House Rent Income Tax Rebate Web 10 janv 2021 nbsp 0183 32 Moreover the maximum deduction that can be claimed in a year is Rs 60 000 and Rs 5 000 per month This 10 deduction is not based on the period for which you occupy the rented premises Hence

Web 22 sept 2022 nbsp 0183 32 HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of Web 13 juin 2020 nbsp 0183 32 Section 24 of income tax act says that if any house is acquired constructed using borrowed capital Then interest paid on such borrowed capital is eligible for deduction amp the amount of deduction is as follows Now there are 2 situations when it comes to house property income Situation 1 Your house property is self occupied

House Rent Income Tax Rebate

House Rent Income Tax Rebate

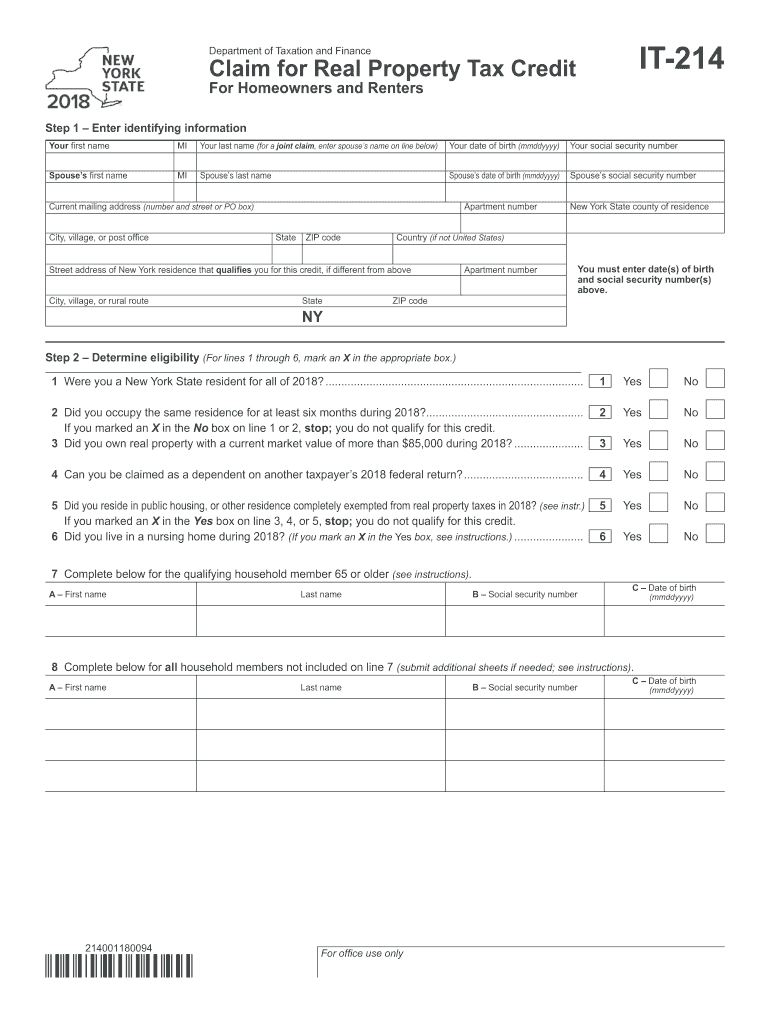

https://www.pdffiller.com/preview/585/571/585571881/large.png

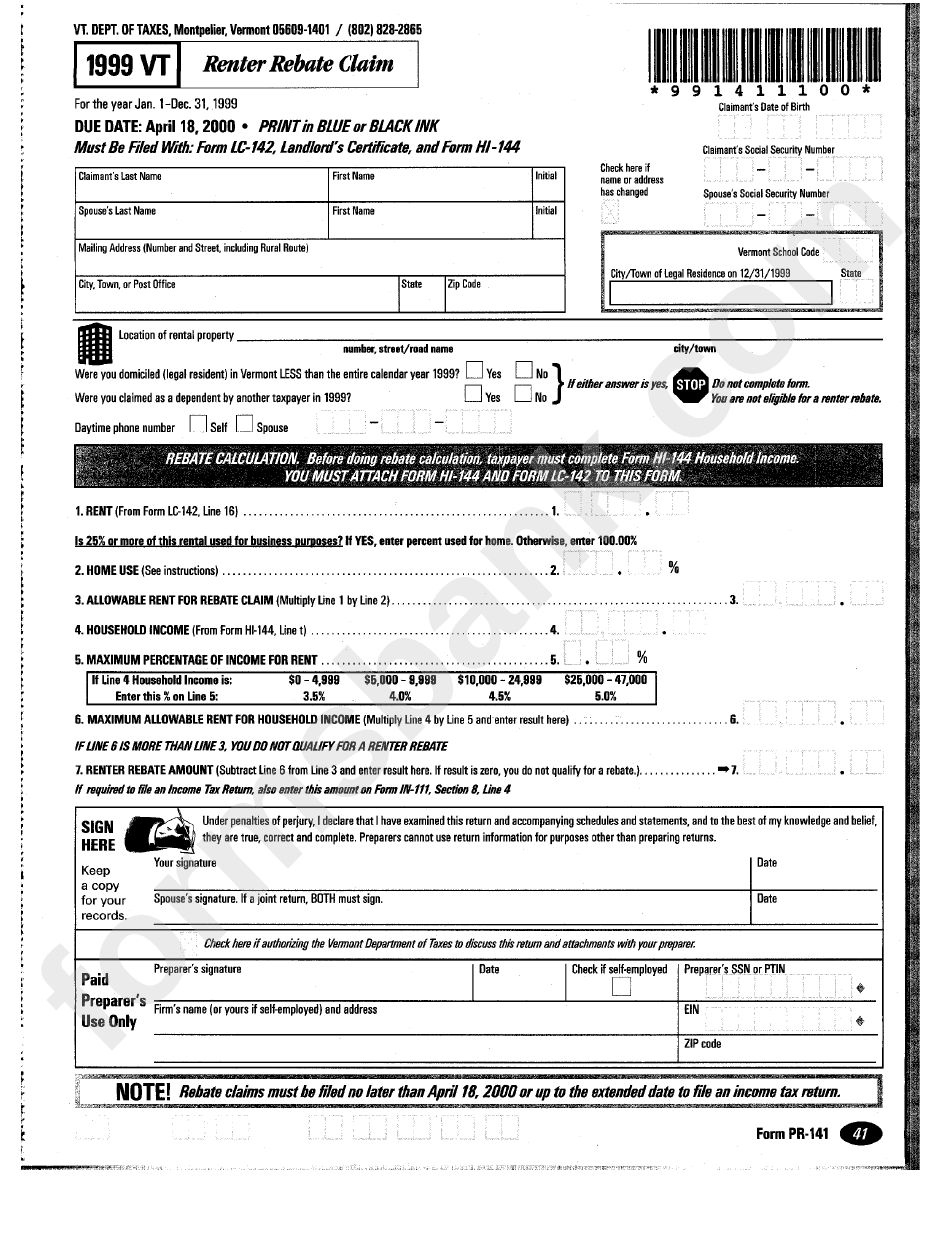

Renters Rebate Sample Form Free Download

http://www.formsbirds.com/formimg/rent-rebate-form/218/renters-rebate-sample-form-l2.png

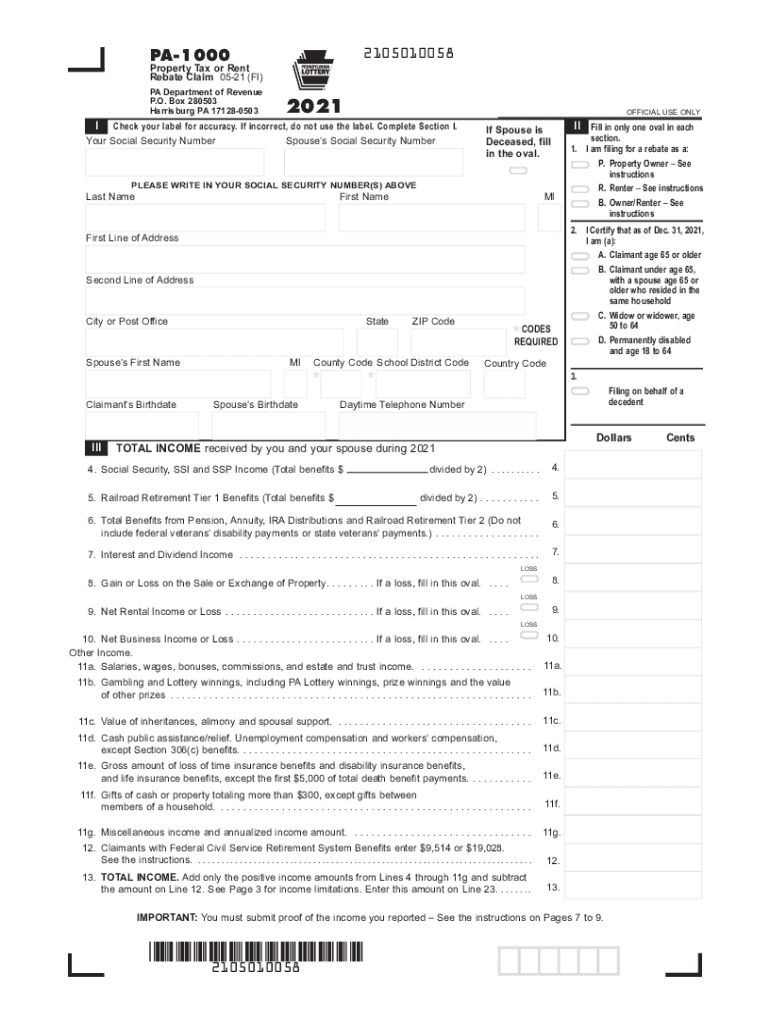

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Web 9 f 233 vr 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 INR 1 30 000 will be exempt from the total House Rent Allowance received Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer

Web Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance Taxable House Rent Allowance Advisory Information relates to the law prevailing in the year of publication as indicated Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the

Download House Rent Income Tax Rebate

More picture related to House Rent Income Tax Rebate

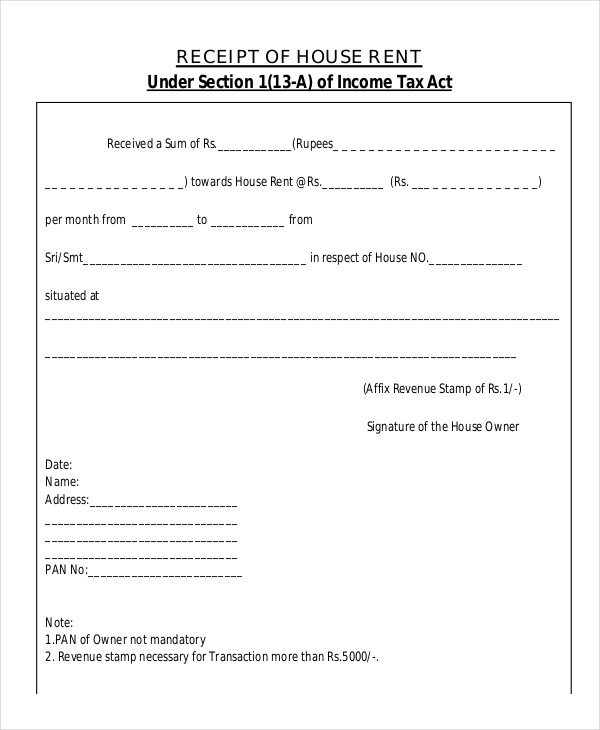

Rent Receipt 26 Free Word PDF Documents Download

https://images.template.net/wp-content/uploads/2016/11/18132953/House-Rent-Receipt-for-Income-Tax.jpg

Rent Rebate Tax Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021.jpg

It 214 Rental Rebate Forms Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/468/970/468970496/large.png

Web Salaried individuals who live in a rented house can claim this exemption and bring down their taxes HRA can be fully or partially exempt from tax Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable Web Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid amount After entering all the information the calculator will show you

Web For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of INR 12 000 month and the actual rent paid is Rs 15 000 month the Web 6 janv 2018 nbsp 0183 32 House rent allowance HRA tax benefit is available only to salaried individuals who are planning to opt for old tax regime Further this tax benefit can be claimed only if they have the HRA component as part of their salary structure and is staying in a rented accommodation Self employed professionals cannot avail this deduction

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Form Pr 141 Renter Rebate Claim Vermont Department Of Taxes 1999

https://data.formsbank.com/pdf_docs_html/277/2773/277317/page_1_bg.png

https://housing.com/news/income-tax-benefit…

Web 10 janv 2021 nbsp 0183 32 Moreover the maximum deduction that can be claimed in a year is Rs 60 000 and Rs 5 000 per month This 10 deduction is not based on the period for which you occupy the rented premises Hence

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of

Free Printable Menards Coupons 2020 Semashow

Renters Printable Rebate Form

FREE 44 Receipt Forms In PDF

House Rent Receipt Form For Income Tax Returns MANNAMweb

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

Rent Receipt Format India Pdf Download

Property Tax Rent Rebate Program Maximizing Savings And Support For

FREE 7 Sample Rent Receipt Form Templates In PDF

House Rent Income Tax Rebate - Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer