How Do I Claim Uniform Tax Allowance You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction

Amy Roberts Updated 5 April 2024 Share this guide If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot police officer or nurse Flat rate expense allowances Flat rate expenses are those that cover the cost of equipment your employee needs for work This equipment may include tools uniforms and stationery Your employee must incur these costs in performing the duties of their employment and the costs must be directly related to the nature of their employment

How Do I Claim Uniform Tax Allowance

How Do I Claim Uniform Tax Allowance

https://www.thesun.ie/wp-content/uploads/sites/3/2018/10/NINTCHDBPICT0004403735981.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

How To Claim Uniform Tax Rebate And Who s It For The Mini Millionaire

https://theminimillionaire.com/wp-content/uploads/2020/12/pexels-ketut-subiyanto-4349800.jpg

Uniform Allowance Claim Tax Back Now

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_732352393-scaled.jpg

Not necessarily according to the Internal Revenue Service IRS Work clothes that can double as street or evening clothes are no more deductible than anything else in your closet To claim a deduction for buying clothes the clothes have to be mandatory for your job and unsuitable for everyday wear TABLE OF CONTENTS Not to worry you can claim tax relief for up to four years of past uniform expenses plus clothing allowances for the current tax year Here s what we mean If you re a high rate taxpayer entitled to the standard flat rate uniform allowance you can get uniform tax rebates for 2022 23 2021 22 2020 21 2019 20 and 2018 19 tax years

The rebate can be claimed for free by filling out a simple form from HMRC or submitting a tax return for self employed people Read on for more information about uniform tax rebates including who is eligible how to make your claim what is covered and how much you could be due to receive HMRC uniform tax allowance is tax relief for people who have to clean repair or replace work clothing Read our blog to know how to claim uniform tax back

Download How Do I Claim Uniform Tax Allowance

More picture related to How Do I Claim Uniform Tax Allowance

Valoare Ocazional Cople itor Hmrc Uniform Tax Canoe Inutil Instruire

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_196039457-scaled.jpg

Claim Uniform Tax Money Back Helpdesk

https://moneybackhelpdesk.co.uk/images/articles/_articleCard/british-police-33109748-1-min.jpg

Uniform Tax Rebate What It Covers And How Much You Can Claim

https://goselfemployed.co/wp-content/uploads/2023/05/Uniform-tax-rebate.png

Uniform Tax Explained If you wear a uniform at work and have to wash repair or replace it yourself you may be able to claim for up to five years of expenses through your tax Who is eligible for a rebate In order to claim tax relief all of the following have to apply You wear a recognisable uniform that shows you have a certain job Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs

Can I claim a uniform tax rebate If you work for a company where you re expected to wear a uniform and it s down to you to wash and repair it you may be able to claim a tax rebate from HM Revenue Customs HMRC Guides Uniform Benefits and Allowances The Benefits and Allowances You Could Be Entitled To For Wearing a Uniform Uniform tax rebates sometimes called uniform benefits or HMRC uniform allowances are a special kind of tax relief for people who have to clean repair or replace specialist work clothing

How To Claim Uniform Tax Rebate Money Back Helpdesk

https://moneybackhelpdesk.co.uk/images/blog/_articleHero/Mechanic-Uniform-Tax-Rebate.jpg

How To Claim Uniform Tax Relief Radiotimesmoney

https://images.immediate.co.uk/production/volatile/sites/46/2018/11/paul46.1-fef2cd4.jpg?resize=620,413?quality=90&resize=620,414

https://www.gov.uk/tax-relief-for-employees/...

You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction

https://www.moneysavingexpert.com/reclaim/uniform-tax-refund

Amy Roberts Updated 5 April 2024 Share this guide If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot police officer or nurse

HMRC Uniform Tax Rebate Top Tips To Help You Claim This Tax Rebate

How To Claim Uniform Tax Rebate Money Back Helpdesk

An Ultimate Guide To Uniform Tax Rebates And How To Claim Them Back

How To Claim Uniform Tax Relief GoCustom Clothing

Uniform Tax Allowance Waltonbridge

Uniform Tax Allowance Claim My Tax Back

Uniform Tax Allowance Claim My Tax Back

10 UK Tax Rebates That You May Be Eligible For Claim My Tax Back

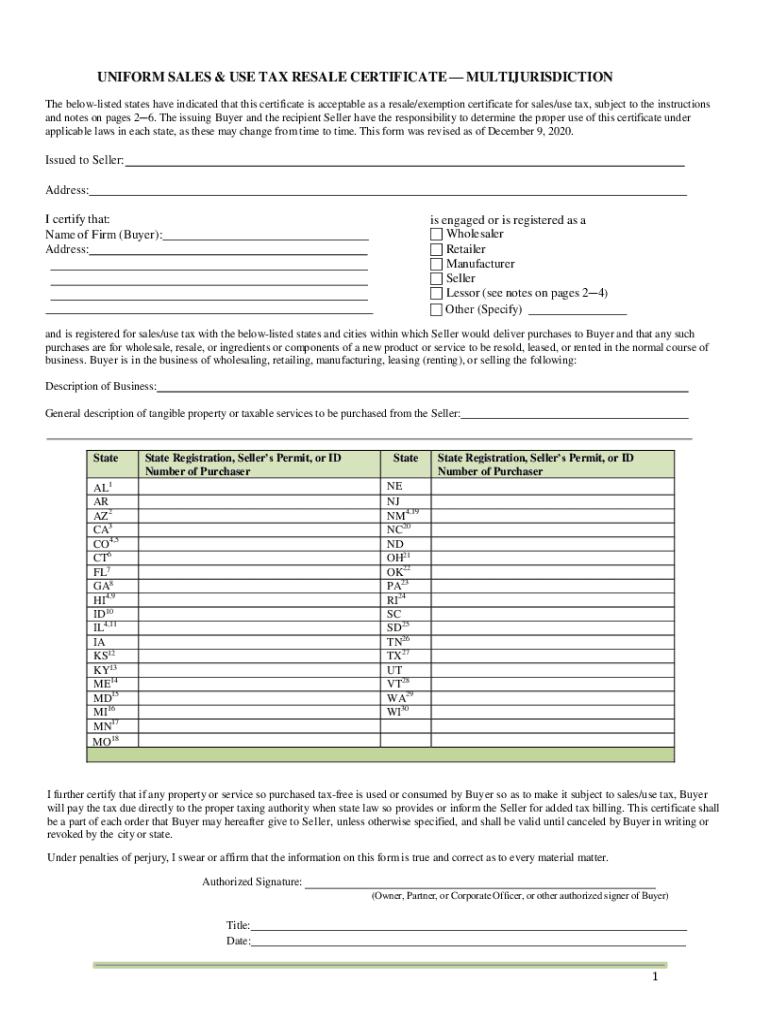

Sales Tax Exemption Certificate Fill Out Sign Online DocHub

How To Claim Uniform Tax Rebate DNS Accountants YouTube

How Do I Claim Uniform Tax Allowance - The tax rebate you can claim is based on The cost of replacing maintaining and washing your uniform The highest rate of income tax you pay The uniform tax rebate does not cover the cost of your initial uniform purchase HMRC lets you choose from two ways to work out the cost of washing replacing and maintaining your