How Do You Qualify For Homestead Exemption In Nebraska Form 458 Schedule I Income Statement and Instructions Form 458B Certification of Disability for Homestead Exemption Form 458T Application for Transfer of Nebraska Homestead Exemption Form 458L Physician s Certification for Late Homestead Exemption Filing

The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners Persons over age 65 see page 4 Veterans totally disabled by a nonservice connected accident or illness see page 7 3 Qualified disabled individuals see page 2 and page 7 4 The Nebraska homestead exemption is a tax relief program that takes some of the cost of property taxes off of certain homeowners It was enacted to help certain groups of individuals who may not have a regular income and that may need financial relief

How Do You Qualify For Homestead Exemption In Nebraska

How Do You Qualify For Homestead Exemption In Nebraska

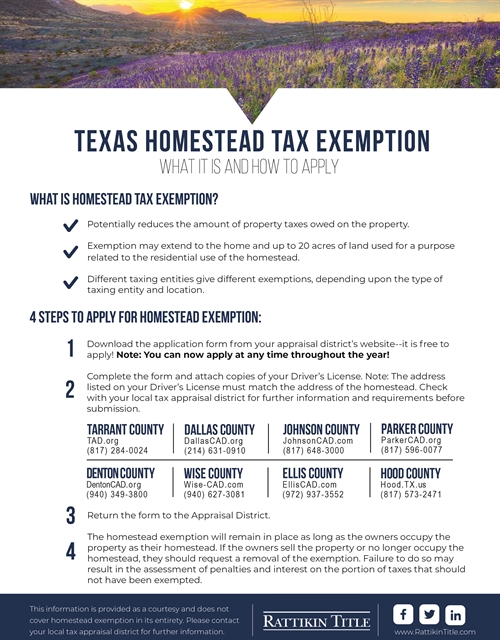

https://sistaticv2.blob.core.windows.net/rattikin/img/resources/Texas-Homestead-Law-Revision-2023-01-12422513.jpg

Homestead Exemption Letter Reminder Template Etsy

https://i.etsystatic.com/30888357/r/il/88a460/4587543232/il_1080xN.4587543232_40w8.jpg

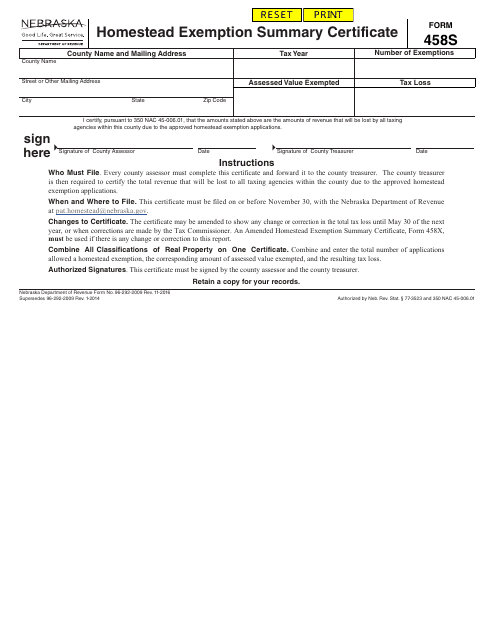

Form 458S Fill Out Sign Online And Download Fillable PDF Nebraska

https://data.templateroller.com/pdf_docs_html/1830/18302/1830268/form-458s-homestead-exemption-summary-certificate-nebraska_big.png

How to Apply for Homestead Exemptions Homestead applications must be filed with the county assessor after February 1 and on or before June 30 of each year Current homestead recipients will receive an application by mail The Nebraska Homestead Exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in Nebraska who occupy a home used as their primary residence from January 1 through August 15 Qualifying categories include

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners Persons over age 65 B Qualified disabled individuals or C Qualified totally disabled veterans and their widow er s Homestead Exemption eligibility is based in part on the applicant s income minus any out of pocket medical expenses When you file for a Homestead Exemption you will need the following information if applicable Income Information Federal Income Tax return if filed Form 1040 1040A 1040 EZ Social Security Form SSA 1099

Download How Do You Qualify For Homestead Exemption In Nebraska

More picture related to How Do You Qualify For Homestead Exemption In Nebraska

Hillsborough County Homestead Application 2018 2024 Form Fill Out And

https://www.signnow.com/preview/446/788/446788151/large.png

APPLY FOR YOUR HOMESTEAD EXEMPTION

https://cascade.madmimi.com/promotion_images/1519/0162/original/Homestead.jpg?1484172204

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Homestead Exemption Application Form 458 PDF format Statutes and Constitution Nebraska keyword search or view chapter by chapter Policies Brought to you by the Nebraska Library Commission with funding from the State of Nebraska and the U S Institute of Museum and Library Services The Nebraska Homestead Exemption program is a property tax relief program for qualified individuals who own a home in Nebraska

Homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of a home from taxation The State of Nebraska reimburses the counties and governmental subdivisions for taxes lost due to homestead exemptions 1 Do I need to apply every year 2 When did I have to turn 65 to qualify for category 1 3 Do I need to own and occupy the property I am applying for 4 I just bought a new home How can I transfer my current homestead exemption to my new house 5 What do I need to determine income requirements 6 What is the household income table 7

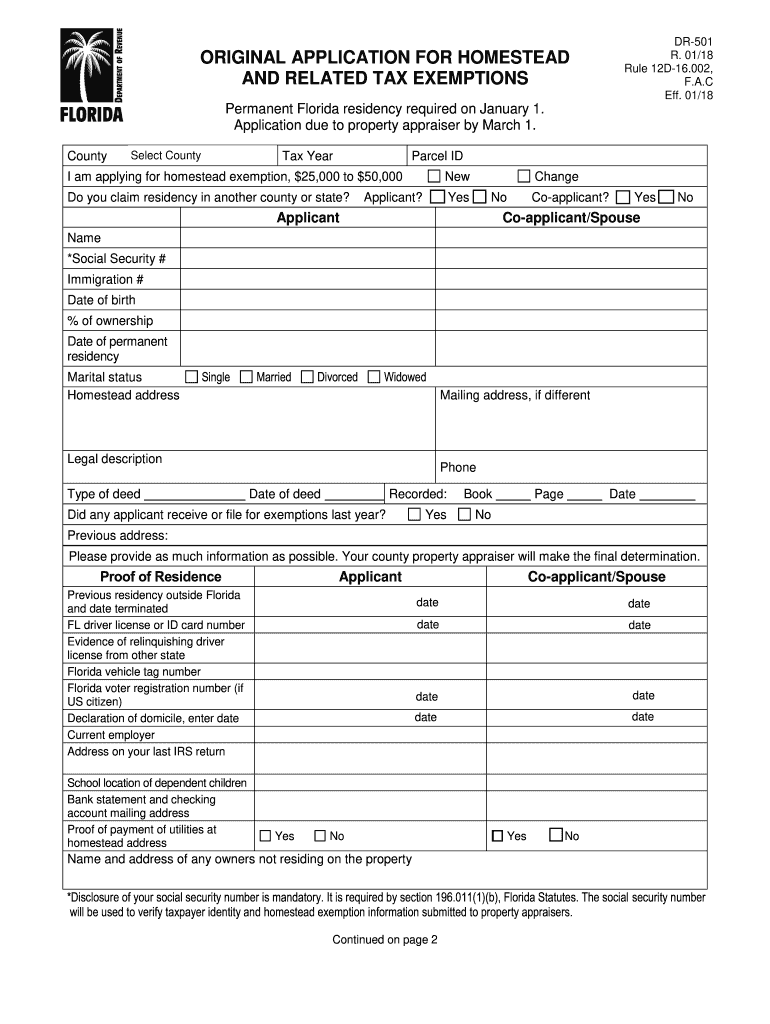

How Do I Register For Florida Homestead Tax Exemption W Video

https://www.yourwaypointe.com/wp-content/uploads/2017/07/Florida-Homestead-Tax-Exemption.jpg

HOW TO FILE FOR YOUR HOMESTEAD EXEMPTION Ready Front Real Estate

https://www.readyfrontrealestate.com/wp-content/uploads/2020/10/raoul-rowe-Your-2020-Guide-to-Filing-Your-Homestead-Exemption.png

https://revenue.nebraska.gov/PAD/homestead-exemption

Form 458 Schedule I Income Statement and Instructions Form 458B Certification of Disability for Homestead Exemption Form 458T Application for Transfer of Nebraska Homestead Exemption Form 458L Physician s Certification for Late Homestead Exemption Filing

https://revenue.nebraska.gov/sites/revenue...

The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners Persons over age 65 see page 4 Veterans totally disabled by a nonservice connected accident or illness see page 7 3 Qualified disabled individuals see page 2 and page 7 4

Nebraska Homestead Exemption Medical Deductions List Jennifer

How Do I Register For Florida Homestead Tax Exemption W Video

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

What Is The Illinois Homestead Exemption DebtStoppers

What Is A Homestead Exemption For Property Ta Bios Pics

What Is Classstrata In Homestead Exemption Form Fill Out Sign Online

What Is Classstrata In Homestead Exemption Form Fill Out Sign Online

Agent Resources HOMESTEAD EXEMPTION LETTER 2 doc NextHome Excellence

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

How Do You Qualify For Homestead Exemption In Nebraska - Nebraska Department of Revenue Homestead Exemption Guide How do I file You must file between February 1st and June 30th EVERY YEAR in the Assessor s Office You may either pick up your form and fill it out at home or bring all of you information in and we will fill it out for you What do I need to bring