How Do You Claim Working From Home Allowance On Tax Return As per HMRC guidance you may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the

For the tax year 2020 2021 I am amending my self assessment form to claim for working from home tax reclaim I managed to trackdown the box where i should be filling the You can claim the business proportion of these bills by working out the actual costs You can only use simplified expenses if you work for 25 hours or more a month from home Example You

How Do You Claim Working From Home Allowance On Tax Return

How Do You Claim Working From Home Allowance On Tax Return

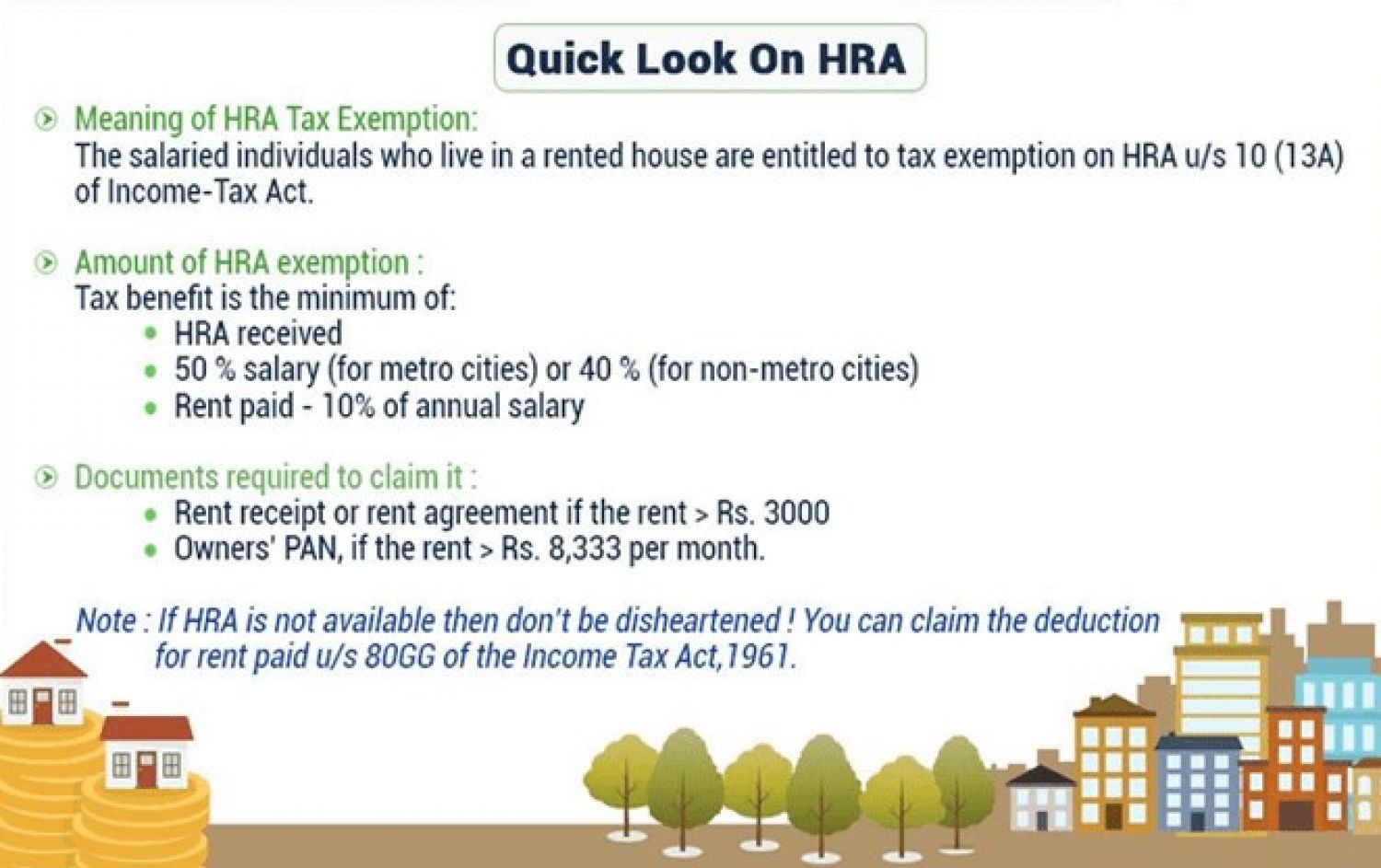

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Who Goes First On Your Joint Tax Return Probably Not The Woman WSJ

https://images.wsj.net/im-709909/square

How To Claim Working From Home Allowance On Self Assessment 2024

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/how-to-claim-working-from-home-allowance-on-self-assessment_447101-1.jpg

As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks This allowance is expected to remain the same for the 2024 25 tax year For limited company owners you can claim tax relief for working from home through your business If you are self employed you can claim this relief on your tax return If you are an employee whose employer does not

How do I claim tax relief for working from home Head over to the new HMRC tax relief microservice page and follow the instructions there You ll need to have your Government HMRC sets out different ways you can claim for working from home if you re self employed In this guide you ll find out your options to claim for your home office the work

Download How Do You Claim Working From Home Allowance On Tax Return

More picture related to How Do You Claim Working From Home Allowance On Tax Return

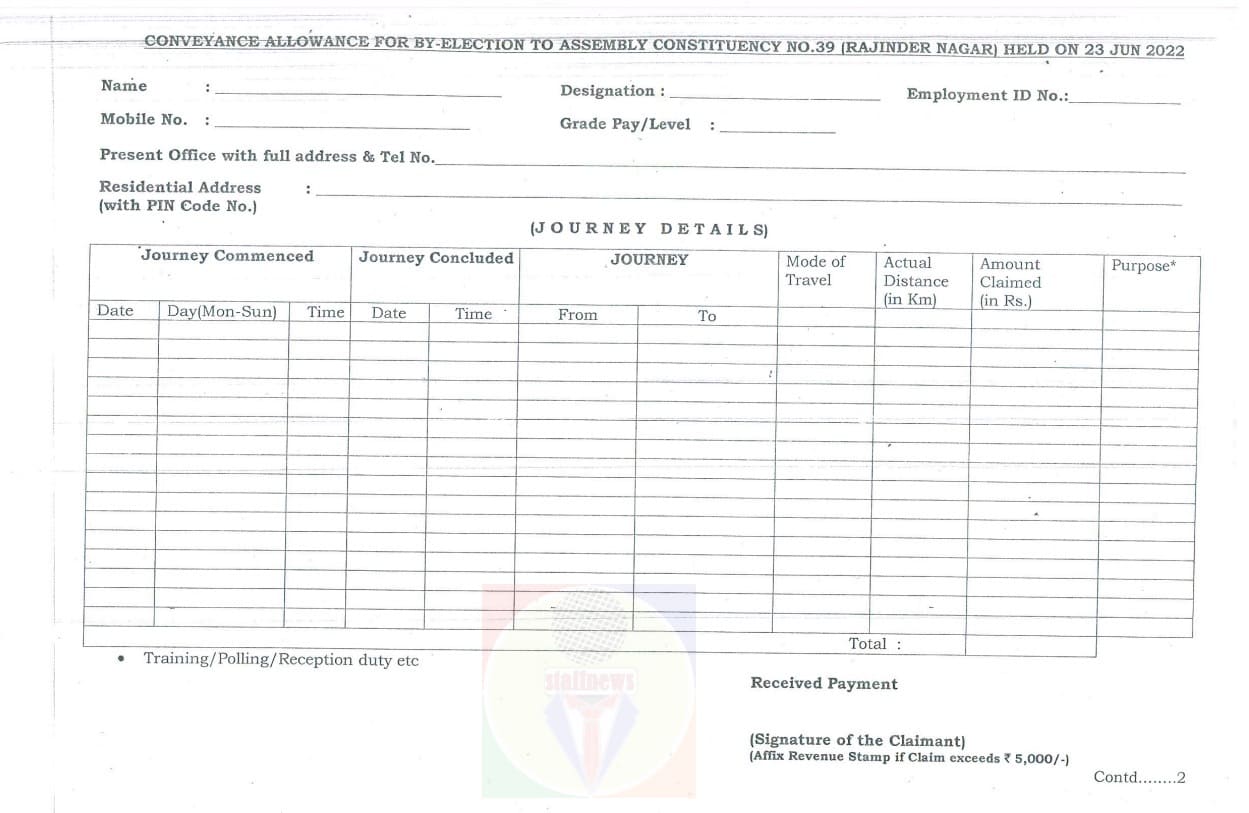

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

https://cdn.mos.cms.futurecdn.net/285sr7iY5FcNx8K3S2JeUd.jpg

How To Claim Working From Home Tax Relief Home Business Business Tips

https://i.pinimg.com/736x/56/8a/3c/568a3c528106380ce4d268619dd937be.jpg

There are two ways to claim expenses either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief during the year or after the end of the year You will get money back

As a sole trader working from home you can claim back part of the expenses associated with having a home office to reduce your tax bill HMRC refers to this as the use home as office Apply for working from home tax relief online at Gov uk or by calling HMRC Anyone required to work from home even for one day could also apply for tax relief for the

Tax Saving Tips How To Claim Working From Home Tax Relief

https://res.cloudinary.com/gosolo-site/image/upload/v1667204083/lxuegxtgot8onzzc6q6a.jpg

Can You Claim Home Insurance On Taxes

https://production-content-assets.ratecity.com.au/20221216/can-you-claim-home-insurance-on-taxes-aHGbEYg36.jpg

https://kb.taxcalc.com › index.php

As per HMRC guidance you may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the

https://forums.moneysavingexpert.com › discussion

For the tax year 2020 2021 I am amending my self assessment form to claim for working from home tax reclaim I managed to trackdown the box where i should be filling the

ATO Announces Changes To Work From Home Deductions Invigor8

Tax Saving Tips How To Claim Working From Home Tax Relief

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Working From Home Look At The New Method Of Claiming Deductions MKS

Work From Home Allowance Increase 80C Exemption What Taxpayers Expect

What Is Line 10100 On Tax Return Tax Help RightFit Advisors

What Is Line 10100 On Tax Return Tax Help RightFit Advisors

Begin Your Journey For Marriage Allowance Refund With The Married

House Rent Allowance Exemption And Tax Deduction

Child Tax Credit How Much Will You Get In 2023 And 2024

How Do You Claim Working From Home Allowance On Tax Return - As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks This allowance is expected to remain the same for the 2024 25 tax year