House Tax Rebate Under Section Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

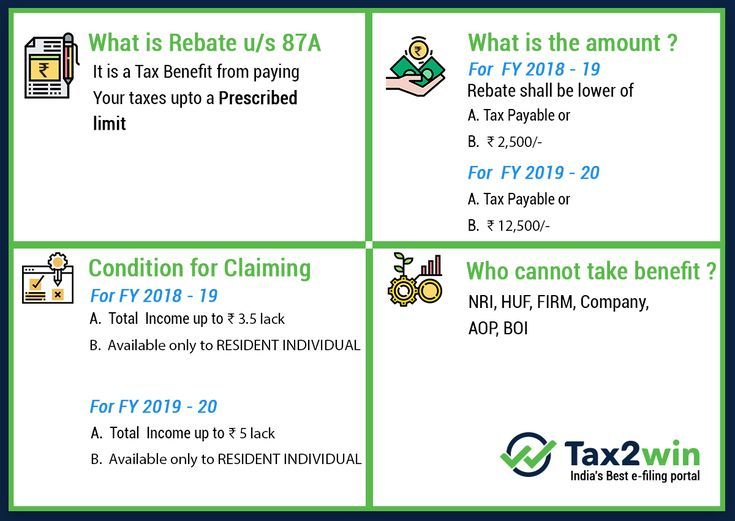

Web 24 mars 2017 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

House Tax Rebate Under Section

House Tax Rebate Under Section

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://www.propertyrebate.net/wp-content/uploads/2023/05/section-87a-tax-rebate-under-section-87a-rebates-financial.jpg

Web 9 f 233 vr 2018 nbsp 0183 32 You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000 The total amount eligible for a tax Web 31 mai 2022 nbsp 0183 32 First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there are a few conditions to be aware of To

Web If a house owner fails to meet any of the below mentioned conditions for the Rs 2 Lakhs tax rebate then their income tax rebate on the home loan interest cannot be more than Web 7 mars 2023 nbsp 0183 32 Deductions Under Section 24 There are two types of deductions for the property owners who are liable to pay income tax under Section 24 as explained below Standard Deduction The house

Download House Tax Rebate Under Section

More picture related to House Tax Rebate Under Section

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/TvlWdoFkYts/maxresdefault.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Tax Rebate Under Section 87A All You Need To Know YouTube

https://i.ytimg.com/vi/JM0j9VqDYfI/maxresdefault.jpg

Web 28 mai 2020 nbsp 0183 32 Under Section 80C a homebuyer not only claims rebate on his home loan principal but also on stamp duty registration charge and other additional expense However the overall deduction limit stands at Web 10 mars 2021 nbsp 0183 32 How can I claim tax benefits under section 80EEA Individual must satisfy certain conditions to be eligible to claim benefit under section 80EEA These include a The home loan must be taken

Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Budget 2023 Summary Of Direct Tax Proposals

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

https://cleartax.in/s/80c-80-deductions

Web 24 mars 2017 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Budget 2023 Summary Of Direct Tax Proposals

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

House Tax Rebate Under Section - Web If a house owner fails to meet any of the below mentioned conditions for the Rs 2 Lakhs tax rebate then their income tax rebate on the home loan interest cannot be more than