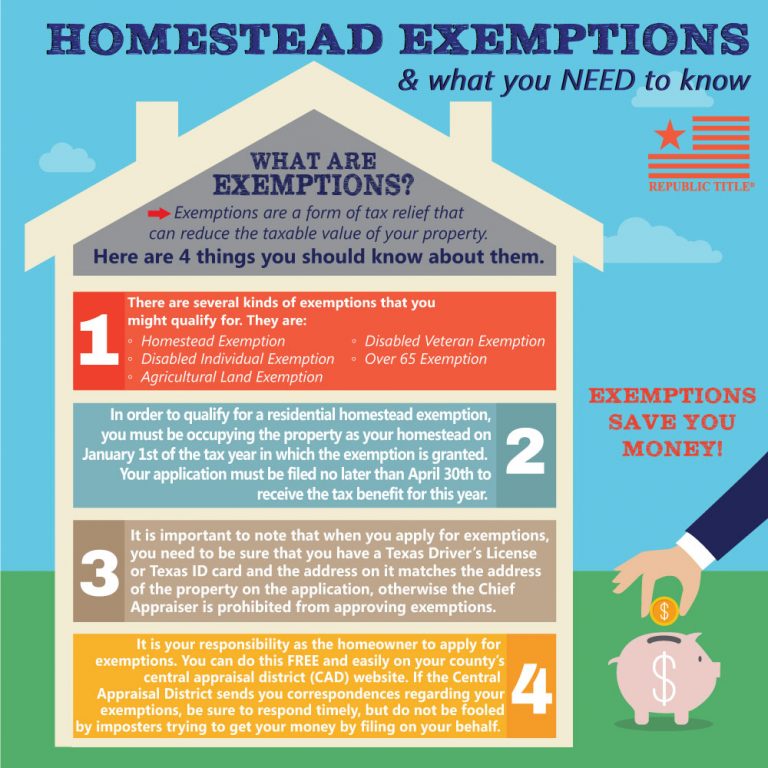

How Do I File For Homestead Exemption In Texas Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located Tax Code Sections 11 13 11 131 11 132 11 133 11 134 and 11 432

Texas residents are eligible for a standard 100 000 homestead exemption from public school districts as of November 2023 which can be applied for via an Application for Residential Homestead Exemption and once granted remains in place without needing annual renewal File your homestead exemption forms online for FREE Claim homestead exemption retroactively for the past two years Section 1 Exemptions Requested Where to find Property ID for homestead exemption Are you transferring an exemption from a previous residence Section 2 Information on property owner s Section 3 Property

How Do I File For Homestead Exemption In Texas

How Do I File For Homestead Exemption In Texas

https://res.cloudinary.com/agiliti/image/upload/v1669104038/texas-homestead-exemption-form-section-1.webp

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

https://sandbergteam.com/wp-content/uploads/2022/01/Homestead-Exemption-Header-2022-1024x630.png

You must apply with your county appraisal district to get a homestead exemption Applying is free and only needs to be filed once You can find forms on your appraisal district website or you can use the Texas Comptroller forms General Exemption Form 50 114 You can use Texas Comptroller Form 50 114 to apply for the General How do I get an additional 10 000 age 65 or older or disabled residence homestead exemption You may apply to the appraisal district the year you become age 65 or qualify for disability If your application is approved you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as

Can I file Texas homestead exemption application online Yes many appraisal districts have an online homestead application In fact CADs encourage homeowners to apply for homestead exemption online for The first step in filing your homestead exemption is downloading the Residence Homestead Exemption Application from your county appraisal district To make this easy for you we ve compiled links and contact information for all counties in and around Texas major metro areas

Download How Do I File For Homestead Exemption In Texas

More picture related to How Do I File For Homestead Exemption In Texas

PRORFETY Homestead Property Tax Exemption Kissimmee Fl

https://i.ytimg.com/vi/QXPFtfP_0fU/maxresdefault.jpg

How To File Texas Homestead Exemption For FREE YouTube

https://i.ytimg.com/vi/D2G4e3M4VzM/maxresdefault.jpg

How To File Homestead Exemption Denton County YouTube

https://i.ytimg.com/vi/SuiCaVfR8ys/maxresdefault.jpg

Fill out a copy of the Application of Residential Homestead Exemption or Property Tax Form 50 114 from your local appraisal district Submit the form to your district Here s how the basic Texas homestead exemption works Section 11 13 b of the state s tax code requires public school districts to offer a 40 000 exemption on residence homesteads located within their districts That s legal jargon for a home that serves as a primary residence

The Texas Legislature has passed a new law effective January 1 2022 permitting buyers to file for homestead exemption in the same year they purchase their new home This will allow for a qualifying new home to be eligible for a Start by requesting the application form from your county appraisal district your mortgage company or by downloading it yourself from Texas s comptroller website You will need to fill out an application each year

Texas Homestead Tax Exemption Guide New For 2024

https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg

Homestead Exemptions

https://www.pbcgov.org/papa/_images/Five_Ways_to_Lose_Homestead.png

https://comptroller.texas.gov/forms/50-114.pdf

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located Tax Code Sections 11 13 11 131 11 132 11 133 11 134 and 11 432

https://www.texasrealestatesource.com/blog/...

Texas residents are eligible for a standard 100 000 homestead exemption from public school districts as of November 2023 which can be applied for via an Application for Residential Homestead Exemption and once granted remains in place without needing annual renewal

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption Guide New For 2024

How To File Homestead Exemption Collin County YouTube

How Much Is The Homestead Exemption In Houston Square Deal Blog

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

How To File Homestead Exemption Dallas County YouTube

Homestead Exemption Mojgan JJ Panah

Hecht Group Can Commercial Property Be Homestead

How Do I File For Homestead Exemption In Texas - Can I file Texas homestead exemption application online Yes many appraisal districts have an online homestead application In fact CADs encourage homeowners to apply for homestead exemption online for