House Loan Rebate Under Section The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate sections of the Income Tax

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

House Loan Rebate Under Section

House Loan Rebate Under Section

https://www.thebluediamondgallery.com/wooden-tile/images/home-loan.jpg

How To Qualify For A Home Loan In South Africa Explained Loanspot io

https://loanspot.io/za/wp-content/uploads/sites/2/2021/01/home-loan-sa-scaled.jpg

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

The government offers tax benefits under Section 24 for income from house property Taxable income includes rental income deemed let out properties self A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C Section 80EE offers tax relief to taxpayers who have taken out a home loan It allows home buyers to take income tax benefits on the interest they need to pay on a home loan As per this section a

Download House Loan Rebate Under Section

More picture related to House Loan Rebate Under Section

How To Assume A House Loan In The Philippines Wealth Serving

https://wealthserving.com/wp-content/uploads/2022/04/house-loan-1024x540.jpg

Latest Income Tax Rebate On Home Loan 2024

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

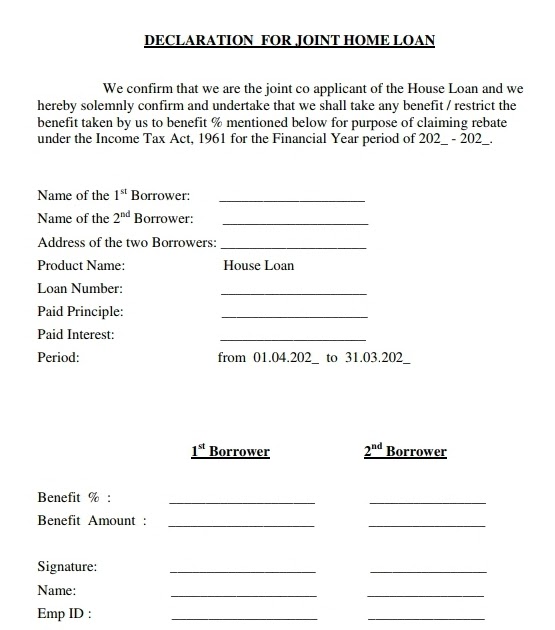

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

Rebate is offered to a home loan borrower in India under four sections Section 80C Section 24 Section 80EEA and Section 80EE How much rebate can a home buyer claim in a year If one ticks all the You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://fincalc-blog.in/wp-content/uploads/2023/02/tax-rebate-under-section-87A.webp

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

https://blog.bankbazaar.com/home-loan-tax-benefits...

The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate sections of the Income Tax

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Home Loan Shinhan Bank

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Section 87A Tax Rebate Under Section 87A Rebates Financial

Get House Loan Interest Deduction Up To 3 50 000 YouTube

Cost Of House Loan Still Less Than 2017 After Recent Rate Rise RBA

Brigade In House Home Loan Services

Brigade In House Home Loan Services

Income Tax Benefits On Home Loan Loanfasttrack

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Joint Home Loan Declaration Form For Income Tax Savings And Non

House Loan Rebate Under Section - Section 80EE offers tax relief to taxpayers who have taken out a home loan It allows home buyers to take income tax benefits on the interest they need to pay on a home loan As per this section a