House Rent Allowance Comes Under 80c HRA full form is House Rent Allowance it is taxable salary comes under Sec 10 13A What is HRA how to claim HRA exemption its eligibility tax benefits

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This But what if you are making payments towards rent for residential accommodation but you do not get HRA from your employer You can still claim the deduction under Section 80GG of the Income Tax Act However for that you will need

House Rent Allowance Comes Under 80c

House Rent Allowance Comes Under 80c

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

HRA How To Compute Exemption

https://taxguru.in/wp-content/uploads/2020/01/House-Rent-Allowance-1.jpg

Children Educational Allowance Exemption 4 Ways To Save Taxes

https://life.futuregenerali.in/media/fa4hvorf/children-education-allowance.jpg

Furthermore the House Rent Allowance exemption available under Section 80GG will be the least out of the following conditions The total rent paid minus 10 of the adjusted Self employed individuals are not eligible to claim HRA under the rules of the Income Tax Act However they are eligible to receive tax deductions under Section 80GG for rental housing How is House Rent Allowance HRA

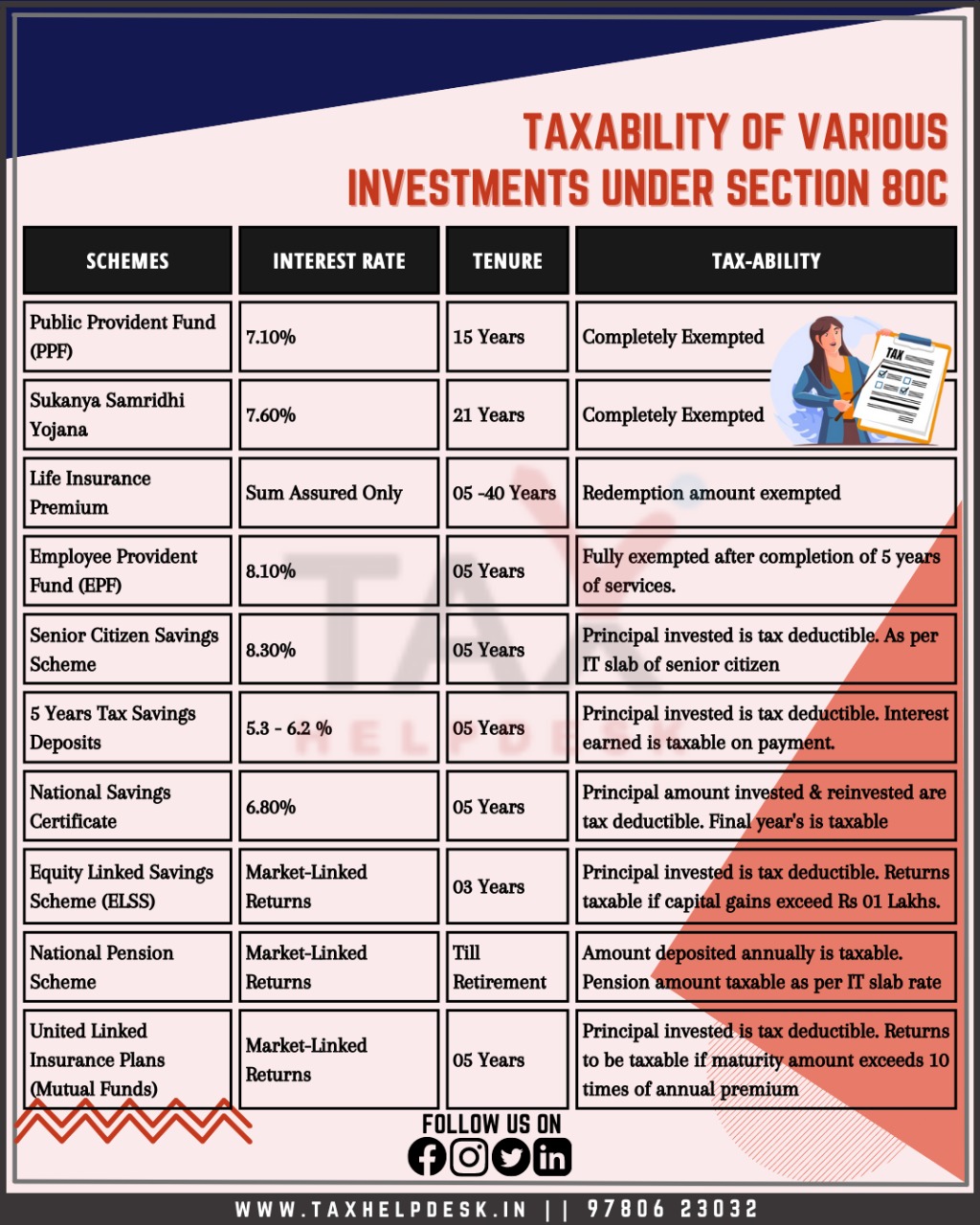

Adjusted income Total income long term capital gain short term capital gain subject to tax at 10 deductions under 80C to 80U income under section 115A or 115D You should not include 80GG deduction in 80C to 80U House Rent Allowance HRA Exemption and Tax Deduction in India offer relief to taxpayers incurring rental expenses HRA a salary component is partially or fully exempt from income tax subject to conditions

Download House Rent Allowance Comes Under 80c

More picture related to House Rent Allowance Comes Under 80c

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

How Car Insurance Claims Process Works Forbes Advisor INDIA

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/in/wp-content/uploads/2021/12/pexels-mikhail-nilov-7736045-Cropped-scaled.jpg

House Rent Receipt Format PDF Download

https://captainsclerk.com/18790bfb/https/34a049/geod.in/wp-content/uploads/2021/07/Receipt-of-House-Rent.jpg

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees Subtract any deductions you have claimed under Sections 80C to 80U except for the deduction under Section 80GG Compare the three options mentioned in step 1 and

No individuals paying rent but do not receive house rent allowance are allowed to claim deduction under section 80GG Also the individual spouse or children should not own At the same time you can also claim deductions on home loan interest under Section 24 b and on principal repayment under Section 80C if you have taken a home loan

House Rent Receipt Example Templates At Allbusinesstemplates

https://i.pinimg.com/originals/c6/86/4f/c6864f0671c620dcac5c7ecd8d1a3dbc.png

HRA Calculation Formula On Salary Change How HRA Exemption Is

https://i.ytimg.com/vi/O-wluM-mvG8/maxresdefault.jpg

https://www.etmoney.com › ... › house-rent-allowance

HRA full form is House Rent Allowance it is taxable salary comes under Sec 10 13A What is HRA how to claim HRA exemption its eligibility tax benefits

https://tax2win.in › guide › hra-house-rent-…

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

House Rent Receipt Example Templates At Allbusinesstemplates

What Is House Rent Allowance Blogs By CA Rachana Ranade

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Episode 102 Ll House Rent Allowance Ll Ll SP Talks YouTube

Episode 102 Ll House Rent Allowance Ll Ll SP Talks YouTube

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling

Housing Allowance Request Form Brokepastor

House Rent Allowance Comes Under 80c - House Rent Allowance HRA Exemption and Tax Deduction in India offer relief to taxpayers incurring rental expenses HRA a salary component is partially or fully exempt from income tax subject to conditions