How Are Hsa Distributions Taxed HSA distributions are tax free when used for IRS approved medical expenses Distributions for non medical purposes are typically subject to taxes and a 20 penalty

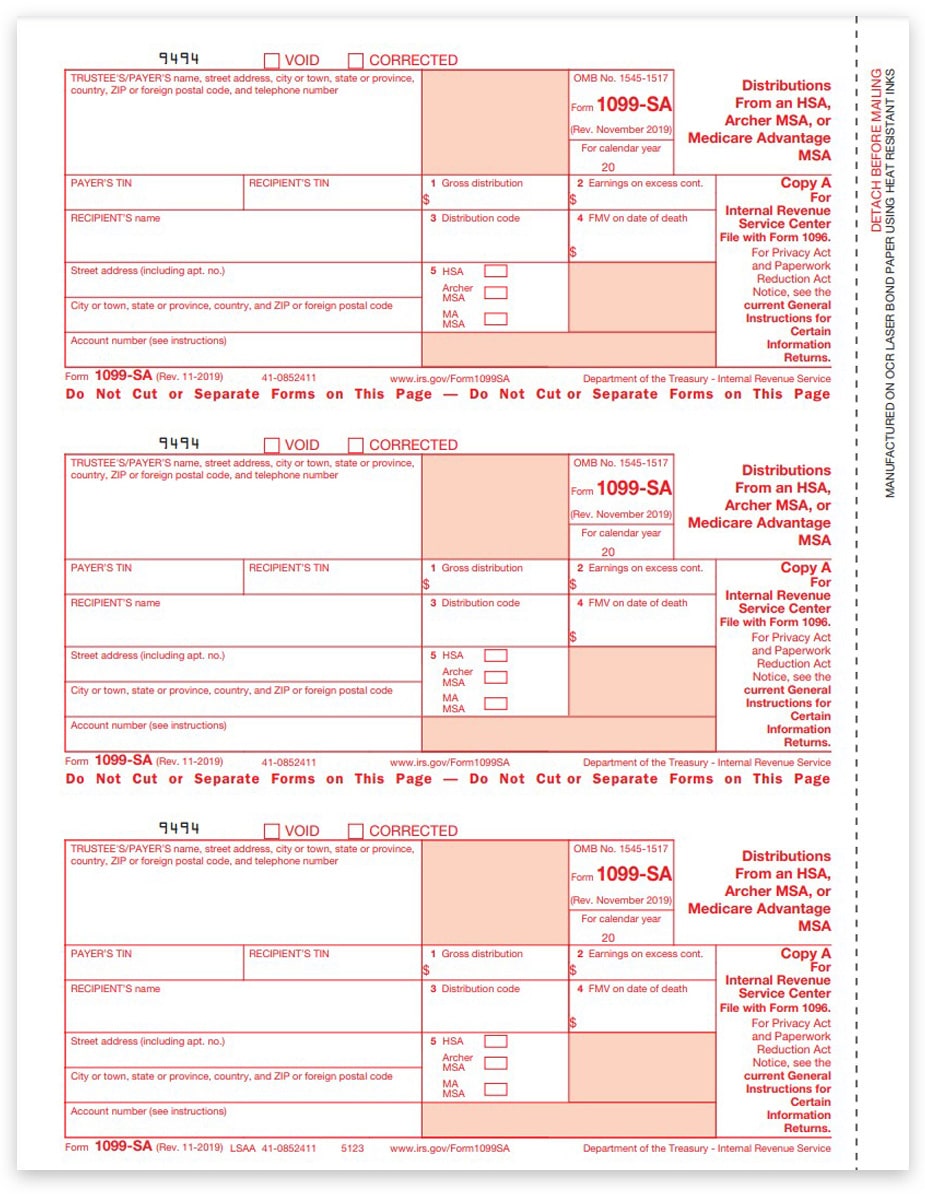

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for When filing taxes you must report taxable distributions from HSAs and MSAs on your tax return and calculate the additional 20 tax on the taxable portion of

How Are Hsa Distributions Taxed

How Are Hsa Distributions Taxed

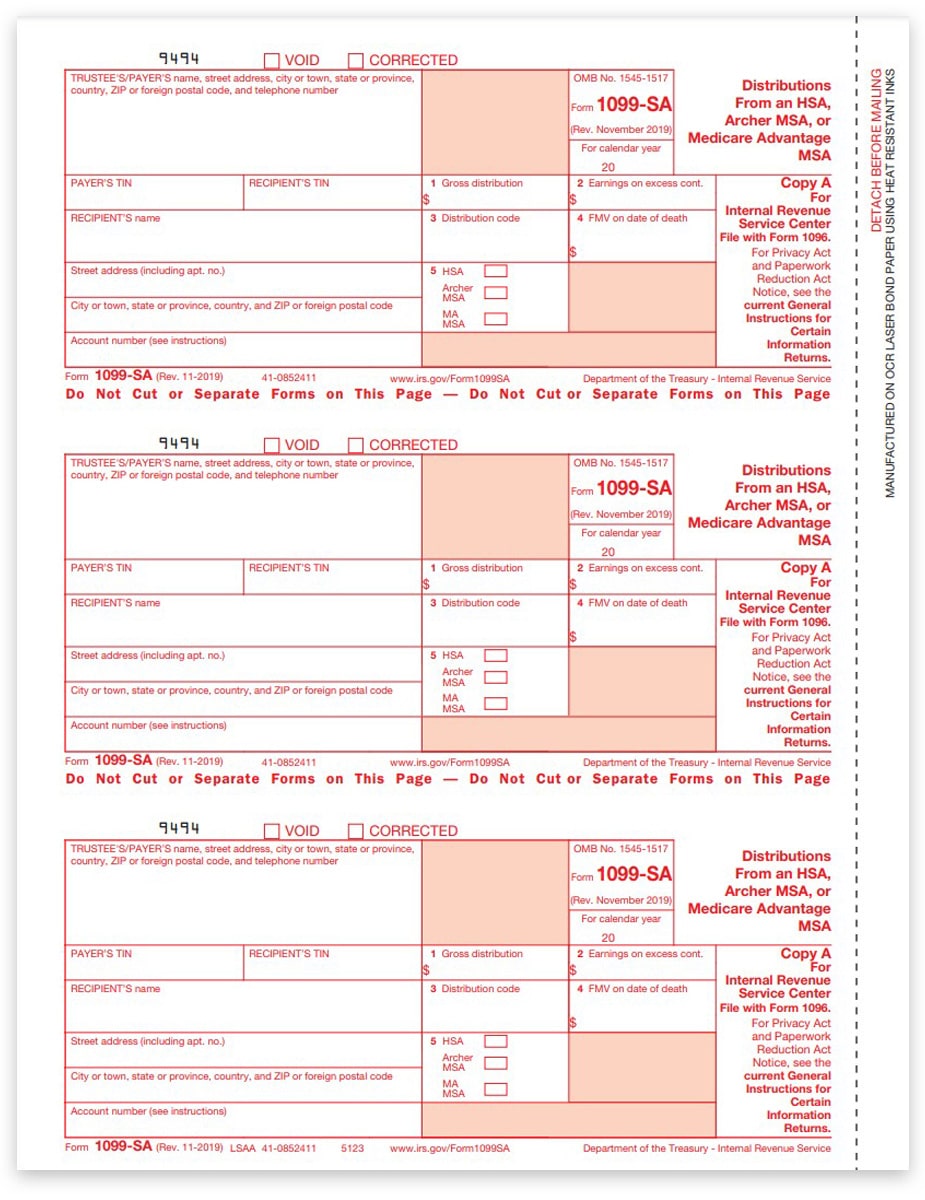

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-A-Federal-Red-LSAA-FINAL-min.jpg

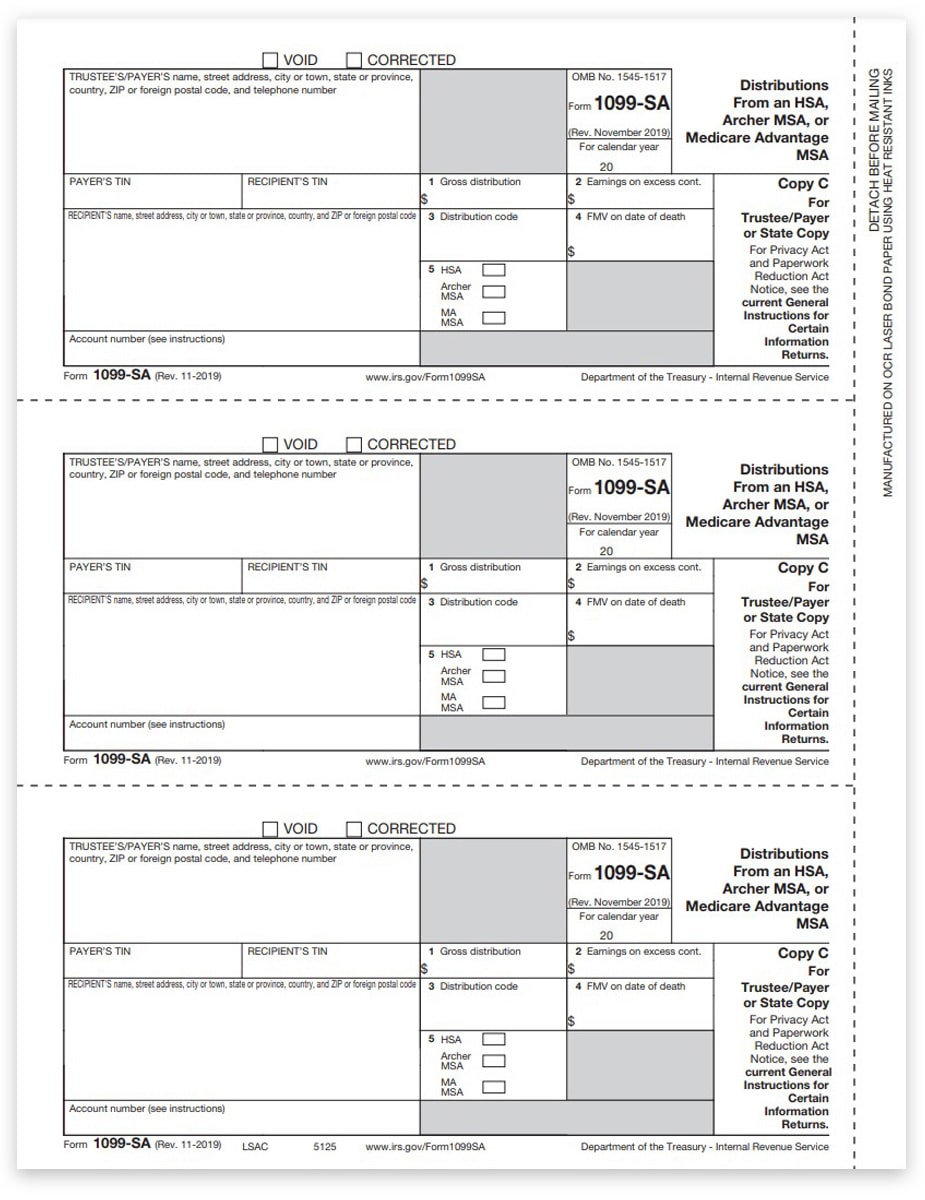

1099SA Forms For MSA Or HSA Distributions Payer Copy C ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-C-Trustee-Payer-State-LSAC-FINAL-min.jpg

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=2048&name=HSA Contribution Limits Table.png

Any HSA withdrawal you make without a qualified medical expense will be subject to income taxes In addition to the income tax you ll have to pay an additional 20 tax on the withdrawal No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA while owned by an employee can be funded by the

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

Download How Are Hsa Distributions Taxed

More picture related to How Are Hsa Distributions Taxed

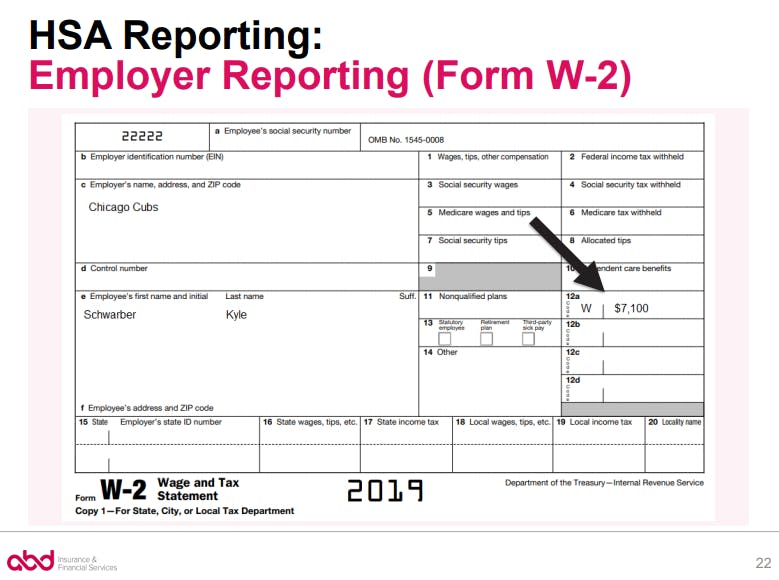

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

A Guide To How S Corp Distributions Are Taxed 2024

http://www.govdocfiling.com/wp-content/uploads/How-are-S-Corp-Distributions-Taxed-copy-1.jpg

Diferencia Entre HSA Y PPO Opinion Duel

https://opinionduel.com/wp-content/uploads/diferencia-entre-hsa-y-ppo.png

HSA distributions for qualified healthcare expenses are tax free There are myriad qualified expenses including co pays prescription drug costs your deductible and qualified over An IRS Form 1099 SA is a U S tax form that reports distributions made from a health savings account HSA Archer medical savings account Archer MSA or

How does my Health Savings Account affect my taxes A Health Savings Account HSA is a way to save money to pay for medical expenses and costs Contributions are tax free Ed Zurndorfer discusses the tax savings when HSA distributions are made to pay medical expenses including which expenses are qualified IRS reporting

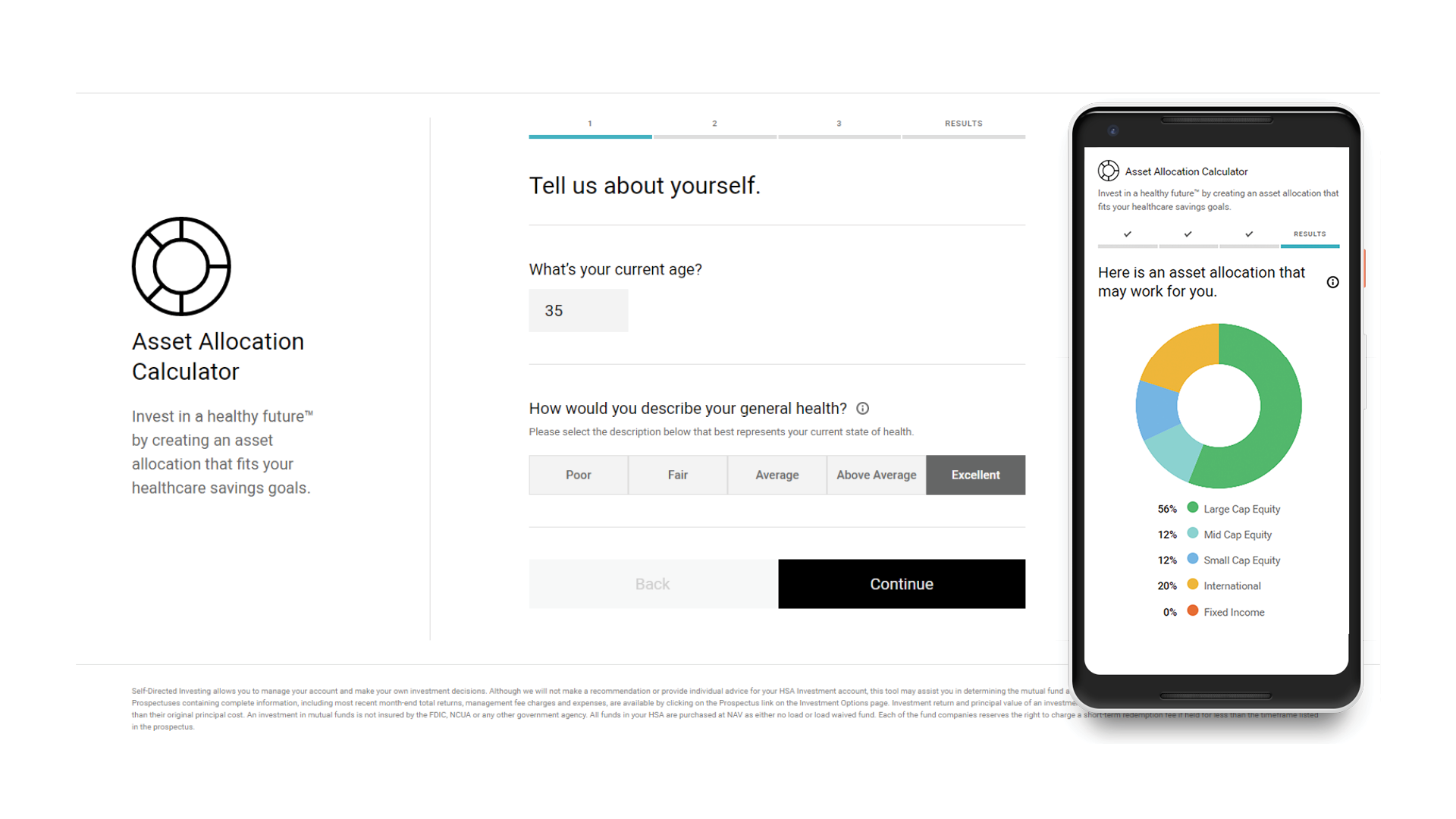

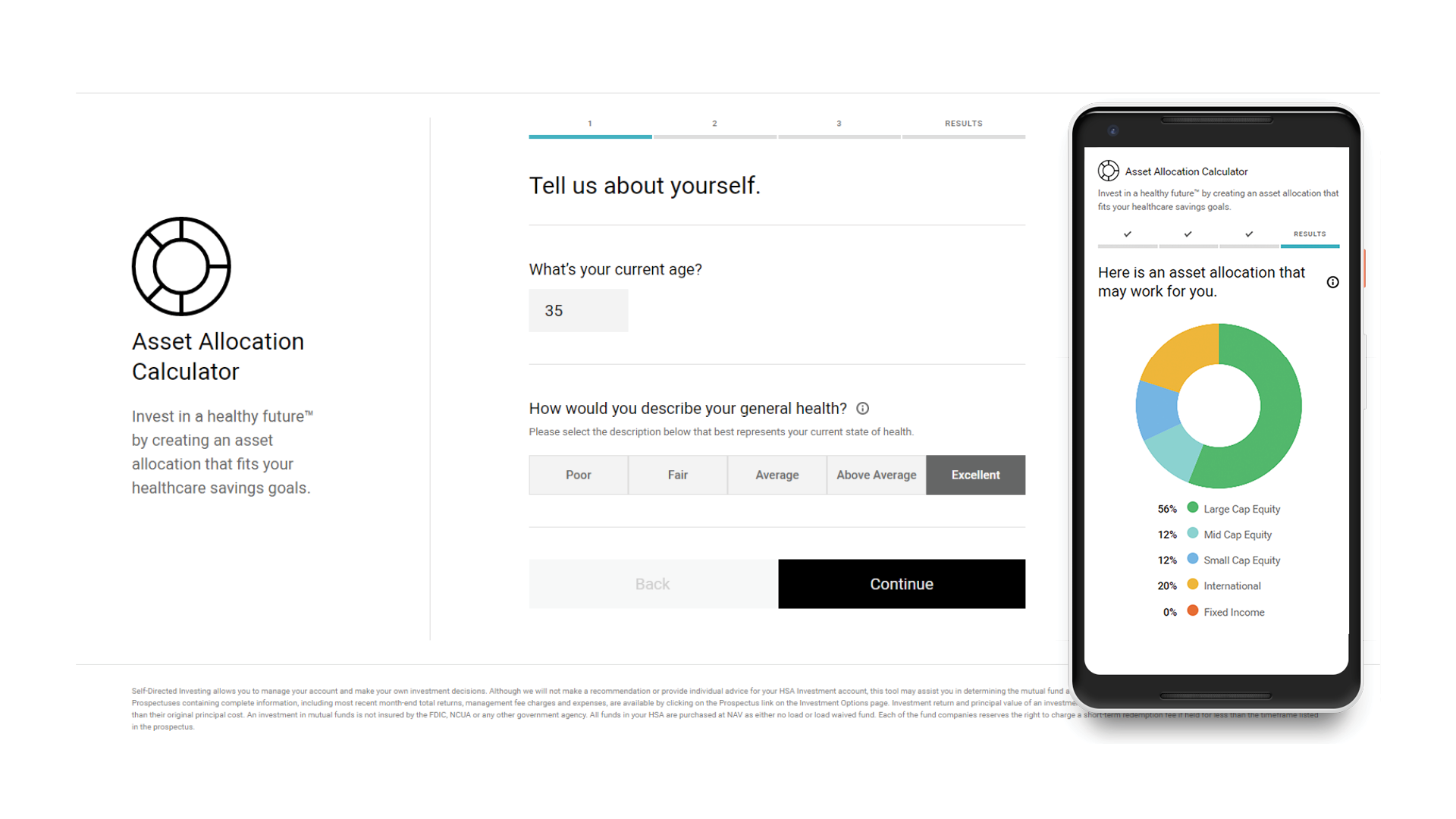

New HSA Asset Allocation Calculator Devenir

https://www.devenir.com/wp-content/uploads/AssetAllocation_Screenshots.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

https://www.fool.com/retirement/plans/hsa/distributions

HSA distributions are tax free when used for IRS approved medical expenses Distributions for non medical purposes are typically subject to taxes and a 20 penalty

https://ttlc.intuit.com/.../hsa-distribution-taxable/L9hETZjiQ_US_en_US

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for

A Beginner s Guide To S Corporation Taxes

New HSA Asset Allocation Calculator Devenir

Qualified Vs Non Qualified Roth IRA Distributions

What Is An S Corp

S Corp

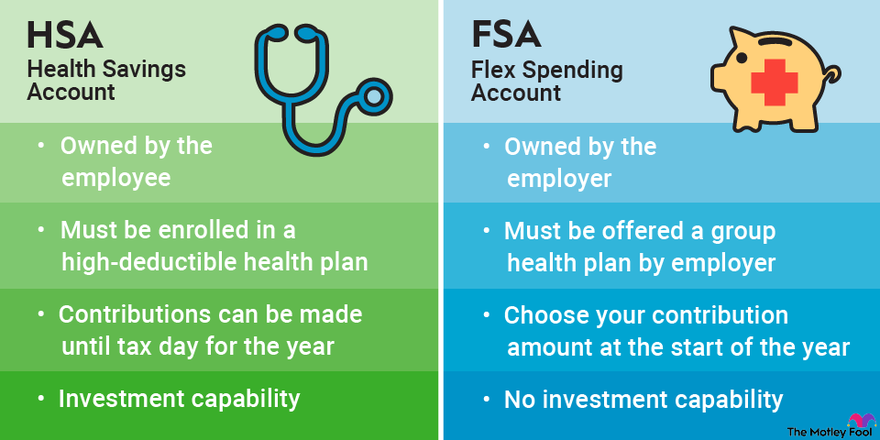

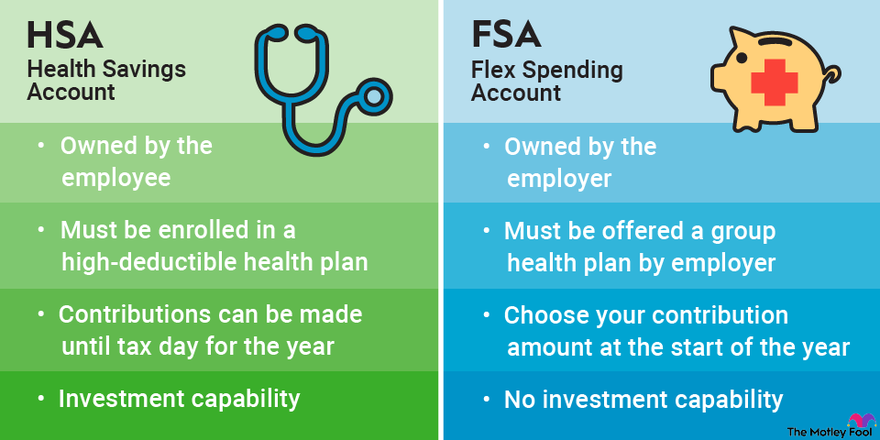

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

HSA Contributions Deadline Hasn t Passed Yet But Act Soon Kiplinger

Comparison Of HSA health Savings FSA Flexible Spending HRA

How Is Social Security Income Taxed

How Are Hsa Distributions Taxed - Distributions from your HSA used exclusively to pay for qualified medical expenses for you your spouse or dependents are excluded from your gross income