Housing Loan Tax Rebate Rules Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan Web Generally you must repay any credit you claimed for a home you bought if you bought the home in 2008 See Form 5405 and its instructions for details and for exceptions to the

Housing Loan Tax Rebate Rules

Housing Loan Tax Rebate Rules

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

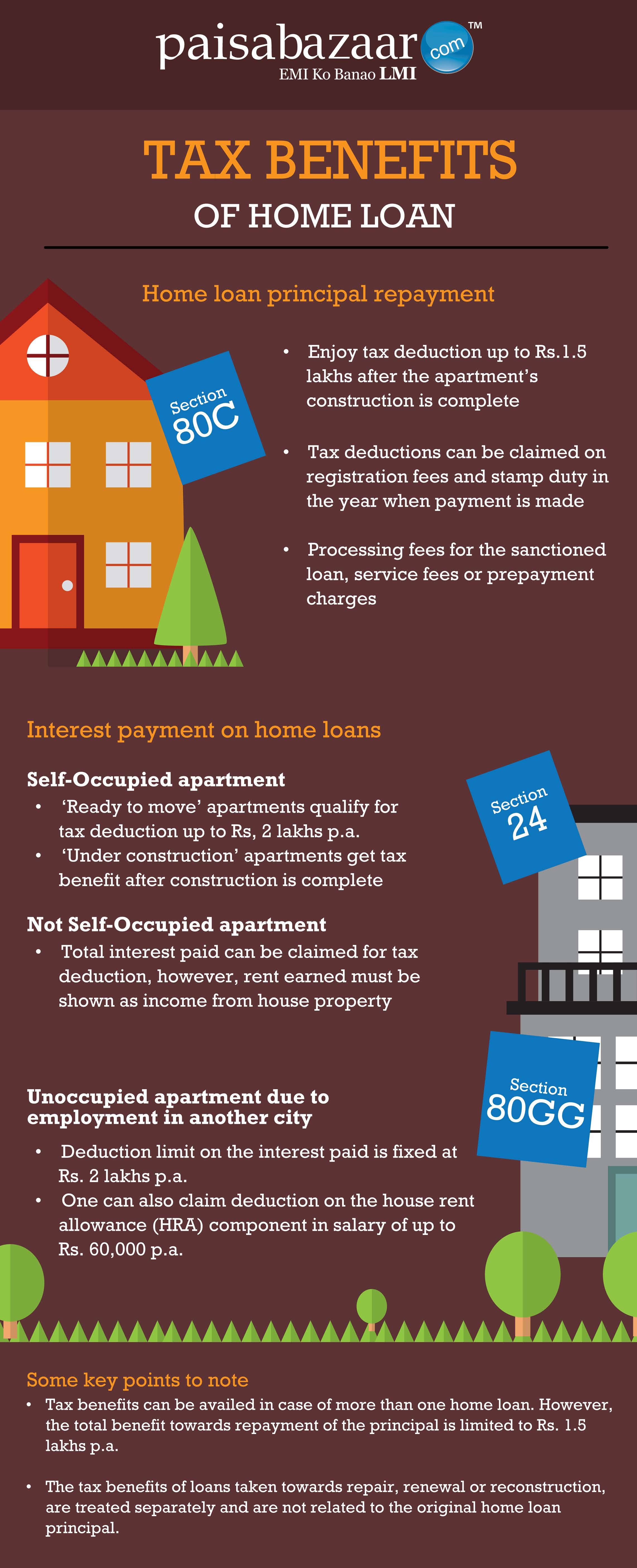

Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they Web Updated on Jul 30th 2022 8 34 49 PM 6 min read CONTENTS Show Section 80EE allows income tax benefits on the interest portion of the residential house property loan

Web 5 f 233 vr 2023 nbsp 0183 32 The maximum amount that can be claimed is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct interest on

Download Housing Loan Tax Rebate Rules

More picture related to Housing Loan Tax Rebate Rules

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Web 8 mars 2022 nbsp 0183 32 Income tax A home loan borrower can claim tax benefit under Section 80 EEA if it has a home loan sanctioned in between 1st April 2019 to 31st March 2022 As Web As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the

Web The principal repaid on such housing loan shall be eligible for deduction under Section 80C up to INR 1 50 000 by each loan holder Stamp duty charges paid can also be claimed under Section 80C However apart Web 26 juil 2018 nbsp 0183 32 Can I get tax rebate under sec 80 C of both the loans Yes you can get the 80C benefit on both loans However the total amount that you will be entitled to will be a

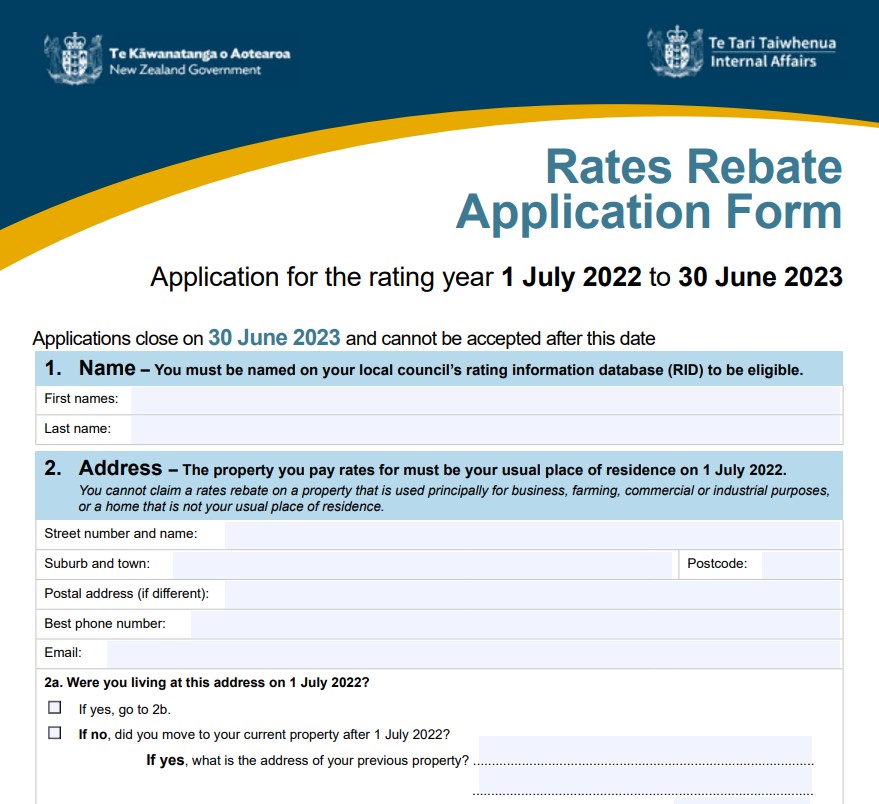

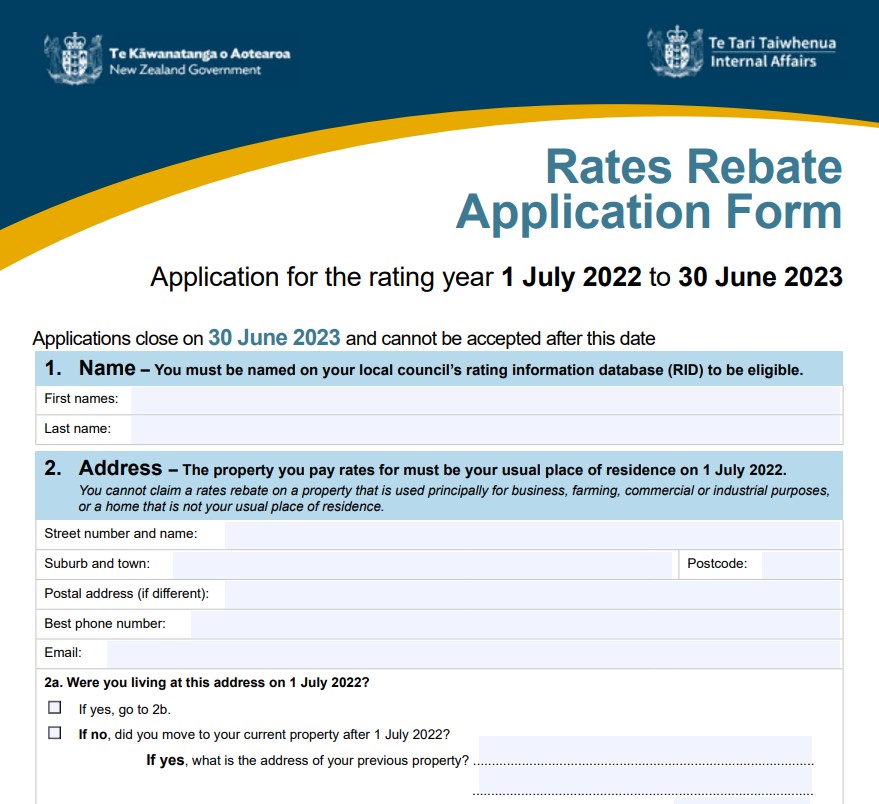

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

https://i.pinimg.com/originals/e9/39/8c/e9398cd21460fc812f7644a4047c23cc.png

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

https://navi.com/blog/tax-benefit-on-home-loan

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Property Tax Rebate Application Printable Pdf Download

Which Type Of Loan Needs Tax Return

GST HST New Housing Rebate Rebates House With Land Home Construction

Pin P Home Improvement And Construction Blogs

Gst New Housing Rebate Application Form Printable Rebate Form

Gst New Housing Rebate Application Form Printable Rebate Form

New Housing Tax Rebate Canada Home Tax Rebate

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

How To Get A Second Home Loan For Rental Income

Housing Loan Tax Rebate Rules - Web Updated on Jul 30th 2022 8 34 49 PM 6 min read CONTENTS Show Section 80EE allows income tax benefits on the interest portion of the residential house property loan