How Are Tax Credits Worked Out Verkko How do I calculate tax credits Updated on 11 April 2023 Here we detail everything you need to know to calculate your tax credits If you meet the qualifying conditions for child tax credit CTC or working tax credit WTC or both the amount you get will depend on which elements of CTC and or WTC you and your family qualify for

Verkko 2 huhtik 2020 nbsp 0183 32 1 Understand what tax credits are Tax credits are an amount of money that you can take off of the amount of taxes that you owe in a given year These reductions in tax burden are offered by the government to people who meet specific criteria like low income homeowners or those who make an effort to use green Verkko 18 jouluk 2023 nbsp 0183 32 A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000

How Are Tax Credits Worked Out

How Are Tax Credits Worked Out

https://traxiontax.com/wp-content/uploads/2022/08/tax-credits-vs-deductions-whats-difference-1024x683.png

Tax Credits Under SECURE 2 0 Expand Small Business Coverage 401 k

https://401kspecialistmag.com/wp-content/uploads/2023/01/tax-credits.jpg

How Are Tax Credits Given To Parents In Columbia SC

https://www.getridoftaxes.com/img/7b6dd5119027f123a0108d1148be1606.jpg?22

Verkko 19 toukok 2022 nbsp 0183 32 Tax credits subtract dollar amounts directly from what you owe the Internal Revenue Service IRS as you complete your tax return They re better than tax deductions because they re applied dollar for dollar to your tax debt for the year and some of them can even result in cash back or be carried forward to subsequent years Verkko 20 lokak 2015 nbsp 0183 32 In numbers 163 14 000 Broadly speaking any single person earning less than 163 14 000 any couple earning less than 163 19 000 and any applicant with children earning less than 163 40 000 may be eligible for

Verkko 7 maalisk 2023 nbsp 0183 32 A tax credit reduces the amount of tax owed dollar for dollar and your tax rate has no impact on a credit For individuals tax credits fall into five general categories family and dependents income and savings homeownership health Verkko 6 jouluk 2023 nbsp 0183 32 A tax credit gives taxpayers a dollar for dollar reduction of their tax bill This differs from a tax deduction which is a dollar amount the IRS allows taxpayers to subtract from their

Download How Are Tax Credits Worked Out

More picture related to How Are Tax Credits Worked Out

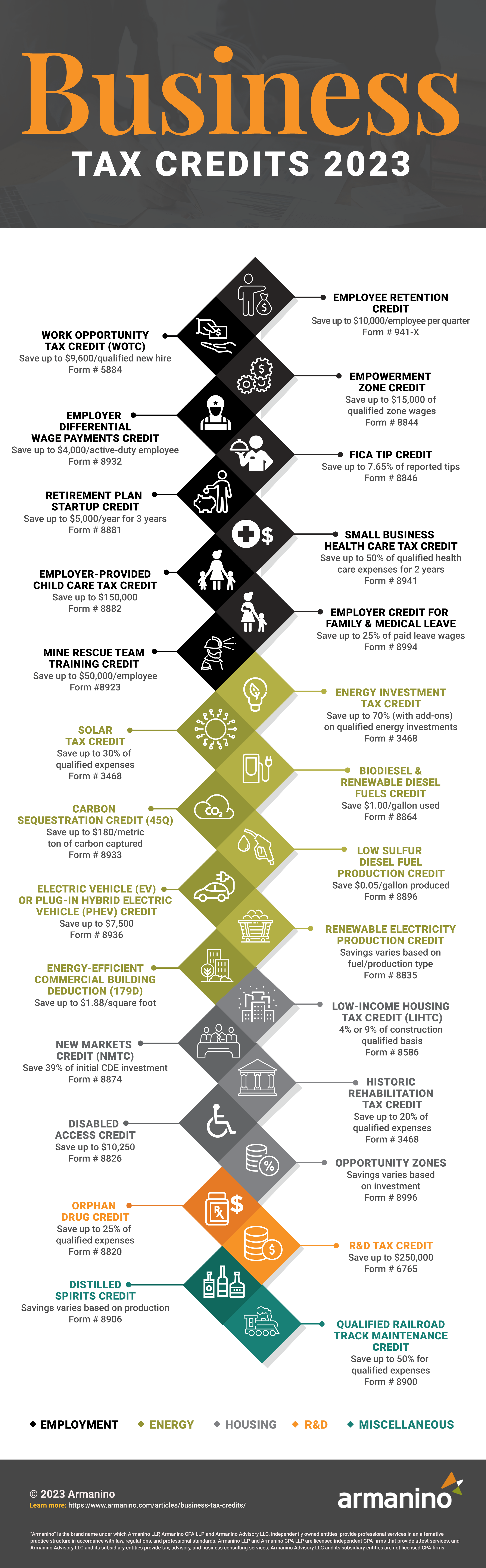

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

What Is The Different Between Tax Credits And Deductions Wester Law

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/11/GettyImages-1222021860.jpg

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

https://www.thescottishsun.co.uk/wp-content/uploads/sites/2/2018/04/nintchdbpict000379813847.jpg?strip=all&quality=100&w=1200&h=800&crop=1

Verkko 28 lokak 2015 nbsp 0183 32 Tax credits have played a huge role in reducing child poverty from 26 in 1997 to 18 in 2010 The Institute of Fiscal Studies IFS has estimated that if tax credits had not been Verkko A tax credit is an amount of money given by the IRS that reduces your tax bill on a dollar for dollar basis It is one of the last steps in calculating your annual tax bill and can be

Verkko 14 hein 228 k 2023 nbsp 0183 32 Personal Finance A Comprehensive Guide to Tax Credits July 14 2023 Imagine if you could pay less taxes or even get money back from the government Sounds too good to be true right Well it s possible with tax credits Tax credits are not just ordinary deductions Verkko 22 kes 228 k 2015 nbsp 0183 32 Tax credits are essentially a means of re distributing income by paying money to a families raising children and b working people on low incomes To their critics they are a handout To

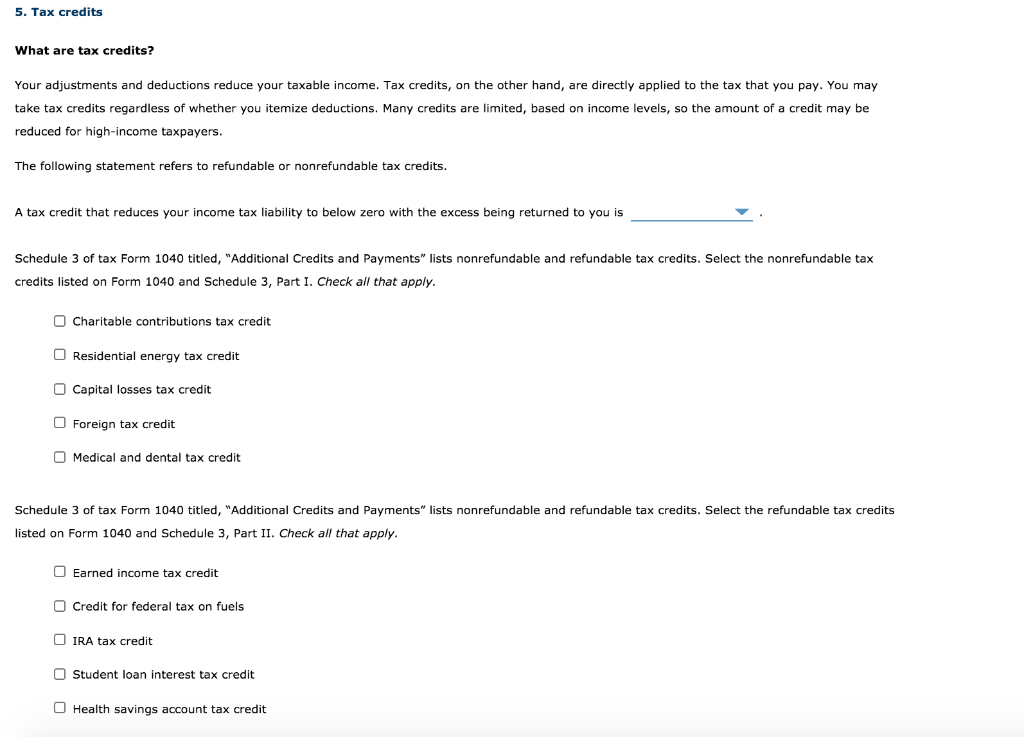

What Are Tax Credits Your Adjustments Deductions And Exemptions

https://img.homeworklib.com/questions/6715d9a0-0f03-11eb-8c88-c90d31bb6c59.png?x-oss-process=image/resize,w_560

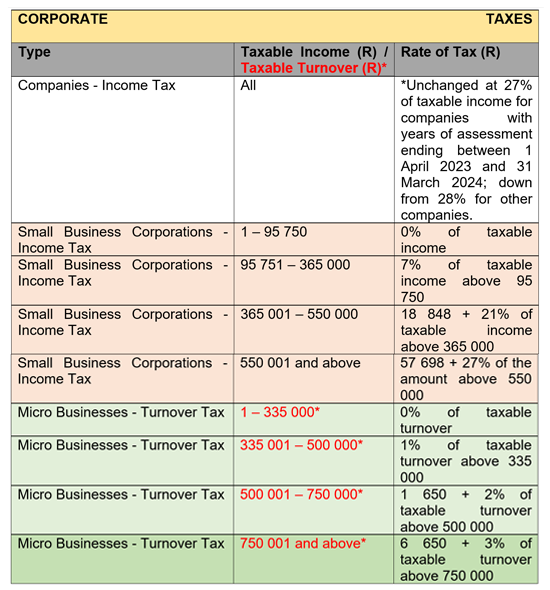

Budget 2023 Your Tax Tables And Tax Calculator Millenium Belasting

https://www.dotnews.co.za/Code/Uploads/Article/2023/BudgetTables/Businesses-–-corporate-tax-rates-unchanged.png

https://www.litrg.org.uk/tax-guides/tax-credits-and-benefits/tax...

Verkko How do I calculate tax credits Updated on 11 April 2023 Here we detail everything you need to know to calculate your tax credits If you meet the qualifying conditions for child tax credit CTC or working tax credit WTC or both the amount you get will depend on which elements of CTC and or WTC you and your family qualify for

https://www.wikihow.com/Calculate-Tax-Credits

Verkko 2 huhtik 2020 nbsp 0183 32 1 Understand what tax credits are Tax credits are an amount of money that you can take off of the amount of taxes that you owe in a given year These reductions in tax burden are offered by the government to people who meet specific criteria like low income homeowners or those who make an effort to use green

27 844 Tax Credits Customers Renew Via HMRC App GOV UK

What Are Tax Credits Your Adjustments Deductions And Exemptions

Exploring Tax Credits For Education Expenses Fiscal Freedom Blog

New Tax Credits For 2022 In Canada Complete Guide GroupEnroll ca

Child Tax Credit 2024 Income Limits What Is The Income Limits For This

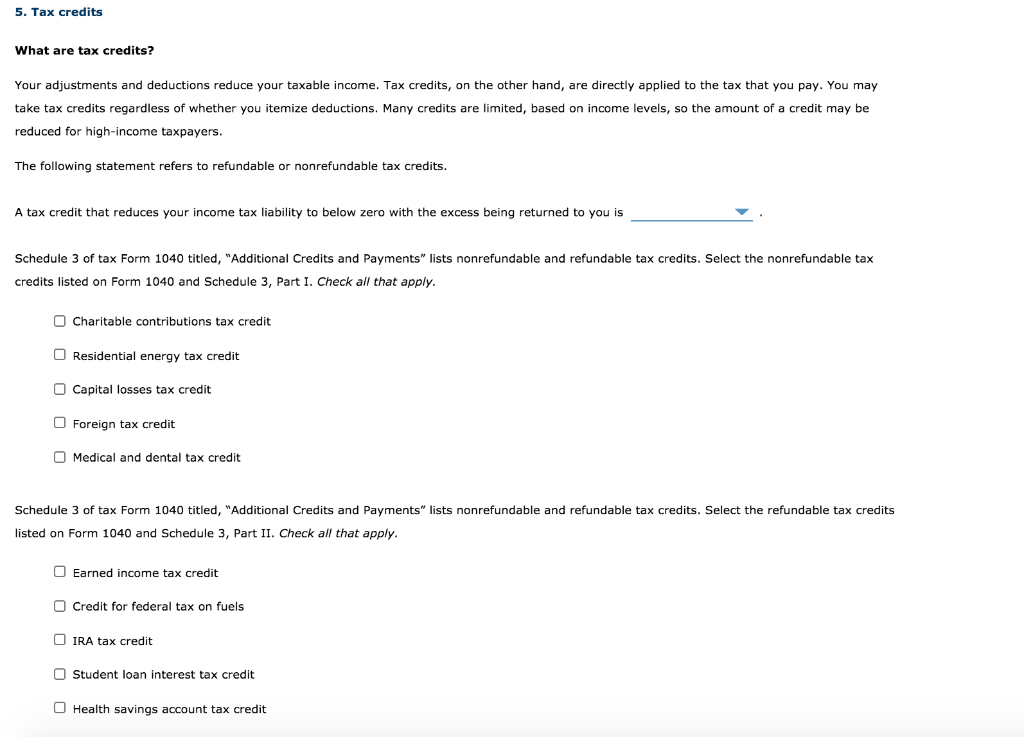

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Exploring Tax Credits Legislation A Comprehensive Overview

Webinar Taxpayers With Disabilities And Families It s Not Too Late To

Maximizing Your Tax Credits With Dependents A Complete Guide

How Are Tax Credits Worked Out - Verkko 6 jouluk 2023 nbsp 0183 32 A tax credit gives taxpayers a dollar for dollar reduction of their tax bill This differs from a tax deduction which is a dollar amount the IRS allows taxpayers to subtract from their