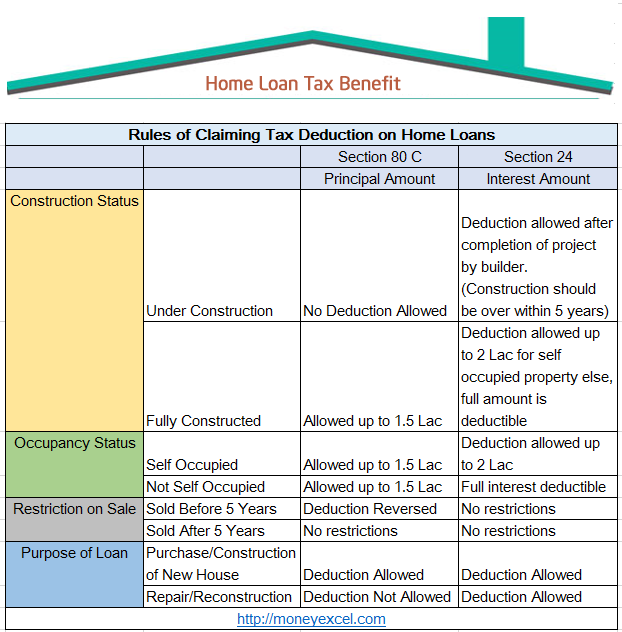

Housing Loan Principal Tax Rebate Web 28 mars 2017 nbsp 0183 32 Deduction on principal repayment The principal portion of the EMI paid for the year is allowed as a deduction under Section 80C The maximum amount that can be

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Web 9 f 233 vr 2018 nbsp 0183 32 The tax benefit on the repayment of the principal of a Home Loan is provided on a payment basis irrespective of the year in which

Housing Loan Principal Tax Rebate

Housing Loan Principal Tax Rebate

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

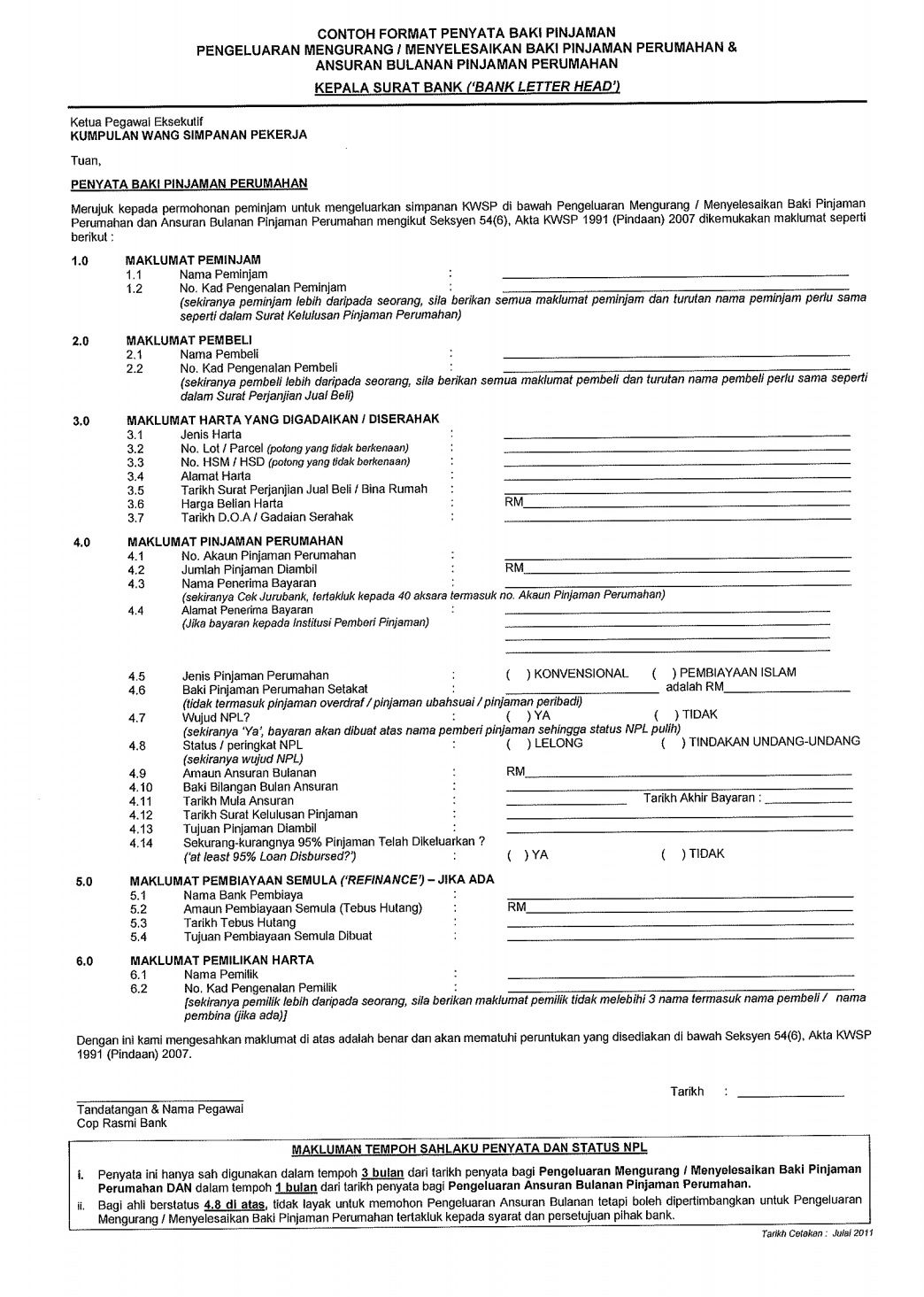

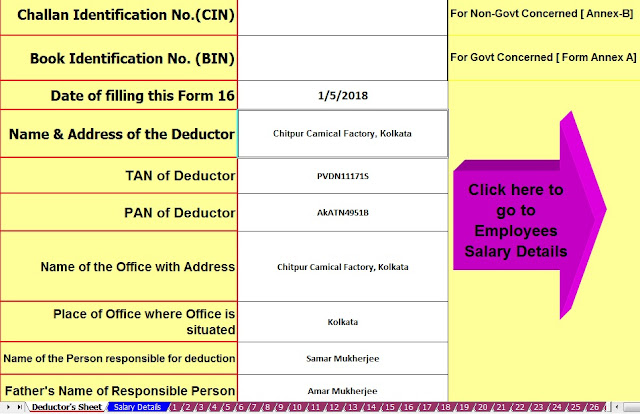

https://1.bp.blogspot.com/-JEikAPP-8mg/WhrmzgzoLYI/AAAAAAAAF6s/_b6piZ2zxgY7oNEK5gMAptqIz0TB5xV4QCLcBGAs/s640/100%2Bemployees%2BMaster%2Bof%2BForm%2B16%2BPart%2BA%2526B%2BPage%2B1.jpg

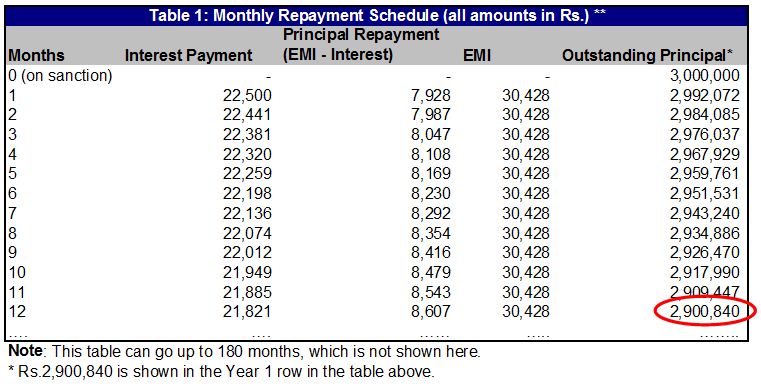

How EPF Can Reduce Your Home Loan Principal Or Monthly Installment Part

https://theblackbeltmillionaire.com/wp-content/uploads/2019/12/Sample-EPF-Housing-Loan-Withdrawal-Form.png?ssl=1&w=1330

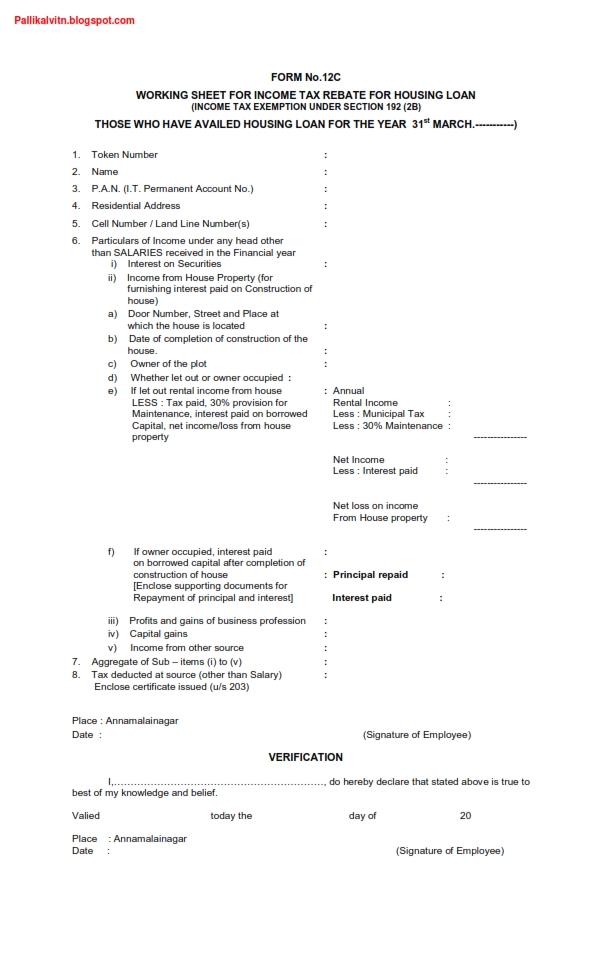

Web 31 mai 2022 nbsp 0183 32 Type of tax rebate Tax rebates on principal repayment Tax rebates on payable interest Additional home loan interest tax benefit for first time homebuyers 2013 15 and 2016 17 Additional tax benefits Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the possession of the second flat is as follows Financial Year Principle on

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Download Housing Loan Principal Tax Rebate

More picture related to Housing Loan Principal Tax Rebate

Home Loan Repayment Schedule

https://d16eikkurngyvx.cloudfront.net/wp-content/uploads/2013/08/Home-loan_11.jpg

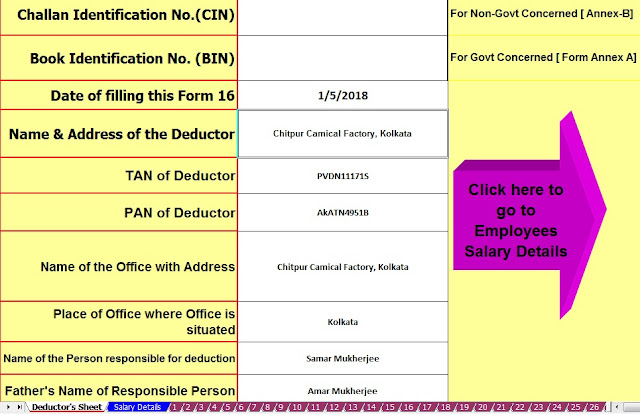

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest Web The tax laws not only allow you deduction for interest but also allow you rebate for repayment of the principal amount under certain circumstances As per provisions of Section 80C an individual and an HUF can claim up

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the Web 5 avr 2022 nbsp 0183 32 The amount paid as Repayment of Principal Amount of Home Loan and Amount paid as Stamp Duty amp Registration Fee is also allowed as tax deduction under

Mortgage Repayment Proportion In 2020 Mortgage Quotes Mortgage

https://i.pinimg.com/originals/82/a8/65/82a86524d2f840a3bb2848816e00713a.jpg

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 Deduction on principal repayment The principal portion of the EMI paid for the year is allowed as a deduction under Section 80C The maximum amount that can be

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

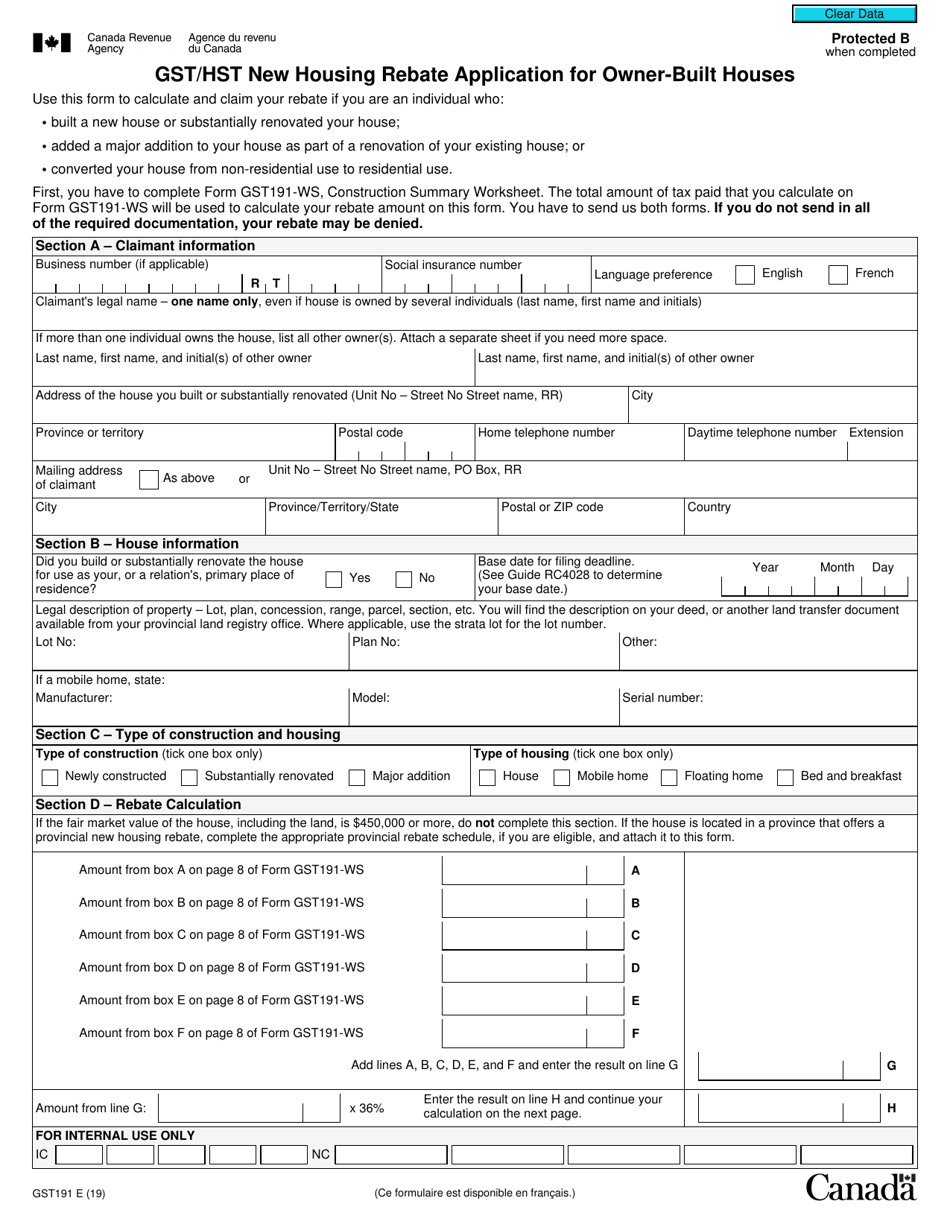

Gst191 Fillable Form Printable Forms Free Online

Mortgage Repayment Proportion In 2020 Mortgage Quotes Mortgage

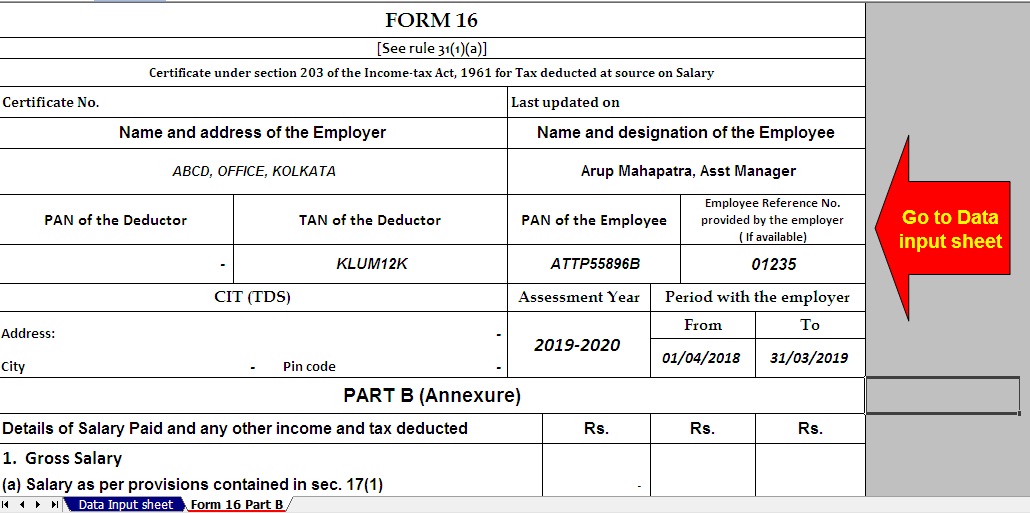

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST BENEFIT

Home Loan Tax Benefit Calculator FrankiSoumya

Home Loan Tax Benefit Calculator FrankiSoumya

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

How To Calculate Your Home Loan Payment For 2023 Funaya Park

FREE 8 Loan Receipt Templates Examples In MS Word PDF

Housing Loan Principal Tax Rebate - Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the possession of the second flat is as follows Financial Year Principle on