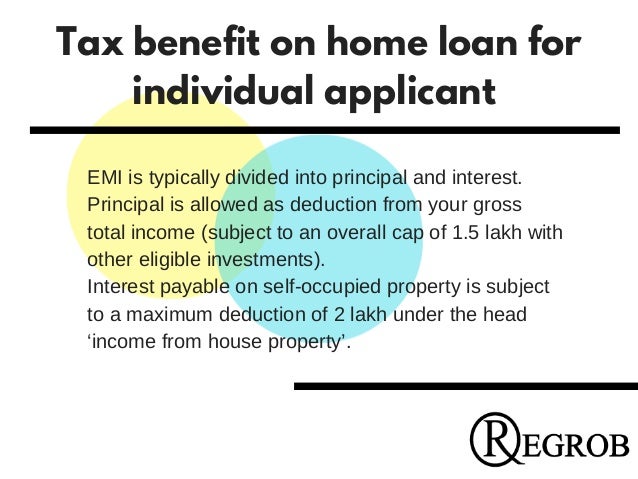

Housing Loan Tax Exemption India The maximum tax exemption for housing loans under Section 80C is Rs 1 5 lakhs per financial year It s worth noting that there are various other investment avenues like

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs These home loan tax exemptions can only be claimed to purchase houses with a stamped value of up to Rs 45 lakh Thus borrowers will be able to claim a maximum income tax

Housing Loan Tax Exemption India

Housing Loan Tax Exemption India

https://www.realestate-tokyo.com/media/15207/housing-loan-tax-exemption.jpg?width=948&height=553&mode=max

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Can I Claim Both Home Loan And HRA Tax Benefits

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

The maximum income tax exemption on a Home Loan in India is the sum of the deductions that can be claimed under Section 24 b and Section 80EEA subject to the conditions Taxpayers who took out a home loan in FY 2016 17 were eligible to claim an extra tax deduction under Section 80EE of up to Rs 50 000 Presently under Section 24 a home

Home loan tax benefits 2024 Deductions allowed on home loan principal Section 80C Deduction How to maximise tax rebate under Section 80C Deductions allowed on What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under

Download Housing Loan Tax Exemption India

More picture related to Housing Loan Tax Exemption India

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Home Loan Interest Tax Exemption India Home Sweet Home Modern

https://image.slidesharecdn.com/taxbenefitsonhomeloaninindia-170208093857/95/tax-benefits-on-home-loan-in-india-call-9529331331-5-638.jpg?cb=1486546872

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March The following are the various tax exemptions on home loans available in India 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a yearly tax

This article will explore the various tax deductions and exemptions available to individuals with mortgage loans in India Analysing Tax Deduction Exemption Of Mortgage Loans 1 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax Act

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

https://tax2win.in/guide/income-tax-benefit-on-housing-loan-interest

The maximum tax exemption for housing loans under Section 80C is Rs 1 5 lakhs per financial year It s worth noting that there are various other investment avenues like

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs

Home Loan Interest Tax Exemption India Home Sweet Home Modern

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Home Loan Tax Exemption Calculator India LOANCROT

How Housing Loan Tax Benefit

Section 80EEA Exemption For Interest On Home Loan With Automated Income

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

Housing Loan Tax Exemption India - The maximum income tax exemption on a Home Loan in India is the sum of the deductions that can be claimed under Section 24 b and Section 80EEA subject to the conditions