House Loan Interest Income Tax Rebate Web 28 mars 2017 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law Web 31 mai 2022 nbsp 0183 32 Section 80EE First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17

House Loan Interest Income Tax Rebate

House Loan Interest Income Tax Rebate

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Web 1 f 233 vr 2021 nbsp 0183 32 Another rule is that if the construction of your under construction house is not completed within 5 years from the year in which the home loan was taken then the tax Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on

Download House Loan Interest Income Tax Rebate

More picture related to House Loan Interest Income Tax Rebate

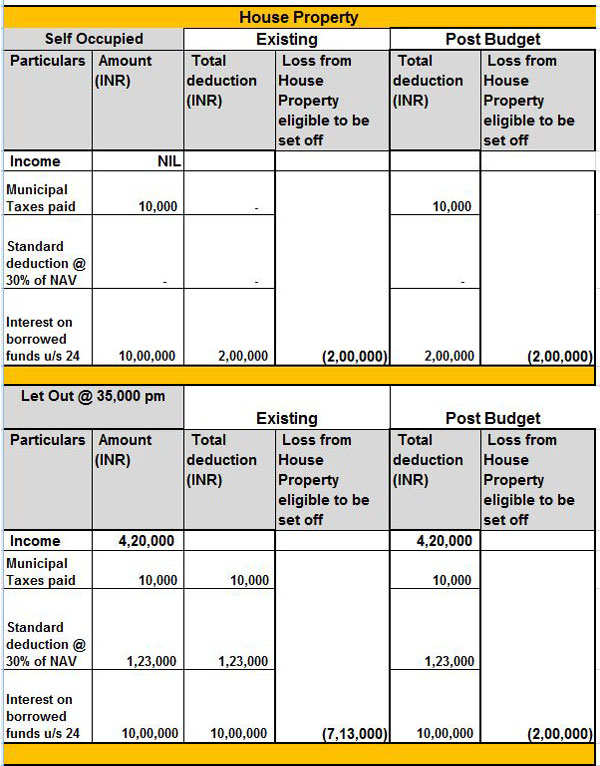

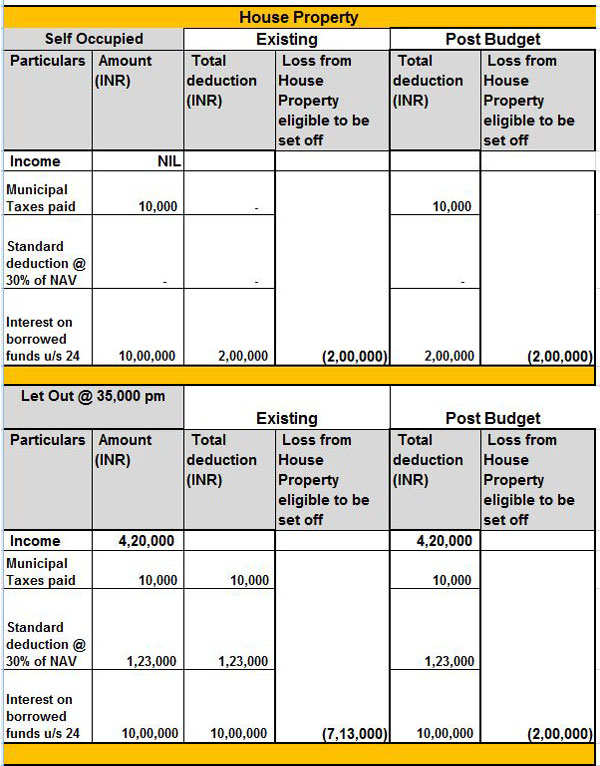

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 13 juin 2020 nbsp 0183 32 For e g in FY 2017 18 you took a home loan of Rs 1 crore amp paid Rs 5 lac as interest in the same year As per Sec 24 only Rs 2 lac will be allowed as interest Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI

Web For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable income on principal repayment Stamp duty and registration Web Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

Form 12BB New Form To Claim Income Tax Benefits Rebate

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Form 11 Mortgage Interest Deduction Understand The Background Of Form

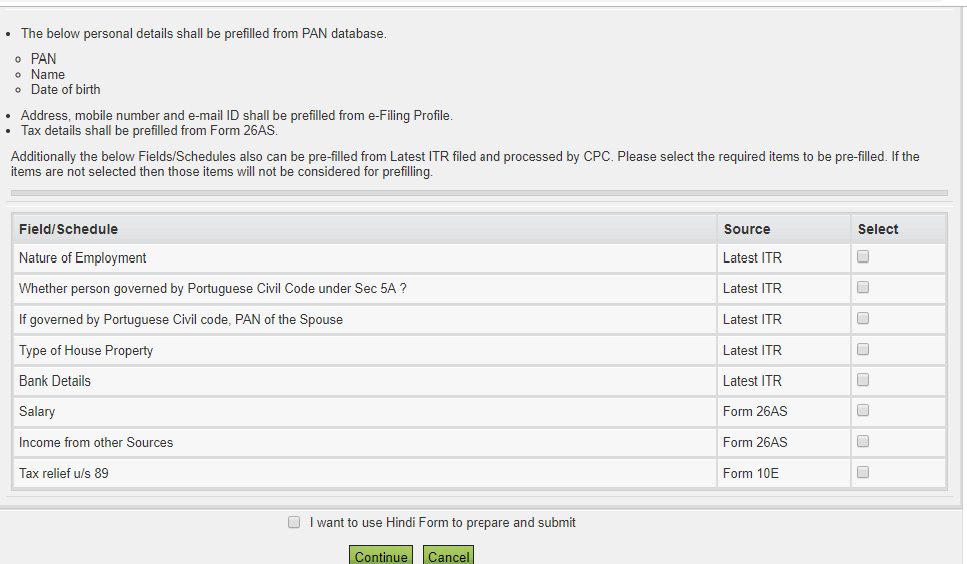

FY 22 23 New Income Tax Return E filing Exemptions Deductions E

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

House Loan Interest Income Tax Rebate - Web 1 f 233 vr 2021 nbsp 0183 32 Another rule is that if the construction of your under construction house is not completed within 5 years from the year in which the home loan was taken then the tax