House Loan Interest Rebate On Income Tax Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

House Loan Interest Rebate On Income Tax

House Loan Interest Rebate On Income Tax

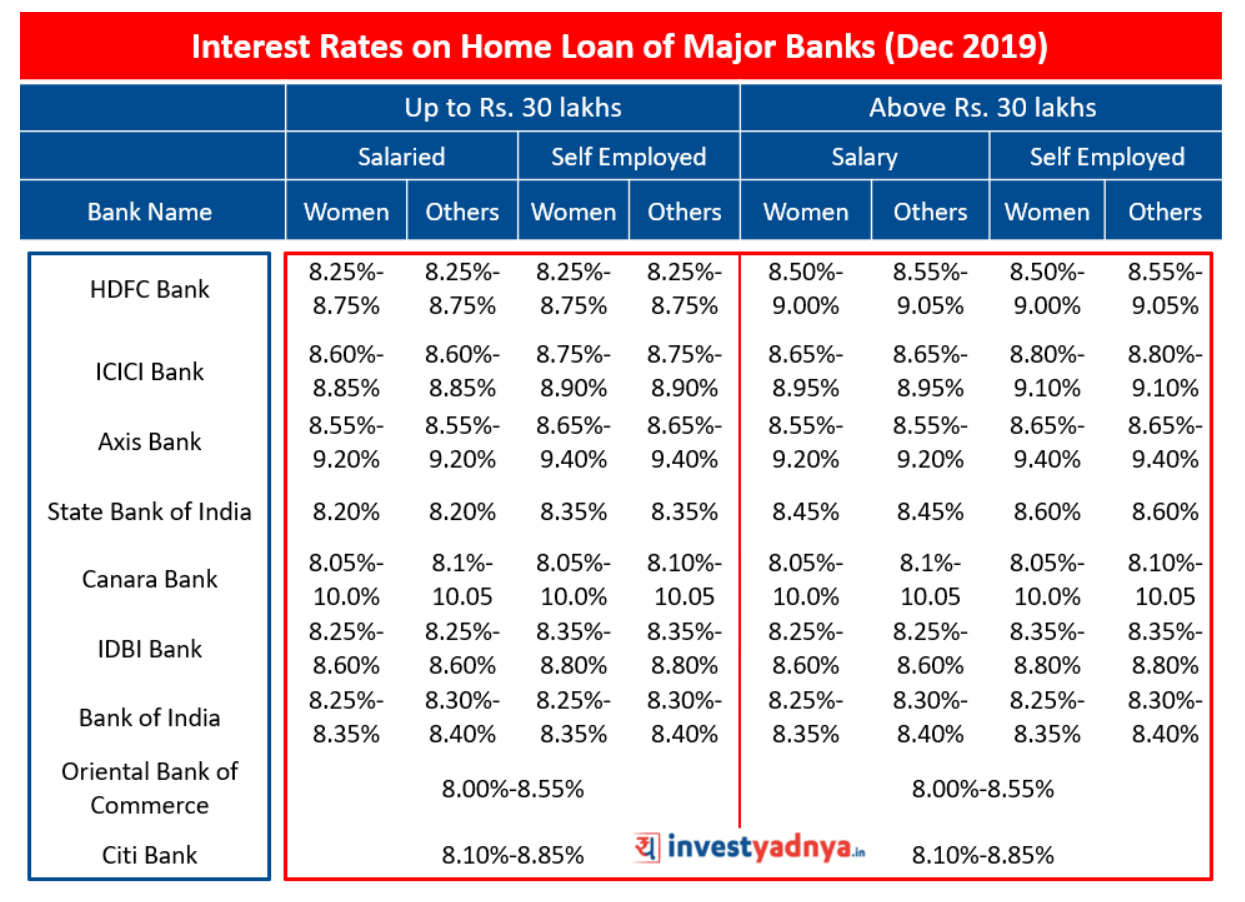

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

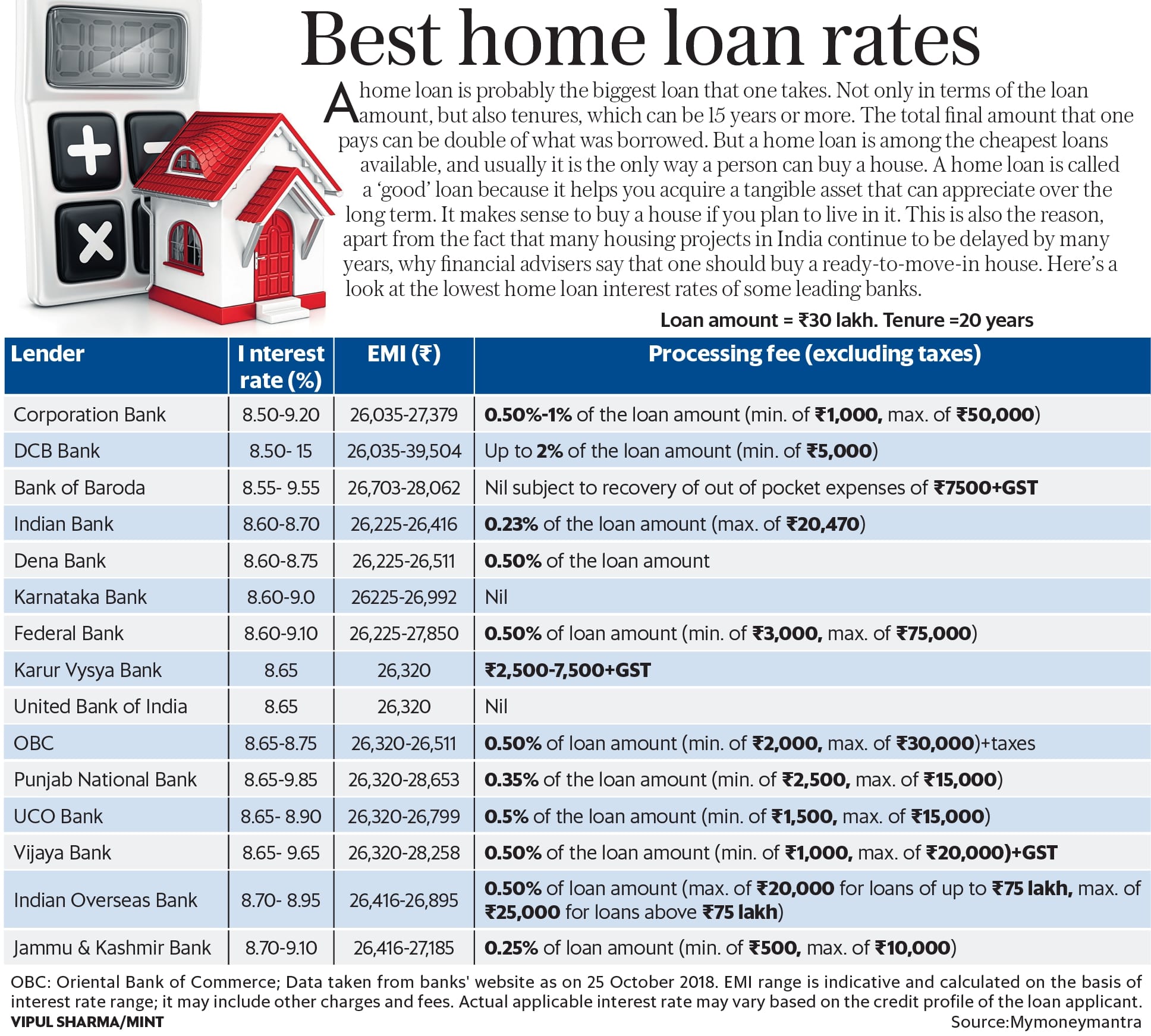

The Best Home Loan Rates Being Offered Right Now Livemint

https://www.livemint.com/r/LiveMint/Period2/2018/10/30/Photos/Processed/home_loan_interest rate.jpg

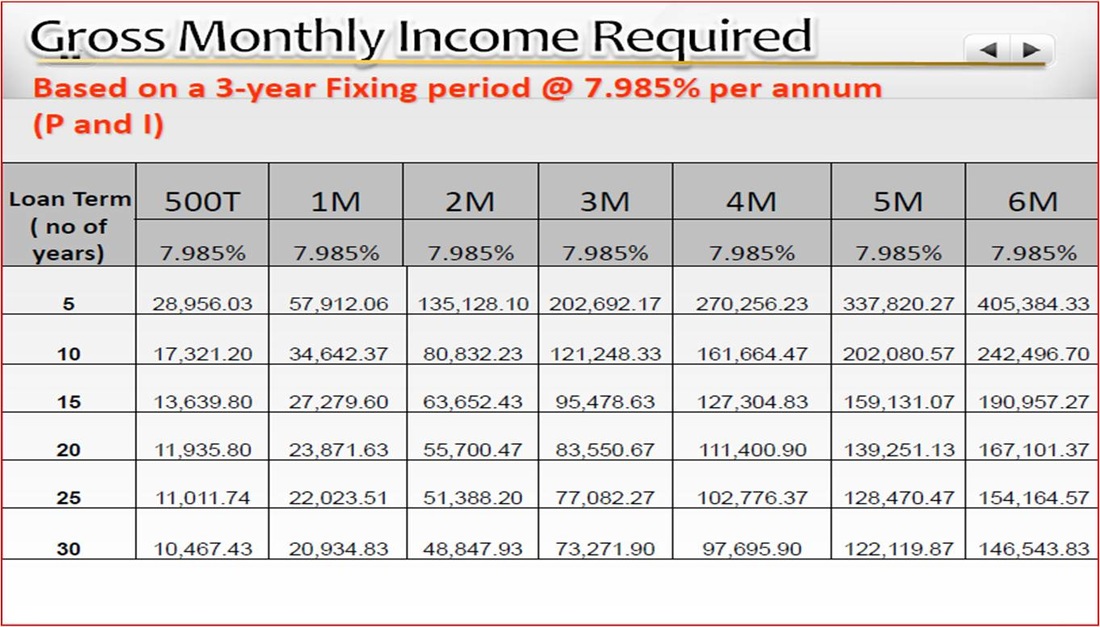

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 19 avr 2021 nbsp 0183 32 Tax benefits for home loans are available for interest payment as well as for repayment of the principal amount I get many questions about whether one can claim Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 while

Download House Loan Interest Rebate On Income Tax

More picture related to House Loan Interest Rebate On Income Tax

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

Web 3 mars 2023 nbsp 0183 32 Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Phase Home Loan Deduction Under Section 80C Income Tax Rebate on Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Web New Updates Union Budget 2023 2024 Eligibility period for claim of additional deduction for interest of Rs 1 5 lakh paid for loan taken for purchase of an affordable house Web By filing under you can get an annual deduction on your home loan interest amount and some much needed relief on the tax on your home loan You can also look into the

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

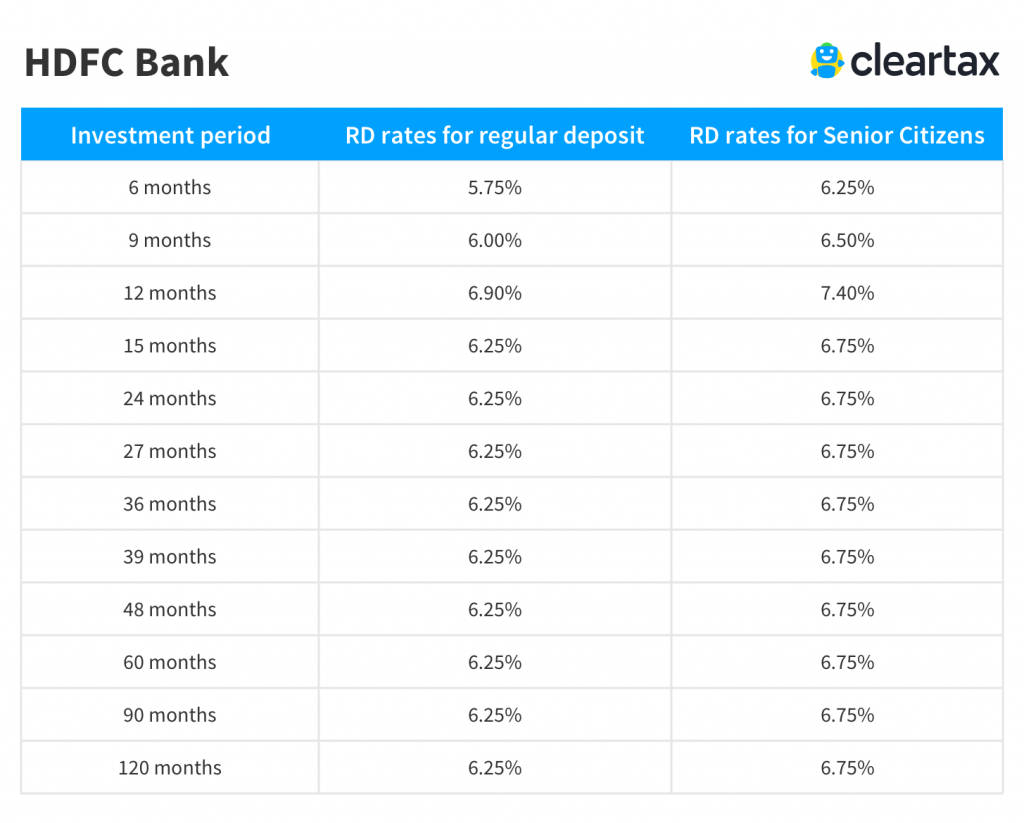

Best Home Loan Interest Rates In India For Nri Home Sweet Home

https://assets1.cleartax-cdn.com/s/img/20180118124633/HDFC-1024x823.png

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Rebate On Home Loan Interest In Income Tax

Form 12BB New Form To Claim Income Tax Benefits Rebate

Oct 2016 Best Home Loan Interest Rates In 2016

Signs That You re Paying Too Much For Your Home

PNB Home Loan Interest Rates Are In The Range Of 8 65 To 9 25 With

PNB Home Loan Interest Rates Are In The Range Of 8 65 To 9 25 With

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

Home Loan Interest Rate Home Sweet Home Insurance Accident

House Loan Interest Rebate On Income Tax - Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that