House Loan Tax Rebate Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

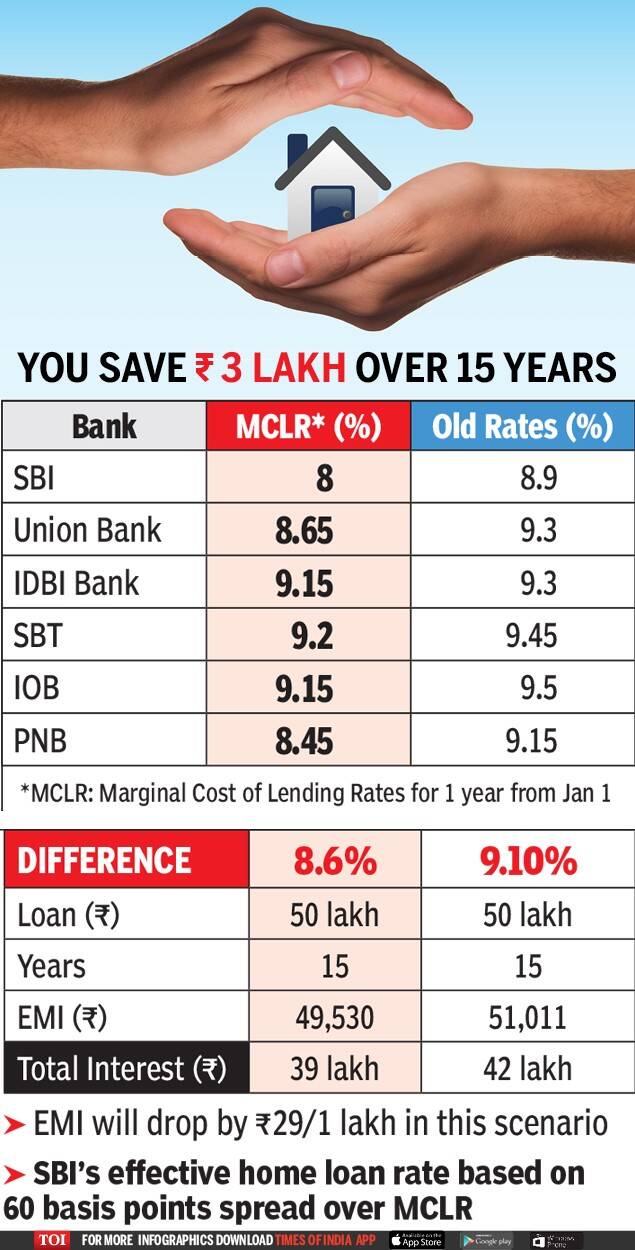

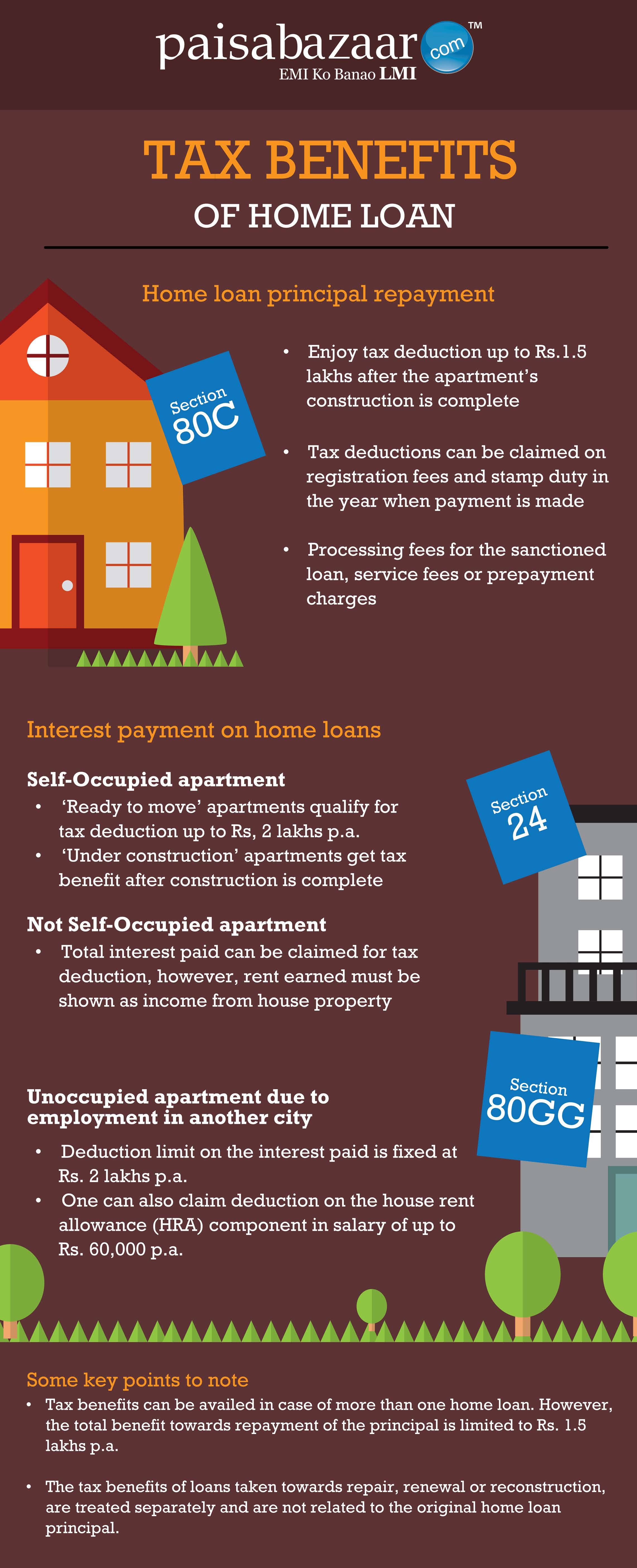

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

House Loan Tax Rebate

House Loan Tax Rebate

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Realtors Seek Tax Rebate On House Loans

https://images.assettype.com/dtnext/import/Images/Article/201602090046480107_Realtors-seek-tax-rebate-on-house-loans_SECVPF.gif

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use Web Section 80EE and Section 80EEA The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing

Web Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable Web Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your home loan With the help of a home

Download House Loan Tax Rebate

More picture related to House Loan Tax Rebate

Home Loan Tax Exemption Home Loan Tax Rebate Rules YouTube

https://i.ytimg.com/vi/1DNKE2fuoA4/maxresdefault.jpg

Home Loan To Become Cheapest In 6 Years As SBI Other Banks Slash Rates

https://static.toiimg.com/photo/56289211.cms

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on

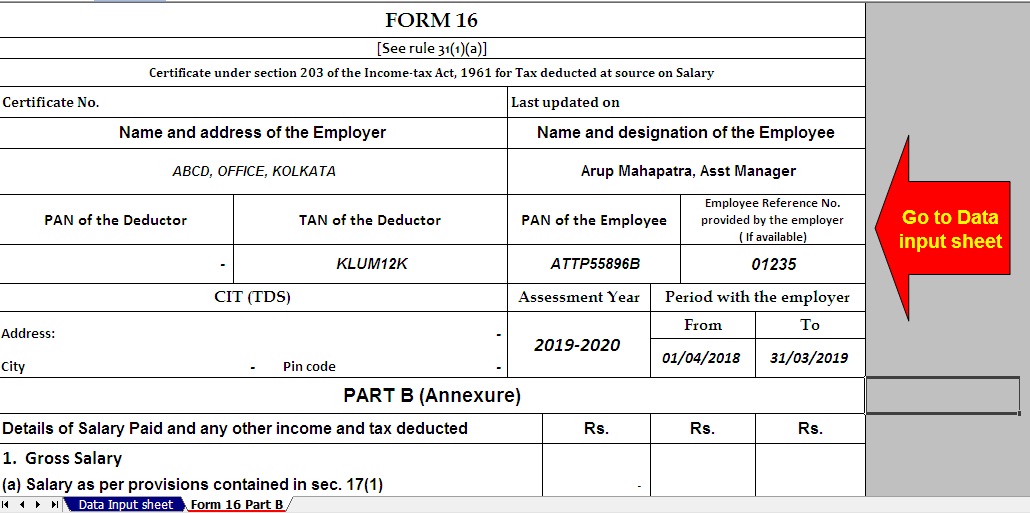

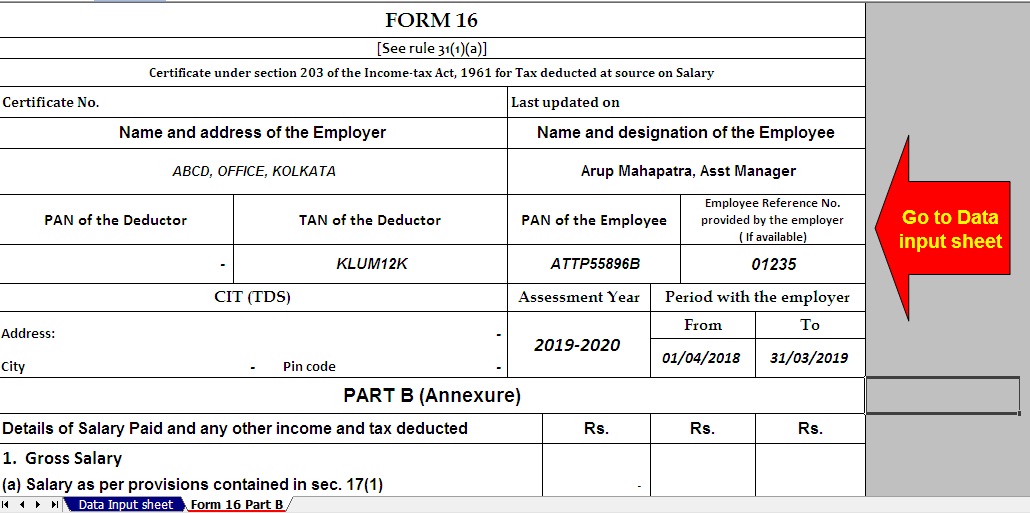

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

https://1.bp.blogspot.com/-iMxeS2BunP0/XqBA6tBeFDI/AAAAAAAAMqY/z1n5gJ66fQovpJMvwhx1NLTrJ58TLiUZACNcBGAsYHQ/s1600/Picture%2B4%2Bof%2BNew%2BForm%2B16%2BPart%2BB.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Home Loan Tax Rebate

Latest Income Tax Rebate On Home Loan 2023

Tax Rebate Calculator On Home Loan TAXW

Tax Rebate Calculator On Home Loan TAXW

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

How To Calculate Tax Rebate On Home Loan Grizzbye

The Homeowners Guide To Tax Credits And Rebates

House Loan Tax Rebate - Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions