Housin Loan Pricipal Tax Rebate India Web 12 juin 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration Web 31 mai 2022 nbsp 0183 32 Section 80EE First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there are a few conditions to be

Housin Loan Pricipal Tax Rebate India

Housin Loan Pricipal Tax Rebate India

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

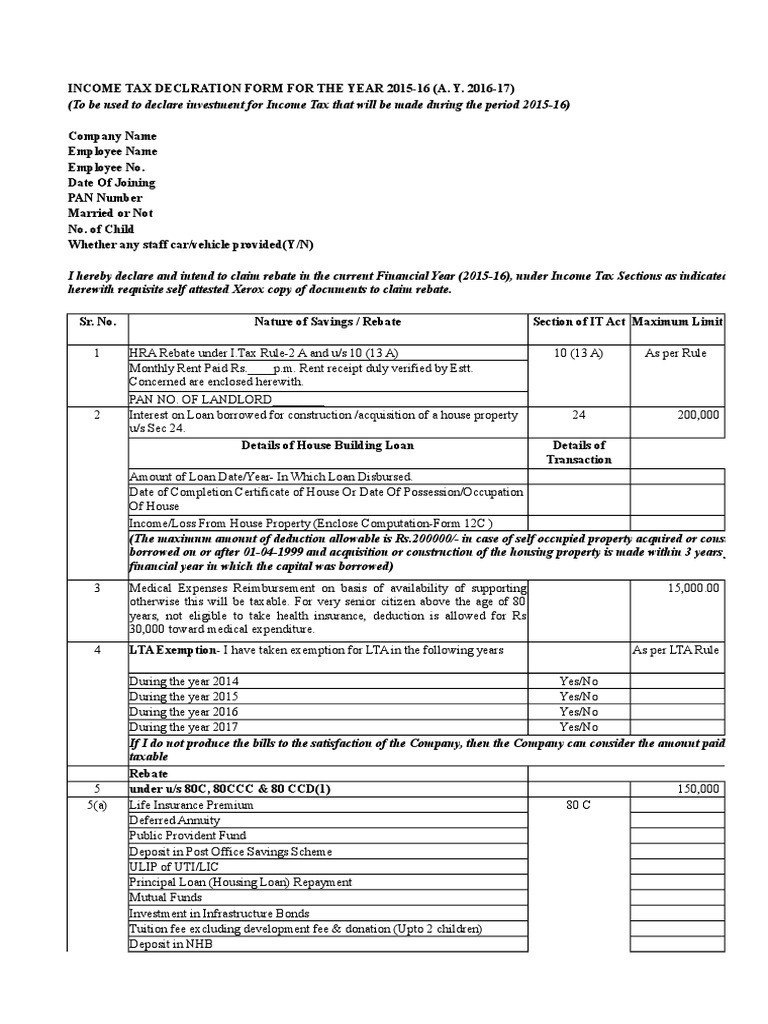

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

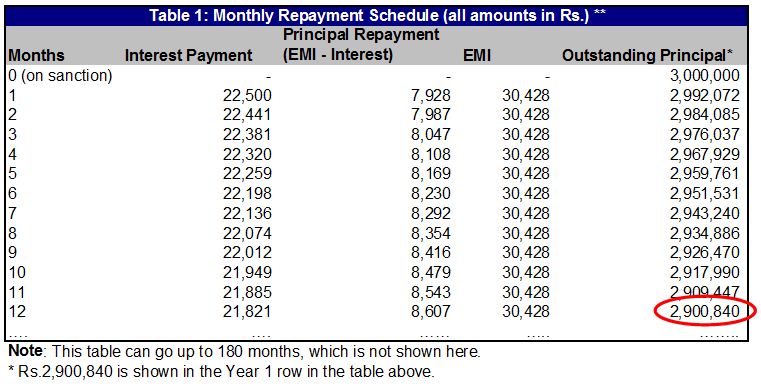

Home Loan Repayment Schedule

https://d16eikkurngyvx.cloudfront.net/wp-content/uploads/2013/08/Home-loan_11.jpg

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Web 24 ao 251 t 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

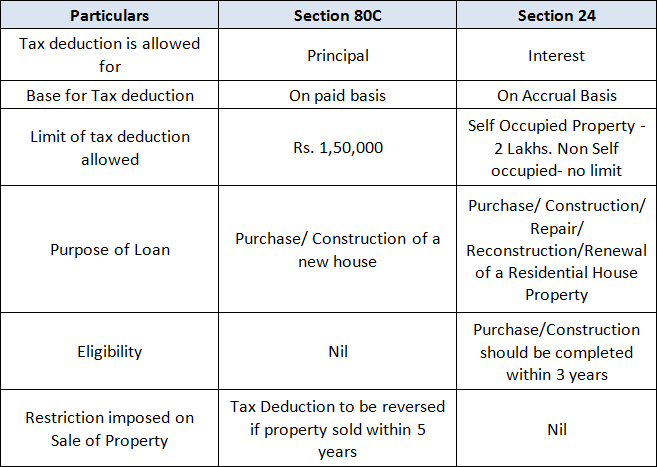

Web An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from Web Section 80C Tax benefit on Home Loan Principal Amount The amount paid as Repayment of Principal Amount of Home Loan by an Individual HUF is allowed as tax

Download Housin Loan Pricipal Tax Rebate India

More picture related to Housin Loan Pricipal Tax Rebate India

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Web 31 mars 2019 nbsp 0183 32 Apply Now Principal Repayment of Home Loan Section 80C In any financial year you can also avail of a deduction on the principal portion of your home loan EMIs This deduction is available under Web What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2

Web 20 mars 2023 nbsp 0183 32 Fortunately you can still avail of tax benefits on home loans under section 80EE of the Income Tax Act This section offers additional tax benefits to first time Web 7 janv 2023 nbsp 0183 32 Homebuyers can also claim income tax deductions on the principal repayment of their home loan under Section 80C of the Income Tax Act The maximum

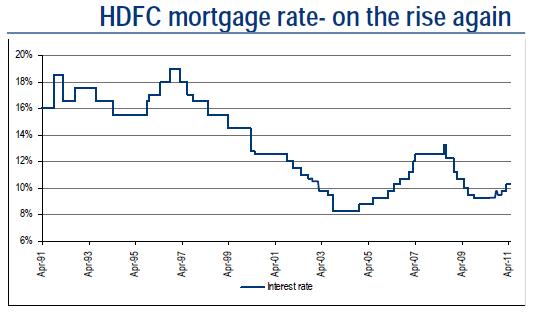

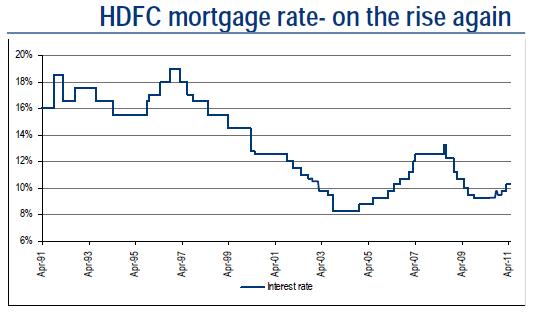

Reliance SEZ India Real Estate

http://4.bp.blogspot.com/-H_wekTPAzzQ/TcuE2GSyHyI/AAAAAAAABuU/nO35Py-VQiI/s1600/historical_mortgage_rate_india.jpg

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://www.bajajfinserv.in/tax-benefits-on-home-loan

Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration

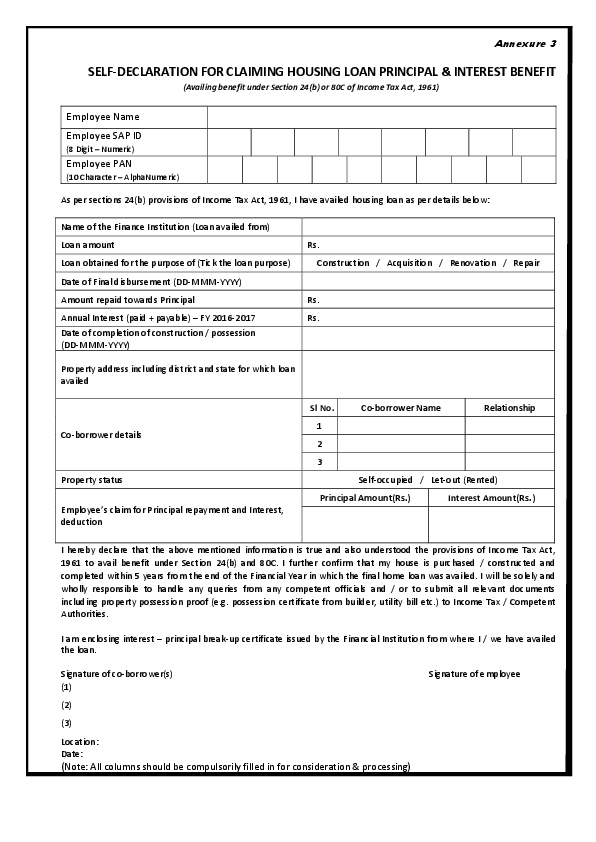

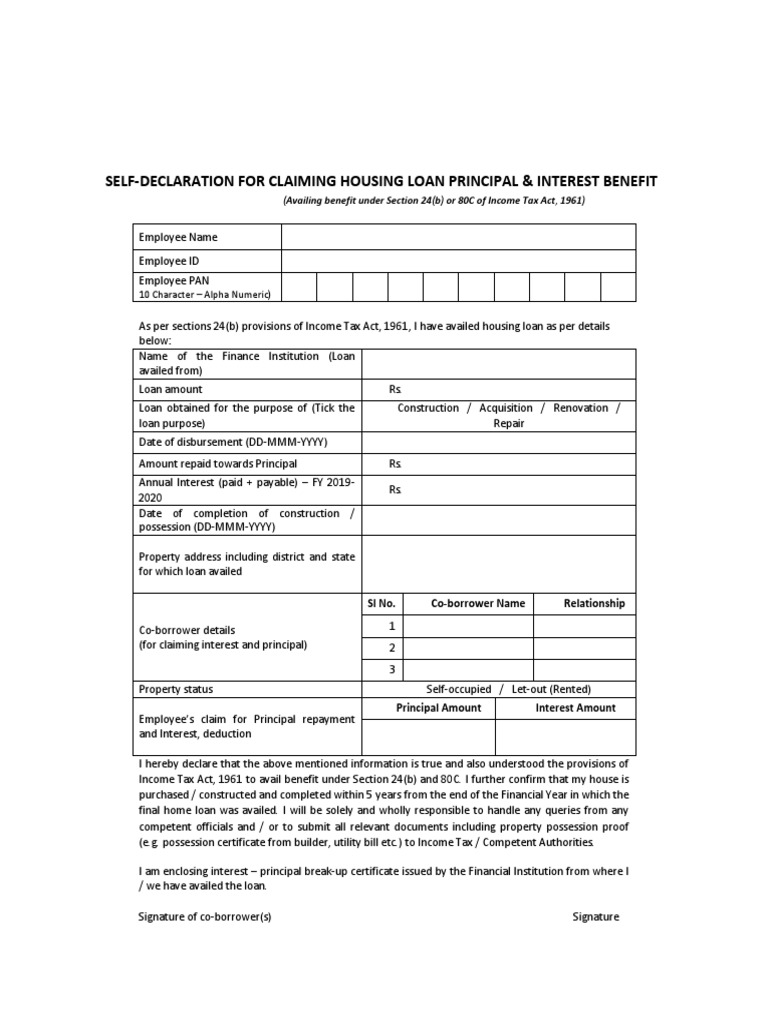

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

Reliance SEZ India Real Estate

Income Tax Benefits On Home Loan Loanfasttrack

SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST BENEFIT

Property Tax Rebate Application Printable Pdf Download

Home Loan Tax Benefit Calculator FrankiSoumya

Home Loan Tax Benefit Calculator FrankiSoumya

FORM 12C HOUSING LOAN DOWNLOAD

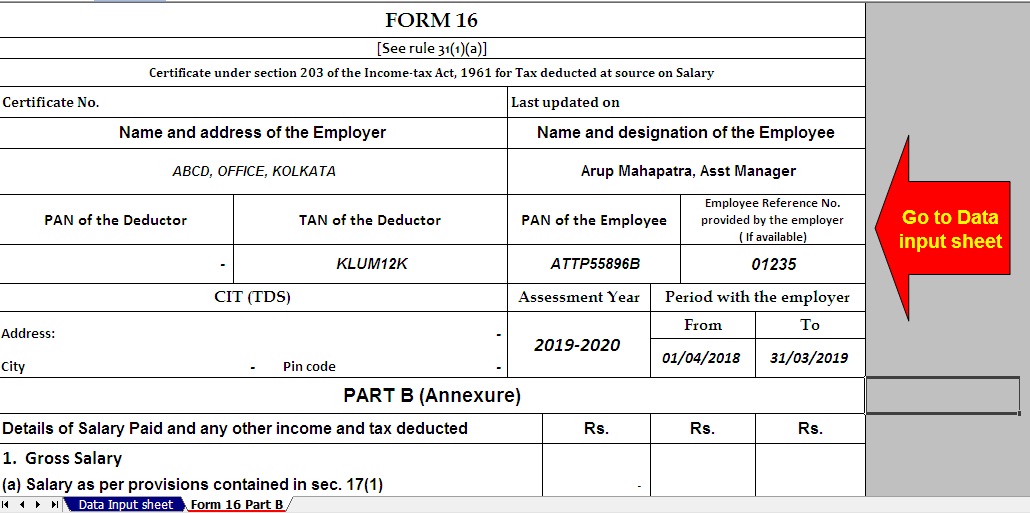

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

How To Get A Second Home Loan For Rental Income

Housin Loan Pricipal Tax Rebate India - Web 5 avr 2022 nbsp 0183 32 Tax Benefits on Housing Loans for Home Buyers Updated on 05 Apr 2022 06 47 PM Know all about the tax saving benefits for home buyers with amp without home