Housing Loan Exemption In Income Tax Ay 2022 23 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special Updated on Mar 14th 2024 7 min read Section 80EE allows benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Housing Loan Exemption In Income Tax Ay 2022 23

Housing Loan Exemption In Income Tax Ay 2022 23

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/05/Income-tax-slabs-for-FY-2022-23-AY-2023-24.png

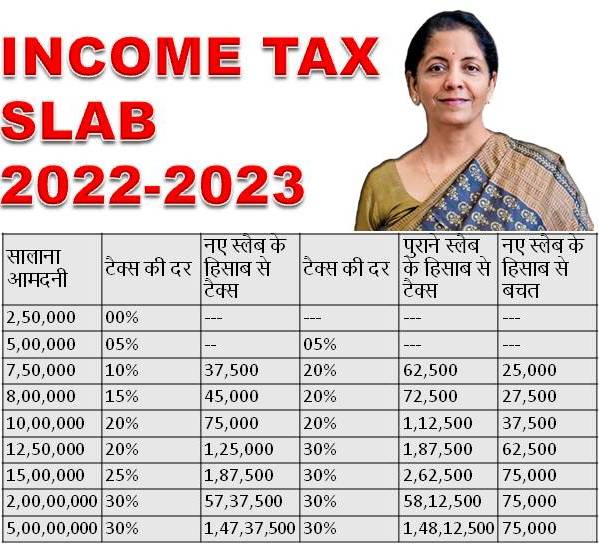

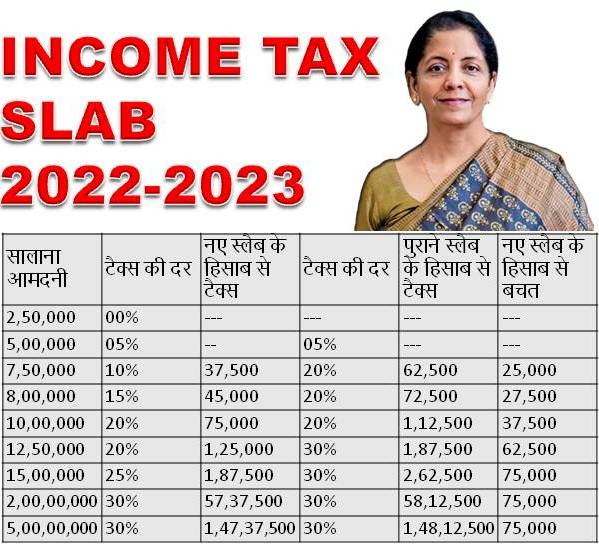

Income Tax Slab For AY 2022 23

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Interest 80EEA 1 5 Lakh The stamp value of the property is under INR 45 lakh Taxpayers not eligible to claim deduction under section 80EE However in the new tax regime deduction is not allowed under sections 24 b 80C 80EE and 80EEA Published by CA PRADEEP KUMAWAT Get to know the tax benefits on home loan interest for the From April 2022 new income tax rules apply First time home buyers will not be eligible to receive tax benefits under Section 80 EEA on new housing loans sanctioned in FY23 as the special benefits announced in Budget 2019 expired on March 31 2022

The below table summarizes the tax benefits which can be explored by the borrower under Income tax Act 1961 the Act Particular Tax Benefit Maximum Benefit Amount Interest on home loan Deduction under section 24 b of the Act Self occupied property up to Rs 2 00 000 Let out property Actual interest paid 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan tax benefits under various sections of the Income Tax Act including Section 24 b 80C 80EE and 80EEA

Download Housing Loan Exemption In Income Tax Ay 2022 23

More picture related to Housing Loan Exemption In Income Tax Ay 2022 23

TDS Rate Chart For FY 2022 23 AY 2023 24 SimBizz

https://simbizz.in/wp-content/uploads/2022/06/simbizz.in-blog.png

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

INCOME TAX RETURN E FILING AY 2022 23 FY 2021 22 LATEST VERSON 2 0

https://i.ytimg.com/vi/cAuUm6bIJ4k/maxresdefault.jpg

If your home loan is disbursed in the next financial year but if you manage to take the sanction letter by 31st March 2022 you can still deduct the interest paid up to Rs 1 5 lakh in the coming financial year i e FY 2022 23 from your taxable income The benefit of this deduction will be available till the repayment of the loan continues 4 Tax benefits on solidarity housing loans 5 Tax benefits on buildings under construction Conclusion Download Automated Income Tax Preparation Excel Based Software All in One for the Government Non Government Private Employees for the F Y 2023 24 and A Y 2024 25 Features of this Excel Utility

Vipul Das A Home Loan is a financial source for your dream come true along with making a better deal for tax savers A home loan provides a number of benefits upon repayment through tax Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Income Tax Slab Rates For AY 2023 24

https://eadvisors.in/wp-content/uploads/2022/12/Income-tax-Slab-Rates-for-AY-2023-24.jpg

https:// cleartax.in /s/home-loan-tax-benefit

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only

https://www. livemint.com /money/personal-finance/...

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax 2022 23 Slab Bed Frames Ideas

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Housing Loan Exemption In Income Tax Ay 2022 23 - Tax benefits on Home Loan FY 2022 2023 Tax benefits on second home loan Tax benefits on joint home loan Eligibility Criteria to Claim Deduction under Section 80EEA What are the conditions to claim deduction u s 80EEA How is the Deduction Calculated Under Section 80EEA What is the difference between Section 80EEA