How Do I Appeal My Property Taxes In Indiana Taxpayers may contact the IBTR directly at 317 232 3786 or visit the IBTR Guide to Appeals at http www in gov ibtr 2330 htm After being heard by the IBTR taxpayers may also seek review by the Indiana Tax Court and subsequently the Indiana Supreme Court

Taxpayer files a property tax appeal with assessing official The taxpayer must use the Form prescribed by the DLGF Form 130 for each parcel being appealed Filing of the appeal initiates a review and requires the assessing official to schedule a preliminary informal meeting with the taxpayer IC 6 1 1 15 1 1 1 2 The first step in the appeals process begins with written notification to the appropriate local official A taxpayer must file Form 130 Taxpayer s Notice to Initiate an Appeal https forms in gov Download aspx id 6979 with the appropriate local official https www in gov dlgf 2440 htm

How Do I Appeal My Property Taxes In Indiana

How Do I Appeal My Property Taxes In Indiana

https://s.yimg.com/ny/api/res/1.2/CmalI9R7bQ3YZtNSFKBTLg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDk-/http://cache-blog.credit.com/wp-content/uploads/2016/03/can-i-appeal-my-property-taxes.jpg

The Ultimate Guide To Indiana Real Estate Taxes

https://cosmic-s3.imgix.net/19450020-cb52-11e9-9a56-cf16cd66e478-the_ultimate_guide_to_indiana_real_estate_taxes-ogid-135476.jpg?auto=format

Free Property Tax Appeal Comps Worksheet Hallock Law LLC Property

https://images.squarespace-cdn.com/content/v1/5c45f889cef372db48f16929/1616596875678-QJ2JNWLQM6WEL8QW9UYC/Property+Tax+Appeal+Comps+Worksheet.png

A taxpayer may appeal an assessment by filing a form Form 130 with the assessing official The taxpayer must file a separate petition for each parcel The Indiana Department of Revenue DOR accepts written appeals up to 60 days from the date the proposed assessment or refund denial is issued The 60 day deadline to file a written protest with DOR is required by statute and cannot be extended

Instructions Information for Appealing an Assessment A taxpayer may appeal an assessment by filing an appeal form with the county assessor An appeal of current year s assessment may have two different filing deadlines which are based on when the Form 11 notice of assessment is mailed If you decide that you have a valid case then start the appeals process by filling out the online form Taxpayer s Notice to Initiate an Appeal This form will accept attachments additional documents photos appraisals or other evidence that supports your claim

Download How Do I Appeal My Property Taxes In Indiana

More picture related to How Do I Appeal My Property Taxes In Indiana

Should I Appeal My Property Taxes YouTube

https://i.ytimg.com/vi/L2jSUPJRGD0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGggaChoMA8=&rs=AOn4CLAj-iYfL3jvrvlIZtXAmWu-0aMBQQ

What Should I Know Before I Appeal My Property Taxes WikiHow Asks A

https://i.ytimg.com/vi/OjAFaYqLFBI/maxresdefault.jpg

How To QUICKLY Fill Out GA Tax Appeal Form PT 311 A YouTube

https://i.ytimg.com/vi/zwiBzAYR8jY/maxresdefault.jpg

Q Who should I contact to initiate an appeal of the assessed value of my property A The appeals process begins with written notification to your local assessing official Appeals begin at the local level and can be appealed to the state only after being reviewed locally Q To whom do I speak about an appeal if my township no longer has an How to Appeal Property Taxes in Indiana An appeal begins with filing a Form 130 Taxpayer s Notice to Initiate an Appeal with the local assessing official The appeal should detail the pertinent facts of why the assessed value is being disputed

To see an illustration of the property tax assessment appeals process click here Budget Process How are property tax rates determined Property taxes represent a property owner s portion of the local government s budgeted spending for the current year Appealing your property value assessments Taxpayers are able to appeal their property assessments

How To Protest Your Dallas County Property Taxes

https://images.marketleader.com/assets/57/1869557_39598648_f.jpg

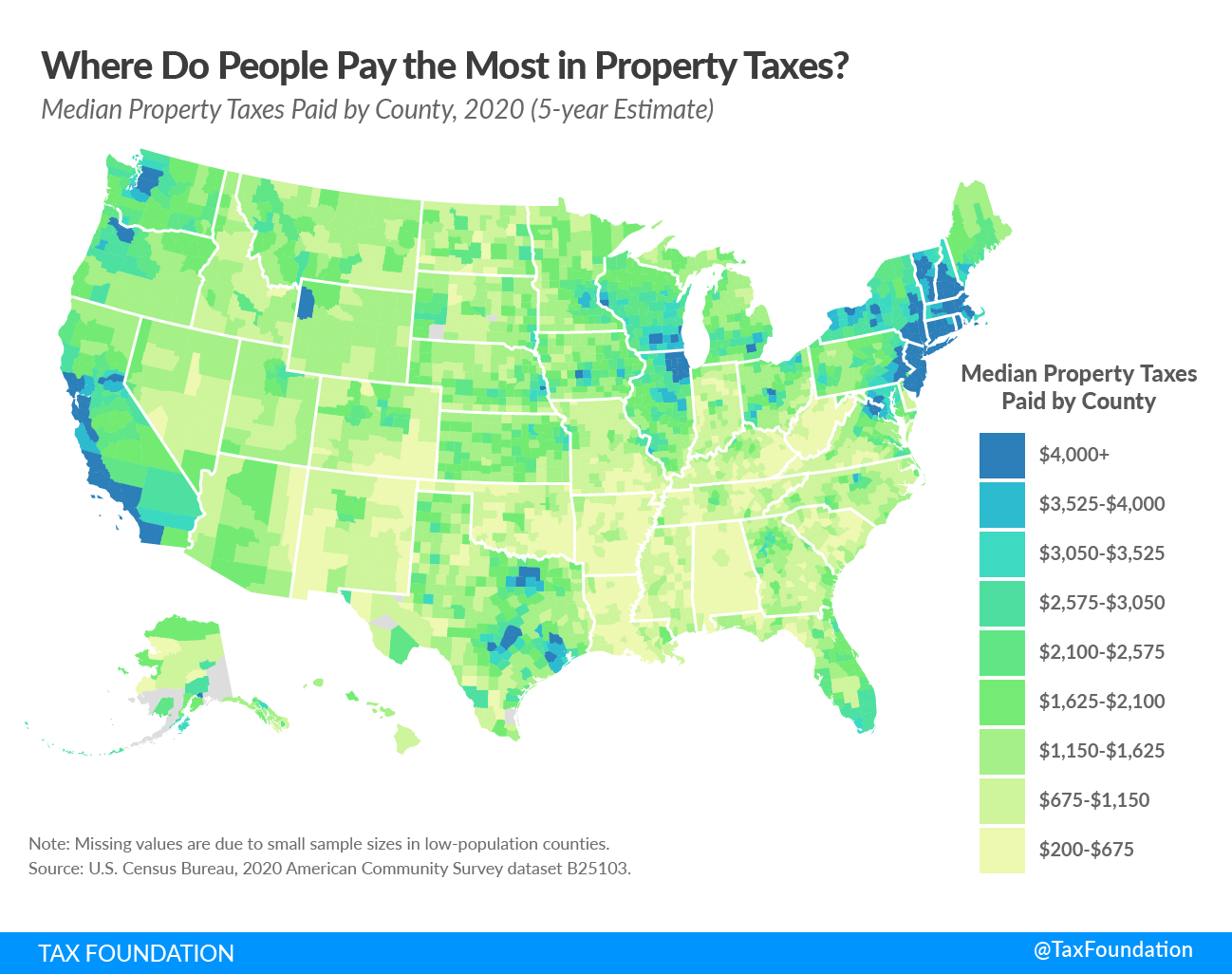

Property Taxes By State County Median Property Tax Bills

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

https://faqs.in.gov/hc/en-us/articles/115005066947...

Taxpayers may contact the IBTR directly at 317 232 3786 or visit the IBTR Guide to Appeals at http www in gov ibtr 2330 htm After being heard by the IBTR taxpayers may also seek review by the Indiana Tax Court and subsequently the Indiana Supreme Court

https://www.in.gov/dlgf/files/Flowchart-for...

Taxpayer files a property tax appeal with assessing official The taxpayer must use the Form prescribed by the DLGF Form 130 for each parcel being appealed Filing of the appeal initiates a review and requires the assessing official to schedule a preliminary informal meeting with the taxpayer IC 6 1 1 15 1 1 1 2

Where Are The Lowest Property Taxes In Indiana

How To Protest Your Dallas County Property Taxes

Know The Steps To Make Appeal For Assessing Your Property Tax By

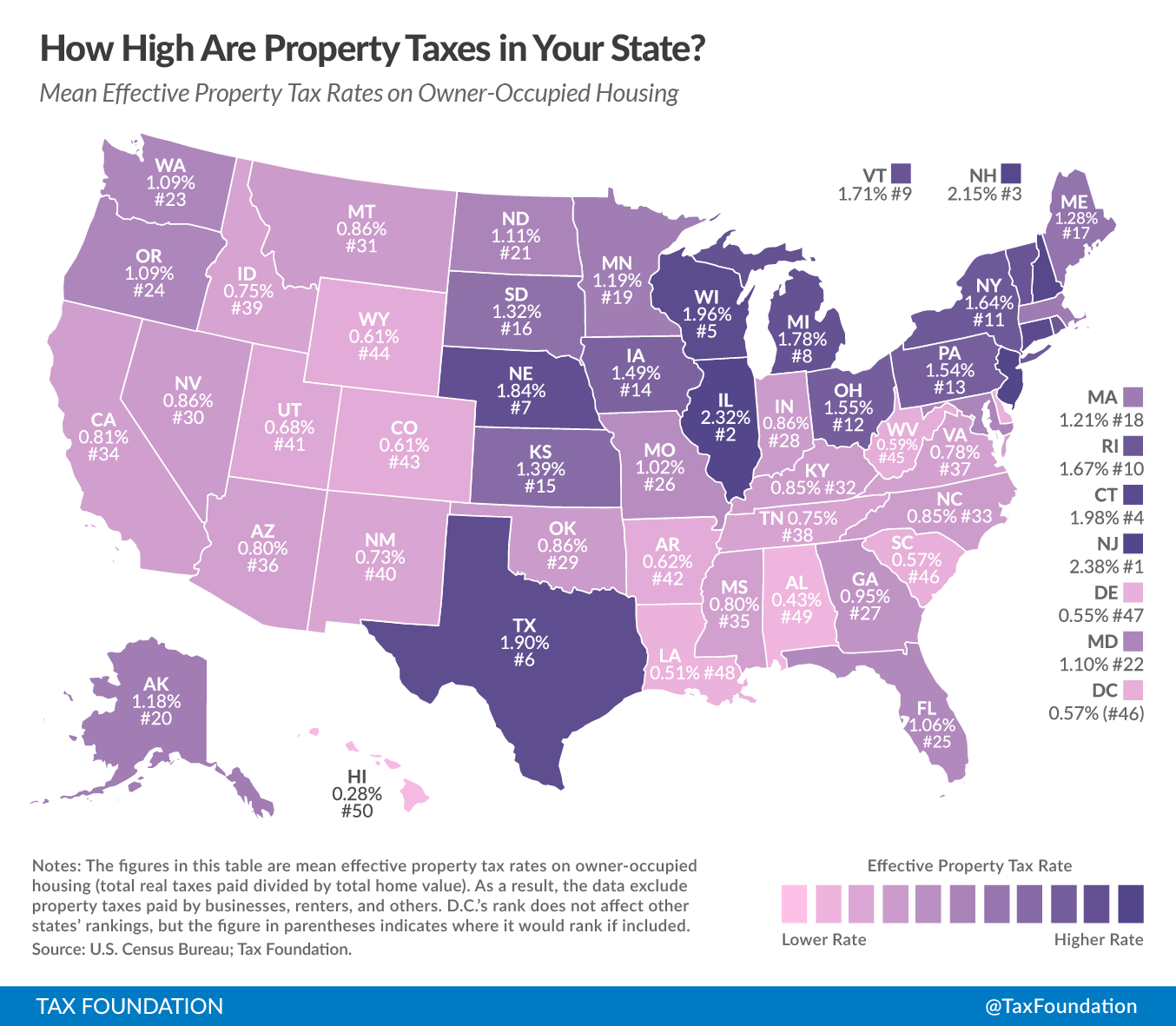

How High Are Property Taxes In Your State Tax Foundation

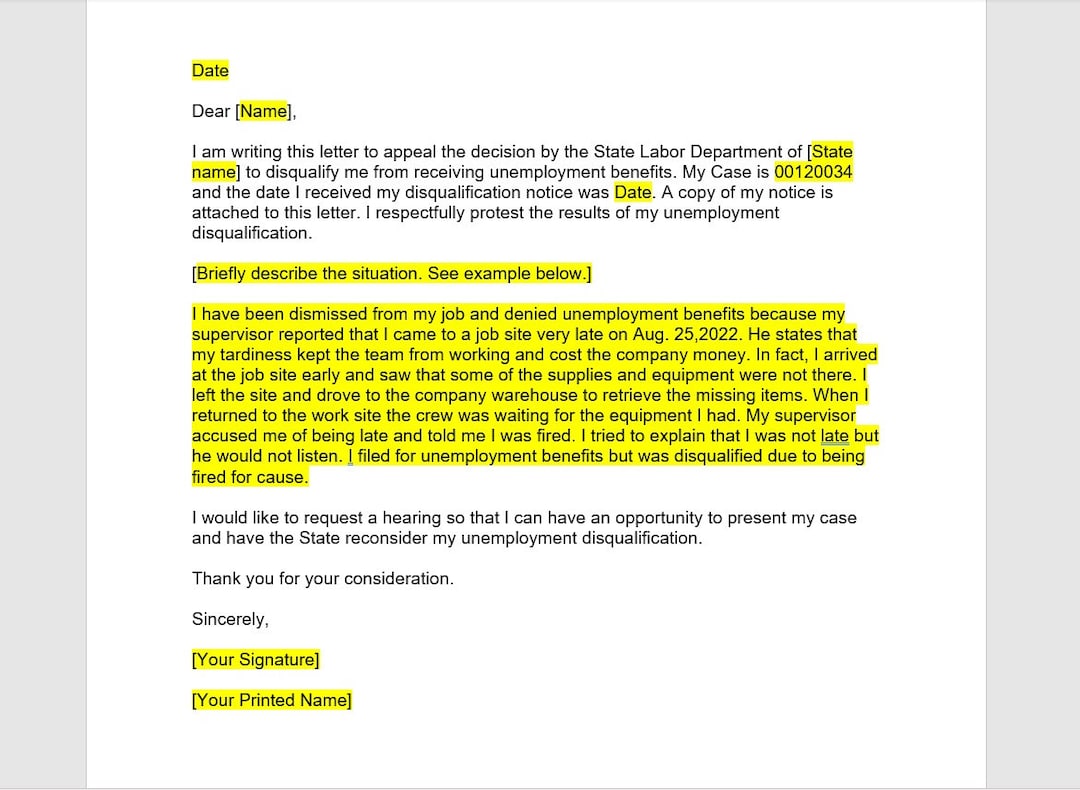

Appeal Letter For Unemployment Disqualification Appeal Letter Etsy

Indiana Property Taxes Are Due TODAY

Indiana Property Taxes Are Due TODAY

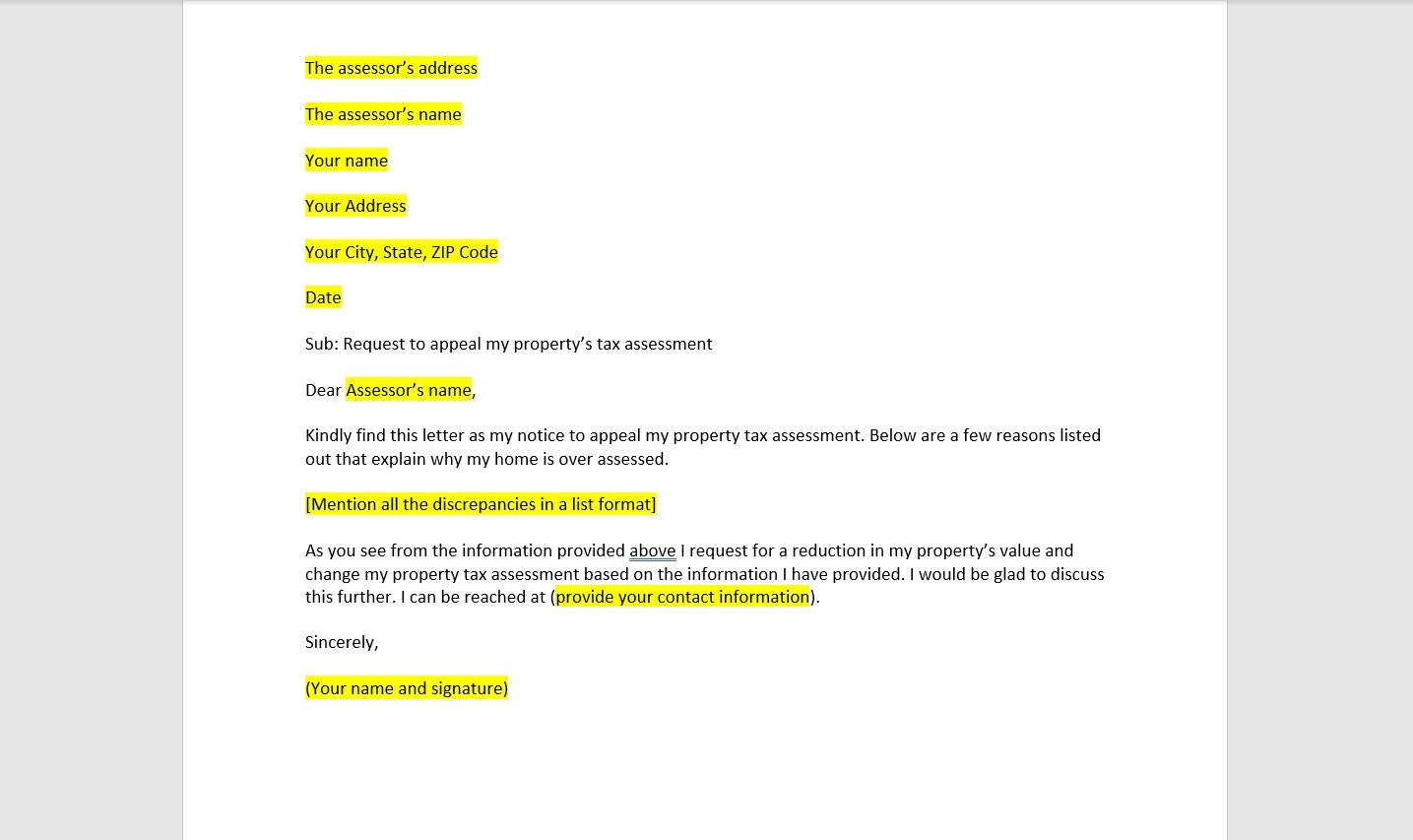

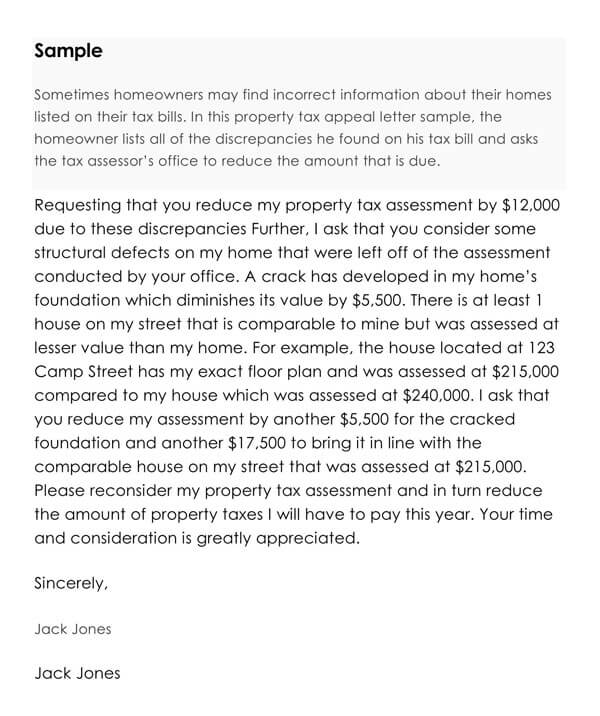

Example Of A Property Tax Appeal Letter CountyForms

Property Tax Appeal Letter Template Property Tax Appeal Letter

Tax Appeal Letter Sample

How Do I Appeal My Property Taxes In Indiana - If you decide that you have a valid case then start the appeals process by filling out the online form Taxpayer s Notice to Initiate an Appeal This form will accept attachments additional documents photos appraisals or other evidence that supports your claim