How Do I Update My Tax Credits Online To do this you can either check your Income Tax and tell HMRC about a change call HMRC If you do not you could pay too much tax or get a tax bill at the end of the year What you must

You ll need your renewal pack if you have one your National Insurance number details about any changes to your circumstances you and your partner s total income for the last tax year 6 April You can do the following transactions for you and your civil partner or spouse View your tax record for the current year This includes the tax credits you receive and the incomes employment and pensions that are on record for you View or update your Universal Social Charge USC position

How Do I Update My Tax Credits Online

How Do I Update My Tax Credits Online

https://help.ted.com/attachments/token/ntITaXry1zqUH9tW7PC6qnUuK/?name=Screen+Shot+2022-05-20+at+2.17.14+PM.png

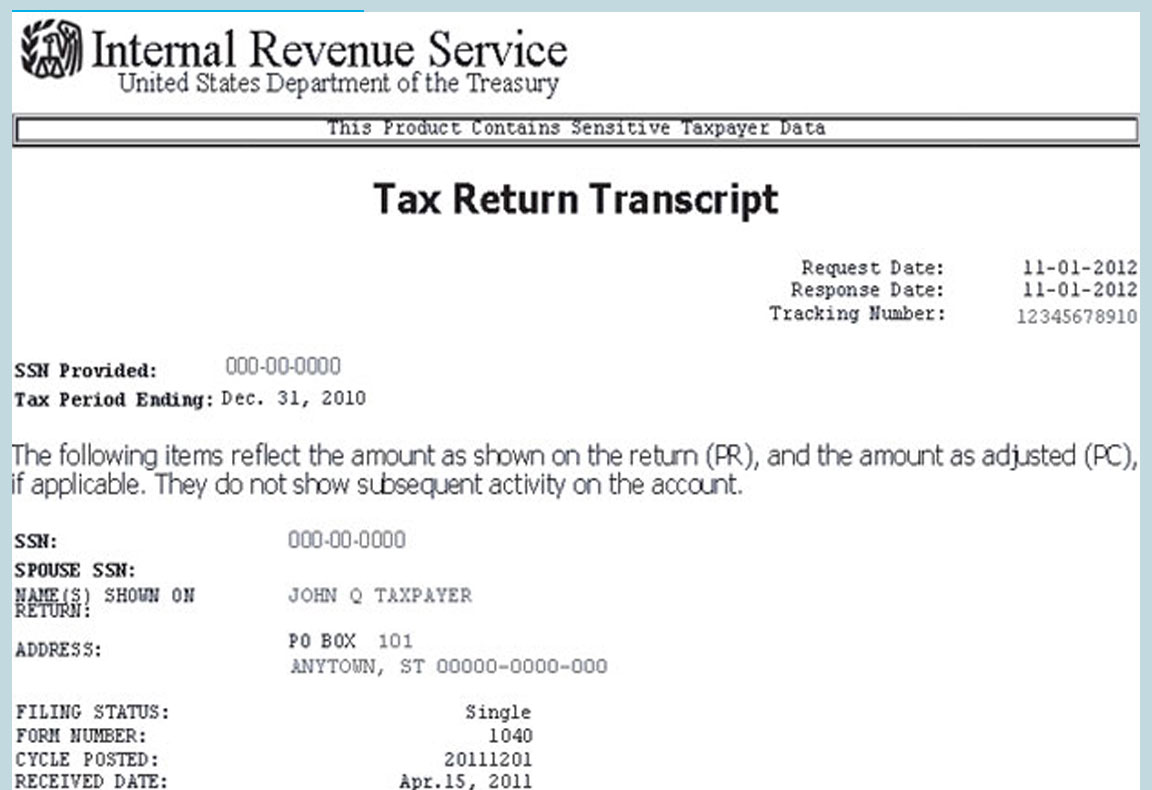

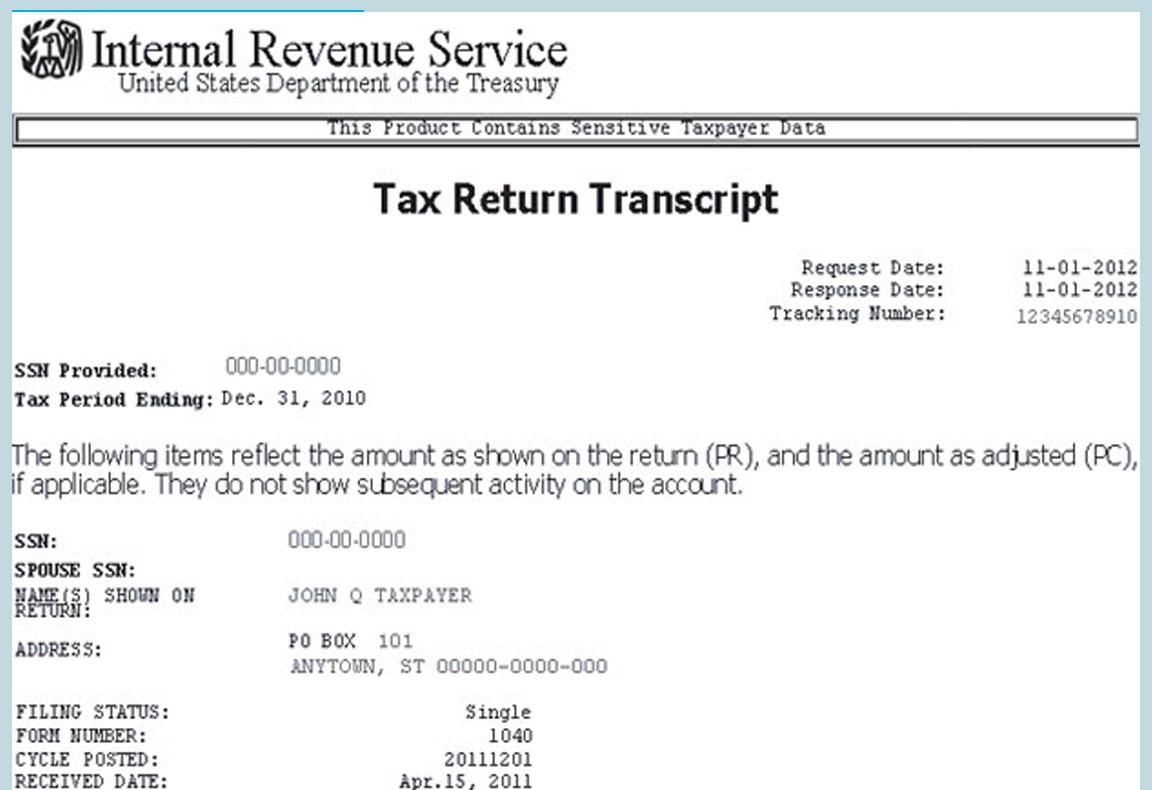

IRS Redesigns Tax Transcript To Protect Taxpayer Data CPA Practice

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/31212/Tax_Return_Transcript_M_1_.5b7dc4cc39e04.png

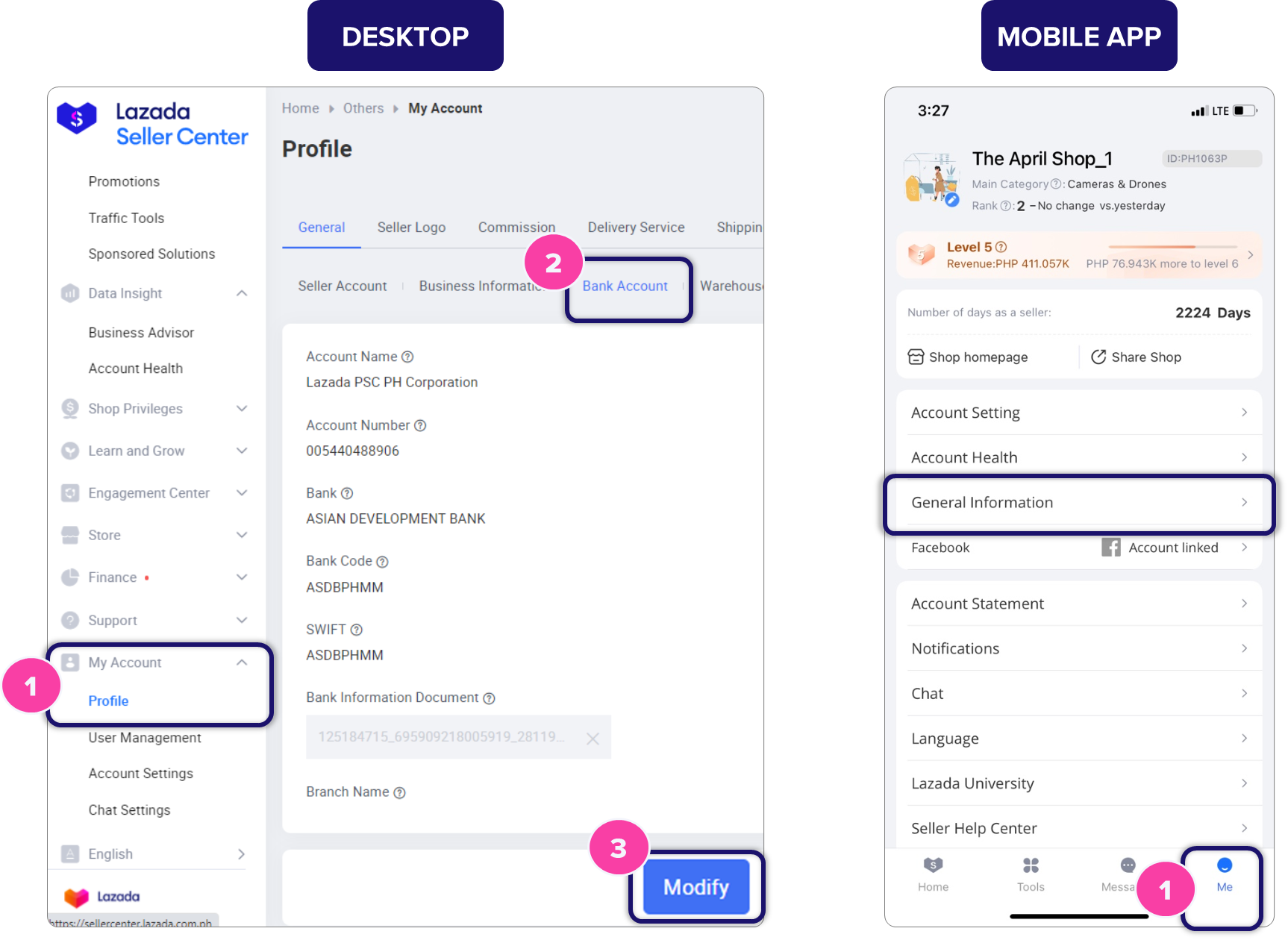

How Do I Update Bank Account Information Lazada Community

https://beebot-sg-knowledgecloud.oss-ap-southeast-1.aliyuncs.com/kc/kc-media/kc-oss-1640247767198-image.png

Changes to your personal information will affect your tax returns You must update your information to prevent delays in processing your tax returns and refunds How to Change Your Address If your address has changed you need to notify the IRS to ensure you receive any IRS refunds or correspondence Look out for the letter this confirms they ve recorded your change of circumstance and will be paying you the right amount of tax credits Check the letter to make sure HMRC has recorded the right change of circumstance You ll need to tell them within 1 month after the date on the letter if they ve made a mistake

How can the expanded and increased Child Tax Credit and advance Child Tax Credit payments coupled with the current income tax withholding from my pay affect the amount of my tax refund or balance due on my income tax return for 2021 updated May 20 2022 Page Last Reviewed or Updated 08 Jun 2023 Access tax records in Online Account You can view your tax records now in your Online Account This is the fastest easiest way to Find out how much you owe Look at your payment history See your prior year adjusted gross income AGI View other tax records Visit or create your Online Account

Download How Do I Update My Tax Credits Online

More picture related to How Do I Update My Tax Credits Online

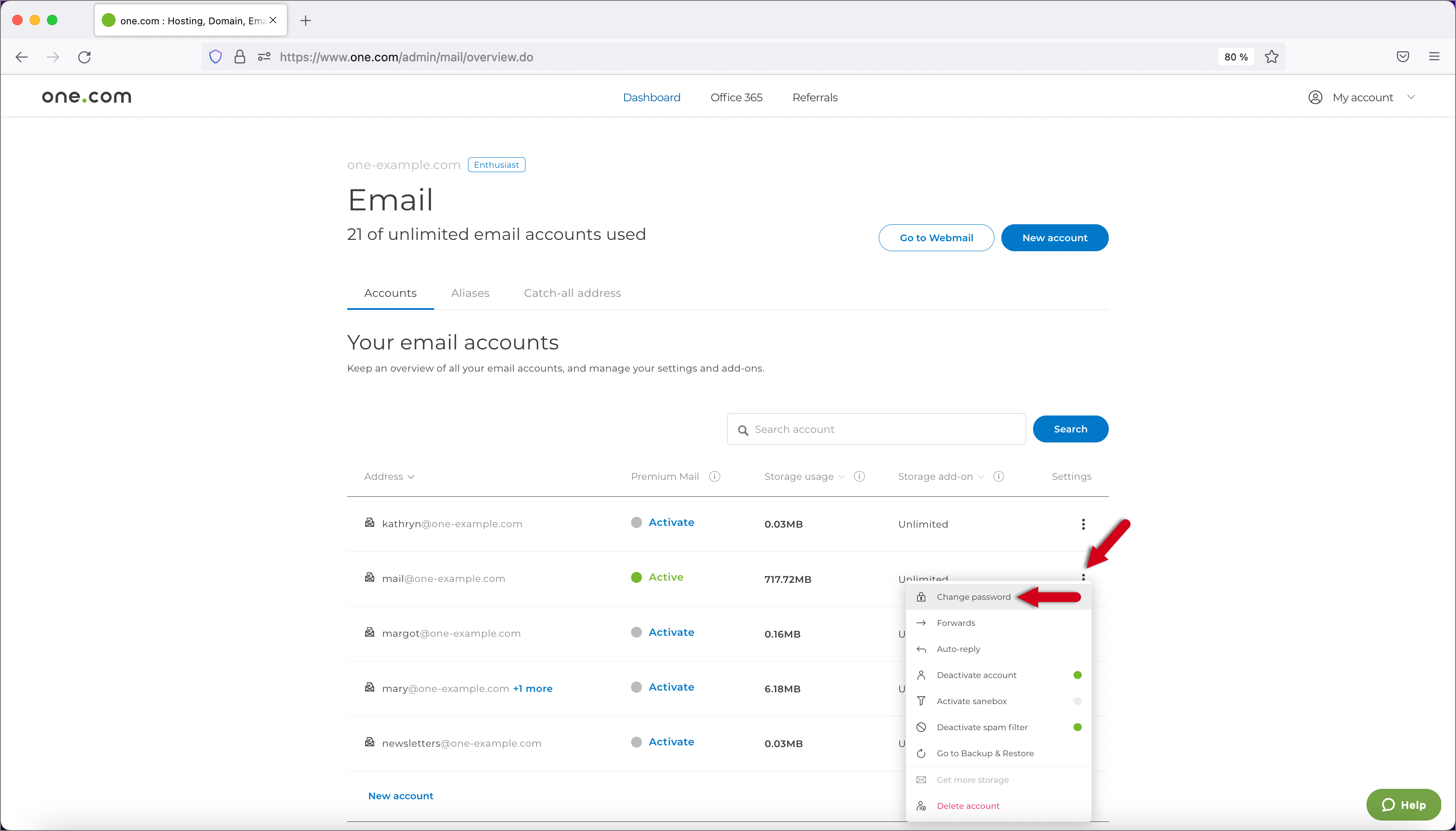

How Do I Change The Password On My Apple Watch Great Offers Save 52

https://help.one.com/hc/article_attachments/7453002816785/changepwd.png

How Do I Update My Tax Information Stripe Help Support

https://media.stripe.com/5ddc237372304ec1aae0f62d7c540113254155fa8fe71083340c6dab2606a5c5.png

How Do I Update The Payment Method On My Subscription Pique

https://files.helpdocs.io/4yn1wqprmf/articles/mr3o99m9j1/1660451379911/n-1-bjz-ztifq-wlr-l-wquo-nv-ee-l-08-db-thzqlj-vhe-j-6-s-6-r-tlq-e-2-r-ds-nn-peeud-hd-acqa-ejo-bsme-kar-juwwfa-ig-5-fjth-wi-z-hh-gwm-rtq-g-pc-e-6-ib-a-92-bkfs-i-1-c-97-h-wejwz-nwjq-0-hno-8-z-ukvupkv-pgm

Enter a line number from the income tax and benefit return such as 12600 or text to describe the line you want to find such as rental income Then select Search From the search results list find the line you want to change and click on it for example click on line 12600 If you want to go to a specific section of the return select The easiest way to report a tax credits change is online via the GOV UK website But the online service does not allow you to report all types of changes such as The bank account that you want to use Most changes that have not yet happened excludes a change to existing childcare costs which is up to one week in advance

You can access this service through myAccount by following these steps Click on the Review your tax 2019 2022 link in PAYE Services Select the appropriate year from the drop down menu and click the select button Request a Statement of Liability Click on Complete Income Tax Return and follow the steps to complete the return Each year HMRC will automatically send you a set of renewal papers and so long as you do what you are asked within the time limits requested the legislation treats you as having claimed again for the new tax year Although called the renewals process not everyone wants to or needs to renew their claim

I Forgot The Password Of My Avokiddo Account How Do I Retrieve It

https://www.avokiddo.com/wp-content/uploads/2021/07/Thinkrolls-free-trial-banner.jpg

How Do I Update My Payment Method Signaturely Help Center

https://d33v4339jhl8k0.cloudfront.net/docs/assets/5f988c41c9e77c001621c103/images/62ed774380fd5a31e7acfa79/file-BjqwD2xhDX.png

https://www.gov.uk/tell-hmrc-change-of-details/income-changes

To do this you can either check your Income Tax and tell HMRC about a change call HMRC If you do not you could pay too much tax or get a tax bill at the end of the year What you must

https://www.gov.uk/renewing-your-tax-credits-claim

You ll need your renewal pack if you have one your National Insurance number details about any changes to your circumstances you and your partner s total income for the last tax year 6 April

How Do I Update The Duolingo English Test Desktop App To The Most

I Forgot The Password Of My Avokiddo Account How Do I Retrieve It

How Do I Update My Payment Method Signaturely Help Center

How Can I Update My Payment Card Details Effective Methods

How Do I Update The Tax Rate For My Items In The Merchant Portal

How Do I Update My Payment Info Flex

How Do I Update My Payment Info Flex

How Do I Update My Banking Details For SASSA Srd Wasomi Ajira

Tax Credits Save You More Than Deductions Here Are The Best Ones

The Complete List Of Tax Credits For Individuals

How Do I Update My Tax Credits Online - Look out for the letter this confirms they ve recorded your change of circumstance and will be paying you the right amount of tax credits Check the letter to make sure HMRC has recorded the right change of circumstance You ll need to tell them within 1 month after the date on the letter if they ve made a mistake