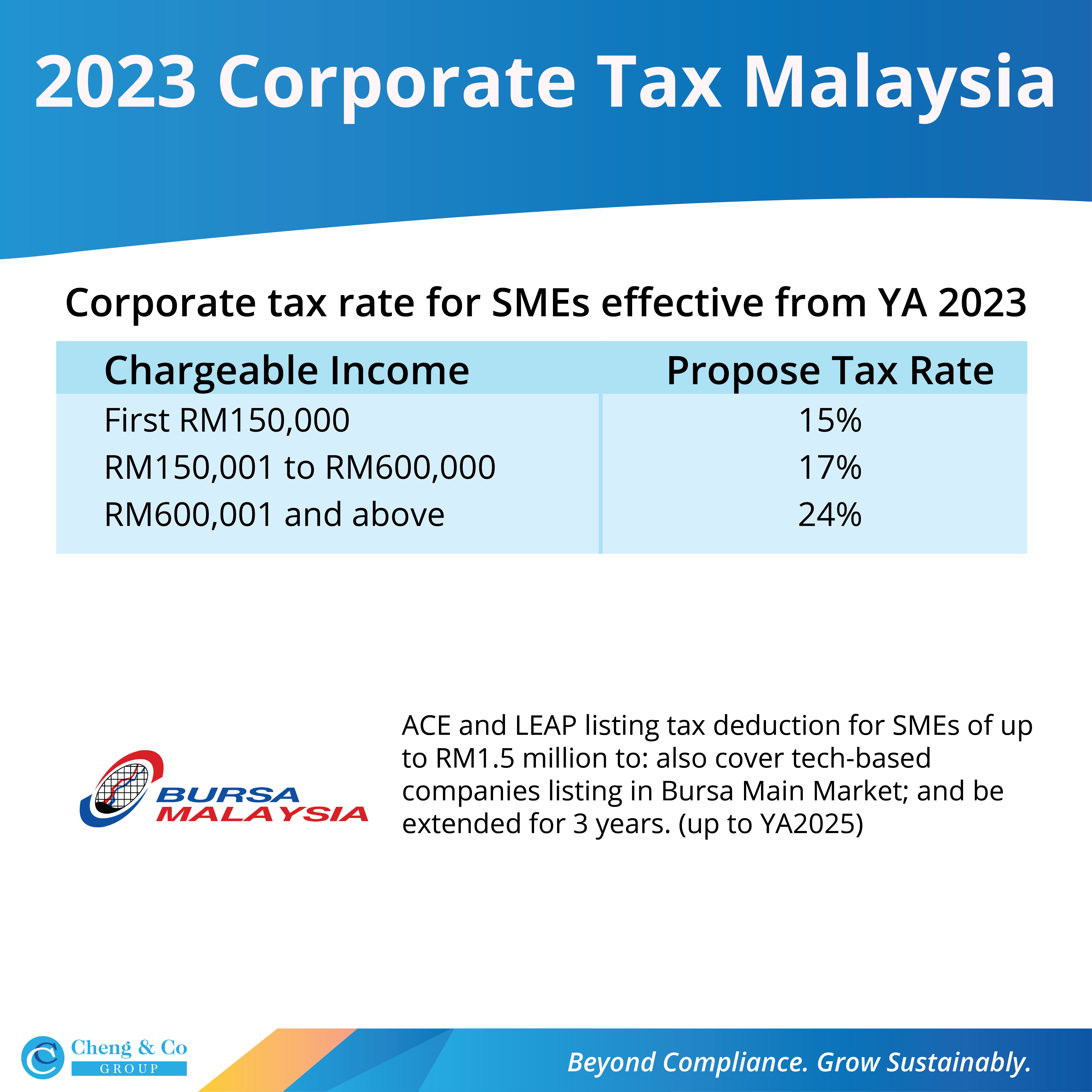

Latest Budget 2023 Malaysia Summary Cheng Co Group

https://chengco.com.my/wp/wp-content/uploads/2022/10/2023-Budget-03.png

https://www.motac.gov.my/en/check/registered-hotel

Sponsorship Tax Deduction Incentives Garis Panduan Manual Pengguna Permohonan Bantuan Serta Insentif Surat Sokongan Kebudayaan G2G Services Online Services Registration Application 1 MALAYSIA HOTEL Lot S0110 0115 Blok J One Avenue Phase 8 Taman Utama Sabah 15 12 09 4

https://page.mysoftinn.com/en/malaysia-tourism-tax...

It is charged at a fixed rate of RM10 00 per room per night However during the Covid 19 pandemic The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022

PERSONAL INCOME TAX RELIEF 2022 MALAYSIA Haji Land Berhad

What Can I Claim On Tax 2023 Malaysia Sep 22 2022 Johor Bahru JB

Personal Tax Relief 2022 L Co Accountants

Self Discovery Quotes In The Alchemist

Personal Tax Relief Y A 2023 L Co Accountants

Budget 2023 Malaysian Association Of Hotels MAH MAH

Budget 2023 Malaysian Association Of Hotels MAH MAH

The Ultimate Income Tax Relief Guide For Malaysians 2023 YouTube

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Hotel Tax Relief Malaysia - Malaysian Tourism Tax System MyTTx Jabatan Kastam Diraja Malaysia Paparan Buletin Pengumuman Terkini Lihat lagi 12 07 2024 Notis Penyelenggaraan Sistem MyTTx 13 07 2024 12 00 AM 4 00 AM Jabatan Kastam Diraja Malaysia Jalan Tun Abdul Razak Presint 2 Suasana PJH 62100 Putrajaya Maklum balas