House Rent Deduction In Income Tax Section India Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA As this allowance is a

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions Use our HRA exemption calculator to easily calculate the tax free portion of your House Rent Allowance HRA Determine how much HRA you can claim based on your rent salary and city

House Rent Deduction In Income Tax Section India

House Rent Deduction In Income Tax Section India

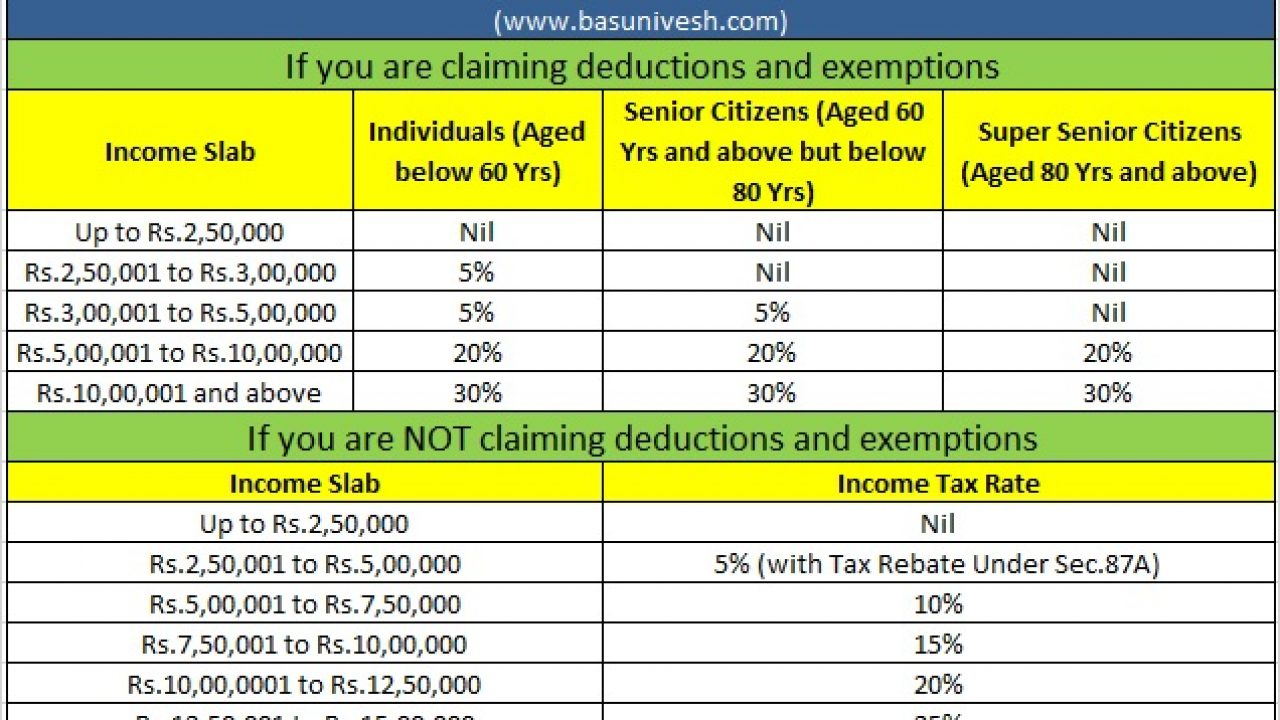

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

https://enskyar.com/img/Blogs/Deduction-from-Salary-under-section-16-of-Income-Tax-Act.jpg

Information On Section 80G Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/12/Section-80G-Deduction.png

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible subject to the following conditions A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary The house rent deduction in income tax is known as HRA house rent allowance under Section 10 13A or Section 80GG of Income Tax Act

Download House Rent Deduction In Income Tax Section India

More picture related to House Rent Deduction In Income Tax Section India

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

https://secureservercdn.net/160.153.137.184/mms.194.myftpupload.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received-768x505.jpg

Section 24 Of Income Tax Act House Property Deduction

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03125718/Deduction-us-24b-2-782x1024.jpg

Section 115BAC Of Income Tax Act IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2020/04/shutterstock_567805387-1.jpg

Learn what is house rent allowance HRA including eligibility criteria documents required Check out HRA taxation rules in India HRA calculator FAQs Taxpayers can claim an income tax deduction for any amount paid as rent under Section 80GG of the Income Tax Act Section 80GG is a facility introduced in the Act for providing a tax deduction to taxpayers who are not

House Rent Allowance HRA Exemption and Tax Deduction in India offer relief to taxpayers incurring rental expenses HRA a salary component is partially or fully exempt from As per the Income Tax Act regulations self employed individuals cannot claim HRA but they certainly can avail of tax deductions towards the rented housing under Section 80GG

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

House Rent Allowance HRA Exemption Rules Tax Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/House-Rent-Allowance.png

https://cleartax.in › hra-house-rent-allowa…

Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA As this allowance is a

https://tax2win.in › guide › hra-house-rent-…

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions

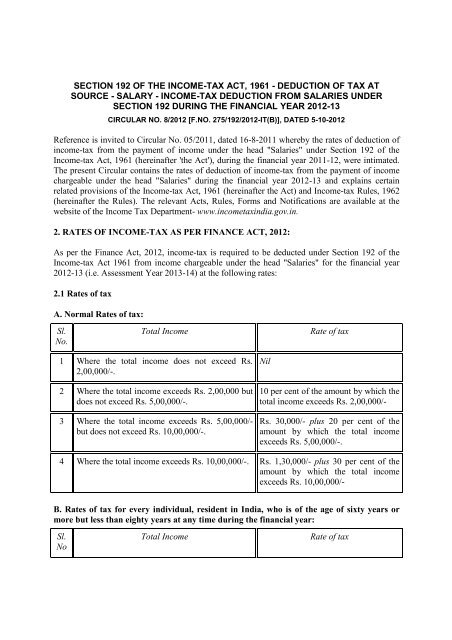

Income tax Deduction From Salaries Under Section

Standard Deduction 2020 Self Employed Standard Deduction 2021

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

House Rent Receipt India

What Is Section 24 Of Income Tax Act Save More Worry Less

What Is Section 24 Of Income Tax Act Save More Worry Less

Section 10 Of Income Tax Act Deductions And Allowances

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

Income Tax Deductions For The FY 2019 20 ComparePolicy

House Rent Deduction In Income Tax Section India - A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA