How Do Tax Deductions Work Uk Understanding how Income Tax and Personal Allowance works can seem confusing at first Learn how much you should pay in England and Northern Ireland

On certain job related expenses known as a tax deductible expense you can claim tax relief for the amounts you ve paid out This applies both where you Deductions from your pay Your employer is not allowed to make deductions unless it s required or allowed by law for example National Insurance income tax or student loan

How Do Tax Deductions Work Uk

How Do Tax Deductions Work Uk

https://i.ytimg.com/vi/qCWzMJiOPrI/maxresdefault.jpg

How Do Tax Deductions Work In Australia

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1e1iJ8.img?w=728&h=485&m=4&q=79

What Are Tax Deductions And Credits 20 Ways To Save Mint

https://blog.mint.com/wp-content/uploads/2022/12/should-i-itemize-or-take-the-standard-deduction.png?w=2880

For the 2024 25 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal Our online income tax calculator will help you work out your take home net pay based on your salary and tax code Find out how much money you will actually receive based on your weekly monthly or annual wages

Check what deductions can be made from pay and wages including overpayments and training costs How much income tax you pay will depend on your earnings and tax free allowances To find out the full rates you need to pay read our income tax advice

Download How Do Tax Deductions Work Uk

More picture related to How Do Tax Deductions Work Uk

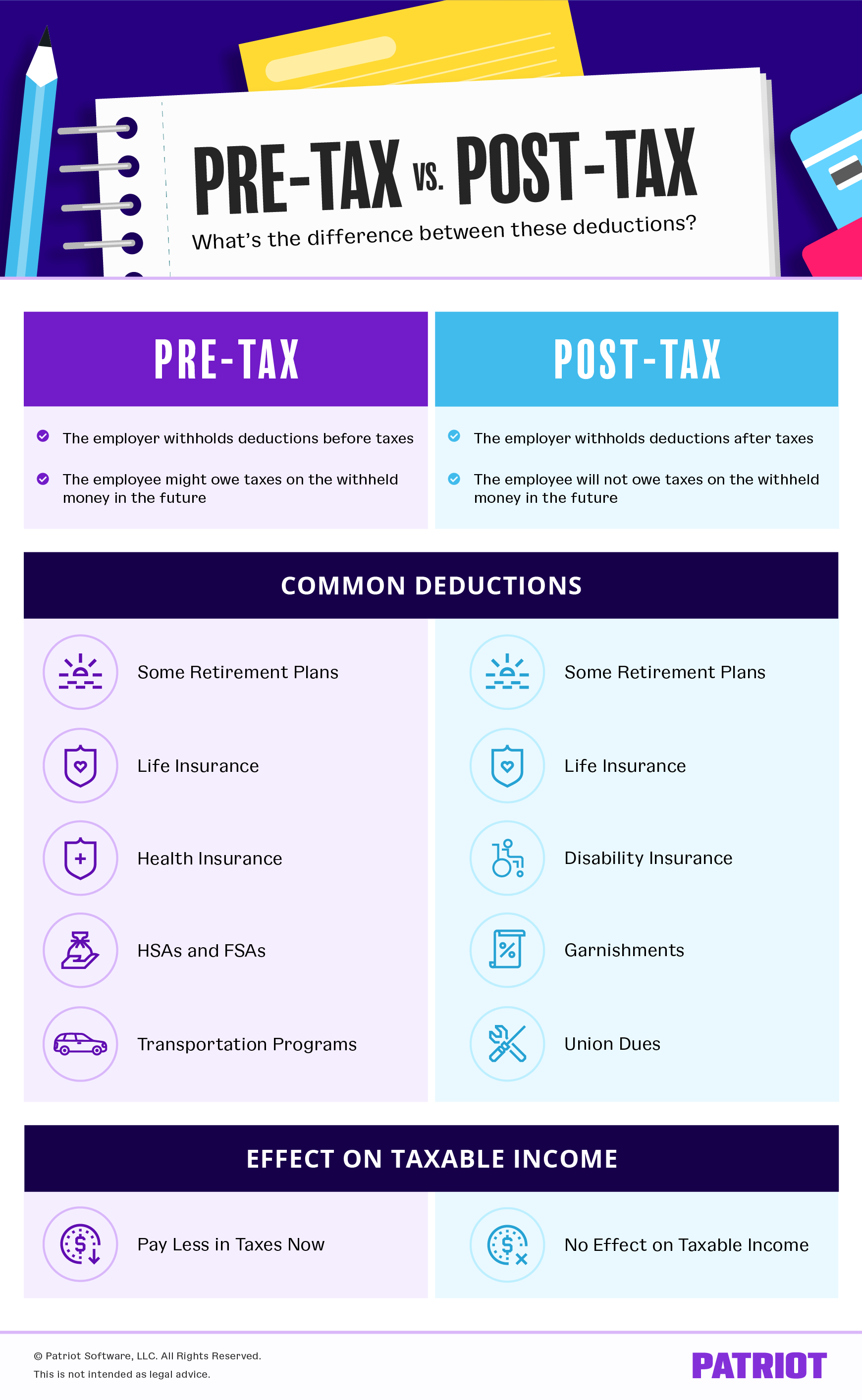

Pre tax Vs Post tax Deductions What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2017/03/pre-tax-vs-post-tax.png

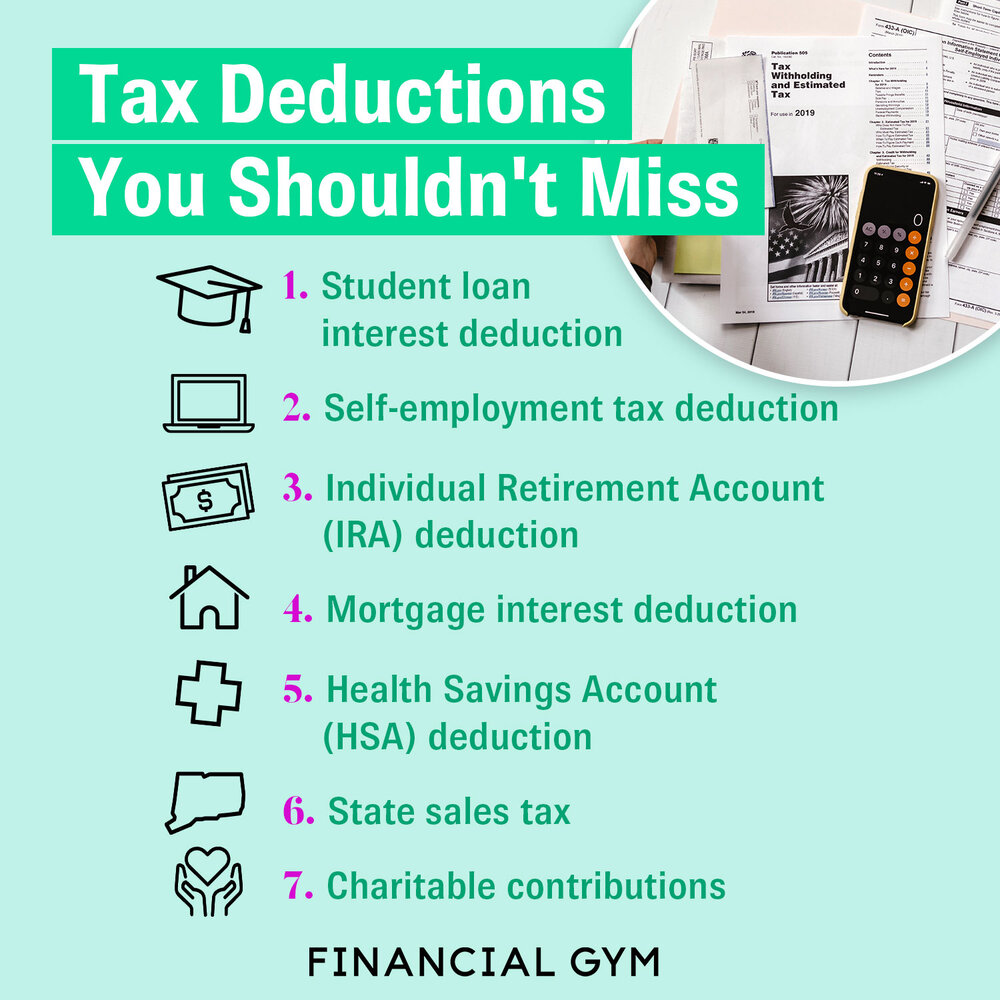

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg?format=1000w

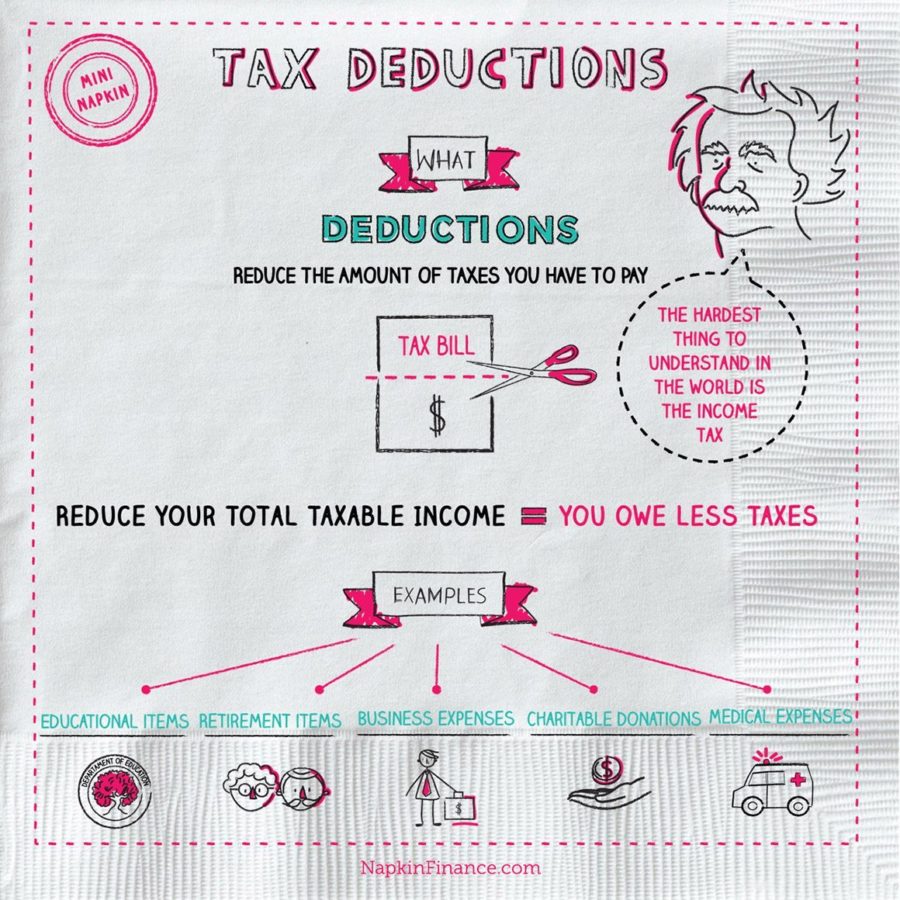

How Do Tax Deductions Work

https://lionessmagazine.com/wp-content/uploads/2018/07/napkin-finance-tax-deductions-e1506911042187.jpg

Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more Understanding which expenses are allowable and which are not is essential for ensuring compliance and optimising one s tax position This article aims to shed

You can claim tax back on some of the costs of running your business what HMRC calls allowable expenses These appear as costs in your business accounts Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income Student loan pension contributions

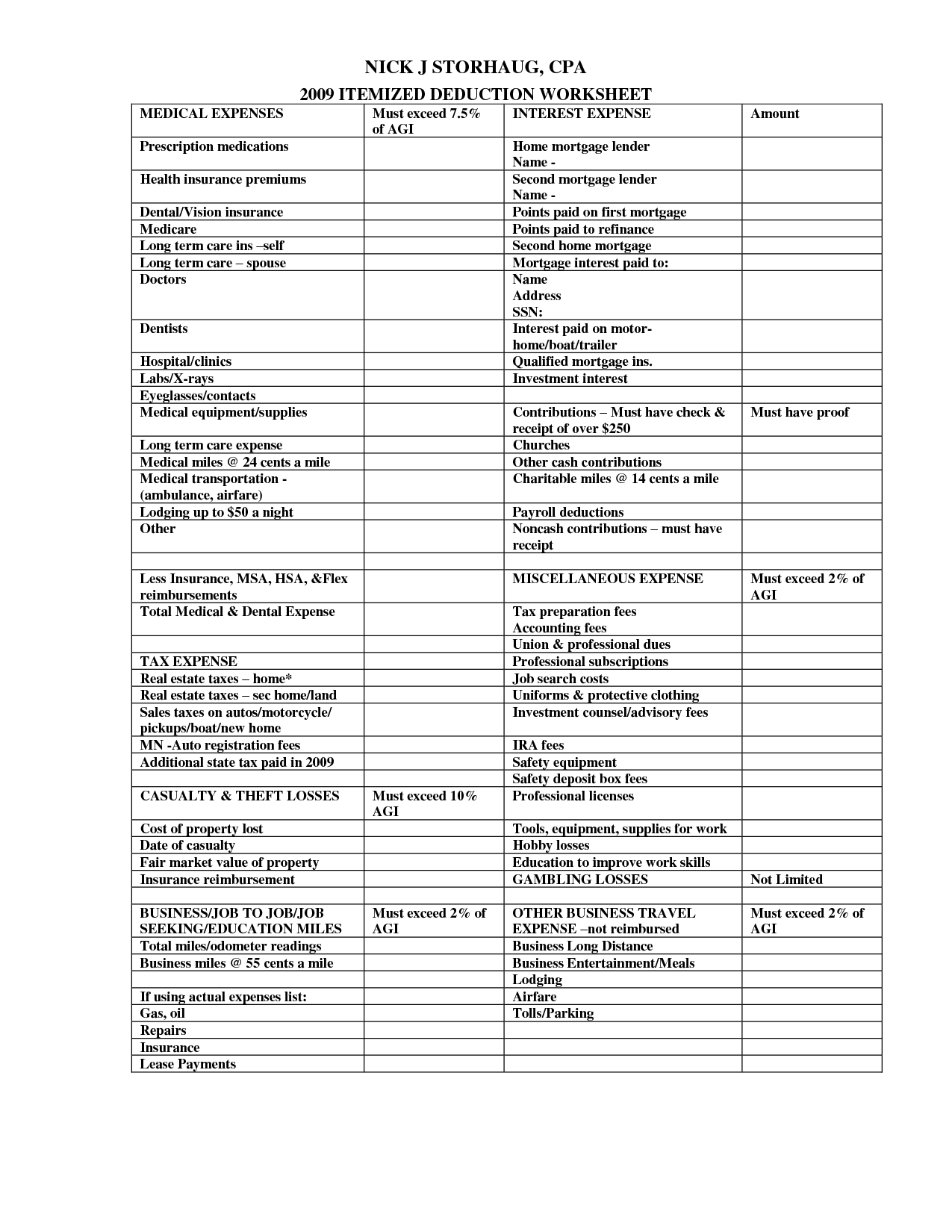

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

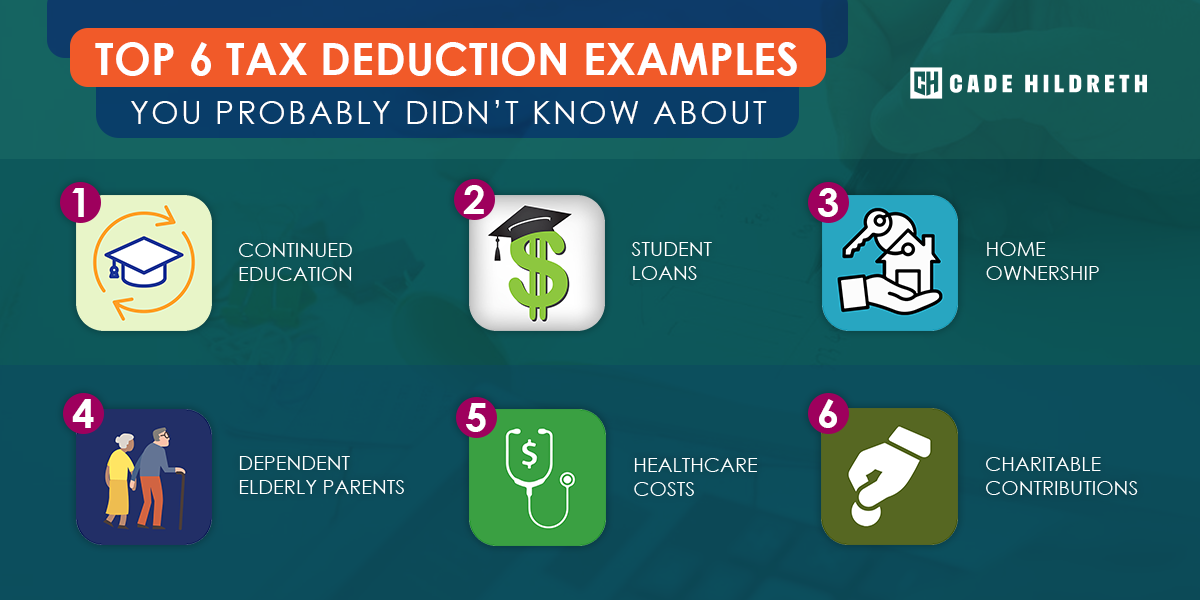

Top 6 Tax Deduction Examples You Probably Didn t Know About

https://cadehildreth.com/wp-content/uploads/2020/01/tax-deduction-examples.png

https://www.moneyhelper.org.uk/en/work/employment/...

Understanding how Income Tax and Personal Allowance works can seem confusing at first Learn how much you should pay in England and Northern Ireland

https://www.which.co.uk/money/tax/income-tax/tax...

On certain job related expenses known as a tax deductible expense you can claim tax relief for the amounts you ve paid out This applies both where you

5 Tax Deductions Small Business Owners Need To Know

Printable Itemized Deductions Worksheet

How Do Tax Breaks Work

The Standard Deduction Vs Itemizing Your Tax Return Which Is Best

Tax Deduction Worksheet For Self Employed

A Singaporean s Guide How To Claim Income Tax Deduction For Work

A Singaporean s Guide How To Claim Income Tax Deduction For Work

What Are Tax Deductions Napkin Finance

Ca Itemized Deduction Worksheet

Tax Credit Vs Tax Deduction Difference And Comparison Diffen

How Do Tax Deductions Work Uk - For the 2024 25 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal