House Rent Allowance Deduction In Income Tax Section 05 May 2020 72 144 Views 5 comments HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer

House Rent Allowance Deduction In Income Tax Section

House Rent Allowance Deduction In Income Tax Section

https://i.ytimg.com/vi/_h6nx9cmYk0/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYNCBJKH8wDw==&rs=AOn4CLAcdOnQOcKfms5yUJWNB-rCHlDhVg

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

https://enskyar.com/img/Blogs/Deduction-from-Salary-under-section-16-of-Income-Tax-Act.jpg

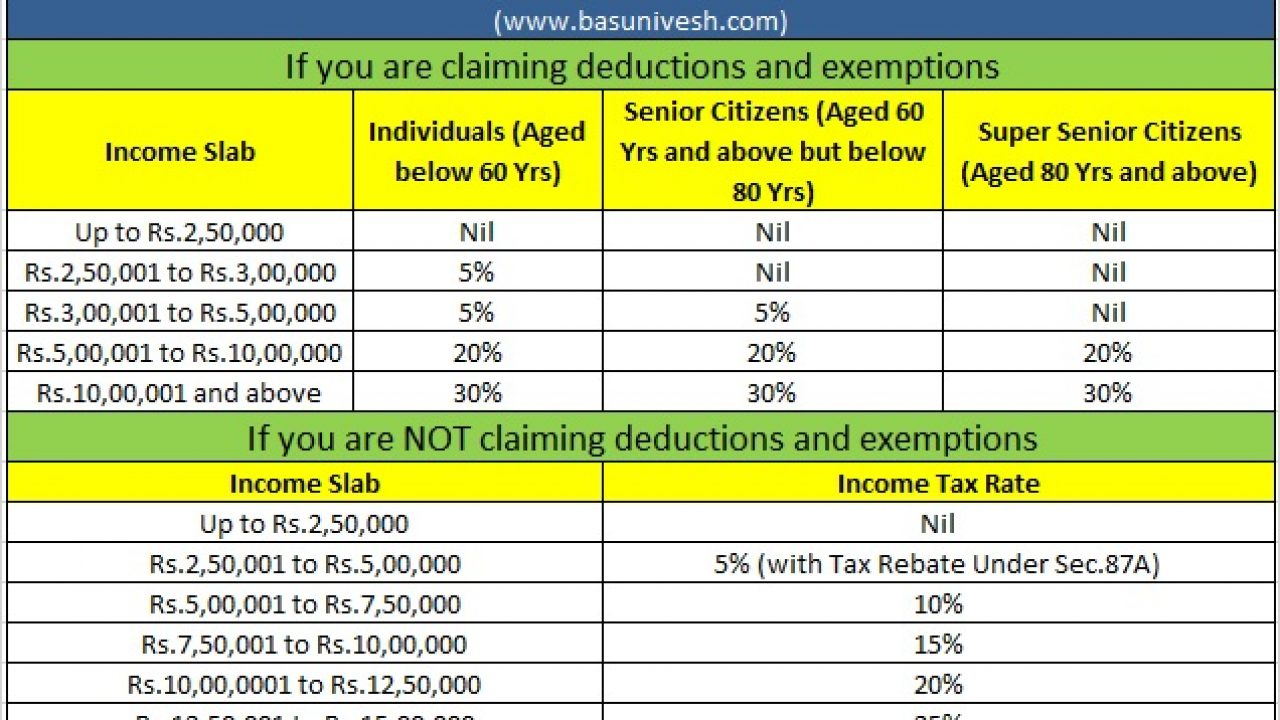

Under Section 80GG the deduction is allowed to an individual who pays rent without receiving any House Rent Allowance from an employer Hence check the Salary Slip to see if there is any House Rent Allowance component in the salary break up Calculate Please enter email to continue You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024

The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee However Income Tax Act provides a deduction of hra under section 10 13A subject to certain limits

Download House Rent Allowance Deduction In Income Tax Section

More picture related to House Rent Allowance Deduction In Income Tax Section

Deduction In Income For House Rent Paid Under 80GG YouTube

https://i.ytimg.com/vi/6JiKmejIq68/maxresdefault.jpg

Standard Deduction In Income Tax With Examples InstaFiling

https://instafiling.com/wp-content/uploads/2022/12/Standard-Deduction-in-Income-Tax-1080x675.png

HRA Or House Rent Allowance Deduction Calculation

https://www.wintwealth.com/blog/wp-content/uploads/2022/12/HRA-House-Rent-Allowance-Exemption-Rules-Deduction-Calculation-1024x536.jpg

HRA or House Rent Allowance is a wage given by employers to staff members to cover housing costs associated with leasing a home The HRA is a crucial part of a person s pay Both salaried and self employed people are covered by HRA According to rule 2A of the Income Tax Rules HRA for salaried individuals is accounted for under section 10 HRA Tax Deduction Under Section 80GG To claim a deduction under Section 80GG of the Income Tax Act individuals need to consider the following and select the lowest amount among them Individuals can claim a deduction of Rs 5 000 per month towards rent paid Calculate 25 of the adjusted total income

As per Section 80GG of income tax rules self employed individuals who do not receive a house rent allowance from the employer can claim a deduction for the rent paid However the maximum amount that can be claimed under this section is up to Rs 60 000 Rs 5 000 per month Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA Given that HRA constitutes a substantial component of an individual s salary it is imperative to adhere to the company s policies regarding using HRA

What Is HRA And Its Exemption And Its Tax Deduction

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2023/02/What-is-House-Rent-Allowance-HRA-Exemption-Tax-Deduction.jpg

Types Of Standard Deduction In Income Tax For 2022

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/11/Types-of-Standard-Deduction-in-Income-Tax-1024x576.png

https://taxguru.in/income-tax/house-rent-allowance...

05 May 2020 72 144 Views 5 comments HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

Section 80GG Deduction For Rent Amount Detailed

What Is HRA And Its Exemption And Its Tax Deduction

Clarification Regarding Deduction House Rent Allowance And 5

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Tax Planning House Rent Allowance HRA Tax Saving Tips YouTube

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

ALL ABOUT HOUSE RENT ALLOWANCE HRA EXEMPTION CALCULATION SIMPLE TAX

HRA Tax Exemption Calculator House Rent Deduction In Income Tax

Know Income Tax Deduction For HRA House Rent Allowance

House Rent Allowance Deduction In Income Tax Section - The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A