Housing Loan Rebate Income Tax Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

Housing Loan Rebate Income Tax

Housing Loan Rebate Income Tax

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

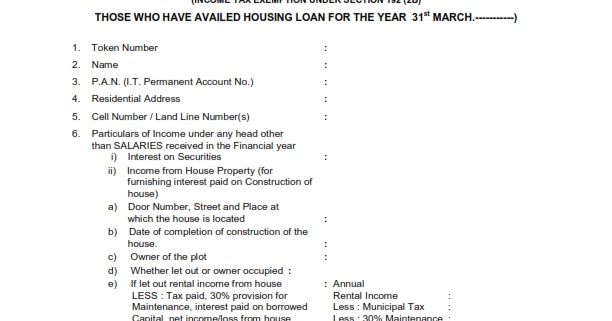

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the Web What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2

Web Income tax rebate on home loan Details Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Download Housing Loan Rebate Income Tax

More picture related to Housing Loan Rebate Income Tax

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 20 mars 2023 nbsp 0183 32 A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961 A home loan repayment consists of two parts the principal amount and the interest Web 27 avr 2023 nbsp 0183 32 If you can claim a total deduction of over 4 25 lakh including your home loan you may wish to continue with the old tax regime as your savings on tax may be

Web Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as stated under Section 80C Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

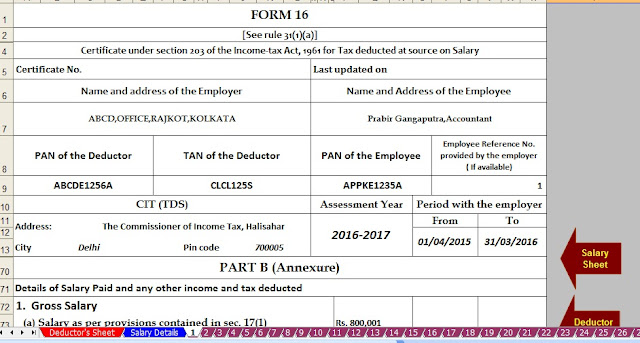

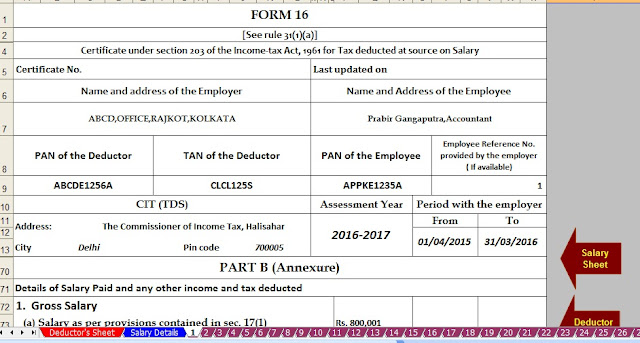

Prepare At A Time 50 Employees Form 16 Part B For F Y 2016 17 With

https://4.bp.blogspot.com/-Hgoun30u-eQ/WGpx_o49OgI/AAAAAAAADzk/bl06AvJ-lJA3PbMmC8AlShcyQb03EKPHwCLcB/s640/Form%2B16%2B3.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Pin P Home Improvement And Construction Blogs

Prepare At A Time 50 Employees Form 16 Part B For F Y 2016 17 With

Income Tax Rebate On Home Loan Fy 2019 20 A design system

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Property Tax Rebate Application Printable Pdf Download

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Home Loan Tax Benefits In India Important Facts

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Housing Loan Rebate Income Tax - Web Income tax rebate on home loan Details Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home