How Do Fuel Tax Credits Work The Fuel Tax Credit is for offsetting the tax that the U S government charges on fuels such as gasoline and diesel in specific circumstances The Internal Revenue Service IRS taxes

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads You can use the fuel tax credits calculation worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You can also use the Fuel tax credit calculator to help you work out your claim online

How Do Fuel Tax Credits Work

How Do Fuel Tax Credits Work

https://www.banlaw.com/wp-content/uploads/2021/12/who-can-claim-fuel-tax-credits-1024x763.jpg

Calculating Fuel Tax Credits Aspire Consulting

https://aspire-ca.com.au/wp-content/uploads/2016/10/Caulculating-Fuel-Tax.jpg

Fuel Tax Credits At Risk NFF Warning On Independent Wins The Weekly

https://content.api.news/v3/images/bin/153fde5b84f035dacbee91a2f6395266

Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import You may be able to claim credits that is get money back for fuel you use in your small business Find out if the fuel and business activities you undertake are eligible for fuel tax credits Learn how to calculate and claim fuel tax credits

Work out your fuel tax credits You can use the following methods when working out your fuel tax credits for heavy vehicles Last updated 21 February 2023 Print or Download General methods for heavy vehicles Basic method for heavy vehicles Simplified method for calculating fuel used in heavy vehicles with auxiliary equipment To make a claim for fuel tax credits you must be registered for goods and services tax GST when you acquire the fuel fuel tax credits when you lodge your claim You can claim fuel tax credits for fuel you purchase manufacture or

Download How Do Fuel Tax Credits Work

More picture related to How Do Fuel Tax Credits Work

Be Prepared For A Decrease In Fuel Tax Credits FTCs Hall Chadwick

https://www.hallchadwickqld.com.au/wp-content/uploads/2022/04/Web-Header-Fuel-Tax.png

What Are Fuel Tax Credits Barrington

https://barringtonata.com.au/site/wp-content/uploads/2021/01/What-are-fuel-tax-credits.jpg

Fuel Tax Credit Changes HTA

https://www.hta.com.au/wp-content/uploads/2022/05/Fuel-tax-credit-changes-1.png

How much is the fuel tax credit The value of the fuel tax credit is the difference between the diesel fuel excise rate and the Road User Charge The current rate of the fuel tax credit can be found on the Australian Tax Office website What is the Road User Charge So here is a guide to help you know how the fuel tax credits scheme works in Australia and how you can claim them What are fuel tax credits The fuel tax credits scheme is a government program that allows eligible individuals and businesses to claim credits for the paid fuel tax

The Inflation Reduction Act also extended the following fuel tax credits through December 31 2024 Biodiesel and renewable diesel credit Biodiesel and renewable diesel mixture credit Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles and light vehicles travelling off public roads or on private roads

Fuel Tax Credits For Businesses Smith Feutrill Chartered Accountants

https://www.smithfeutrill.com.au/site/wp-content/uploads/2021/01/Fuel-tax-credits-for-businesses.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

https://www.investopedia.com/terms/f/fuel-credit.asp

The Fuel Tax Credit is for offsetting the tax that the U S government charges on fuels such as gasoline and diesel in specific circumstances The Internal Revenue Service IRS taxes

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads

Estimating The cost Of Fuel Tax Credits Is A Tricky Business

Fuel Tax Credits For Businesses Smith Feutrill Chartered Accountants

What Are ATO Fuel Tax Credits YouTube

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Fuel Tax Credits Explained Bulk Fuel Australia

Reminder Fuel Tax Credit Rates Have Increased Custom Accounting Pty Ltd

Reminder Fuel Tax Credit Rates Have Increased Custom Accounting Pty Ltd

What Are Fuel Tax Credits Teletrac Navman AU

Fuel Tax Credit Rates Have Changed Small Business Minder

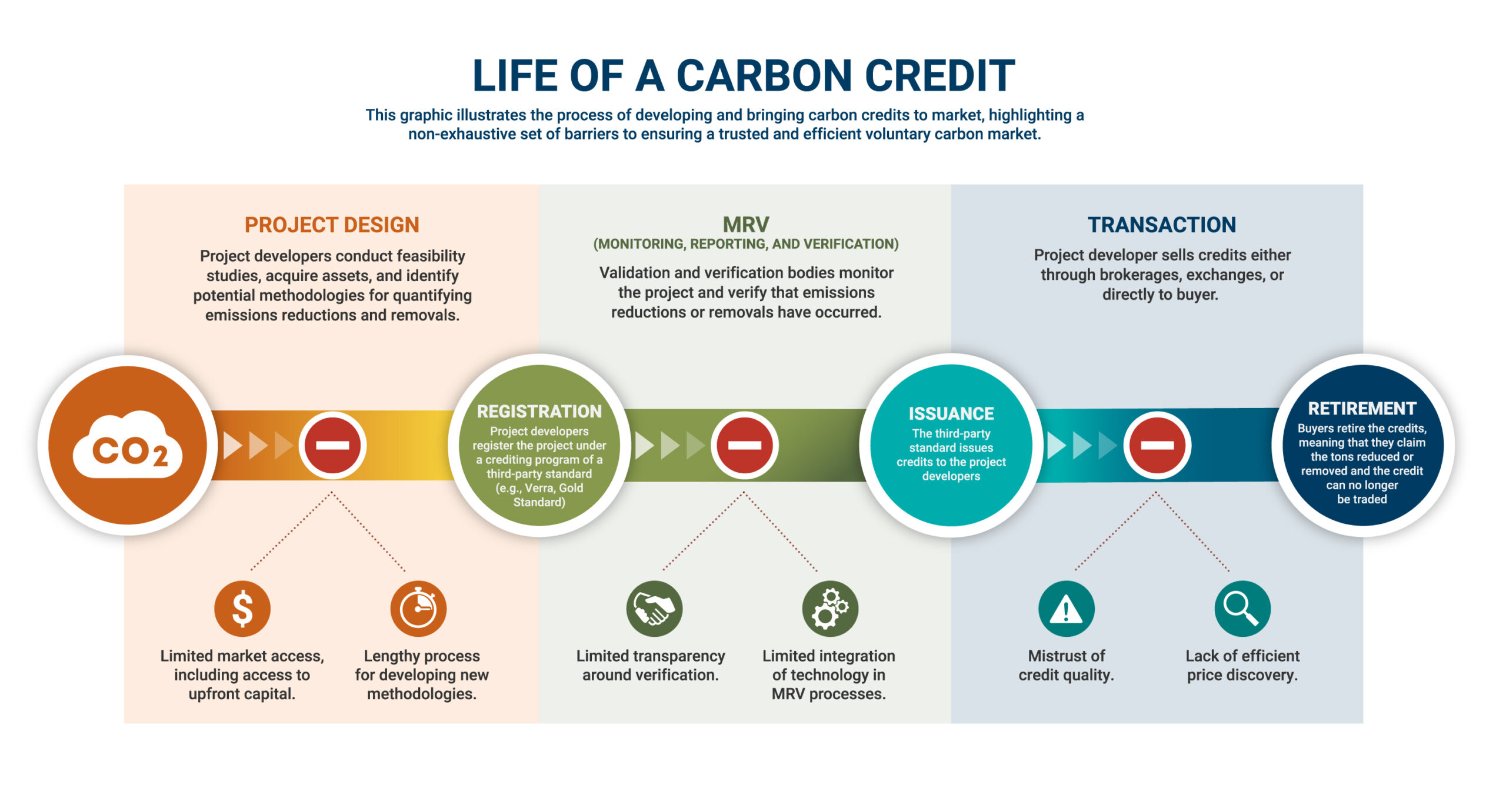

How To Build A Trusted Voluntary Carbon Market RMI

How Do Fuel Tax Credits Work - Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import