How Do You Write Off A Car Over 6000 Pounds How do I write off a 6 000 pound car If your vehicle still weighs less than 14 000 pounds you could receive a maximum first year deduction of up to 27 000 for 2022 taxes and up to 28 900 for 2023 taxes

You may qualify to deduct some of your vehicle related expenses if you use your car for business purposes The IRS defines a car as any four wheeled vehicle including a truck or van intended for use on public streets roads and highways It mustn t exceed 6 000 pounds in unloaded gross weight Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business AND you buy it brand new from the dealer no private party used vehicle It has to be brand new The amount on the example factors in a brand new SUV over 6 000 lbs

How Do You Write Off A Car Over 6000 Pounds

How Do You Write Off A Car Over 6000 Pounds

https://i.ytimg.com/vi/Ce-xd007kkc/maxresdefault.jpg

What You Need To Know In 2019 To Write Off 6 000 Pound GVWR Vehicles

http://static1.squarespace.com/static/58d31e84d2b857698e85d3a9/5925f97a725e25c61b4b9f38/5df93ffec5bb6c13c5fbf94e/1576616742795/InkedIMG_9936_LI.jpg?format=1500w

Should You Claim Tax Deductions For Company s Vehicle Wraps Wraps

https://www.wrapsdirect.com/wp-content/uploads/2023/04/IMG_5900-scaled.jpeg

What vehicles qualify for the Section 179 deduction in 2024 Eligible vehicles for the Section 179 tax write off include Heavy SUVs pickups and vans over 6 000 lbs GVWR more than 50 business use Obvious non personal work vehicles dump truck backhoe farm tractor etc Delivery use vehicles cargo vans box trucks Since a vehicle that weighs over 6 000 pounds can certainly be considered a business asset it is reasonable to expect a Section 179 allowance to exist for it A few examples of the assets that may fall within this section include everything from traditional vans like GMC Savanna 2500 to pick up trucks like Ram 3500

Under the IRS s depreciation provisions different rules apply between smaller vehicles such as sedans versus larger vehicles such as trucks and vans Large vehicles defined as vehicles that weigh between 6 000 and 14 000 lbs are eligible for higher tax deductions in the first year that the vehicle is placed into service How Do You Write Off a Car Over 6 000 Pounds It is possible to claim a deduction for vehicles that weigh more than 6 000 pounds but less than 14 000 pounds as other property used for

Download How Do You Write Off A Car Over 6000 Pounds

More picture related to How Do You Write Off A Car Over 6000 Pounds

What Happens When A Car Is Written Off

https://media.marketrealist.com/brand-img/qNPWDLI_f/1024x536/car-write-off-2-1639407908153.jpg

Luxury Cars That Weigh Over 6000 Pounds Therefore Diary Pictures Library

https://weightofstuff.com/wp-content/uploads/2021/05/2008-Bentley-Azure-6000-lbs.jpg

Luxury Cars That Weigh Over 6000 Pounds Therefore Diary Pictures Library

https://weightofstuff.com/wp-content/uploads/2021/05/Mercedes-Benz-G500-Cabriolet-6000-lbs.jpg

For 2024 these amounts change to The maximum first year depreciation write off is 12 400 plus up to an additional 8 000 in bonus depreciation For SUVs with loaded vehicle weights over 6 000 pounds but no more than 14 000 pounds 60 of the cost can be expensed using bonus depreciation in 2023 Keep good records A 6 000 pound vehicle can qualify for valuable tax deduction opportunities through Section 179 of the federal tax code Understanding how these deductions can be claimed is absolutely

In this article we go in depth on writing off your car using three popular methods for deducting auto expenses the Section 179 deduction and deducting mileage via the standard mileage or actual expense method You ll have all the foundational information you need to make informed decisions about your tax plan with your trusted tax professional The tax write off value for a 6000 pound car can be significant In this article we ll explain how much you can write off and how to claim the deduction We ll also discuss the Section 179 deduction and how it can help you save even more money

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

https://weightofstuff.com/wp-content/uploads/2021/07/vehicles-that-weigh-6000-lbs.jpg.webp

What Happens When A Car Is Written Off

https://media.marketrealist.com/brand-img/Ud3oqKiG6/1280x670/car-write-off-1639407710650.jpg

https://www.jacksonhewitt.com/tax-help/tax-tips...

How do I write off a 6 000 pound car If your vehicle still weighs less than 14 000 pounds you could receive a maximum first year deduction of up to 27 000 for 2022 taxes and up to 28 900 for 2023 taxes

https://www.thebalancemoney.com/vehicle-tax...

You may qualify to deduct some of your vehicle related expenses if you use your car for business purposes The IRS defines a car as any four wheeled vehicle including a truck or van intended for use on public streets roads and highways It mustn t exceed 6 000 pounds in unloaded gross weight

9 Vehicles That Weigh Over 6000 Pounds Measuring Stuff

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

Can You Write Off A Car For Business Incite Tax

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

Write Off Cartell Car Check

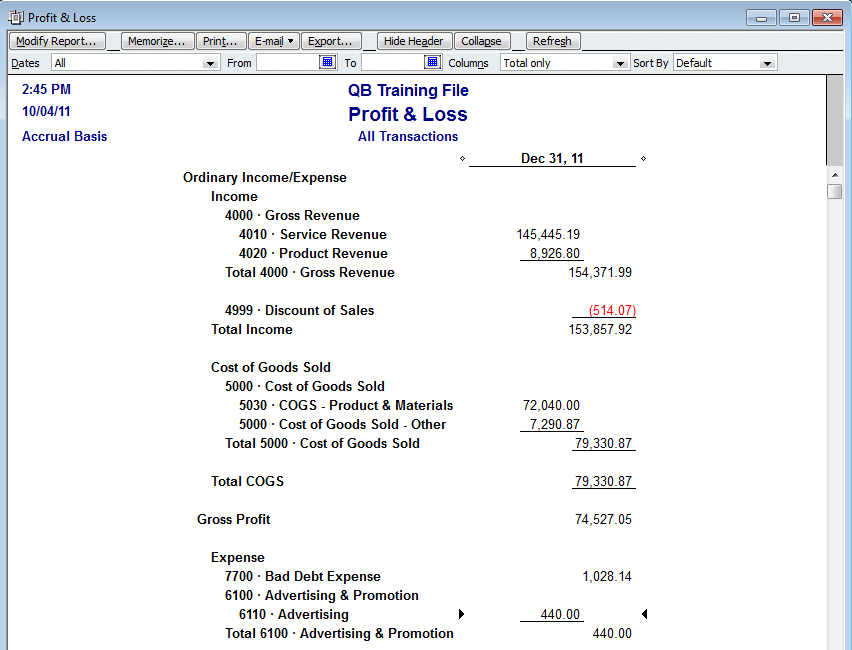

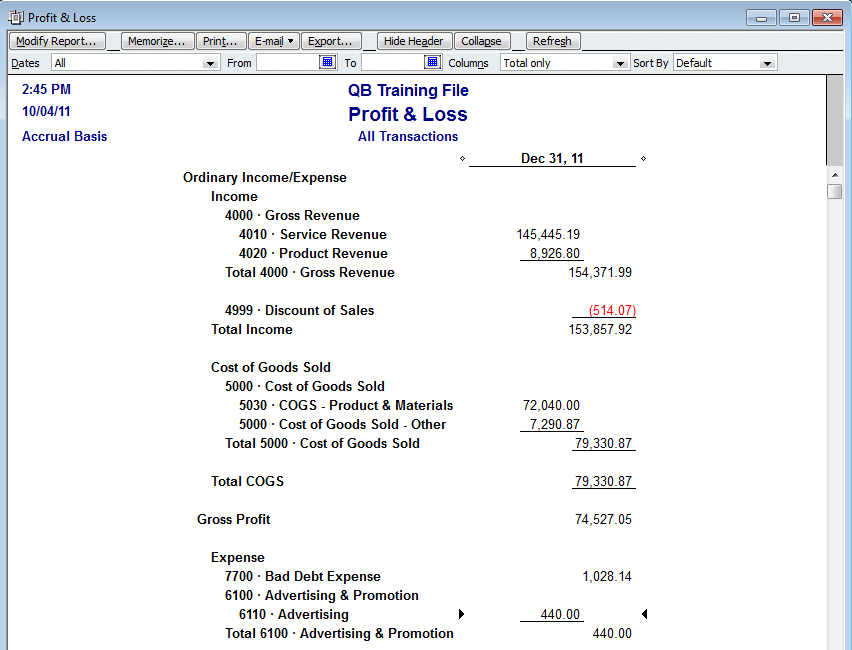

Writing Off Bad Debt Quick Trainer Inc

Writing Off Bad Debt Quick Trainer Inc

Car Over 6000 Lbs Write Off Wonderful Thing Webcast Image Archive

Vehicles Over 6 000 Pounds US Can I Get A Tax Deduction 2024

How To Write Off A Car Lease With An LLC Sane Driver

How Do You Write Off A Car Over 6000 Pounds - Since a vehicle that weighs over 6 000 pounds can certainly be considered a business asset it is reasonable to expect a Section 179 allowance to exist for it A few examples of the assets that may fall within this section include everything from traditional vans like GMC Savanna 2500 to pick up trucks like Ram 3500