Housing Loan Claim In Income Tax Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be You can claim a deduction of up to 1 50 000 on the principal repayment In our example the principal component is 50 000 which is well within the limit so you

Housing Loan Claim In Income Tax

Housing Loan Claim In Income Tax

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

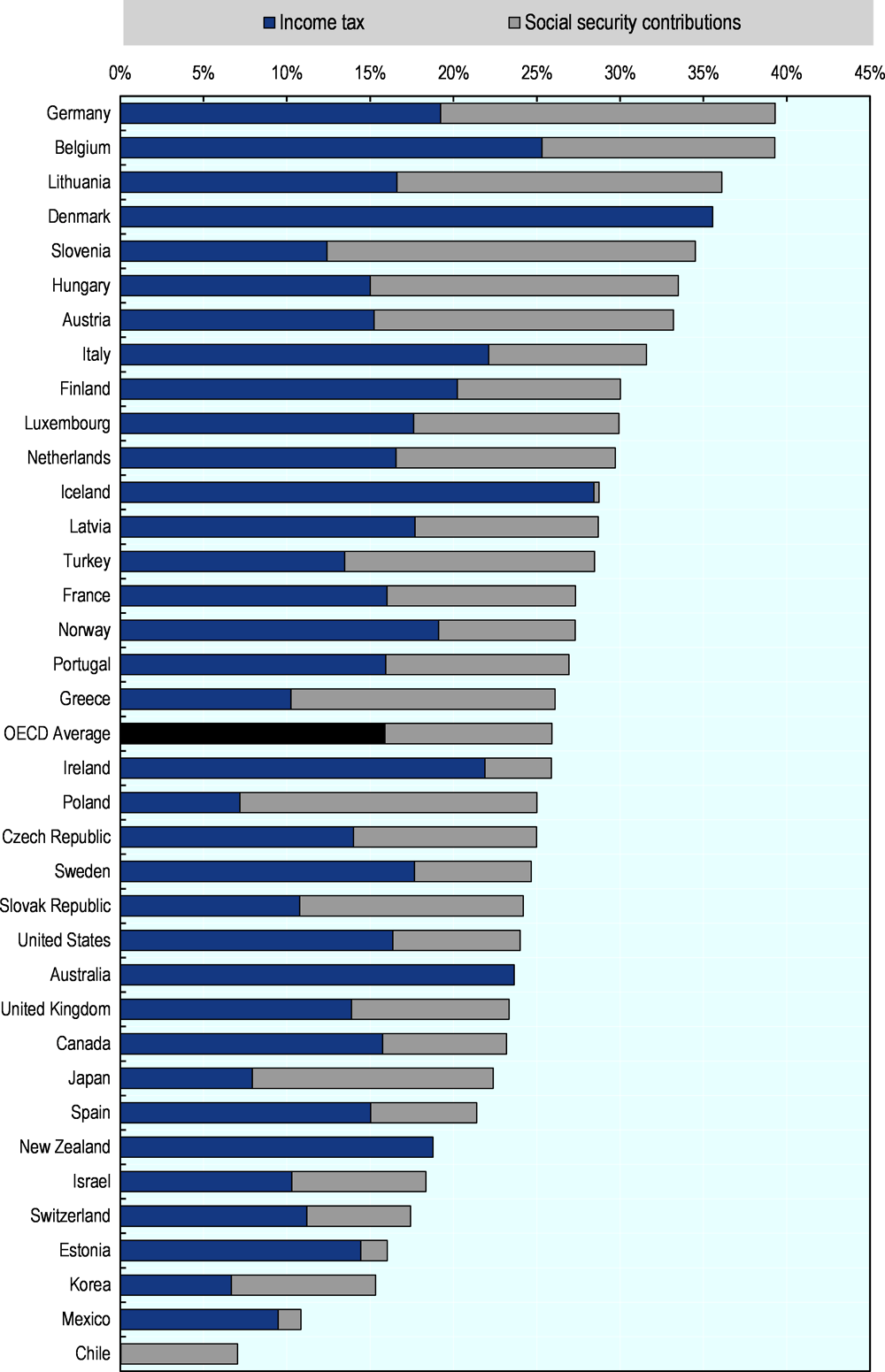

Overview Taxing Wages 2020 OECD ILibrary

https://www.oecd-ilibrary.org/sites/bdfe626d-en/images/images/011_Part_I_Chapter-1/media/image3.png

Major Changes In Income Tax Income Tax Slabs Tax Rates Calculation

https://i.ytimg.com/vi/rRGs7tKMgUM/maxresdefault.jpg

INCOME TAX HOUSE PROPERTY 4 STEPS TO CLAIM INTEREST ON HOME LOAN DEDUCTION 4 Steps to Claim Interest on Home Loan Deduction When Home Loan interest over Rs 2 lakh can be claimed as Income Tax deduction Section 24B tax deduction on home loan interest over Rs 2 lakh Up to Rs 2

Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration Income Tax Exemption on Home Loan These refer to the tax deductions you can claim on the principal up to INR 1 5 lakhs per annum and interest payments

Download Housing Loan Claim In Income Tax

More picture related to Housing Loan Claim In Income Tax

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Document In This Notes About Undisclosed Source Of Income In Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/df429db1b5f472adb16157417bc4c332/thumb_1200_1553.png

How To Fill Housing Loan Interest And Principal In Income Tax Return

https://i.ytimg.com/vi/0xIFd-jhyEU/maxresdefault.jpg

How To Claim Tax Benefit On Home Loan In Income Tax Return Curated By Namit Singh Sengar News18 Last Updated April 18 2023 05 50 IST New Yes it is possible to claim Home Loan tax benefits before possession However these tax rebates are only applicable to payments made toward principal repayment Suppose you

For a self occupied property Each co owner who is also a co applicant in the loan can claim a maximum deduction of Rs 2 00 000 for interest on the home loan The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

https://i.ytimg.com/vi/wqhdYtP4JVc/maxresdefault.jpg

https:// cleartax.in /s/home-loan-tax-benefits

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

https:// housing.com /news/home-loans-guide-claiming-tax-benefits

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Benefits On Housing Loan In India

Solutions To Practical Problems In Income Tax Sahitya Bhawan

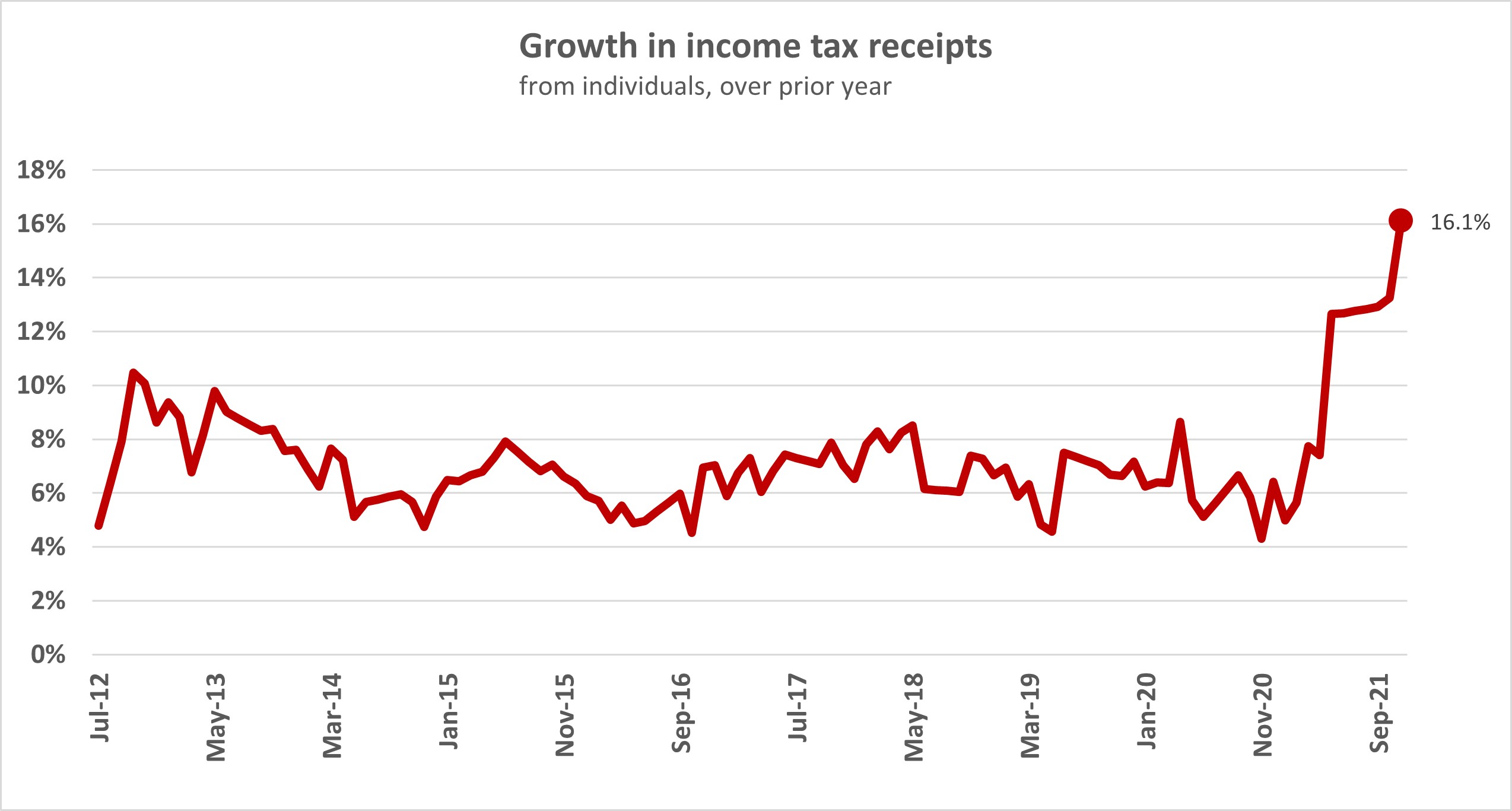

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Housing Loan Claim Form By Manu Gupta

Can I Claim Both Home Loan And HRA Tax Benefits

Can I Claim Both Home Loan And HRA Tax Benefits

Income Tax Preparation

Income Tax India Official On LinkedIn Direct Tax Collections

Strategic Approaches Unleashing The Potential For Tax Savings In

Housing Loan Claim In Income Tax - Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration