How Do I Claim My Furnace Tax Credit Claim the credits using the IRS Form 5695 Who can use this credit Must be an existing home your principal residence New construction and rentals do not apply A principal

Use Form 5695 to figure and take your residential energy credits The residential energy credits are The energy efficient home improvement credit Also use Form 5695 to take You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your qualified energy property was originally placed in

How Do I Claim My Furnace Tax Credit

How Do I Claim My Furnace Tax Credit

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/getty/article/165/54/86517326_XS.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

This Is What That Switch By Your Furnace Is For The Family Handyman

https://www.familyhandyman.com/wp-content/uploads/2021/09/20210910-FurnaceSwitch-AD-0003v3-scaled.jpg

Claim the credits using the IRS Form 5695 You may claim the energy efficient home improvement credit for improvements to your main home where you live most of the time Your home must be in the U S and it The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler There are no

Download How Do I Claim My Furnace Tax Credit

More picture related to How Do I Claim My Furnace Tax Credit

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

New Federal Tax Credits Make Replacing Your Furnace Easier

https://x8i6e4k6.stackpathcdn.com/wp-content/uploads/2022/11/replacing-your-furnace-and-saving-money-660x360.jpeg

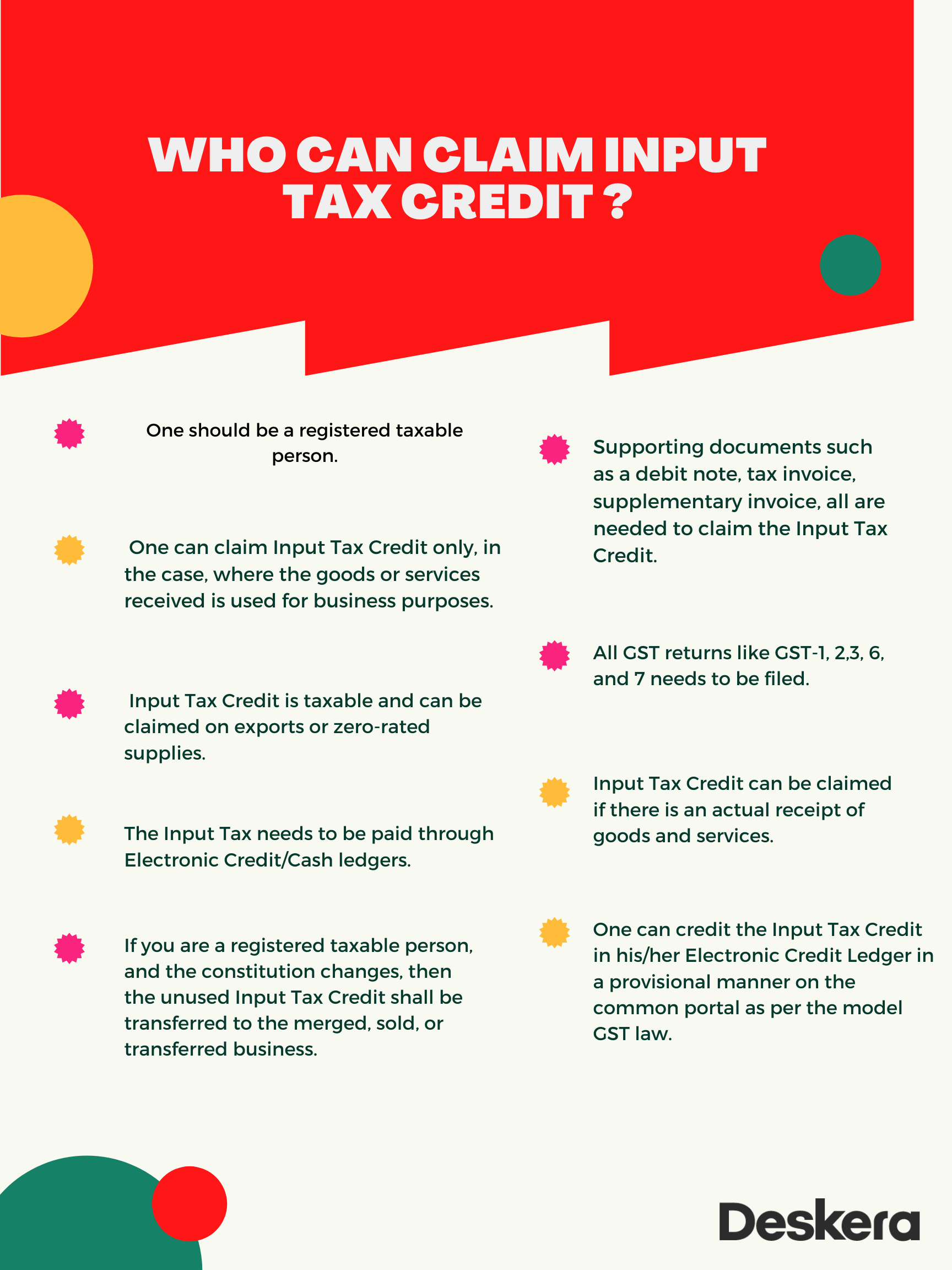

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

For qualified HVAC improvements homeowners might be able to claim 25c tax credits equal to 10 of the install costs up to a maximum of 500 If you re unsure of how to get the tax credit you might be eligible for don t There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the

The maximum allowable credit each homeowner can claim for a given year is 1 200 for energy property costs and specific energy efficient home improvements with a limit of 250 per door whole house Here s my breakdown of the basic process Purchase a qualifying HVAC system Install the system into your home labor costs qualify for tax credit Fill out the

Sentences With Claim 12 Sentences About Claim In English

https://sentenceswith.net/wp-content/uploads/2022/06/Sentences-with-Claim-12-Sentences-about-Claim-in-English.png

New Furnace Cost Gas Furnace Replacement Vs Repair 2019

https://www.remodelingimage.com/wp-content/uploads/2017/12/new-gas-furnace-installation.jpg

https://www.energystar.gov/about/federal-tax...

Claim the credits using the IRS Form 5695 Who can use this credit Must be an existing home your principal residence New construction and rentals do not apply A principal

https://www.irs.gov/instructions/i5695

Use Form 5695 to figure and take your residential energy credits The residential energy credits are The energy efficient home improvement credit Also use Form 5695 to take

Rules For Claiming A Parent As A Dependent TaxSlayer

Sentences With Claim 12 Sentences About Claim In English

Marriage Allowance 1Accounts

.jpg)

Does The Ac Use Gas Or Electricity

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

How Do I Claim My Gift MistoBox

How Do I Claim My Gift MistoBox

The California Furnace Tax Credit An FAQ For Homeowners Bell Brothers

Waar Is De Claimcode Op Een Amazon cadeaubon Stapsgewijze Handleiding

Hvac Can I Remove The Fresh Air Supply That Is Attached Next To My

How Do I Claim My Furnace Tax Credit - The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy