How Do I Qualify For First Time Homebuyer Tax Credit Irs According to the U S Department of Housing and Urban Development HUD you may qualify as a first time homebuyer if you meet the following requirements Keep in mind

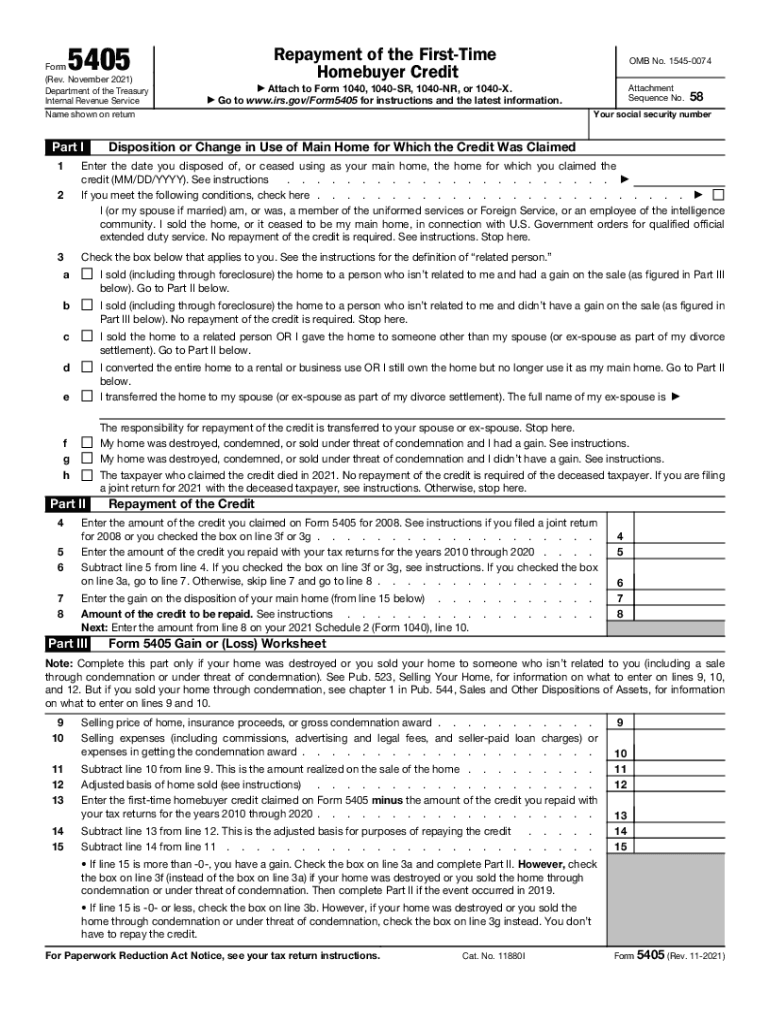

A new version of Form 5405 First Time Homebuyer Credit is available for taxpayers who purchased a home after Nov 6 this new version of the form must be used to claim the credit The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years

How Do I Qualify For First Time Homebuyer Tax Credit Irs

How Do I Qualify For First Time Homebuyer Tax Credit Irs

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

First Time Home Buyer Benefits Do You Qualify

https://u.realgeeks.media/bestdmvhomes/first_time_homebuyer_benefits.jpg

Income Tax Advice From The Experts Tax Refund Financial Counseling

https://i.pinimg.com/originals/5e/96/1b/5e961b404ec8bc51d0495598727357d0.jpg

How to Claim IRS Tax Credits for First Time Homebuyers To claim IRS tax credits for first time homebuyers follow these steps A Mortgage Interest Deduction Obtain a copy of your Form The primary tax credit available to first time homebuyers is the mortgage credit certificate MCC This federal tax credit allows you to deduct a portion of your mortgage interest each tax year MCCs are limited to low and moderate

How Can You Qualify For The First Time Home Buyer Federal Tax Credit In the previous bill you must be a first time home buyer to be eligible for this tax credit That means you can t have co signed a mortgage or bought a house in the A first time homebuyer tax credit is financial assistance the United States government offers to citizens purchasing their first home It works by offering a substantial tax

Download How Do I Qualify For First Time Homebuyer Tax Credit Irs

More picture related to How Do I Qualify For First Time Homebuyer Tax Credit Irs

6 Easy Ways How To Qualify For First Time Homebuyer Tax Credit

https://i1.wp.com/d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOHL1121063_780x440_mobile.jpg

What Is The First Time Homebuyer Tax Credit Does It Still Exist

https://i.pinimg.com/736x/43/68/48/4368485612ee4c7e36e107dcc8a68d06.jpg

How The First time Homebuyer Tax Credit Worked HowStuffWorks

https://media.hswstatic.com/eyJidWNrZXQiOiJjb250ZW50Lmhzd3N0YXRpYy5jb20iLCJrZXkiOiJnaWZcL2hvbWVidXllci10YXgtY3JlZGl0LW9yaWcuanBnIiwiZWRpdHMiOnsicmVzaXplIjp7IndpZHRoIjoiMTIwMCJ9fX0=

Under this new bill eligible buyers would be able to claim a first time homebuyer tax credit worth up to 15 000 In this article we ll explain who could benefit from this tax credit and how to find out if you re eligible for the The first time homebuyer tax credit was an Obama era tax credit that no longer exists Here s what it did and which tax benefits homeowners can still use

First you must occupy the home as your primary residence within 60 days of purchase Second the credit must be claimed on your tax return in the year in which you First time homeowners must be at least 18 years old Homebuyers cannot claim the credit if they purchased a home from a direct relative The new tax credit stands to work

Homebuyer Tax Credit

https://info.gonewhampshirehousing.com/hs-fs/hubfs/2018 AdWords/img_640x425@2x_tax_credit.jpg?width=1920&name=img_640x425@2x_tax_credit.jpg

First Time Homebuyer Tax Incentives All You Need To Know About

https://ratebeat.com/wp-content/uploads/2021/12/first-time-homebuyer-tax-incentives-all-you-need-to-know-about-mortgage-credit-certificates.png

https://www.bankrate.com › mortgages › first-time...

According to the U S Department of Housing and Urban Development HUD you may qualify as a first time homebuyer if you meet the following requirements Keep in mind

https://www.irs.gov › pub › irs-news

A new version of Form 5405 First Time Homebuyer Credit is available for taxpayers who purchased a home after Nov 6 this new version of the form must be used to claim the credit

Biden s First Time Homebuyer Tax Credit Program How To Benefit The

Homebuyer Tax Credit

Biden s First Time Homebuyer Tax Credit Is A Big Improvement Over The

Who Can Qualify For Biden s 15 000 First Time Homebuyer Tax Credit

Return Of The 5 000 First time Homebuyer Tax Credit To DC PoPville

First Time Homebuyers Got Billions In Tax Credits September October 2012

First Time Homebuyers Got Billions In Tax Credits September October 2012

Who Qualifies For Biden s 15 000 First Time Home Buyer Tax Credit

Irs First Time Homebuyer Credit Fill Out Sign Online DocHub

Form 5405 First Time Homebuyer Credit

How Do I Qualify For First Time Homebuyer Tax Credit Irs - The primary tax credit available to first time homebuyers is the mortgage credit certificate MCC This federal tax credit allows you to deduct a portion of your mortgage interest each tax year MCCs are limited to low and moderate