House Tax Credit Nj The Stay NJ Task Force is developing recommendations for a new property tax relief program for senior citizens and low income residents The program is expected to be implemented in 2026 and provide 50 of the property tax bill for homeowners

ANCHOR is a program that offers property tax relief to New Jersey residents who own or rent property in New Jersey as their main home and meet certain income limits Learn how to apply check your benefit status and avoid scams on the official website StayNJ is a new program that offers tax credits worth 50 of property tax bills for seniors with incomes up to 500 000 The credits will be available from January 2026 and seniors can also

House Tax Credit Nj

House Tax Credit Nj

https://vebcpa.com/wp-content/uploads/2022/11/11-2022_njeitc_800.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Earned Income Tax Credit EITC Get My Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

Under the new program known as ANCHOR homeowners making up to 150 000 will receive 1 500 rebates on their property tax bills and those making 150 000 to 250 000 will receive 1 000 Stay NJ in conjunction with ANCHOR and Senior Freeze is designed to cut property taxes by up to 50 capped at 6 500 for residents 65 and older in New Jersey who earn less than 500 000 a year

Lawmakers in both chambers on Monday approved a series of technical fixes meant to prepare for the implementation of Stay NJ a tax credit program that promises to cut property tax bills in half for New Jerseyans 65 and older The bill passed the Senate in a unanimous vote and cleared the Assembly with a single no vote from Assemblyman Brian Learn how to apply for the new ANCHOR program which replaces the Homestead Rebate and helps homeowners and renters save on property taxes Find out who qualifies how much you can get and

Download House Tax Credit Nj

More picture related to House Tax Credit Nj

Child Tax Credit 94 3 The Point

https://townsquare.media/site/385/files/2022/03/attachment-RS34914_GettyImages-163352496.jpg

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

2017 Tax Reform Estate Tax Rate Changes

https://cdn2.hubspot.net/hubfs/3912314/Imported_Blog_Media/EstateTeax-2.jpeg

The deadline to apply for New Jersey s ANCHOR property tax relief is quickly approaching Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will receive a tax credit of 1 000 Find out if you are eligible to claim a property tax deduction or credit for Tax Year 2023 based on your income and residency See the tax return instructions and the Property Tax Credit Application for more details

ANCHOR is a proposed expansion of the Homestead Benefit program that would provide property tax credits to homeowners and renters with lower and middle incomes Learn how ANCHOR would affect different groups how it compares to existing relief programs and how it affects wealth inequality Learn about the state funded programs that aim to ease local property tax bills for New Jersey residents including the new Stay NJ program that promises to cut taxes in half for seniors in 2026 Find out who qualifies when to apply and what changes have been made to eligibility and benefits

Minnesota Property Tax Refunds MNbump

https://mnbump.com/wp-content/uploads/2022/04/Housing-Tax-Credit.jpg

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://www.nj.gov › treasury › staynj

The Stay NJ Task Force is developing recommendations for a new property tax relief program for senior citizens and low income residents The program is expected to be implemented in 2026 and provide 50 of the property tax bill for homeowners

https://nj.gov › treasury › taxation › anchor › index.shtml

ANCHOR is a program that offers property tax relief to New Jersey residents who own or rent property in New Jersey as their main home and meet certain income limits Learn how to apply check your benefit status and avoid scams on the official website

Minnesota Property Tax Refunds MNbump

Latest Version Of House Tax Bill Meets Budget Requirements

New Tax Credit To Fully Offset The Cost For Small Businesses Who

Determining If You Need A Property Tax Loan Johnson Starr

Contact Us Property Tax Associates Inc

Contact Us Property Tax Associates Inc

6 Ways The Senate And House Disagree Over Tax Reform Money Talks News

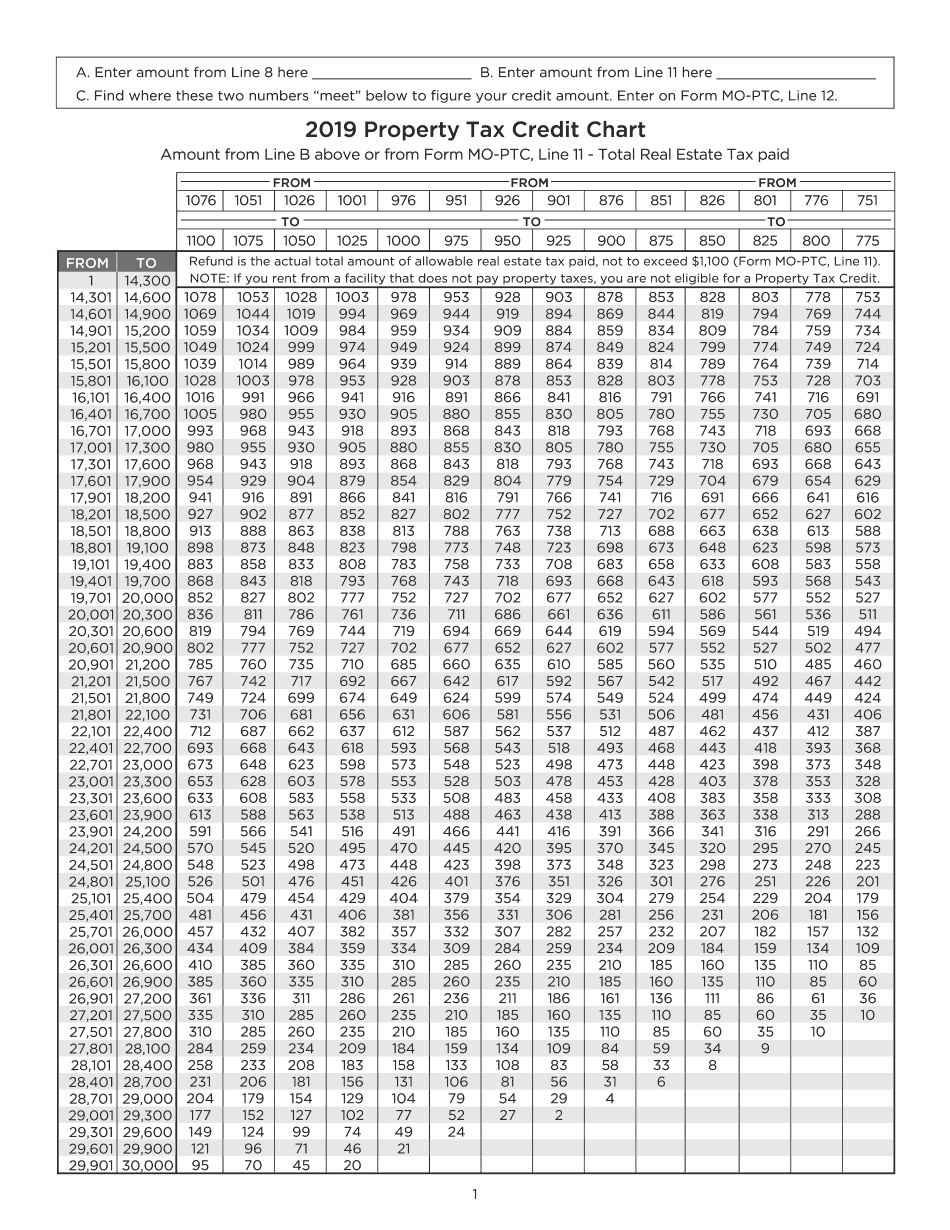

Create Fillable Property Tax Credit Chart Form With Us Fastly Easyly

Individual Tax WEC CPA Blog

House Tax Credit Nj - The ANCHOR program provides up to 1 750 in property tax relief for eligible homeowners and renters in New Jersey Learn about the eligibility criteria filing deadline payment process and