How Do I Apply For Senior Property Tax Exemption In Illinois To apply for a prorated Senior Exemption you must submit the following Senior Exemption application form Closing or settlement statement Copy of proof of

When do I apply for a Senior Freeze Exemption Senior homeowners must apply for the Senior Freeze Exemption every year during the normal filing period in spring Are there When do I apply for a Senior Freeze Exemption Annual applications are ordinarily required for Senior Freeze Exemption recipients and the Assessor s Office sends

How Do I Apply For Senior Property Tax Exemption In Illinois

How Do I Apply For Senior Property Tax Exemption In Illinois

https://i.ytimg.com/vi/PLheYPBHJSY/maxresdefault.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

How Do I Apply For Property Tax Exemption In Florida YouTube

https://i.ytimg.com/vi/3FAqNyGwXYA/maxresdefault.jpg

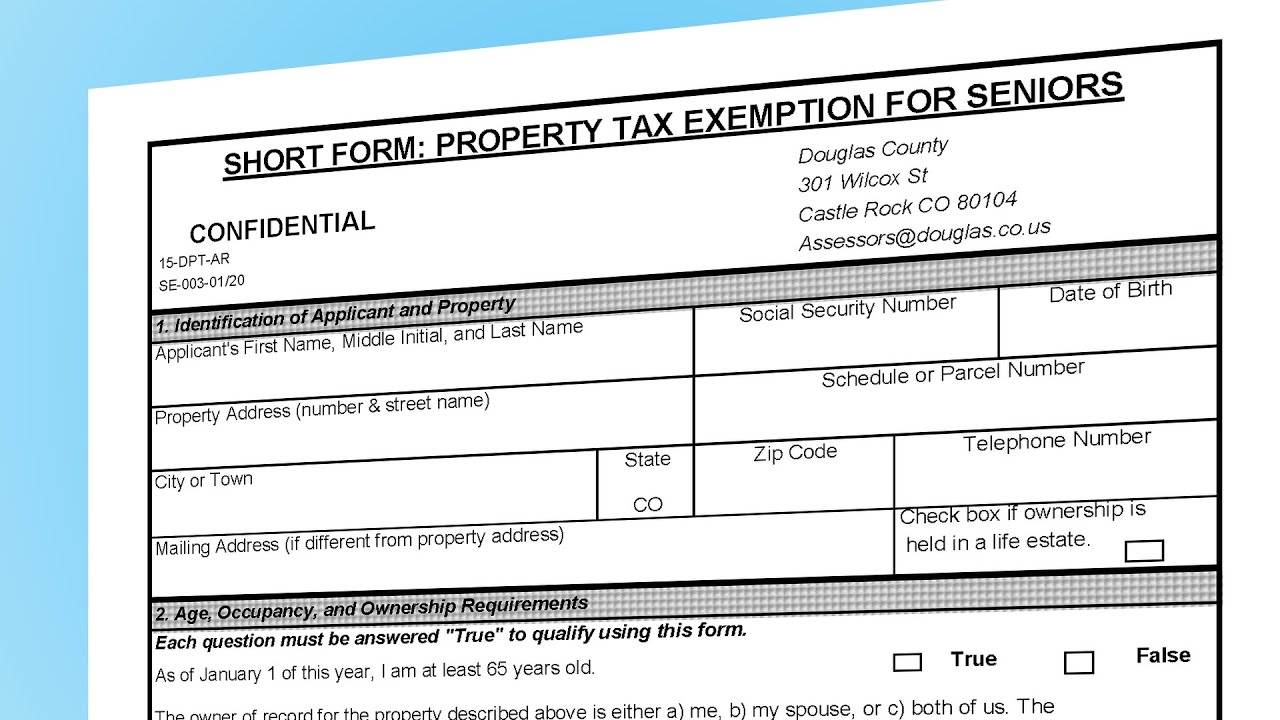

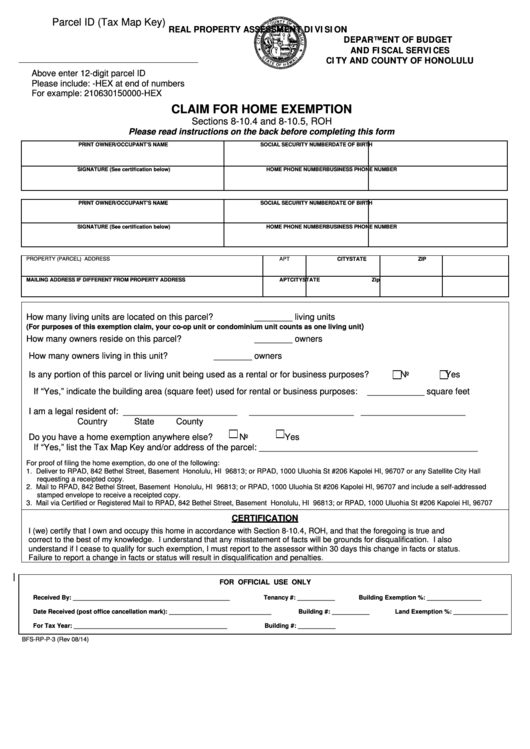

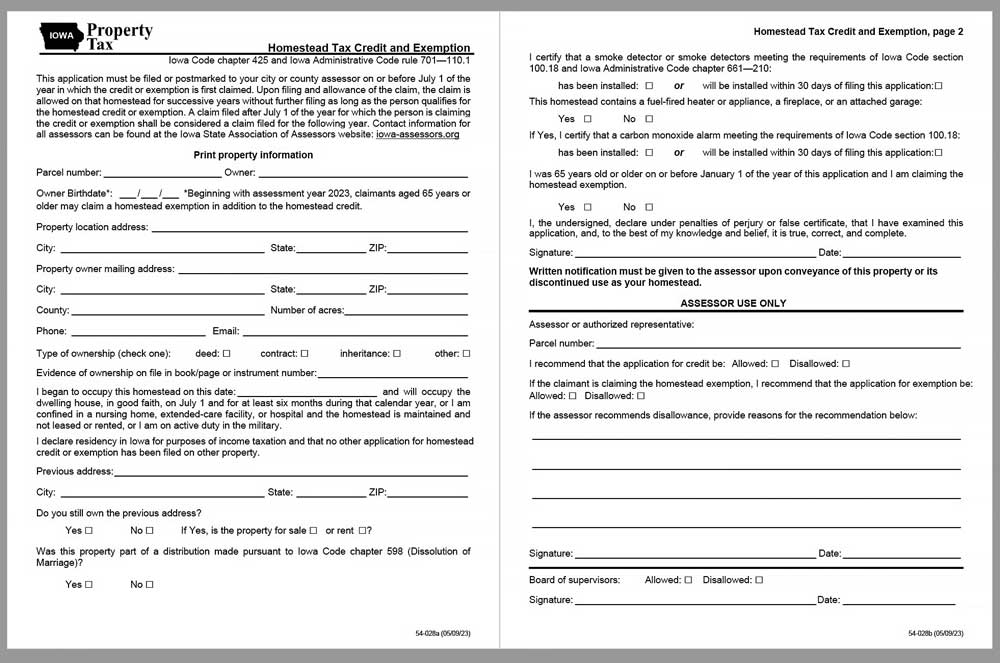

Property tax exemptions are provided for owners with the following situations Homeowner Exemption Senior Citizen Exemption Senior Freeze Exemption Longtime To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older

To Apply All applications must be submitted online through the Smartfile E Filing Portal There is no annual renewal for this exemption Applicants will need to provide proof of 35 ILCS 200 15 172 allows you as a qualified senior citizen to have your home s equalized assessed value EAV frozen at a base year value and prevent or limit any

Download How Do I Apply For Senior Property Tax Exemption In Illinois

More picture related to How Do I Apply For Senior Property Tax Exemption In Illinois

How To Apply For Senior Property Tax Exemption CountyOffice

https://i.ytimg.com/vi/JTTlTtyUILY/maxresdefault.jpg

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

Senior Property Tax Exemptions 101 How You Can Save Big

https://na.rdcpix.com/0f6ea462159088aa63055d8d4f552cacw-c2145427720rd-w832_h468_r4_q80.jpg

Cook County homeowners may take advantage of several valuable property tax saving exemptions There are currently four exemptions that must be applied for or renewed The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That

How do I apply for this exemption You must apply for the exemption with the County Assessment Office You can get an application here Senior Citizen Exemption Form or Seniors and veterans that need to reapply will be mailed application booklets New homeowners first time applicants or those that need to reapply can now do so

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Senior Citizen Property Tax Exemption California Form Riverside County

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/how-to-apply-for-senior-property-tax-exemption-in-california-prorfety.jpg?fit=1080%2C1349&ssl=1

https://stage-drupal.ccaotest.com/senior-citizen-exemption

To apply for a prorated Senior Exemption you must submit the following Senior Exemption application form Closing or settlement statement Copy of proof of

https://www.cookcountyassessor.com/senior-freeze-exemption

When do I apply for a Senior Freeze Exemption Senior homeowners must apply for the Senior Freeze Exemption every year during the normal filing period in spring Are there

Homeowners Exemption Form Riverside County ExemptForm

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Property Tax Exemption For Illinois Disabled Veterans

Senior Homeowners Urged To Apply For New Property Tax Exemption Before

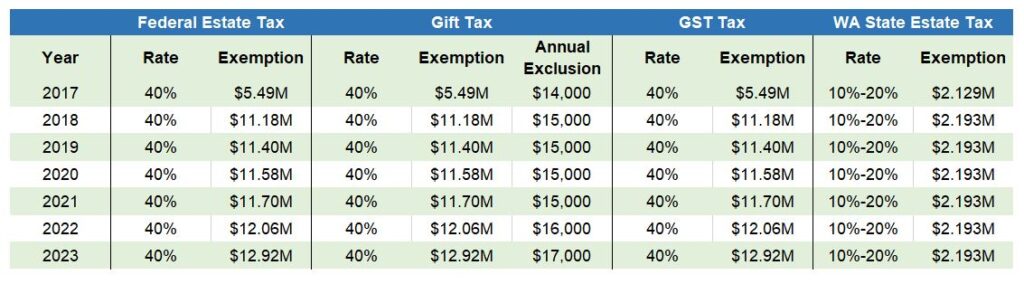

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

Illinois Tax Exempt Certificate Five Mile House

Illinois Tax Exempt Certificate Five Mile House

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Tax Exemption Certificate Form Fill Out Sign Online DocHub

Senior Property Tax Exemption Available Weld County

How Do I Apply For Senior Property Tax Exemption In Illinois - To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older