House Rent Tax Rebate Section Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is an exemption in the Income Tax Act that can help lower taxes partially or wholly This allowance is Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in

House Rent Tax Rebate Section

House Rent Tax Rebate Section

https://images.sampletemplates.com/wp-content/uploads/2016/04/25123356/Rent-Rebate-Form-Download.jpg

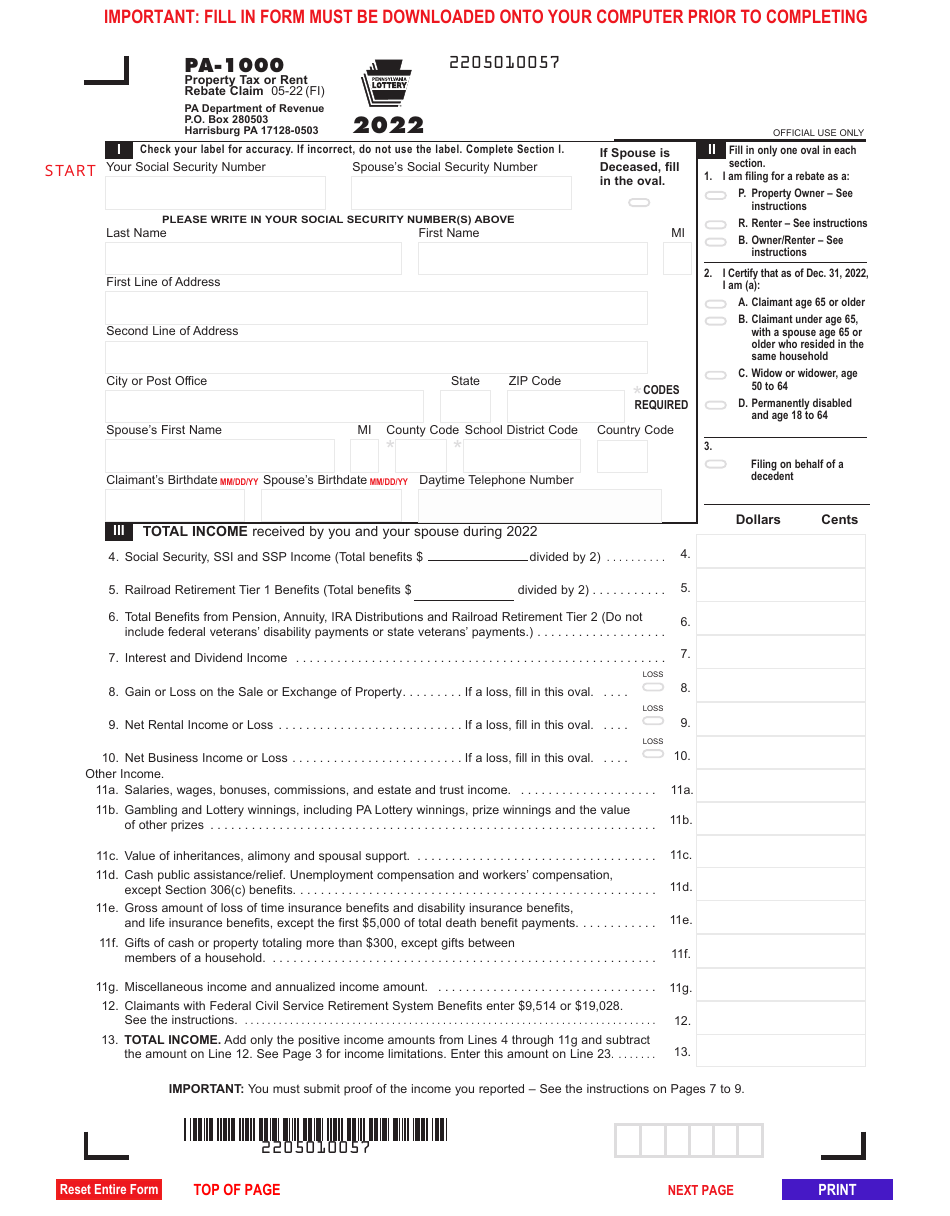

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

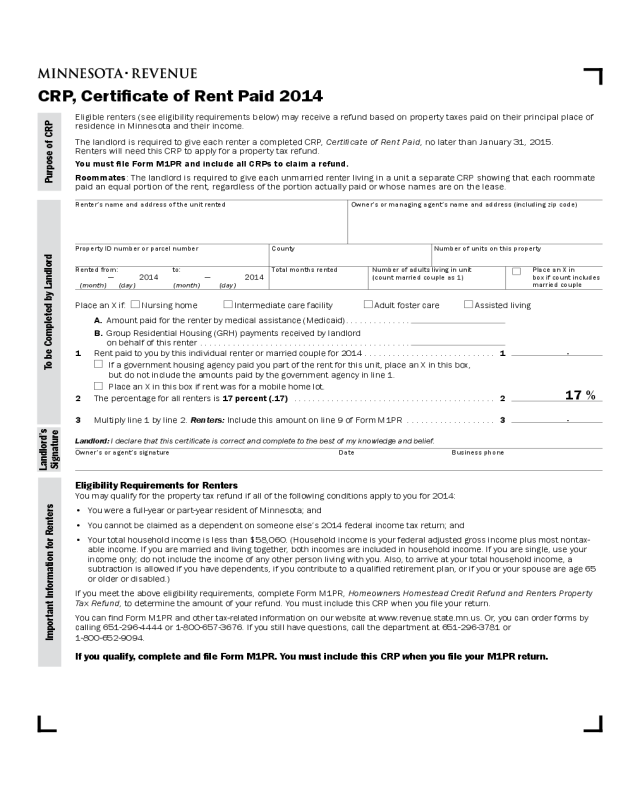

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Web 13 juin 2020 nbsp 0183 32 Section 24 of income tax act says that if any house is acquired constructed using borrowed capital Then interest paid on such borrowed capital is eligible for

Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee Web You are entitled to tax exemption under Section 10 13A of the Income Tax Act with respect to the HRA received by you subject to certain limits and conditions The first condition is that you should actually be paying

Download House Rent Tax Rebate Section

More picture related to House Rent Tax Rebate Section

Rent Rebate Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/47/686/47686220/large.png

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

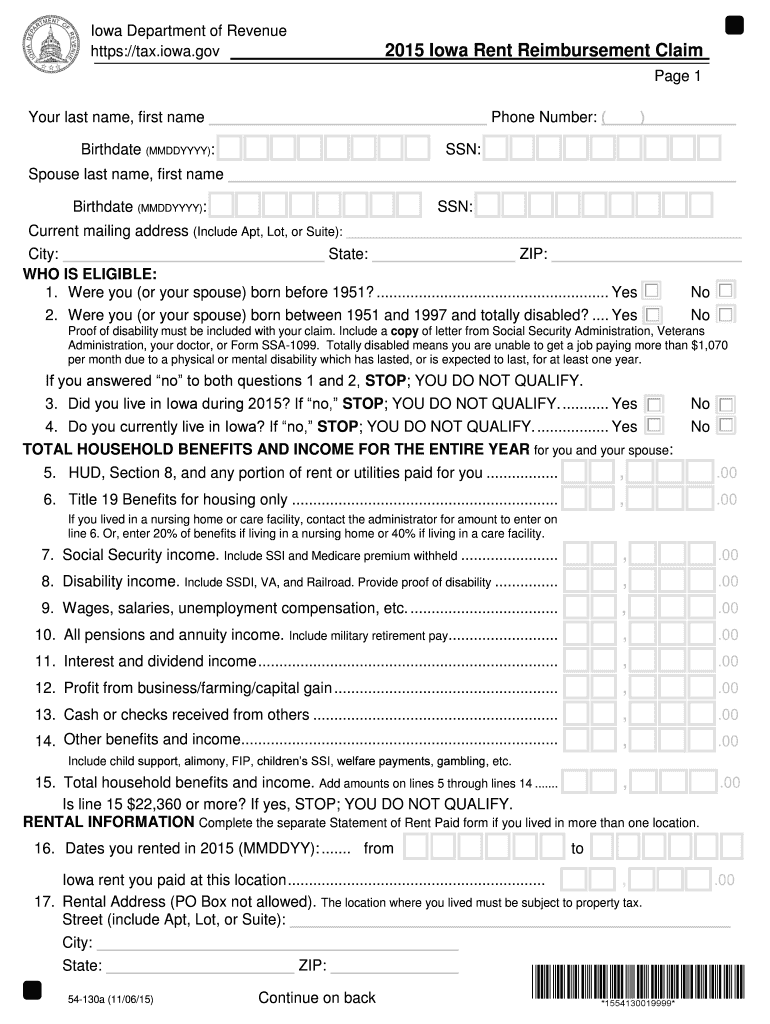

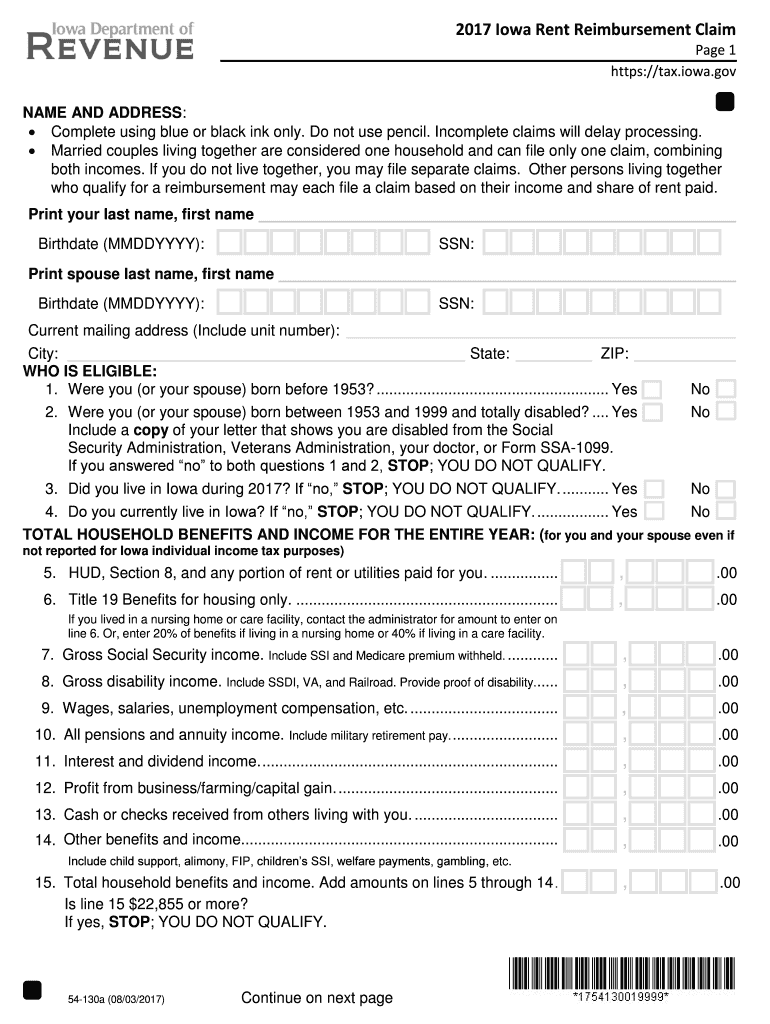

Iowa Rent Rebate 2015 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/6/964/6964546/large.png

Web 27 f 233 vr 2023 nbsp 0183 32 If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted Web 30 juil 2022 nbsp 0183 32 Actual house rent allowance received or Rent paid less 10 of the basic salary or 40 of basic salary 50 for rented accommodation in

Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer Web 26 janv 2022 nbsp 0183 32 Under Section 80GG individuals can claim deduction in lieu of rent paid if they are not receiving HRA However the maximum limit allowed to claim such

Mo Crp Form 2018 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/536/237/536237227/large.png

Rent Reimbursement Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/430/911/430911015/large.png

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this

https://cleartax.in/s/hra-house-rent-allowance

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is an exemption in the Income Tax Act that can help lower taxes partially or wholly This allowance is

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Mo Crp Form 2018 Fill Out Sign Online DocHub

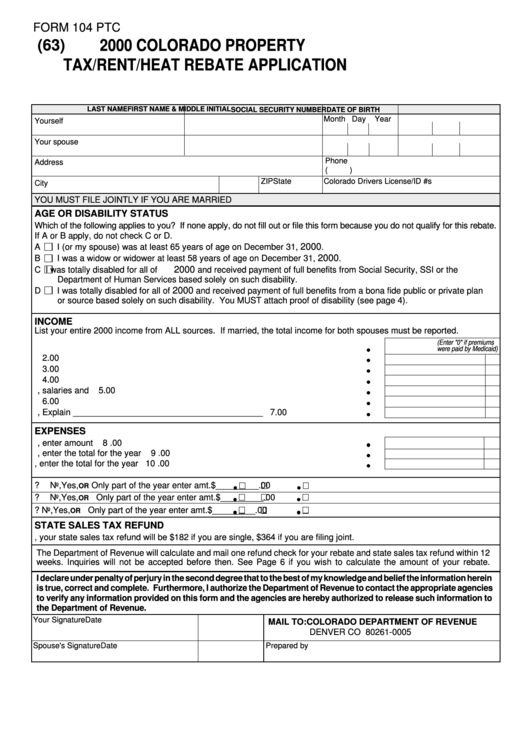

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

Rent Rebate Tax Form Missouri Printable Rebate Form

2019 Rent Rebate Form Missouri Justgoing 2020

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Mass Save Rebate Forms 2022 Mass Save Rebate

Microfinance Loan Application Form

House Rent Tax Rebate Section - Web HRA exemption in income tax for salaried individuals The tax exemption that salaried individuals can claim on the HRA that they receive from their employers is laid down