Housing Loan Interest Deduction Under Section If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per

Housing Loan Interest Deduction Under Section

Housing Loan Interest Deduction Under Section

https://www.taxontips.com/wp-content/uploads/2020/04/interest-on-housing-loan.jpg

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are receiving income from the house property then the amount that you are paying as interest on your Home Loan will be reduced from this income Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto 1 50 000 in section 80EEA provided specified conditions are fulfilled

By using Section 80EEA an individual is permitted to claim a deduction under Section 24B for the interest paid on home loans This section undertakes the general provisions associated with the deduction on home loan interest First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can individually claim Rs 3 50 lakhs per annum as

Download Housing Loan Interest Deduction Under Section

More picture related to Housing Loan Interest Deduction Under Section

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

https://life.futuregenerali.in/media/suwdjtal/tax-saving-on-interest-paid-on-house-loan.jpg

Section 24 Deduction Income From House Property

https://taxguru.in/wp-content/uploads/2021/05/Section-24-Deduction-–-Income-From-House-Property.jpg

For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024 Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest deduction of up to Rs

Individuals are eligible for income tax benefits under Section 80EE of Income Tax Act on the interest component of residential property loans obtained from any financial institution This section s primary goal is to make it possible for people to If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://taxguru.in/wp-content/uploads/2022/01/Conditions-to-claim-544x1536.jpg

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Claiming The Student Loan Interest Deduction

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Student Loan Interest Deduction What You Need To Know

Student Loan Interest Deduction What You Need To Know

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Home Loan Interest Home Loan Interest Deduction Under Which Section

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

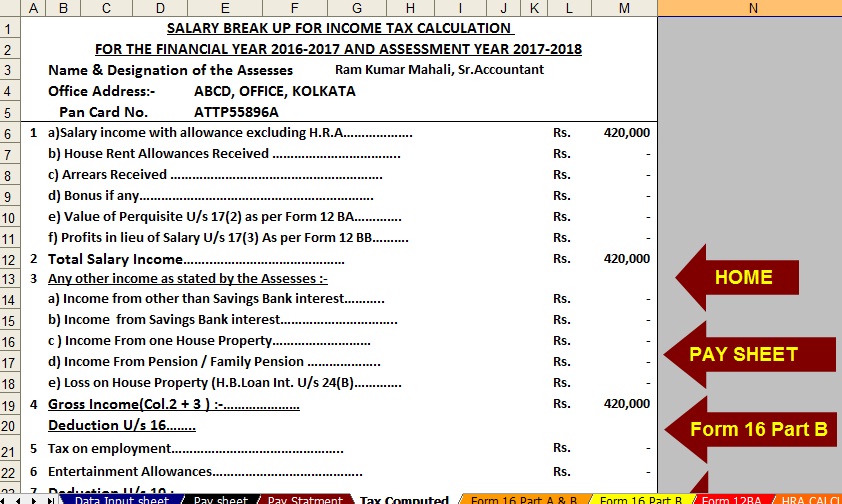

Housing Loan Interest Deduction Under Section - Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction