How Are K1 Taxed Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S

A typical corporation s regular dividend is taxed as long term capital gains while much of the income paid and shown on a Schedule K 1 can be classified as regular income That means it s K 1 income is the income that a shareholder or a partner of a business receives Schedule K 1 is used to report losses dividends and earnings You ll need the information on Schedule K 1 to complete your annual tax return Trusts and estates are also required to use Schedule K 1 forms

How Are K1 Taxed

How Are K1 Taxed

https://i.ytimg.com/vi/xTbDR6KewSY/maxresdefault.jpg

How Is K1 Passive Income Taxed Juice ai

https://juice.ai/wp-content/uploads/2022/11/how-is-k1-passive-income-taxed_photo-3.jpeg

Canada s Cannabis Taxation Regime TaxEd International Fasken Tax Blog

https://taxedinternational.com/wp-content/uploads/2017/11/photo-1503262167919-559b953d24081.jpg

K 1s are tax forms that are used for business partnerships to report to the IRS a partner s income losses capital gain dividends etc from the partnership for the tax year With the K 1 a partner s earnings can be taxed at an individual tax rate versus the corporate tax rate Schedule K 1 is the federal tax form prepared by these entities to report annual income losses credits deductions and other distributions for each partner shareholder or beneficiary If you

The United States tax code allows some entities to use pass through taxation This effectively shifts the income tax from the earner to those who benefit The Schedule K 1 is the form that reports the amounts that are passed through to Schedule K 1 is a schedule of IRS Form 1065 U S Return of Partnership Income It s provided to partners in a business partnership to report their share of a partnership s profits losses deductions and credits to the IRS You fill out Schedule K 1 as part of your Partnership Tax Return Form 1065 which reports your partnership s total

Download How Are K1 Taxed

More picture related to How Are K1 Taxed

How Is K1 Passive Income Taxed Juice ai

https://juice.ai/wp-content/uploads/2022/11/how-is-k1-passive-income-taxed_photo-1.jpeg

K1 Entertainment News Episode 1963 K1 Headlines

https://d2anahhhmp1ffz.cloudfront.net/3908673528/e0059bf1297d58358bb384ec087711d204970305

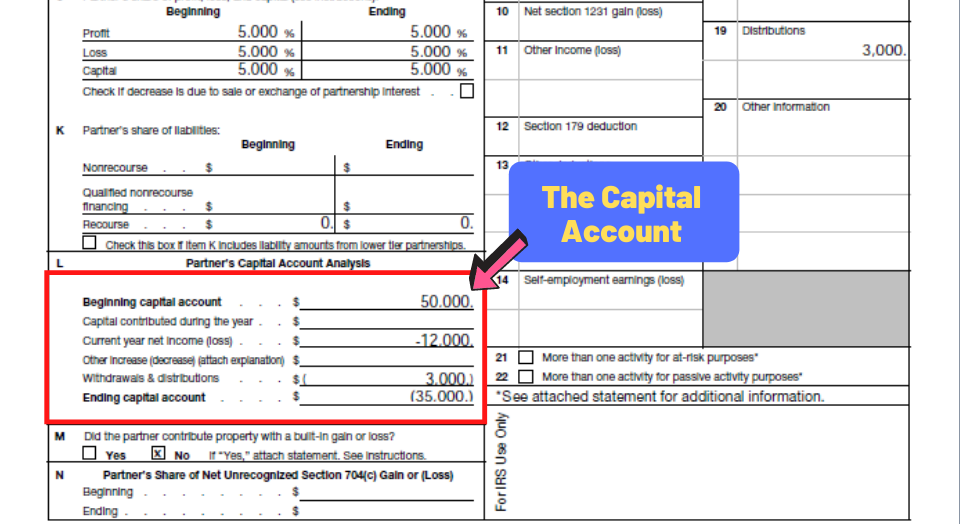

How Is K1 Income Taxed The Multifamily Passive Income Tax Rate

https://willowdaleequity.com/wp-content/uploads/2021/06/The-capital-account-in-a-k-1-example.png

A Schedule K 1 often simply called a K 1 is a tax document that is prepared annually by many limited liability companies LLC and other pass through entities including trusts estates and S corporations whose taxes may be passed onto partners rather than paid by the company The K 1 is prepared by the entity to distribute to owners shareholders to outline their portion of the income loss and deductions Similar to a 1099 form received that highlights contractor income you do not have to

[desc-10] [desc-11]

How Are Trusts Taxed FAQs Wealthspire

https://www.wealthspire.com/wp-content/uploads/2021/03/how-are-trusts-taxed.jpg

How Is K1 Income Taxed Nita Nelson Bookkeeping

https://nitanelsonbookkeeping.com/wp-content/uploads/2022/10/45.jpg

https://www.investopedia.com/terms/s/schedule-k-1.asp

Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S

https://www.fool.com/investing/general/2015/10/02/the-schedule-k-1...

A typical corporation s regular dividend is taxed as long term capital gains while much of the income paid and shown on a Schedule K 1 can be classified as regular income That means it s

K1 Entertainment News Episode 1915 K1 Headlines

How Are Trusts Taxed FAQs Wealthspire

Interpreting AI Compute Trends AI Impacts

AKedOLRqoGIZ9xzPxmHj2y FC6 kpG34Bvy g6MVH 2K s900 c k c0x00ffffff no rj

Tax Deductions Investment Watch

K1 Features Episode 370 K1 Headlines

K1 Features Episode 370 K1 Headlines

K1 Entertainment News Episode 1651 K1 Headlines

K1 Entertainment News Episode 2754 K1 Headlines

K1 Entertainment News Episode 1861 K1 Headlines

How Are K1 Taxed - The United States tax code allows some entities to use pass through taxation This effectively shifts the income tax from the earner to those who benefit The Schedule K 1 is the form that reports the amounts that are passed through to